Explore Any Narratives

Discover and contribute to detailed historical accounts and cultural stories. Share your knowledge and engage with enthusiasts worldwide.

Cryptocurrencies have made significant inroads into the financial landscape over the past decade, transforming the way individuals and businesses transact across the globe. From facilitating cross-border payments without the need for intermediaries to offering secure and anonymous transactions, cryptocurrencies provide a plethora of benefits that go beyond traditional fiat currencies.

The decentralized nature of cryptocurrencies such as Bitcoin and Ethereum is one of their most appealing features. Unlike traditional financial systems where central banks or governments control the issuance and regulation of currency, cryptocurrencies operate on blockchain networks. This decentralization ensures that there is no single point of failure or manipulation, making the system more resistant to fraud, corruption, and censorship.

Moreover, blockchain technology provides a level of transparency not usually found in traditional financial systems. Every transaction on the blockchain is recorded and visible to all participants within the network. While the identity of participants can be anonymized, every transaction is traceable and immutable, providing a transparent yet secure record of all financial activities.

Cryptocurrencies offer significant cost savings compared to traditional payment methods. For instance, sending payments internationally using traditional bank transfers often involves high transaction fees and long processing times. Cryptocurrencies, on the other hand, typically enable faster transactions and lower fees, especially when conducted via peer-to-peer networks on platforms like Paxful and Binance.

In addition, businesses that adopt cryptocurrencies can reduce the overhead costs associated with traditional banking services. They can avoid the need for extensive physical infrastructure to support cash transactions and automate many aspects of their operations. The lower operational costs can translate into higher profit margins, making it easier for businesses to maintain competitiveness in the global marketplace.

Cryptocurrencies have the potential to revolutionize financial inclusion by providing access to financial services to those who traditionally have been excluded. In many developing countries, a large portion of the population lacks access to traditional banking services due to factors such as distance, poverty, and lack of identification. Cryptocurrencies can bypass these barriers and provide a simple and fast way to transact.

Furthermore, cryptocurrencies can enable microtransactions that are challenging with traditional financial systems. For example, content creators can receive instant payments for their work through platforms like Steemit, while small businesses can accept micropayments from customers making small purchases using cryptocurrencies.

While anonymity and privacy are often misunderstood as synonymous with illegal activity, they can play a significant role in protecting individual freedoms and personal information. Cryptocurrencies offer users the ability to transact without revealing their identities, which can be crucial in regions with restrictive laws or where identity theft is prevalent.

For instance, cryptocurrencies like Monero provide advanced privacy features that make it difficult for third parties to track the movement of funds. This enhances user privacy and security, ensuring that personal financial data remains confidential. Additionally, cryptocurrencies can be a valuable tool for individuals and organizations looking to conduct transactions without fear of surveillance or government interference.

Cryptocurrencies offer unparalleled flexibility and scalability, allowing users and businesses to adapt to changing market conditions quickly. Traditional financial systems can take time to process transactions, approve loans, or issue payments, whereas cryptocurrencies often allow for near-instantaneous execution, regardless of geographic location.

Furthermore, blockchain technology can support a wide range of use cases beyond simple payments. Smart contracts and decentralized applications (dApps) built on blockchain platforms can automate complex financial processes, reducing the need for intermediaries and increasing efficiency. This flexibility makes cryptocurrencies a versatile tool for various industries, from real estate to supply chain management.

Cryptocurrencies are known for their inherent resilience against inflation, which can negatively impact traditional fiat currencies, especially in countries with high inflation rates. Unlike national currencies, cryptocurrencies like gold or silver can act as a store of value without the risk of devaluation due to monetary policies.

Additionally, blockchain technology's decentralized nature helps protect against economic shocks and systemic risks that can cripple traditional financial systems. If one entity fails, the rest of the network can continue operating, ensuring the continuity of financial transactions. This stability can be particularly beneficial during economic crises, providing a resilient alternative to conventional finance.

The benefits of using cryptocurrencies are numerous and far-reaching, offering advantages in terms of decentralization, cost efficiency, accessibility, anonymity, flexibility, and resilience. As more individuals and businesses adopt cryptocurrencies, it is likely that we will see a shift towards a more decentralized, transparent, and efficient financial system.

