Internet Computer DFINITY: The Revolutionary Platform Transforming the Web

The Internet Computer (ICP) is a groundbreaking Layer-1 blockchain platform developed by the DFINITY Foundation. It aims to redefine the internet by enabling web-speed, decentralized applications and hosting entire websites and services on-chain. Often referred to as the "World Computer", ICP presents a serverless alternative to traditional Big Tech cloud infrastructure, promising a future where the internet is truly decentralized.

What Is the Internet Computer (ICP)?

The Internet Computer is not just another blockchain. It is a comprehensive decentralized computing platform designed to run entire web services—front-end, logic, and storage—directly on a public blockchain. Unlike conventional blockchains that focus primarily on financial transactions or decentralized finance (DeFi), ICP aims to decentralize the entire internet stack, challenging the dominance of centralized cloud providers like Amazon Web Services (AWS) and Google Cloud.

At its core, ICP leverages canister smart contracts, which are stateful WebAssembly modules capable of serving web content directly to users. This innovative approach eliminates the need for traditional web hosting, offering a fully on-chain experience that is both scalable and efficient.

Key Innovations Behind the Internet Computer

1. Chain-Key Cryptography: The Backbone of Speed and Security

One of ICP’s most significant technological advancements is its use of chain-key cryptography. This novel cryptographic technique enables fast finality and single public key verification across multiple subnets. Unlike traditional blockchains that suffer from slow transaction speeds and high latency, ICP’s chain-key design ensures near-instant finality, making it suitable for real-time web applications.

According to DFINITY’s technical documentation, ICP achieves finality times in seconds, a remarkable feat compared to other blockchains that may take minutes or even hours to confirm transactions. This speed is crucial for delivering a web-like user experience without compromising decentralization.

2. Subnet Architecture: Scalability Through Chain-of-Chains

ICP’s scalability is powered by its subnet architecture, a chain-of-chains model that allows the network to scale horizontally. Each subnet operates as an independent blockchain, capable of processing transactions and hosting canister smart contracts. This modular design enables ICP to handle high throughput while maintaining decentralization.

Recent upgrades have significantly enhanced ICP’s storage capacity. Reports indicate that per-subnet storage has doubled to 2 TiB, with the network comprising dozens of subnets and an aggregate storage capacity reaching tens of terabytes. For example, community analyses cite figures such as ~94 TiB across 47 subnets, highlighting the platform’s ability to support large-scale, data-intensive applications.

3. Canister Smart Contracts: The Future of Decentralized Applications

At the heart of ICP’s functionality are canister smart contracts. These are stateful, scalable modules written in WebAssembly, capable of executing complex logic and serving dynamic web content. Unlike traditional smart contracts that are often limited to simple transactions, canisters can host entire applications, including front-end interfaces, back-end logic, and data storage.

This innovation allows developers to build fully decentralized applications (dApps) that run entirely on-chain. From social media platforms to enterprise-grade software, canisters provide the flexibility and power needed to create next-generation web services without relying on centralized infrastructure.

The Vision Behind DFINITY’s Internet Computer

Decentralizing the Internet Stack

DFINITY’s mission with the Internet Computer is to decentralize the entire internet stack. This means moving beyond just decentralized finance or payments and instead focusing on hosting entire web services—including front-end interfaces, back-end logic, and data storage—on a public blockchain. By doing so, ICP aims to reduce reliance on centralized cloud providers, offering a more open, secure, and censorship-resistant alternative.

The platform’s architecture is designed to support web-speed performance, ensuring that decentralized applications can compete with their centralized counterparts in terms of user experience and functionality. This is achieved through a combination of chain-key cryptography, subnet scalability, and canister smart contracts, all working together to create a seamless, high-performance environment for developers and users alike.

Challenging Big Tech with a Serverless Alternative

One of the most compelling aspects of ICP is its potential to disrupt the cloud computing industry. Today, a handful of tech giants—Amazon, Google, and Microsoft—dominate the cloud infrastructure market, controlling vast amounts of data and exerting significant influence over the internet. ICP’s serverless architecture offers a decentralized alternative, allowing developers to build and deploy applications without relying on these centralized providers.

