The Dominance of Major Film Studios in 2025: An Era of Transformation

The global film industry witnessed significant changes in 2025, with the power dynamics reshaping the landscape of cinematic storytelling. This era has been marked by the continued dominance of what is now known as the “Big Five” film studios: Warner Bros., Walt Disney, Universal, Sony Pictures, and Paramount Pictures. These corporations, collectively controlling a substantial portion of the North American market share, have not only shaped the cultural narrative but also influenced the financial strategies governing the film industry.

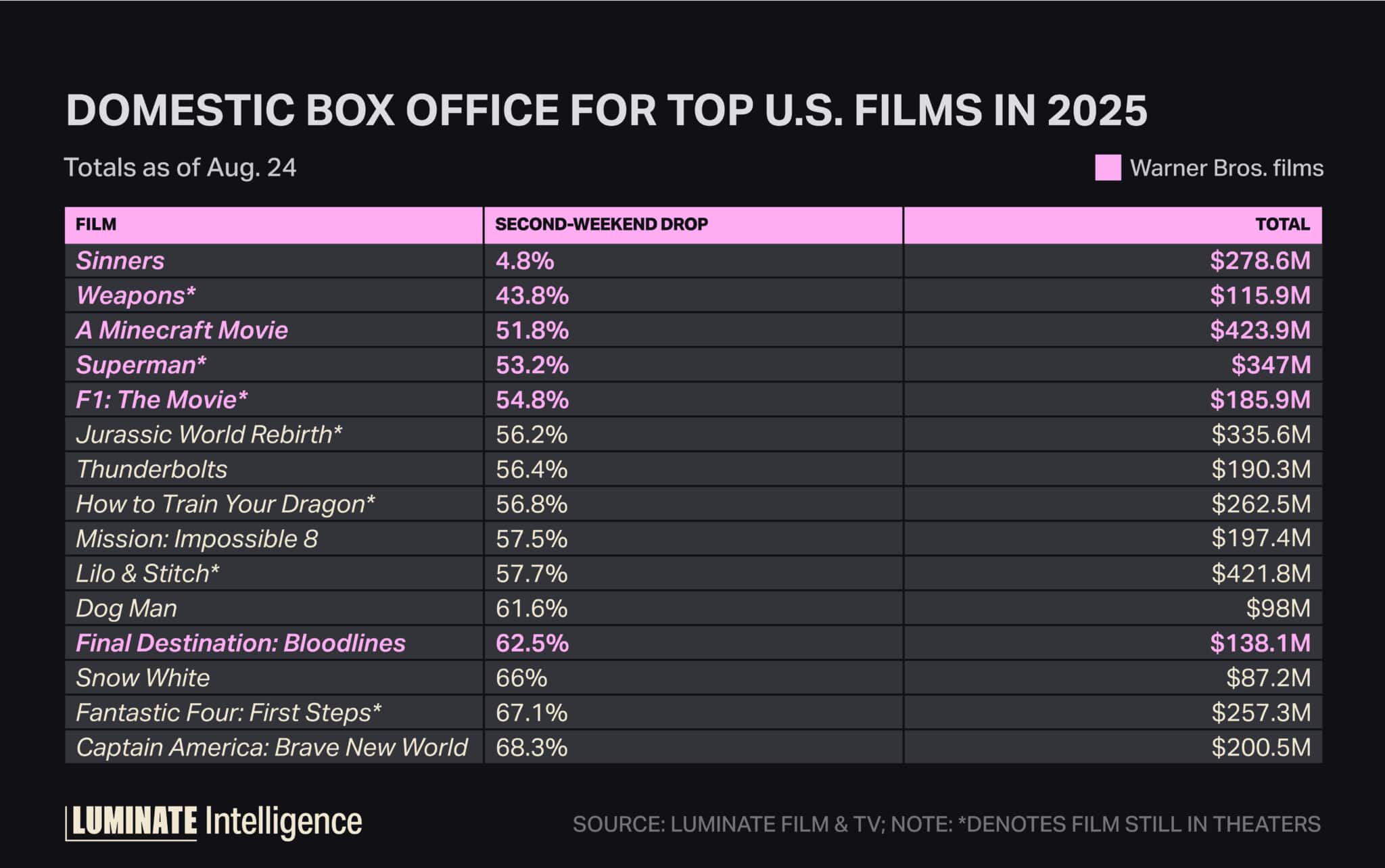

Warner Bros., led by a string of successful movies, particularly The Minecraft Movie and James Gunn's reboot of Superman, claimed the top spot in domestic box office revenue with a market share of 23.91%, grossing approximately $1.86 billion from a release of 13 films. Meanwhile, Walt Disney, though facing some disappointments with films such as Captain America: Brave New World and Snow White, maintained a strong position with its 23.16% market share, grossing roughly $1.8 billion across 14 movies, including the highly anticipated Lilo & Stitch.

In contrast, Universal's diversified portfolio earned it 17.92% of the market share, reflecting its strategic approach to both popular franchises and independent productions. Sony Pictures, with its focus on high-quality yet commercially viable content, secured a 6.74% market share, while Paramount Pictures carved out a niche with 6.49%, showing the studios' ability to carve territories despite intense competition.

In addition, the rise of emerging players like Amazon MGM Studios and A24 adds a layer of complexity to this already sophisticated market. While Amazon MGM, with its expansive OTT platform, has become a formidable contender, A24's success in niche-driven, auteur-led projects highlights an alternative path to traditional blockbuster dominance.

The film industry's evolution in 2025 has been characterized by a unique blend of veteran franchise exploitation and cutting-edge innovation. Warner Bros.' revival of legacy IPs, such as those from DC Comics, exemplifies how the studios can revitalize established franchises while ensuring audience engagement. Similarly, Universal's vast and varied slate underscores the importance of maintaining a balanced approach between tried-and-true properties and fresh ideas.

