Explore Any Narratives

Discover and contribute to detailed historical accounts and cultural stories. Share your knowledge and engage with enthusiasts worldwide.

On a frigid February day in 1637, in a tavern in Haarlem, a merchant paid 5,200 guilders for a single tulip bulb. The price was not unusual for the time. It represented the cost of a grand canal house, or the lifetime earnings of a master shipwright. The next week, he could not sell it for 100 guilders. The trade was a futures contract, a slip of paper. The bulb, a delicate flower infected with a mosaic virus that painted its petals with stunning, unstable streaks, never changed hands. The merchant was ruined. Nearly four centuries later, in March 2024, a pseudonymous trader spent 1,200 Solana tokens—roughly $200,000 at the time—on a digital image of a cartoon frog with a laser-eyed shiba inu superimposed on its head. The non-fungible token, or NFT, was part of a memecoin promotion. A month later, it was functionally worthless. The blockchain recorded the transaction forever. The trader vanished back into the internet.

History does not repeat, but it often delivers a brutal, ironic rhyme. The speculative frenzy known as Tulip Mania, which gripped the Dutch Republic from roughly 1634 to 1637, stands as the archetypal financial bubble. Today's cryptocurrency markets, with their vertiginous rallies and catastrophic crashes, provoke an eerie sense of déjà vu. The comparison is a favorite cudgel for skeptics and a thorn in the side for true believers. It is also dangerously simplistic and uncomfortably accurate. Examining these two phenomena side-by-side is not an academic exercise. It is a journey into the unchanging core of human psychology, dressed in the flamboyant costumes of two radically different technological eras.

Tulips arrived in the Netherlands from the Ottoman Empire in the late 1500s, a exotic luxury for the botanical gardens of the wealthy. Their appeal was not merely aesthetic; it was viral. A tulip breaking—sporting unpredictable, flame-like streaks of color—was caused by a mosaic virus that weakened the bulb. This fragility made the most spectacular varieties, like the famed Semper Augustus or Viceroy, incredibly rare and impossible to reliably reproduce. In an age of burgeoning Dutch wealth, fueled by the phenomenal success of the Dutch East India Company, these flowers became the ultimate Veblen good: their value was inextricably linked to their exorbitant cost and social cachet.

The market evolved with terrifying speed. By 1634, speculation had moved from the gardens of the elite to the taverns and trading halls of merchants, artisans, and even farmers. Critically, the trade shifted from physical bulbs to promissory notes—futures contracts on next season's harvest. This financial innovation was the rocket fuel. A bulb still in the ground could be bought and sold ten times in an afternoon, each trader betting on selling to a greater fool before the music stopped. The physical object became irrelevant; the slip of paper was everything.

According to historian Mike Dash, author of Tulipomania, "At the height of the mania, a single bulb of the Viceroy variety was traded for goods whose total value was staggering: 2,400 guilders. This included four fat oxen, eight fat swine, twelve fat sheep, four tons of wheat, eight tons of rye, two hogsheads of wine, four tons of beer, two tons of butter, 1,000 pounds of cheese, a bed, a suit of clothes, and a silver drinking cup."

The peak arrived in the winter of 1636-37. Prices for rare bulbs reached levels that defy modern comprehension. The record sale of a Semper Augustus bulb for 12,000 guilders is the most famous. To contextualize, a skilled craftsman earned about 300 guilders a year. This was not an investment. It was a collective delusion of grandeur, a belief that the aesthetic rules of a new, wealthy society had permanently rewritten economic laws.

The genesis of the crypto craze is a 2008 whitepaper by the anonymous Satoshi Nakamoto. Bitcoin proposed a decentralized digital currency, free from government control. Its underlying innovation, blockchain technology, promised a revolution in trust. The initial appeal was ideological, a libertarian dream. But the seed of speculation was planted in its very code: a hard cap of 21 million Bitcoins. Scarcity, real or perceived, is the lifeblood of a bubble.

The parallels to the tulip trade are structural before they are psychological. Just as traders moved from bulbs to contracts, crypto evolved from a currency (Bitcoin) to a platform for speculation (Ethereum and smart contracts). Initial Coin Offerings (ICOs) in 2017 were the digital equivalent of tulip futures—investments in promises, often with no product, team, or utility. The 2021 explosion of NFTs and decentralized finance (DeFi) protocols created new, complex asset classes whose values were driven by hype, community, and the fear of missing out. The memecoin phenomenon, epitomized by Dogecoin and its endless spawn, is the purest echo of Tulip Mania. Their value is derived entirely from internet culture and collective belief, a digital Semper Augustus with a doge face.

