Explore Any Narratives

Discover and contribute to detailed historical accounts and cultural stories. Share your knowledge and engage with enthusiasts worldwide.

The world of cryptocurrencies is rapidly evolving, with the potential for both astronomical returns and significant losses. While many enthusiasts celebrate these digital assets for their innovation and decentralized nature, it's equally important to acknowledge the risks associated with this space. Scammers and hackers have found new avenues in cryptocurrencies to exploit unsuspecting investors, leading to the rise of various scams. In this article, we will delve into some of the most common cryptocurrency scams and provide practical tips to help you avoid them.

Phishing attacks are one of the most prevalent forms of scamming in the crypto world. Attackers often pose as trusted entities such as exchanges, wallets, or reputable projects, attempting to steal personal information or funds. They may use phishing emails, websites, or even fake social media accounts to deceive users into sharing sensitive data such as private keys or login credentials.

These attackers frequently deploy sophisticated techniques to make their attempts appear legitimate. For instance, they might create phishing websites that mimic those of well-known exchanges. These sites often have similar URLs and design elements to the real ones but are designed to capture user information and transfer funds to the attacker's controlled addresses.

To avoid falling prey to phishing attacks:

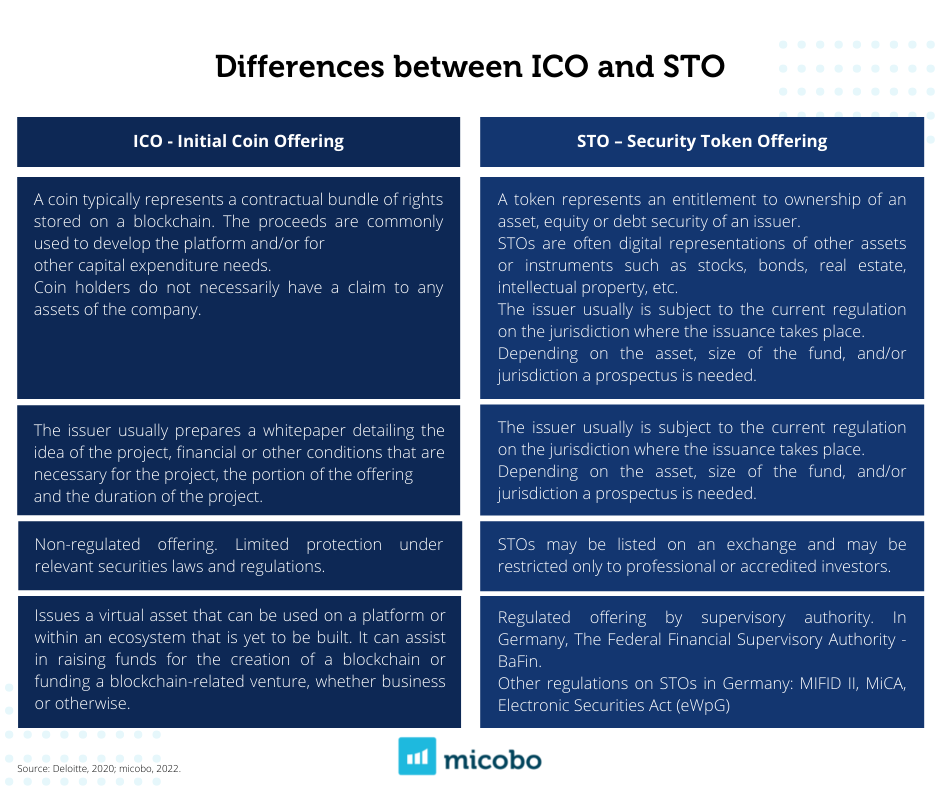

Initial Coin Offerings (ICOs) have been a popular method for raising capital since 2017. However, the lack of regulation in this space has led to numerous scams where fraudulent projects raise money under false pretenses. Investors are often misled by exaggerated promises, misleading marketing materials, and outright theft.

A common tactic in ICO scams involves creating projects with flashy websites and social media presence, often using celebrity endorsements to build credibility. Once the project gains traction, they initiate a token sale, during which investors are encouraged to send their cryptocurrencies. After collecting substantial funds, the creators may either run away with the money or simply disappear without providing any actual value or product.

To avoid falling victim to ICO scams:

Tether, a blockchain-based stablecoin, was once thought to be anchored to the US dollar and thus serve as a reliable form of exchange in times of market volatility. Unfortunately, questions about its reserves and transparency have raised serious concerns. Similar schemes involving other stablecoins have also emerged, often with dubious backing mechanisms. These tethers can lead to significant financial losses if investors believe they are stable but turn out to be unsupported.