By leveraging on-chain storage and computation, ICP eliminates many of the vulnerabilities associated with centralized cloud services, such as data breaches, censorship, and single points of failure. This shift not only enhances security but also promotes greater innovation and competition in the tech industry, empowering developers to create applications that are truly owned and controlled by their users.

Governance and Decentralization: The Network Nervous System (NNS)

A critical component of ICP’s design is its on-chain governance system, known as the Network Nervous System (NNS). The NNS is a decentralized autonomous organization (DAO) that allows token holders to vote on proposals and upgrades, ensuring that the platform evolves in a transparent and community-driven manner.

However, the NNS has faced scrutiny regarding voter participation and centralization. Community analyses have noted that voter turnout in NNS proposals hovers around 27%, raising questions about the level of engagement and the distribution of influence within the network. While the NNS is designed to be fully decentralized, some critics argue that DFINITY’s early involvement in the project has led to perceived centralization of decision-making power.

Despite these challenges, the NNS remains a pioneering example of on-chain governance, offering a framework for decentralized decision-making that could serve as a model for other blockchain projects. As ICP continues to grow, the effectiveness of the NNS in fostering true decentralization will be a key factor in its long-term success.

Recent Developments and the 2025 Roadmap

AI Integration: The “Self-Writing Internet”

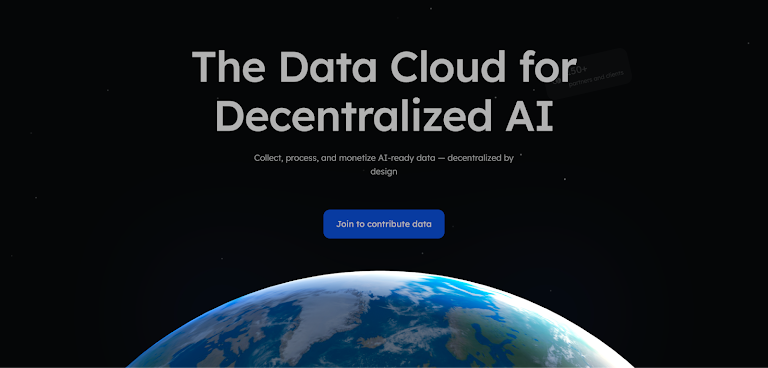

One of the most exciting developments in ICP’s evolution is its focus on artificial intelligence (AI). DFINITY’s 2025 roadmap introduces a vision for a “Self-Writing Internet”, where AI plays a central role in creating and updating applications. This initiative, often referred to as Caffeine or Caffeine AI, aims to enable developers to perform AI inference and data processing directly on-chain, reducing dependence on centralized APIs.

The integration of AI into ICP’s ecosystem is designed to make application development more accessible, even to non-technical users. By leveraging conversational interfaces and AI-driven tools, DFINITY envisions a future where anyone can generate and deploy decentralized applications with minimal coding knowledge. This could significantly lower the barrier to entry for developers and accelerate the adoption of decentralized technologies.

Enhancing Developer Experience and Onboarding

In addition to AI integration, DFINITY is placing a strong emphasis on improving the developer experience. The 2025 roadmap includes numerous upgrades to the command-line interface (CLI) and toolchain, aimed at simplifying the process of building and deploying applications on ICP. These improvements are part of a broader effort to attract mainstream developers beyond the crypto community, making it easier for them to transition to decentralized platforms.

Key features of the roadmap include:

- Levitron: A tool designed to enhance edge telemetry, providing developers with better insights into application performance and user interactions.

- CLI and Toolchain Reforms: Modernization efforts to streamline development workflows and reduce onboarding friction.

- Expanded Storage and Subnet Capacity: Recent upgrades have doubled per-subnet storage to 2 TiB, enabling larger on-chain applications and more complex use cases.

Competing in the Decentralized AI Landscape

ICP’s push into on-chain AI positions it as a direct competitor to both traditional Web2 cloud providers and other blockchain projects exploring decentralized AI solutions. By enabling AI models to run as smart contracts on its network, ICP aims to provide a fully decentralized alternative to centralized AI services, offering greater transparency, security, and user control.