Notably, the success of films like The Minecraft Movie and James Gunn's Superman suggests that major studios are increasingly investing in high-concept, visually impressive projects that cater to a wide range of viewers. On the other hand, Disney's challenges indicate the risks associated with sticking too closely to a formula that may not resonate with all audiences.

The market segmentation by MPAA ratings reveals a fascinating insight into viewer preferences and studio strategies. PG-rated films topped the gross revenue chart with $2.66 billion and 235 million tickets sold, while R-rated films came in second with $2.58 billion and 228 million tickets, indicating a broad appeal across demographic boundaries.

This distribution pattern reflects the studios’ efforts to balance family-friendly content with mature themes that attract adult audiences. It also demonstrates the resilience of films catering to specific age groups and interests, proving that niche markets still hold significant value.

The slight decline in market share from the previous year (2024) does not signal a decline in dominance for the big studios. Instead, it highlights the fragmented nature of the market where emerging voices and new platforms are gaining ground.

At the core of this dominance sits the vertical integration of major studios. These conglomerates extend their influence far beyond the mere production and distribution of films. The Big Five operate extensive media networks, streaming platforms, and ancillary businesses, all of which amplify their reach and control over different facets of the entertainment industry.

For instance, Disney's acquisition of 20th Century Fox was a strategic move that consolidated its position in a rapidly evolving market. Similarly, Warner Bros. and Comcast’s NBCUniversal demonstrate the ongoing merger and acquisition trends that continue to shape the film industry's future.

This consolidation not only ensures a robust financial infrastructure but also allows these studios to leverage proprietary technology and intellectual property effectively. From Industrial Light & Magic's groundbreaking visual effects to Pixar’s unparalleled animation prowess, the vertical integration model has become indispensable for staying ahead in the modern digital era.

The resurgence of theatrical box offices in 2025 marks a hopeful turn for the industry. Studios like Warner Bros. have successfully balanced legacy IP revivals with original content, revitalizing interest in traditional movie-going experiences. This strategic shift towards a hybrid model has instilled investor confidence and generated a vibrant environment for creative expression within the studios.