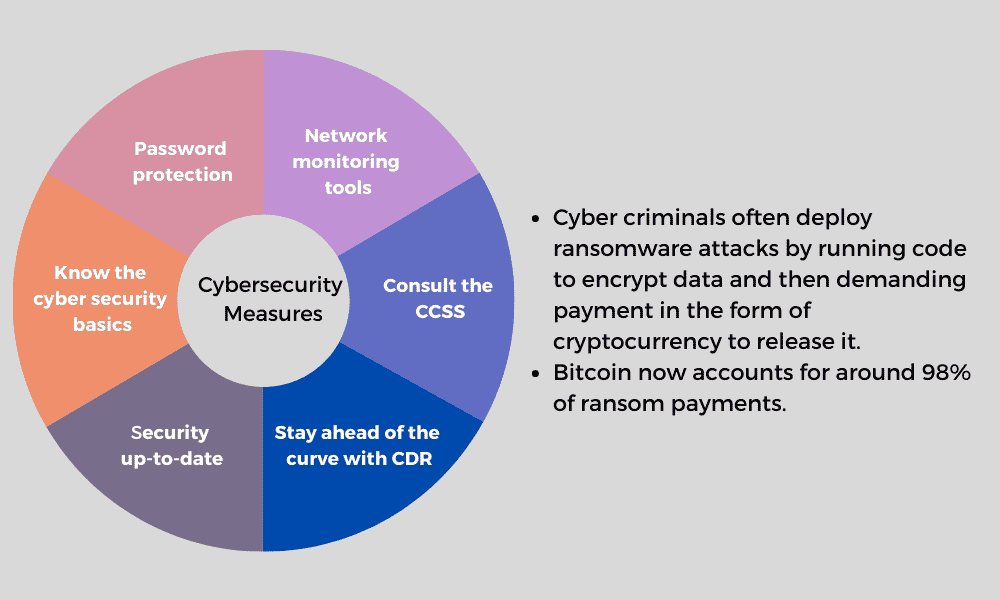

However, it is important to note that cryptocurrencies also come with risks, including volatility, regulatory uncertainty, and cybersecurity threats. It is crucial for users and businesses to understand these risks and take appropriate measures to mitigate them.

As the technological landscape evolves, cryptocurrencies are likely to play an increasingly prominent role in shaping the future of finance. Whether through direct monetary transactions or supporting broader technological advancements, cryptocurrencies offer a world of possibilities and opportunities for individuals and businesses alike.

One of the challenges facing cryptocurrencies is regulatory clarity. While some countries have taken steps to regulate cryptocurrencies, others remain ambivalent, leading to legal uncertainties that can deter widespread adoption. However, as more nations implement specific regulations, the industry is beginning to find a balance between innovation and compliance.

New regulations can also accelerate the development and adoption of cryptocurrencies. For example, jurisdictions like Japan and Singapore have established clear guidelines that encourage financial institutions to engage with cryptocurrencies, leading to increased innovation and investment in the sector. These regulatory frameworks often outline how cryptocurrencies should be classified, taxed, and integrated into existing financial systems.

Besides, regulatory clarity fosters a stable environment for startups and established companies to innovate and experiment with new financial products and services. Companies like Ripple, which specializes in cross-border payments, have gained regulatory approval in certain markets, thereby enabling more institutional participation in the cryptocurrency ecosystem.

Cryptocurrencies offer a chance for economic diversification, particularly in regions where traditional economies are struggling. In Venezuela, for instance, where hyperinflation is rampant, the use of cryptocurrencies like stablecoins backed by fiat currency has provided a means of preserving purchasing power and conducting transactions without the risk of losing value rapidly.

Mining cryptocurrencies, especially in areas with abundant natural resources like renewable energy, can also contribute to local economic growth. Countries like Iceland and Norway, endowed with vast geothermal and hydropower resources, have leveraged these assets to become major cryptocurrency mining hubs. This not only provides employment opportunities but also attracts foreign investment, contributing to the overall economic development of these nations.

The user experience in using cryptocurrencies has significantly improved over the years. Today, users can easily buy, sell, and trade cryptocurrencies through a multitude of exchanges, custodians, and wallets. Mobile apps like Coinbase and Binance have made trading more accessible to a global audience, allowing users to manage their investments from their smartphones.

Moreover, user-friendly interfaces and educational resources have addressed one of the main hurdles—lack of knowledge. Online communities, forums, and social media platforms offer guidance, tutorials, and support, helping new users navigate the complexities of cryptocurrencies. These resources are critical for fostering a more informed and engaged user base.

Cryptocurrencies have found applications beyond individual transactions. Enterprises are increasingly leveraging blockchain technology to streamline internal processes and enhance transparency. For example, supply chain management has seen significant improvements with the implementation of blockchain-based solutions that reduce fraud, improve traceability, and increase efficiency.

Smart contracts, automated agreements that execute when predefined conditions are met, are being adopted in various sectors such as real estate, finance, and healthcare. These smart contracts eliminate intermediaries, lower costs, and ensure compliance, thus enhancing trust among parties involved in these transactions.

Many large corporations, including IBM, Walmart, and Maersk, have already implemented blockchain solutions to improve their supply chain operations. These initiatives demonstrate the potential of cryptocurrencies and blockchain technology to disrupt traditional business models and drive innovations.