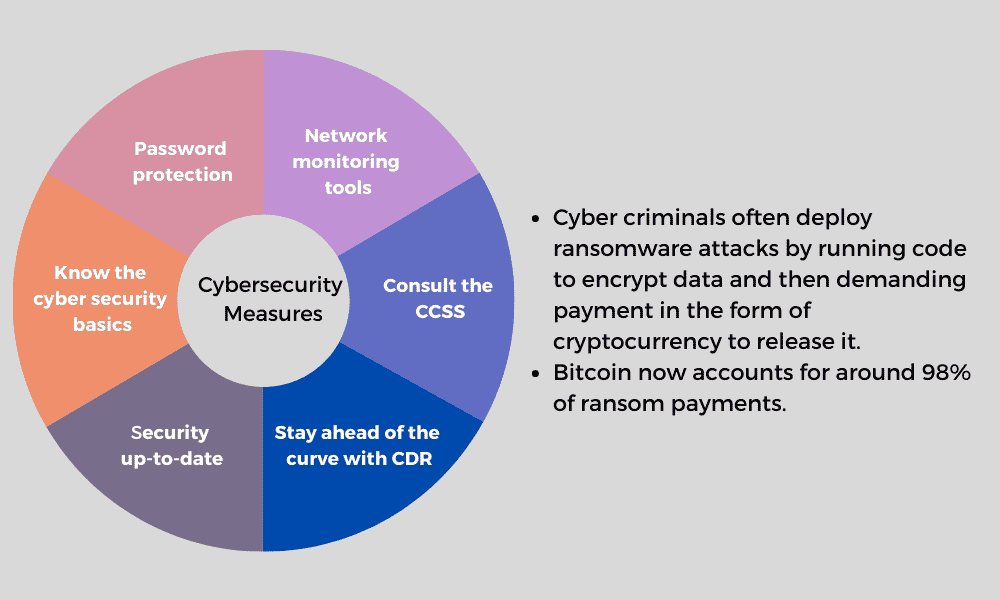

A 2025 report by Finance Watch, a European financial watchdog, noted, "The social dynamics of crypto rallies, particularly in memecoins promoted on platforms like Twitter and TikTok, are indistinguishable from historical manias. The asset's fundamental utility is zero. Its price is a direct function of community engagement and viral momentum, a greater fool theory executed at the speed of light."

The scale, however, is galactic. Tulip Mania was a localized event in a small, albeit wealthy, nation. At its peak, the total value of all tulip contracts was a fraction of the Dutch economy. The crypto market, as of late 2025, saw total market capitalization repeatedly touch $3 trillion. Daily trading volume routinely eclipsed $100 billion. This is a global casino, operating 24/7, accessible to anyone with a smartphone and an internet connection. The tavern in Haarlem has been replaced by a planetary nervous system.

Yet, the human faces in both stories share a kinship. The weaver who mortgaged his loom to buy a tulip contract in 1636 is the college student who borrowed money to ape into a Solana memecoin in 2024. The merchant who hosted trading parties in his Amsterdam home is the influencer running a paid Telegram pump group. The drive is identical: the intoxicating belief that one has found a shortcut to the elite, a way to transform ordinary life through the alchemy of speculation. The mechanisms are just faster, shinier, and infinitely more connected.

Strip away the petals and the pixels. At the operational core of both frenzies lies a critical abstraction: the decoupling of the asset from its underlying reality. For the Dutch, this was the futures contract. For crypto, it's the blockchain ledger. Both are systems of trust, but one was scribbled on tavern ledgers and the other is encrypted across a global network. The difference in technology is profound. The psychological payload is identical.

During the winter of 1636-37, you could not physically trade a tulip bulb. Digging it up in the frozen Dutch earth meant killing it. The market's solution was elegant and dangerous. Traders gathered in Haarlem's taverns and wrote contracts for future delivery once the ground thawed. These slips of paper, representing a promise of a bulb to come, became the speculative instrument. They could change hands dozens of times in a season. The actual flower became almost irrelevant.

"The tulip speculation involved a few hundred wealthy traders, not the broader Dutch population. It was concentrated among a small merchant class." — Modern Historical Consensus, correcting the Mackay narrative

This is the precise mirror of a non-fungible token trading on OpenSea or a Bitcoin futures contract on the Chicago Mercantile Exchange. You are not trading the underlying code or the use of the blockchain. You are trading a digital token representing ownership or a bet on future price movement. The NFT of a cartoon ape does not grant you copyright. The Bitcoin futures contract does not put a private key in your wallet. They are abstractions built on abstractions, layers of promises. The tavern ledgers were centralized and corruptible. The blockchain is decentralized and, in theory, immutable. Both created a frictionless environment for speculation to metastasize.