The increasing importance of streaming platforms is evident in the growing cooperation between major studios and OTT services. Companies like Amazon MGM Studios have leveraged Prime Video and MGM+ to complement their theatrical releases, expanding their reach and enhancing overall profitability. This dual strategy ensures that both big screens and online platforms benefit from synergies within the same corporate structure.

While the theatrical business remains crucial, the emergence of independent studios like A24 represents a significant shift. By focusing on niche, highly acclaimed films, these studios provide an alternative to the blockbuster-driven ethos of the major players. Their success highlights the potential for smaller, more daring productions to find large audiences, proving that innovation can thrive even under industry giants.

The competitive landscape in 2025 is marked by an intensifying battle among major studios, each vying for a larger slice of the pie through increased production slates and innovative marketing strategies. Universal and Paramount Picture’s expansion plans are indicative of this trend, as they aim to push boundaries and explore new territories within the entertainment space.

As we look ahead to the future of the film industry, the trajectory of these big players suggests ongoing transformation. They must adapt to changing technologies, shifting consumer preferences, and the rising influence of independent voices. The key to sustained success lies not just in maintaining dominance but in fostering creativity and openness to new forms of storytelling.

With the global market poised for further changes, the film studios of today must navigate the complexities of an ever-evolving industry while holding onto their traditional strengths. The coming years promise to be filled with challenges but also filled with opportunities for those who can innovate and evolve.

The Rise of Streaming and Ancillary Markets

The rise of streaming platforms has become a pivotal force influencing the film landscape, challenging traditional models of content distribution. Platforms like Netflix, Amazon Prime Video, and MGM+ have not only complemented theatrical releases but have also begun to dominate the home viewing market. According to data, streaming services accounted for a significant portion of revenue, especially for major studios looking to expand their reach. Studios like Warner Bros. and Disney, leveraging their extensive library of films, have seen a surge in streaming subscriptions, further enhancing their control over content distribution.

The success of streaming initiatives is underscored by the growing subscription base and user engagement. Amazon MGM’s Prime Video, for instance, reported a 30% increase in subscriptions and a 45% growth in stream minutes watched compared to the previous year. This success is driven by the platform’s exclusive content offerings, coupled with the convenience and accessibility of viewing any time, anywhere. Such trends suggest that the future of film consumption may increasingly lean towards subscription-based models, rather than relying solely on theatrical or physical media sales.

The collaboration between major studios and OTT platforms has also opened new avenues for monetization. Warner Bros.’ partnership with HBO Max and its integration with WarnerMedia’s streaming service exemplifies this trend. This alignment not only enhances the visibility of content but also leverages the broader entertainment portfolio of the studio, creating a more cohesive and appealing offering to audiences. Similarly, Disney's Star and Peacock partnerships reflect the conglomerate’s strategic vision to dominate the streaming space while maintaining strong ties to its traditional theatrical releases.

Audience Engagement Beyond Cinema Screens

Beyond streaming, the studios are engaging their audiences in innovative ways, both pre- and post-release. Warner Bros. took a bold step by releasing the highly anticipated sequel to The Minecraft Movie exclusively on HBO Max for the first month, followed by a theatrical opening. This dual release strategy allowed them to gauge audience reaction and adjust marketing efforts accordingly. Such tactics highlight the studios’ adaptability and their commitment to providing the best possible experience for their fans.

The interactive film format and immersive viewing experiences have also garnered attention. Studios like Universal are exploring virtual reality (VR) and augmented reality (AR) technologies to enhance storytelling. The Mummy Unleashed VR Experience, for example, provided users with an immersive, interactive journey that went beyond the conventional theatrical format. These innovations not only enhance the viewing experience but also generate additional revenue streams through premium ticketing and merchandise sales.