The environmental impact of cryptocurrencies, particularly those requiring significant computational power (like Bitcoin), has been a topic of concern. Concerns about energy consumption have led some cryptocurrency projects to focus on more sustainable alternatives. For example, Cardano has implemented a proof-of-stake consensus mechanism that significantly reduces energy usage compared to proof-of-work systems.

Innovations like zero-knowledge proofs, which allow for private transactions without revealing transaction details, further enhance sustainability by minimizing the computational resources needed for secure transactions. Additionally, initiatives like the Token Charity Foundation and the Blockchain Sustainability Alliance are working to promote eco-friendly practices within the cryptocurrency community.

As the cryptocurrency ecosystem continues to evolve, several emerging trends are worth noting. Decentralized Finance (DeFi) platforms are gaining traction, offering users a range of financial tools and services without the need for traditional financial institutions. DeFi protocols like Compound and Uniswap allow users to earn interest on deposited assets, lend to others, and engage in token swaps, all on a decentralized network.

Additionally, non-fungible tokens (NFTs) represent a significant trend, with artists, musicians, and gamers utilizing NFTs to create unique digital assets that can be traded and owned. Platforms like OpenSea and Rarible have emerged as marketplaces for NFTs, facilitating transactions and promoting digital creativity.

Futuristically, we can expect rapid advancements in blockchain technology and cryptocurrencies. Quantum computing, for instance, could potentially solve some of the current limitations faced by blockchain networks, enhancing security and processing speed. Blockchain interoperability, allowing different blockchain networks to coexist and communicate seamlessly, is another area ripe for innovation.

The benefits of using cryptocurrencies are manifold and continue to grow as the technology matures and more use cases emerge. From enhancing financial inclusivity and cost efficiency to promoting innovation and sustainability, cryptocurrencies offer a promising alternative to traditional financial systems. However, to fully realize these benefits, the cryptocurrency industry needs to address regulatory challenges, foster user education, and promote environmental sustainability.

As the landscape continues to evolve, cryptocurrencies are poised to play an even more significant role in shaping the future of finance and beyond. By embracing the potential of this revolutionary technology, we can unlock new opportunities and contribute to a more innovative and inclusive global economy.

Despite the numerous benefits offered by cryptocurrencies, several challenges remain, primarily related to security, regulation, and mass adoption. Ensuring the safety and integrity of transactions is crucial for the sustained growth of the crypto ecosystem. One of the primary concerns is the risk of hacking and theft, especially with exchanges and wallet providers that hold large amounts of user funds.

To address these issues, both consumers and businesses are turning to multi-factor authentication (MFA), cold storage wallets, and insurance products. Multi-factor authentication adds an extra layer of security to logins, while cold storage wallets keep cryptocurrencies offline, thereby reducing the risk of online hacks. Insurance products help mitigate losses caused by security breaches, providing financial protection to users.

In addition to individual security measures, there is a growing emphasis on improving the security of blockchain networks themselves. Innovations like zk-SNARKs and zk-STARKs are being developed to enhance privacy while maintaining strong security. These technologies allow for zero-knowledge proofs, enabling users to prove possession of certain data without revealing the actual data itself. This not only improves security but also enhances privacy and user satisfaction.

While regulatory clarity is crucial for the long-term success of cryptocurrencies, the current regulatory landscape varies widely across countries. Some jurisdictions, such as Switzerland and Malta, have established favorable environments for cryptocurrency businesses, attracting innovative fintech companies and attracting investments. In contrast, other regions face stricter regulations or outright bans, which can hinder adoption and investment.

Effective regulatory frameworks strike a balance between preventing illicit activities and fostering innovation. They include measures such as anti-money laundering (AML) and know-your-customer (KYC) requirements, tax regulations, and consumer protection rules. The US Securities and Exchange Commission (SEC) has played a significant role in defining the regulatory status of cryptocurrencies, with classifications like security tokens (STOs) and utility tokens (UTOS).

Collaboration between governments and the crypto industry is essential for creating robust legal frameworks. Industry groups like the Crypto Association in the US and industry consortia like the Global Blockchain Business Council (GBBC) work to advocate for fair regulations and promote responsible growth. As the industry matures, more comprehensive and harmonized regulatory approaches are expected to emerge, paving the way for greater acceptance and widespread adoption.

To achieve broader adoption, cryptocurrencies must overcome barriers such as complexity and user awareness. Simplifying the user experience and making cryptocurrencies more accessible are key strategies. Initiatives such as integrating cryptocurrencies into everyday payments and creating more user-friendly wallets can make cryptocurrencies a viable option for individuals who currently do not use digital currencies.