Early evidence of this vision can be seen in hackathon projects and community-driven initiatives, where developers have created practical applications—such as mapping tools, document generators, and agent-based systems—using ICP’s AI capabilities. These projects serve as proof-of-concept for the platform’s potential to support a wide range of AI-driven use cases, from enterprise solutions to consumer-facing applications.

Conclusion: The Future of the Internet Computer

The Internet Computer represents a bold and ambitious vision for the future of the web. By combining decentralized infrastructure with cutting-edge cryptography and AI integration, DFINITY is positioning ICP as a transformative platform capable of challenging the dominance of centralized cloud providers.

As ICP continues to evolve, its success will depend on several key factors, including developer adoption, governance transparency, and the feasibility of on-chain AI. With its 2025 roadmap setting an ambitious course, the Internet Computer is poised to play a pivotal role in shaping the next generation of decentralized applications and services.

In the next part of this series, we will delve deeper into ICP’s technical architecture, explore its real-world use cases, and examine the challenges and opportunities that lie ahead for this revolutionary platform.

Technical Deep Dive: How the Internet Computer Works

The Role of Chain-Key Cryptography in ICP’s Performance

Chain-key cryptography is the cornerstone of ICP’s ability to deliver web-speed performance while maintaining decentralization. Unlike traditional blockchains that rely on slower consensus mechanisms, ICP’s chain-key technology enables instant finality and single public key verification across its subnet architecture. This means transactions and smart contract executions are confirmed in seconds, making ICP one of the fastest blockchain platforms available today.

The cryptographic protocol also allows for secure and efficient cross-subnet communication, ensuring that data and computations can flow seamlessly across the network. This is critical for supporting complex, multi-component applications that require high throughput and low latency. By eliminating the need for multiple confirmations and reducing transaction delays, chain-key cryptography positions ICP as a viable alternative to centralized cloud services.

Subnets: The Scalability Engine of ICP

ICP’s subnet architecture is designed to scale horizontally, allowing the network to expand its capacity by adding more subnets as demand grows. Each subnet operates as an independent blockchain, capable of processing transactions and hosting canister smart contracts. This modular approach ensures that ICP can handle high volumes of traffic without sacrificing performance or decentralization.

Recent upgrades have significantly enhanced ICP’s storage and computational capabilities. For instance, per-subnet storage has been doubled to 2 TiB, with the network now comprising dozens of subnets and an aggregate storage capacity exceeding 94 TiB. This expansion enables developers to build data-intensive applications, such as decentralized social media platforms, enterprise databases, and AI-driven services, all running entirely on-chain.

Canister Smart Contracts: The Building Blocks of Decentralized Applications

At the heart of ICP’s functionality are canister smart contracts, which are stateful WebAssembly modules capable of executing complex logic and serving dynamic web content. Unlike traditional smart contracts, which are often limited to simple transactions, canisters can host entire applications, including front-end interfaces, back-end logic, and data storage. This makes them uniquely suited for building fully decentralized applications (dApps) that rival the functionality of centralized web services.

Canisters are designed to be scalable and interoperable, allowing developers to create modular applications that can interact seamlessly with other canisters across the network. This interoperability is facilitated by ICP’s chain-key cryptography, which ensures secure and efficient communication between different parts of the network. As a result, developers can build sophisticated, multi-component applications that leverage the full power of decentralized computing.

Real-World Use Cases and Applications on ICP

Decentralized Social Media and Content Platforms

One of the most promising use cases for ICP is in the realm of decentralized social media. Traditional social media platforms are centralized, meaning they are controlled by a single entity that can censor content, sell user data, or manipulate algorithms. ICP’s on-chain infrastructure provides an alternative, allowing developers to create social media platforms that are censorship-resistant, user-owned, and transparent.

For example, a decentralized social media application built on ICP could store all user data and content on-chain, ensuring that posts, images, and videos are permanently recorded and immutable. Users would have full control over their data, and the platform’s governance could be managed through a decentralized autonomous organization (DAO), giving the community a say in how the platform evolves.