Additionally, the studios have embraced social media and fan communities to foster ongoing engagement. Warner Bros.’ The Minecraft Movie campaign engaged younger audiences through TikTok challenges and social media campaigns, building a grassroots following before the theatrical release. This strategic use of social media has proven to be effective in generating buzz and driving word-of-mouth promotion. Similarly, Disney’s Lilo & Stitch utilized animated social media posts to keep fans engaged and excited about its release.

The Role of Franchises and Intellectual Property

Franchises remain central to the studios’ content strategy, acting as a reliable source of revenue and brand recognition. From DC Comics to Disney’s Marvel and Star Wars, franchise-building has become an art form. Warner Bros.’ continued success with the DC Extended Universe and its recent expansion into streaming content demonstrate the enduring appeal of well-established franchises. Similarly, Disney’s expansion into gaming and other media, fueled by successful franchises like Star Wars and Pixar, showcases the versatility and profitability of these intellectual properties.

The studios also focus on developing their IPs across various forms of media, from video games and toys to theme park attractions. This multi-platform approach ensures that fans of these franchises can engage with the content in diverse ways, extending the life cycle of popular IPs. The success of Star Wars toys, games, and theme park experiences illustrates how IP cross-promotion can drive additional revenue, reinforcing the interconnectedness of the entertainment ecosystem.

Challenges and Innovations

The dominance of big studios also brings challenges, particularly in terms of maintaining relevance and avoiding stagnation. One significant challenge is the oversaturation of the market, with an ever-increasing number of films vying for limited audience attention. Studios like Paramount Pictures have taken steps to address this by focusing on niche markets and leveraging emerging technologies to stand out. Their recent foray into VR films and their investment in digital marketing highlight an ongoing effort to stay competitive in a crowded field.

Another challenge is the ever-evolving nature of consumer preferences. Younger audiences are increasingly drawn to digital content, prompting studios to reevaluate their strategies. Paramount Pictures, for instance, has invested heavily in digital marketing and virtual events to attract younger, tech-savvy audiences. Similarly, Warner Bros. has launched multiple digital-first content offerings, including exclusive web series and limited-time digital events, to engage a wider demographic.

To tackle these challenges, the studios are embracing cutting-edge technologies and new narrative formats. Universal’s exploration of transmedia storytelling, combining film with interactive digital experiences, represents a forward-thinking approach. This strategy not only enhances the storytelling process but also creates new opportunities for revenue generation. The success of The Mummy Unleashed VR Experience indicates that immersive storytelling can significantly impact audience engagement and satisfaction.

The studios are also experimenting with decentralized production models, harnessing the power of crowd funding and user-generated content to drive innovative projects. Warner Bros., for example, has explored crowdfunding for short films and micro-budget productions, allowing them to tap into untapped creative pools. Similarly, A24’s success with auteur-driven films suggests that grassroots storytelling can be a force to reckon with, potentially leading to new collaborations and fresh perspectives within the industry.

The Future of the Film Industry

The future of the film industry in 2025 and beyond promises to be defined by collaboration, innovation, and a willingness to adapt. As market forces continue to evolve, major studios will need to remain agile and responsive to changing consumer behaviors and technological advancements. The ongoing integration of streaming platforms and digital marketing will play a crucial role in shaping this future, as will the continued development and refinement of immersive storytelling formats.

The film studios of tomorrow must not only protect their traditional strengths but also embrace new opportunities. By fostering a culture of creativity, engagement, and innovation, they can ensure their enduring relevance in the ever-changing world of entertainment. As the industry moves forward, the success of major studios will depend on their ability to navigate the complex interplay of tradition and disruption, striking a balanced relationship between the familiar and the novel.

The evolution of the film industry in tandem with the rise of new technologies and emerging platforms presents both challenges and opportunities. As the next decade unfolds, the big five studios will undoubtedly face new obstacles but will also have unprecedented chances to redefine the narrative and set new standards for cinematic excellence.