Promoting financial literacy and education is also crucial. Schools and universities can incorporate blockchain and cryptocurrency topics into their curricula, helping students understand the technology and its implications. Public awareness campaigns can demystify complex concepts and highlight the real-world benefits of cryptocurrencies, fostering a more informed and engaged user base.

Incentivizing early adopters through loyalty programs and partnerships with traditional financial institutions can drive initial demand. For example, major banks and payment processors partnering with cryptocurrency firms can integrate blockchain technology into their existing services, making it more appealing for consumers who already rely on these institutions.

Cryptocurrencies offer a wide array of benefits, from increased financial flexibility to enhanced security and reduced costs. As the technology continues to mature, it presents a promising future for both individuals and businesses. However, addressing ongoing challenges such as security, regulation, and user education is paramount for widespread adoption and long-term success.

By adopting best practices in security, advocating for sound regulatory frameworks, and implementing strategies to educate and incentivize users, the crypto industry can overcome current obstacles and unlock its full potential. As more people and businesses embrace cryptocurrencies, the financial landscape is set to undergo transformative changes, ushering in a new era of innovation and opportunity.

Looking forward, cryptocurrencies are likely to play an integral role in shaping the future of finance. Whether through financial inclusion, economic diversification, or disruptive technological advancements, cryptocurrencies present a world of possibilities that are only beginning to be realized. Embracing this technology with an understanding of its benefits and challenges is essential for navigating the coming era of digital finance.

In conclusion, cryptocurrencies are not just about money; they represent a fundamental shift in how we perceive and interact with financial systems. As we continue to explore and harness their potential, we move closer to a future defined by greater transparency, efficiency, and empowerment.

As technological innovation advances, the journey ahead promises exciting developments and transformative changes. The benefits of cryptocurrencies extend far beyond their current applications, opening doors to new possibilities and opportunities. With continued effort and collaboration, cryptocurrencies can become a cornerstone of a robust and equitable global financial system.

Your personal space to curate, organize, and share knowledge with the world.

Discover and contribute to detailed historical accounts and cultural stories. Share your knowledge and engage with enthusiasts worldwide.

Connect with others who share your interests. Create and participate in themed boards about any topic you have in mind.

Contribute your knowledge and insights. Create engaging content and participate in meaningful discussions across multiple languages.

Already have an account? Sign in here

Unlock the world of crypto tokens! Learn about utility, governance, stablecoins, and DeFi tokens. Discover the latest tr...

View Board

Demystifying cryptocurrency! Explore the different types of cryptocurrencies, from Bitcoin and Ethereum to stablecoins a...

View Board

Explore DigiByte (DGB), a fast, secure, and scalable cryptocurrency. Learn about its innovative features, blockchain tec...

View Board

Discover Tezos, a self-amending blockchain with Liquid Proof-of-Stake (LPoS) for energy efficiency and seamless upgrades...

View Board

Uniswap’s code‑driven AMM turned a trillion‑dollar market into a permissionless engine, burning UNI as fees surge across...

View Board

Abu Dhabi's transformation from a desert outpost to a global capital, driven by oil wealth and visionary leadership, is ...

View Board

Discover the essentials of cryptocurrency mining: how it works, hardware choices, and profitability factors. Start your ...

View Board

Explore Filecoin, the blockchain-based decentralized storage network. Learn how it leverages IPFS, FIL tokens, and crypt...

View Board

Tesla's Optimus Gen 3 humanoid robot now runs at 5.2 mph, autonomously navigates uneven terrain, and performs 3,000 task...

View Board

Hyundai's Atlas robot debuts at CES 2026, marking a shift from lab experiments to mass production, with 30,000 units ann...

View Board

Découvrez Bitcoin, la première cryptomonnaie. Apprenez son histoire, son fonctionnement, et comment elle révolutionne la...

View Board

Navigating the Gig Economy: The Future of Work or a Step Backwards?

View Board

AI stock picks for 2026 focus on companies building infrastructure, monetizing AI at scale, and supplying critical tools...

View Board

Explore the evolution of film censorship in the US, from early government bans to the Hays Code and MPAA ratings. Discov...

View Board

The open AI accelerator exchange in 2025 breaks NVIDIA's CUDA dominance, enabling seamless model deployment across diver...

View Board

CES 2025 spotlighted AI's physical leap—robots, not jackets—revealing a stark divide between raw compute power and weara...

View Board

Uncovering the tumultuous history of Johannesburg, where gold rush fortunes and apartheid-era segregation forged a natio...

View Board

A 24-year-old Brazilian woman built a digital empire on joy, using her university marketing studies to master the viral ...

View Board

Dutch tulip mania of 1637 and today's crypto frenzy reveal eerily similar patterns of speculative delusion, with futures...

View Board

Dar es Salaam's economic engine remains unstoppable, despite the official capital's relocation to Dodoma, as the port ha...

View Board

Comments