Fraudulent tethering schemes usually involve creating a platform or project that claims to back its tokens with actual dollars but does not do so transparently. Investors are often lured by promised high returns or innovative features, only to find themselves exposed to a fraudulent scheme.

Here are ways to avoid such schemes:

Decentralized finance (DeFi) platforms have transformed traditional financial services through smart contracts and blockchain technology. However, the lack of intermediaries comes with significant risks, including smart contract vulnerabilities and liquidity manipulation attacks.

Smart contract hacks occur when attackers exploit flaws in the code to drain funds from wallets or smart contracts. One high-profile example includes the Sushiswap hack, where attackers exploited a bug to drain millions of dollars worth of funds from DeFi protocols. Similarly, liquidity manipulation attacks involve creating large volumes of trades to manipulate the price of coins or tokens, leading to financial losses for unsuspecting users.

To protect yourself in the DeFi space:

Cryptocurrencies are susceptible to market manipulation, where scammers intentionally cause price fluctuations to their advantage. This can be achieved through coordinated buying/selling activities, spreading rumors, or running pump-and-dump schemes.

Pump-and-dump schemes involve a group of actors colluding to artificially inflate the price of a coin by spreading positive news or creating fake buy orders. Once the price reaches certain levels, they quickly sell off their holdings, causing the price to drop sharply and leaving other investors holding worthless assets.

To avoid falling into these traps:

One of the most effective defenses against cryptocurrency scams is education. Understanding how these scams work and knowing the signs to watch out for can significantly reduce your risk. Regularly staying updated on the latest scams and security measures is crucial in this constantly evolving landscape.

Additionally, community engagement plays a vital role. Platforms like Reddit, Telegram, and other forums dedicated to discussing cryptocurrencies can provide valuable insights and warnings from other experienced users. Building a network of trustworthy peers can help ensure that you receive credible information and advice.

In conclusion, while cryptocurrencies offer exciting possibilities for innovation and investment, they also come with unique risks. By learning about common scams, maintaining a vigilant mindset, and educating yourself and others, you can better protect yourself against these threats. As a responsible crypto investor, always prioritize caution and due diligence to ensure a safer and more sustainable journey in the world of digital assets.

Stay safe out there!

Regulatory bodies play a crucial role in mitigating some of the risks associated with cryptocurrencies. Countries around the world are increasingly introducing regulations to protect investors and consumers. For instance, the SEC (Securities and Exchange Commission) in the United States has taken several actions to crack down on fraudulent ICOs and crypto offerings. Similar efforts are being made by regulators in other countries to ensure that market participants adhere to established guidelines.

However, the patchwork of regulatory frameworks globally can create confusion and make it challenging for investors to navigate. Clear and consistent regulatory standards can help investors make informed decisions and avoid falling into traps set by scammers. Engaging with regulatory bodies and staying informed about local regulations can offer additional layers of protection.

For individuals looking to navigate regulatory landscapes, consider the following:

A secure wallet is essential in protecting your investments from hacking and theft. Hardware wallets and paper wallets are popular choices among experts due to their strong security features. Hardware wallets store your private keys offline, which makes them highly resistant to online attacks. Paper wallets involve printing out your private keys and storing them securely, though they require greater care to prevent physical damage.

Software wallets are generally more convenient but come with higher risks due to their reliance on internet-connected devices. It’s crucial to ensure that you use reliable software wallets and follow best practices such as two-factor authentication, regular backups, and avoiding phishing attacks.

To enhance security with wallets:

Selecting a reputable crypto exchange is another crucial step in protecting your investments. Exchanges handle billions of dollars daily and act as central hubs for trading and liquidity provision. While exchanges offer convenience and access to a wide range of assets, they also introduce centralized risk, including potential hacks, internal mismanagement, and regulatory issues.

When choosing an exchange:

Identity and privacy are critical considerations in the crypto space. Revealing too much personal information can put you at risk of identity theft, while lack of privacy can expose you to targeted scams. Many exchanges and wallet providers offer privacy features, but it's important to understand how these work and whether they meet your needs.

To protect your identity and privacy:

While the world of cryptocurrencies offers vast opportunities for innovation and financial freedom, it also presents unique challenges and pitfalls. By understanding common scams, adhering to best security practices, and staying informed about regulatory landscapes, you can better protect yourself from falling victim to frauds. Utilizing secure wallets, choosing reputable exchanges, and maintaining strong privacy measures are all essential steps in safeguarding your investments.