The Impact on Global Cinema

The influence of major studios extends far beyond North America, impacting global cinema through co-productions, foreign investments, and commissioning cycles. Studios like Warner Bros. and Disney have entered into numerous international agreements to produce and distribute films across diverse markets, ensuring their content reaches audiences worldwide. For instance, the international release dates of films produced by these studios are strategically planned to maximize global box office performance.

The global nature of production cycles is also evident in the increasing number of international co-productions. Studios like Paramount Pictures have developed partnerships with production companies from various countries, resulting in films that blend local and international sensibilities. This approach not only enriches the storytelling but also ensures the films are culturally relevant and commercially viable in multiple regions.

In addition, the distribution strategies employed by major studios have a significant impact on the global film market. Warner Bros. and Disney have established distribution networks in countries where there are fewer local distributors. This direct involvement ensures that their films are shown in theaters, leading to increased screen counts and higher box office revenues. Such strategic distribution plays a crucial role in the economic health of the film industry worldwide.

The Role of Regional Markets

Regional markets, particularly in Asia, Latin America, and Europe, have gained significant importance in the global film industry. Studios like Sony Pictures and Universal have recognized the potential of these markets and have adjusted their strategies accordingly. For instance, Sony Pictures has established a robust presence in Asian markets, producing films tailored to local tastes and cultural nuances. Similarly, Universal has seen success in Latin American markets, where its diverse slate of films appeals to localized preferences.

The increasing significance of regional markets is also reflected in the production decisions made by major studios. Films such as Lilo & Stitch and The Minecraft Movie have been specifically tailored to appeal to these regions, with marketing campaigns that reflect local cultures and sensibilities. This region-specific approach not only enhances the relevance of the films but also creates a stronger emotional connection with audiences.

The success of these regional strategies is further corroborated by the financial performance of these films. For example, Lilo & Stitch performed exceptionally well in markets like China, where cultural resonances were leveraged to boost ticket sales. Similarly, The Minecraft Movie enjoyed strong audiences in Latin American markets, driven by the popularity of the game and localized marketing efforts.

The Evolving Role of Independent Studios

The rise of independent studios like A24 and Lionsgate represents a significant shift in the film industry. While major studios continue to dominate the mainstream market, independent studios have carved out niches by focusing on artistic expression and auteur-driven content. Films produced by A24 have garnered critical acclaim and commercial success, despite being distributed by larger studios.

Independent studios often take bold, calculated risks, pursuing projects that might not fit the mold of big-budget blockbusters. Their success stories serve as case studies for the broader industry, illustrating the potential for creative risk-taking and innovative storytelling. The rise of independent studios also brings diversity to the landscape, ensuring that voices outside the mainstream have a platform to tell their stories.

Moreover, the growing success of niche films provides insights into future industry trends. Successful auteur-driven films like Uncut Gems and Finding Nemo suggest that the market can support both artistic expression and commercial viability, given the right context and marketing. This duality opens up possibilities for mainstream studios to experiment with artistic and narrative styles that resonate deeply with specific audiences.

Conclusion

The film industry in 2025 and beyond is a dynamic and evolving landscape, dominated by major studios but also influenced by emergent trends and independent voices. The continued influence of the Big Five, along with the rise of emerging players, reflects a complex interplay of power and adaptation. Major studios maintain their dominance through strategic partnerships, robust distribution networks, and innovative storytelling, while independent studios offer fresh perspectives and alternative narratives.

As the industry navigates the challenges and opportunities of the 21st century, it is clear that the path to success is multifaceted. By embracing technological advancements, engaging global audiences, and promoting diverse storytelling, the film industry can continue to thrive and evolve. The future of cinema lies in the hands of those who can balance tradition with innovation, ensuring that the medium remains a vibrant, compelling, and diverse form of artistic expression.

Ultimately, the film industry’s ability to adapt and innovate will determine its continued relevance in an ever-changing world. As we look towards the future, one thing is certain: the stories we tell and the films we watch will continue to captivate, inspire, and entertain audiences around the globe.

Comments