The velocity of the tulip bubble shocks even modern observers. Take the Switsers variety. According to market records, its price exploded by a factor of twelve in the frantic five weeks between late December 1636 and early February 1637. The entire peak intensity, the true mania, lasted roughly three months. Then, on February 3, 1637, an auction in Haarlem failed to attract any bids. The music stopped. By May, prices had cratered back to near their starting levels. The boom and bust cycle was violently compressed.

Crypto operates on a different temporal scale but with similar parabolic heartbeats. A memecoin can achieve a twelve-fold gain in hours, not weeks, propelled by a single tweet from a celebrity. The 2021 bull run saw the total market capitalization swell from under $800 billion in January to over $2.9 trillion by November, before losing nearly half that value in the following six weeks. The 2024-2025 cycle repeated the pattern with institutional sheen. The compression of time is the internet's greatest gift to speculation. News, hype, and panic are now globally simultaneous.

But scale is where the comparison truly warps. Tulip Mania was a rich man's parlor game with localized consequences. The Dutch Republic's broader economy, as historians now confirm, showed no sign of crisis. The nation continued to enjoy the world's highest per-capita incomes. The damage was contained to the portfolios of a few hundred merchants, many of whom were Mennonites operating in a distinct community. The famous narratives of maidservants and chimney sweeps investing their life savings are almost certainly Victorian-era fabrications.

"The Dutch economy remained robust throughout. The mania's impact was exaggerated, affecting only a small group of traders rather than causing widespread bankruptcies." — Anne Goldgar, historian and author of Tulipmania: Money, Honor, and Knowledge in the Dutch Golden Age

Contrast this with the crypto ecosystem. The collapse of the FTX exchange in November 2022 vaporized an estimated $32 billion in customer funds and sent contagion rippling through lending platforms, hedge funds, and other exchanges. Millions of retail investors globally were affected. The Terra/Luna collapse months earlier erased over $40 billion in wealth in days. This is not a contained event. It is a networked crisis. The very global reach and interconnectedness that proponents hail as crypto's strength becomes its systemic risk. A Dutch merchant in 1637 could walk away from a tulip contract, maybe face a local court. A crypto investor in 2022 watched their life savings evaporate into a blockchain address controlled by a 25-year-old in the Bahamas, with no regulatory recourse.

How we remember a bubble is often more powerful than the bubble itself. Tulip Mania owes its infamous reputation largely to one book: Charles Mackay's 1841 Extraordinary Popular Delusions and the Madness of Crowds. Mackay, a Scottish journalist, crafted a irresistible moral fable—a tale of a whole society gripped by irrational greed, from nobles to peasants, brought low by a worthless flower. It was a sensational story that confirmed Victorian attitudes about speculation and the follies of the past. It was also largely fiction.

Modern scholarship has systematically dismantled Mackay's account. The bubble was shorter, shallower, and involved far fewer people than he claimed. Yet, the Mackay myth persists because it serves a purpose. For centuries, it has been wielded as a cautionary tale, a quick rhetorical dagger to stab any new, incomprehensible asset class. "It's just like tulip mania!" is the ultimate dismissal. It implies not just a bubble, but a specific kind of collective stupidity, a descent into aesthetic frivolity over solid value.

The crypto industry has been locked in a battle against this narrative from its inception. Proponents bristle at the tulip comparison, and for some legitimate reasons. They argue Bitcoin has a fixed, verifiable scarcity (21 million coins), unlike the theoretically limitless new tulip varieties that could be (and were) cultivated. They point to the utility of the blockchain—smart contracts, decentralized finance, digital ownership records—as intrinsic value tulips could never claim. A tulip is a tulip. Ethereum is a global, programmable computer.

"Crypto's narrative is technological determinism wrapped in libertarian ideology. It's not about pretty flowers; it's about dismantling the legacy financial system. The tulip comparison is a lazy insult from people who don't want to understand the underlying technology." — Andreas M. Antonopoulos, cryptocurrency author and speaker

But does the average person buying Shiba Inu coin because of a Musk tweet care about dismantling the legacy financial system? Or are they chasing the same dizzying wealth effect that drove a merchant to mortgage his home for a Viceroy bulb? The utility argument is crypto's strongest defense, but it is also its most vulnerable flank. For every genuinely innovative DeFi protocol, there are ten thousand useless "vampire squid" tokens with no purpose beyond speculation. The NFT space is dominated by profile picture collections whose social utility—digital status signaling—is functionally identical to the social utility of a rare tulip in a 17th-century Leiden garden. Both say, "Look what I can afford. Look at my taste. I am part of the in-group."