Armed with knowledge and vigilance, you can navigate the complexities of the crypto ecosystem with confidence. Remember, the key to successful investments lies not only in finding profitable opportunities but in ensuring that these opportunities come with minimal risk.

Stay informed, stay cautious, and stay secure!

Building a strong community around your cryptocurrency investments can be invaluable. Crypto communities are active forums where individuals share experiences, warn each other about scams, and provide support. Platforms like Reddit, Telegram, Discord, and specialized crypto communities can offer a wealth of information and resources. Joining these groups allows you to stay informed about the latest trends, scams, and security measures.

Here are some ways to engage and utilize crypto communities effectively:

Beyond community engagement, reporting scams to the relevant authorities or platforms is crucial. Most exchanges and regulatory bodies have mechanisms in place to receive tips about scams. Providing detailed information can lead to quicker resolutions and prevent further losses for victims.

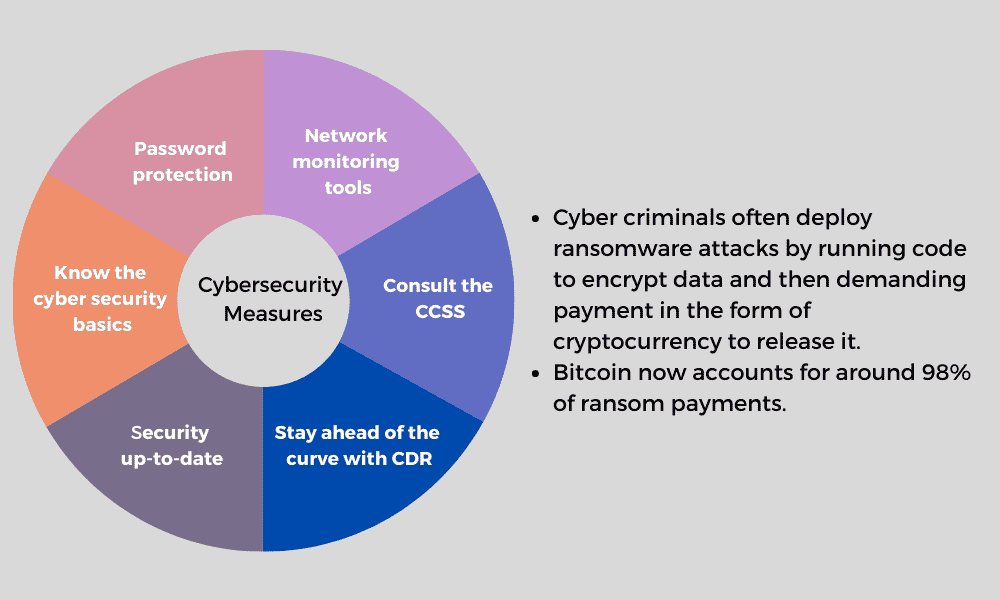

There are several security tools and software solutions that can significantly enhance your protection against scams. Here are some tools that can help:

In addition to using security software, it’s crucial to maintain good cybersecurity hygiene:

The crypto space is continually evolving, and new threats emerge regularly. Staying informed about emerging threats is essential to staying one step ahead of scammers. Here are some sources to keep you updated:

Additionally, participating in webinars, conferences, and workshops focused on crypto security can offer direct access to industry experts and cutting-edge knowledge.

Facing scams in the crypto space is an ongoing challenge, but with the right strategies and tools, you can minimize the risks. Educating yourself about common scams, using secure practices, engaging with the community, and leveraging available security tools can significantly enhance your safety and security.

Remember, the crypto world is dynamic, and staying informed is key to navigating it safely. Continuously educate yourself, remain vigilant, and take proactive steps to protect your investments. By doing so, you can enjoy the many benefits of crypto while minimizing the associated risks.

Happy crypto trading, and may you remain secure!

Your personal space to curate, organize, and share knowledge with the world.

Discover and contribute to detailed historical accounts and cultural stories. Share your knowledge and engage with enthusiasts worldwide.

Connect with others who share your interests. Create and participate in themed boards about any topic you have in mind.

Contribute your knowledge and insights. Create engaging content and participate in meaningful discussions across multiple languages.

Already have an account? Sign in here

Learn how to buy cryptocurrency confidently with this comprehensive guide. Discover key steps including choosing exchang...

View Board

Understand the major risks of cryptocurrency investing, including extreme volatility, security threats, regulatory uncer...

View BoardExplore the fascinating world of crypto tokens with our comprehensive guide. Discover the functionality, types, and sign...