Enterprise-Grade Decentralized Applications

ICP’s scalability and performance make it an ideal platform for enterprise-grade decentralized applications. Businesses can leverage ICP to build secure, transparent, and efficient systems for supply chain management, financial services, and data analytics. By running these applications on-chain, companies can reduce their reliance on centralized cloud providers, lowering costs and enhancing security.

For instance, a decentralized supply chain management system on ICP could track the movement of goods in real-time, with all data stored immutably on the blockchain. This would provide greater transparency and accountability, reducing the risk of fraud and counterfeiting. Similarly, financial institutions could use ICP to build decentralized lending platforms or cross-border payment systems that operate without intermediaries, lowering transaction fees and increasing efficiency.

AI and Machine Learning on the Internet Computer

ICP’s integration of on-chain AI opens up new possibilities for decentralized machine learning and data processing. By running AI models as smart contracts, developers can create applications that perform real-time inference and analysis without relying on centralized APIs. This is particularly valuable for industries that require high levels of data privacy and security, such as healthcare, finance, and government.

For example, a decentralized healthcare application on ICP could use AI to analyze patient data and provide personalized treatment recommendations, all while ensuring that sensitive information remains encrypted and secure. Similarly, financial institutions could deploy AI-driven fraud detection systems that operate entirely on-chain, reducing the risk of data breaches and unauthorized access.

Challenges and Opportunities for the Internet Computer

Governance and Decentralization: Addressing Community Concerns

While ICP’s Network Nervous System (NNS) is designed to be a fully decentralized governance model, it has faced criticism regarding voter participation and centralization. Community analyses have noted that voter turnout in NNS proposals is around 27%, raising concerns about the level of engagement and the distribution of influence within the network. Some critics argue that DFINITY’s early involvement in the project has led to perceived centralization of decision-making power.

To address these concerns, DFINITY has emphasized the importance of transparency and community involvement in the governance process. The NNS is continually evolving, with new features and improvements aimed at increasing participation and ensuring that decisions are made in a fair and decentralized manner. As ICP matures, the effectiveness of the NNS in fostering true decentralization will be a key factor in its long-term success.

Developer Adoption and Ecosystem Growth

One of the biggest challenges facing ICP is developer adoption. While the platform offers powerful tools and capabilities, attracting developers from the broader tech community remains a priority. DFINITY’s 2025 roadmap includes numerous initiatives aimed at improving the developer experience, such as CLI and toolchain reforms, as well as efforts to lower the barrier to entry for non-technical users.

To accelerate ecosystem growth, DFINITY has also focused on hackathons, grants, and educational programs to encourage innovation and attract new talent. Early success stories, such as hackathon projects demonstrating AI-driven applications and decentralized social media platforms, provide compelling evidence of ICP’s potential. As more developers join the ecosystem, the platform’s utility and adoption are expected to grow exponentially.

Competing in the Decentralized AI Landscape

ICP’s push into on-chain AI positions it as a direct competitor to both traditional Web2 cloud providers and other blockchain projects exploring decentralized AI solutions. By enabling AI models to run as smart contracts, ICP offers a fully decentralized alternative to centralized AI services, providing greater transparency, security, and user control.

However, the feasibility of running large-scale AI models entirely on-chain remains a challenge. Issues such as model size, inference latency, and computational costs must be addressed to ensure that ICP can support meaningful AI workloads. DFINITY is actively working on solutions to these challenges, including optimizations to its subnet architecture and the development of specialized AI-focused tools.

The Future of the Internet Computer: What’s Next?

Expanding the Ecosystem: Partnerships and Integrations

As ICP continues to evolve, partnerships and integrations will play a crucial role in its growth. DFINITY has already begun collaborating with enterprise partners, academic institutions, and other blockchain projects to expand the platform’s reach and utility. These partnerships are expected to drive real-world adoption and demonstrate ICP’s potential to disrupt traditional industries.

For example, integrations with decentralized finance (DeFi) platforms could enable new financial products and services that leverage ICP’s scalability and security. Similarly, partnerships with AI research organizations could accelerate the development of on-chain machine learning tools, further solidifying ICP’s position as a leader in decentralized AI.