This is the hilarious, uncomfortable truth the crypto faithful often ignore. The technological revolution is real. The potential is vast. And yet, a staggering percentage of the activity and capital flowing through this revolutionary system is engaged in a centuries-old human ritual: gambling on fashionable tokens of status. The tavern is digital. the drinks are virtual. The hustle is eternal.

"The social dynamics are indistinguishable from historical manias. The asset's fundamental utility can be zero. Its price is a direct function of community engagement and viral momentum, a greater fool theory executed at the speed of light." — Finance Watch Report, 2025

So who wins the narrative war? The skeptics wielding Mackay's exaggerated fable, or the proponents pointing to Satoshi's whitepaper? The answer is both, and neither. The Mackay narrative is historically inaccurate but psychologically resonant. The techno-utopian narrative is technologically sound but willfully blind to the human behavior it enables. The real story lies in the tension between them. We are not repeating 1637. We are using 21st-century tools to perform a 17th-century play, on a planetary stage, with exponentially higher stakes. The script is familiar. The special effects are unbelievable.

Why does this four-century-old comparison still sting, still provoke such fierce debate? The significance of juxtaposing Tulip Mania and the Crypto Craze transcends financial history. It forces a confrontation with an uncomfortable truth about progress. We build ever more sophisticated systems—global markets, instantaneous communication, cryptography that can secure nations—and then use them to play the oldest game in the economic book. We dress our primal urges in the language of the future. The tulip was a product of early globalization and botanical science. Crypto is a product of cryptography and network theory. Both became canvases for hope, greed, and the desperate human need to believe the old rules no longer apply.

This matters because it reframes how we assess technological revolutions. We judge them by their highest ideals—decentralization, financial inclusion, artistic expression. We must also judge them by their most pervasive use cases. The printing press gave us Shakespeare and scientific journals. It also gave us limitless pamphlets of propaganda and scurrilous gossip. The blockchain may yet underpin a new internet of value. Today, it underpins an astonishing volume of pure, unadulterated speculation. Recognizing this duality is not cynicism. It is clarity.

"Financial manias are not failures of a system. They are features of a system built on credit and future promises. The technology changes the speed and the scale, not the fundamental plot. We are watching a very old play with new, very expensive special effects." — Dr. William Quinn, co-author of Boom and Bust: A Global History of Financial Bubbles

The legacy of Tulip Mania is not a historical fact, but a cultural shadow—a ready-made story we use to make sense of chaos. The legacy of the Crypto Craze is still being written, but it is already bifurcating. One path leads to a mature asset class, integrated into global finance, with clear utility in settlements, tokenization, and digital ownership. The other path leads to a perpetual casino, a gamified shadow economy of leverage and memes. The terrifying, hilarious reality is that both paths are being paved simultaneously on the same blockchain.

The most persistent and persuasive promise of the crypto revolution is democratization. It is the core rebuttal to the tulip comparison. Tulips were for the rich. Crypto is for everyone. The narrative insists that decentralized finance strips power from gatekeeping banks and gives it to the people. The data, and the aftermath of crashes, reveal a more familiar hierarchy.

While anyone can buy a memecoin, the architecture of wealth accumulation remains strikingly concentrated. Whales—entities holding vast sums of a cryptocurrency—control disproportionate influence. The 2022 collapses demonstrated that the ecosystem, for all its decentralized ideals, quickly coalesced around centralized, opaque figures like Sam Bankman-Fried. The gains during bull markets are distributed; the losses during collapses are devastatingly democratic. The retail investor who put $500 into Luna or borrowed against their NFT to ape into another project was wiped out just as thoroughly as the Dutch merchant with his tulip contract, but on a global scale. The technology lowered the barrier to entry. It did not lower the barrier to financial ruin.

Furthermore, the environmental and computational costs create a new kind of gatekeeper. Proof-of-Work mining, which secures Bitcoin, is an arms race of energy consumption, consolidating influence in regions with cheap power and specialized hardware. The claim of a level playing field ignores the very real, very physical inequalities of energy access and capital required to participate at the highest levels. It is a democratization of speculation, not necessarily of wealth or security. This is the critical weakness in the crypto utopian argument. It confuses access with equity, and confuses the absence of a traditional banker with the absence of power structures altogether.

The tulip market was brutally honest about its exclusivity. The crypto market often obscures its new oligarchies behind the buzzword of "decentralization." This is not a failure of technology, but a recurrent failure of the stories we tell ourselves about technology. We see the protocol and believe it creates justice. More often, it simply creates a new venue for ancient human dynamics to play out, with a more complex rulebook.