View Board

Last news about Crypto Week from 17/11/2025 to 23/11/2025

View Board

Last news about Crypto Week from 28/04/2025 to 04/05/2025

View Board

Discover the numerous benefits of using cryptocurrencies, including decentralization, cost efficiency, financial inclusi...

View Board

Explore the dynamic world of cryptocurrencies in our comprehensive guide, "Understanding Different Types of Cryptocurren...

View Board

"Discover Ripple XRP's history, technology, and market impact. Learn about its unique consensus algorithm, low transacti...

View Board

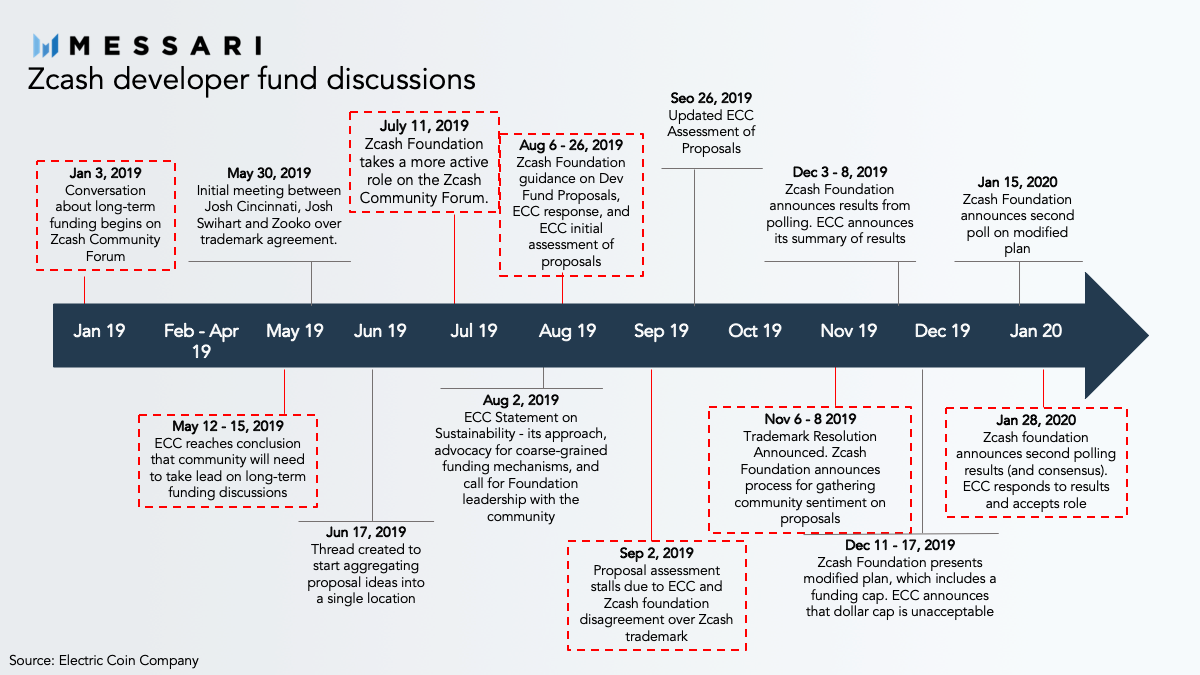

Discover Zcash cryptocurrency: its history, tech, and unique advantages. Explore the future of this privacy-focused coin...

View Board

Explore the in-depth world of DigiByte with our comprehensive guide, diving into its unique features, technological inno...

View Board

Last news about Crypto Week from 03/11/2025 to 09/11/2025

View Board

Explore the transformative world of Initial Coin Offerings (ICOs) and discover how this innovative fundraising strategy ...

View Board

Explore the world of cryptocurrency with our comprehensive guide, unraveling the intricacies of this digital phenomenon....

View Board

IOTA revolutionizes blockchain with Tangle technology, offering zero transaction fees, scalability, and decentralization...

View Board

Celo revolutionizes payments and finance with a blockchain platform focused on financial inclusion, decentralized financ...

View Board

Crypto Exchanges Explained: Understanding the Complex World of Digital Currencies The Rise of Cryptocurrencies: In rece...

View Board

**Optimized Meta Description:** *"Learn how to trade cryptocurrency with this complete beginner’s guide—from choosing...

View Board

Explore how digital signatures are revolutionizing data security by verifying identity and ensuring data integrity in th...

View Board

Last news about Crypto Week from 05/05/2025 to 11/05/2025

View Board

Last news about Crypto Week from 21/04/2025 to 27/04/2025

View Board

Comments