Enhancing Performance and Scalability

DFINITY’s 2025 roadmap includes numerous upgrades aimed at enhancing ICP’s performance and scalability. Key initiatives include:

- Levitron: A tool designed to improve edge telemetry, providing developers with better insights into application performance and user interactions.

- CLI and Toolchain Reforms: Modernization efforts to streamline development workflows and reduce onboarding friction.

- Expanded Storage and Subnet Capacity: Continued increases in per-subnet storage and the addition of new subnets to support larger applications and higher traffic volumes.

These upgrades are expected to further improve ICP’s speed, efficiency, and usability, making it an even more attractive platform for developers and enterprises alike.

The Road to Mainstream Adoption

The ultimate goal for ICP is mainstream adoption, where decentralized applications become the norm rather than the exception. To achieve this, DFINITY is focusing on education, outreach, and user-friendly tools that make it easier for developers and businesses to transition to decentralized platforms.

As ICP’s ecosystem grows, we can expect to see a wider range of applications, from decentralized social media to enterprise-grade AI services, all running on a platform that is secure, scalable, and truly decentralized. With its ambitious roadmap and commitment to innovation, the Internet Computer is well-positioned to play a pivotal role in shaping the future of the web.

In the final part of this series, we will explore ICP’s tokenomics, economic model, and the role of the ICP token in the platform’s ecosystem. We will also examine the challenges and opportunities that lie ahead as ICP continues its journey toward becoming the “World Computer”.

ICP Tokenomics: The Economic Engine of the Internet Computer

Understanding the Role of the ICP Token

The ICP token is the native cryptocurrency of the Internet Computer, serving multiple critical functions within the ecosystem. Primarily, it is used for governance, transaction fees, and rewarding network participants. Unlike many other cryptocurrencies that focus solely on speculative trading, ICP is designed to be a utility token that drives the platform’s decentralized economy.

One of the most important roles of the ICP token is its use in the Network Nervous System (NNS). Token holders can stake their ICP to participate in governance, voting on proposals that shape the future of the platform. This staking mechanism not only incentivizes community engagement but also helps secure the network by aligning the interests of participants with the long-term success of ICP.

Transaction Fees and Network Incentives

ICP is also used to pay for transaction fees and computational resources on the network. When developers deploy canister smart contracts or users interact with decentralized applications, a small amount of ICP is required to cover the cost of computation and storage. These fees are then distributed to node providers who maintain the network’s infrastructure, ensuring that the system remains decentralized and economically sustainable.

The economic model of ICP is designed to be deflationary in the long run, with a portion of transaction fees being burned to reduce the overall supply of tokens. This mechanism helps maintain the value of ICP over time, providing an incentive for holders to participate in the network rather than simply speculating on price movements.

Challenges in ICP’s Economic Model

Despite its innovative design, ICP’s tokenomics have faced criticism, particularly in the early days of the project. The initial token distribution was concentrated among a small number of investors and the DFINITY Foundation, leading to concerns about centralization and market manipulation. Additionally, the volatility of the ICP token has been a point of contention, with significant price fluctuations impacting both developers and investors.

To address these challenges, DFINITY has taken steps to increase transparency and decentralize the distribution of ICP. Initiatives such as community grants, developer incentives, and staking rewards are aimed at broadening participation and ensuring that the token’s value is driven by real-world utility rather than speculative trading.

The Internet Computer in the Broader Blockchain Ecosystem

How ICP Compares to Other Layer-1 Blockchains

The Internet Computer stands out in the crowded field of Layer-1 blockchains due to its unique focus on decentralized computing rather than just financial transactions. While platforms like Ethereum and Solana are primarily designed for DeFi and smart contracts, ICP is built to host entire web services, including front-end interfaces, back-end logic, and data storage. This makes it a direct competitor to centralized cloud providers like AWS and Google Cloud.

Key differentiators that set ICP apart include:

- Chain-Key Cryptography: Enables near-instant finality and secure cross-subnet communication.

- Canister Smart Contracts: Stateful WebAssembly modules that can host entire applications on-chain.

- Subnet Architecture: Horizontal scalability that allows the network to expand as demand grows.

- On-Chain AI Integration: The ability to run AI models as smart contracts, reducing reliance on centralized APIs.