The forward look for crypto is not a question of if another cycle will occur, but when and what shape it will take. The next major catalyst is already on calendars: the next Bitcoin halving, projected for early 2028. This scheduled reduction in mining rewards has historically preceded major bull runs, and the entire industry is engineered around this four-year heartbeat. More concretely, watch for the maturation of Real-World Asset (RWA) tokenization, which aims to move beyond speculative tokens and place stocks, bonds, and real estate on-chain. The success or failure of multi-billion dollar funds like BlackRock's tokenized fund projects through 2026 and 2027 will be a critical test. Is the technology a better mousetrap for traditional finance, or will it remain a parallel universe of speculation?

Regulation will be the other great shaper. The European Union's Markets in Crypto-Assets (MiCA) framework is fully in force. The United States continues its glacial, contentious march toward legislative clarity. The outcome will determine whether crypto remains a wild frontier or becomes a fenced-in district of the global financial city. Either outcome will change the nature of the game. Stricter rules may dampen the manic peaks but could also legitimize the troughs, attracting more cautious capital.

The tulip, after its mania, settled into its rightful place. It became a beloved, modestly priced ornamental flower, a staple of Dutch horticulture and a peaceful export. It never again pretended to be a financial instrument. The question for crypto is whether it can find a similar, sustainable equilibrium. Can Bitcoin evolve into "digital gold" — a volatile but recognized store of value? Can Ethereum become the foundational layer for a new internet, its token valued for the computational work it facilitates, not just the price speculation it inspires?

In a Haarlem museum today, you can see a 17th-century painting of a tulip, meticulously rendered. It is beautiful, static, a relic of a fever long broken. On a screen, you can watch a live chart of a cryptocurrency, its jagged line pulsing with the collective anxiety and hope of millions. One is a closed chapter, a story we tell with the clean lines of hindsight. The other is a chaotic, open manuscript, being written in real-time by every trader, developer, and regulator on the planet. The merchant in the tavern and the developer in the home office are kin, separated by centuries but united by a shared, perilous faith: that this time, the beautiful abstraction will finally be worth what they paid for it.

Your personal space to curate, organize, and share knowledge with the world.

Discover and contribute to detailed historical accounts and cultural stories. Share your knowledge and engage with enthusiasts worldwide.

Connect with others who share your interests. Create and participate in themed boards about any topic you have in mind.

Contribute your knowledge and insights. Create engaging content and participate in meaningful discussions across multiple languages.

Already have an account? Sign in here

Philip Mason, the unseen architect of market volatility, reshaped finance, culture and tech with fractal insights that s...

View Board

Behavioral economics dismantled the myth of rational markets, revealing how psychology shapes financial decisions—from m...

View Board

AI stock picks for 2026 focus on companies building infrastructure, monetizing AI at scale, and supplying critical tools...

View Board

Eddie Woo's remarkable journey from a humble mathematics teacher to a global phenomenon has redefined the way we approac...

View Board

Na Alabama, NASA realizou cem testes de fluxo frio num reator nuclear do tamanho de um barril, simulando propulsão térmi...

View Board

Explore Kandahar, Afghanistan: a historical crossroads of empires and cultures for 2500 years. Discover its ancient root...

View Board

Animal Crossing: New Horizons – Nintendo Switch 2 Edition redefine o refúgio digital com 4K, controles de mouse e multip...

View Board

In 1932, desperate WWI veterans marched on Washington for promised bonuses, only to face tanks, tear gas, and fire from ...

View Board

The Black Death wiped out 30-60% of Europe, but in its wake, women’s wages surged by 20-30% as they filled labor gaps, r...

View Board

Discover Agis IV, the Spartan king who dared to challenge the status quo! Learn about his ambitious reforms, debt cancel...

View Board

Discover Maurice Allais, the groundbreaking French economist and Nobel laureate. Learn about his innovative theories on ...

View BoardUnlock the world of crypto tokens! Learn about utility, governance, stablecoins, and DeFi tokens. Discover the latest tr...

View Board

Assyrian conquest in 732 BCE left Damascus layered with Roman roads, Umayyad mosaics, Crusader citadels, and Ottoman kha...

View Board

Explore the benefits of using cryptocurrencies in 2026: faster payments, lower costs, financial inclusion, and tokenized...

View Board

Demystifying cryptocurrency! Explore the different types of cryptocurrencies, from Bitcoin and Ethereum to stablecoins a...

View Board

Explore the life of Christopher O'Neill, from his finance career and family background to his marriage to Princess Madel...

View Board

Découvrez Bitcoin, la première cryptomonnaie. Apprenez son histoire, son fonctionnement, et comment elle révolutionne la...

View Board

Comments