Interoperability with Other Blockchains

While ICP is designed to be a self-contained computing platform, interoperability with other blockchains is crucial for its long-term success. DFINITY has recognized this need and is actively working on solutions to enable cross-chain communication. For example, ICP’s chain-key cryptography can facilitate secure interactions with other blockchains, allowing developers to build applications that leverage the strengths of multiple platforms.

One potential use case for interoperability is the integration of ICP with Ethereum or other DeFi-focused blockchains. This could enable the creation of hybrid applications that combine ICP’s decentralized computing capabilities with the financial infrastructure of other networks. Such integrations would not only expand ICP’s utility but also attract developers from across the blockchain ecosystem.

The Road Ahead: Challenges and Opportunities for ICP

Overcoming Adoption Barriers

Despite its technological advancements, the Internet Computer faces several challenges on its path to mainstream adoption. One of the most significant barriers is developer familiarity. Many developers are accustomed to building applications on centralized cloud platforms or other blockchains like Ethereum. Transitioning to ICP requires learning new tools, frameworks, and paradigms, which can be a steep learning curve.

To address this, DFINITY has prioritized developer onboarding through initiatives such as:

- Improved Documentation and Tutorials: Comprehensive guides and resources to help developers get started with ICP.

- Hackathons and Grants: Competitions and funding opportunities to incentivize innovation.

- CLI and Toolchain Enhancements: Modernization of development tools to streamline the building and deployment process.

The Future of On-Chain AI

ICP’s integration of on-chain AI is one of its most ambitious and potentially transformative features. By enabling AI models to run as smart contracts, ICP aims to create a decentralized alternative to centralized AI services. This could democratize access to AI, allowing developers to build applications that leverage machine learning without relying on Big Tech APIs.

However, the feasibility of running large-scale AI models entirely on-chain remains a challenge. Issues such as computational costs, model size, and inference latency must be addressed to ensure that ICP can support meaningful AI workloads. DFINITY is actively researching solutions, including optimizations to its subnet architecture and the development of specialized AI tools.

Regulatory and Compliance Considerations

As with any blockchain project, regulatory compliance is a critical factor for ICP’s long-term success. The platform’s focus on decentralized computing and AI raises unique legal and ethical questions, particularly around data privacy, security, and governance. DFINITY has emphasized its commitment to working with regulators and ensuring that ICP complies with global standards.

One area of particular interest is the Network Nervous System (NNS), which operates as a decentralized autonomous organization (DAO). Regulators are still grappling with how to classify and oversee DAOs, and ICP’s governance model may face scrutiny as the platform grows. DFINITY’s proactive approach to transparency and compliance will be essential in navigating these challenges.

Conclusion: The Internet Computer’s Vision for a Decentralized Future

The Internet Computer represents a bold and ambitious vision for the future of the web. By combining decentralized infrastructure with cutting-edge cryptography and AI integration, DFINITY is positioning ICP as a transformative platform capable of challenging the dominance of centralized cloud providers. The platform’s unique features—such as chain-key cryptography, canister smart contracts, and subnet architecture—set it apart from other blockchains and make it a compelling alternative for developers and enterprises alike.

However, ICP’s journey is not without challenges. Developer adoption, governance transparency, and regulatory compliance are all critical factors that will determine its long-term success. DFINITY’s commitment to addressing these issues, as evidenced by its 2025 roadmap and ongoing upgrades, demonstrates a clear focus on building a platform that is not only technologically advanced but also sustainable and community-driven.

As the Internet Computer continues to evolve, its potential to reshape the internet as we know it becomes increasingly apparent. From decentralized social media to enterprise-grade AI applications, ICP offers a glimpse into a future where the web is open, secure, and truly decentralized. With its innovative technology and ambitious roadmap, the Internet Computer is poised to play a pivotal role in the next generation of the internet—one that is built by and for its users.

In this new era of decentralized computing, the Internet Computer stands as a testament to the power of blockchain technology to transform not just finance, but the entire digital landscape. As developers, businesses, and users alike embrace this vision, ICP has the potential to become the “World Computer” it aspires to be—a platform that redefines what is possible on the web and empowers individuals to take control of their digital future.

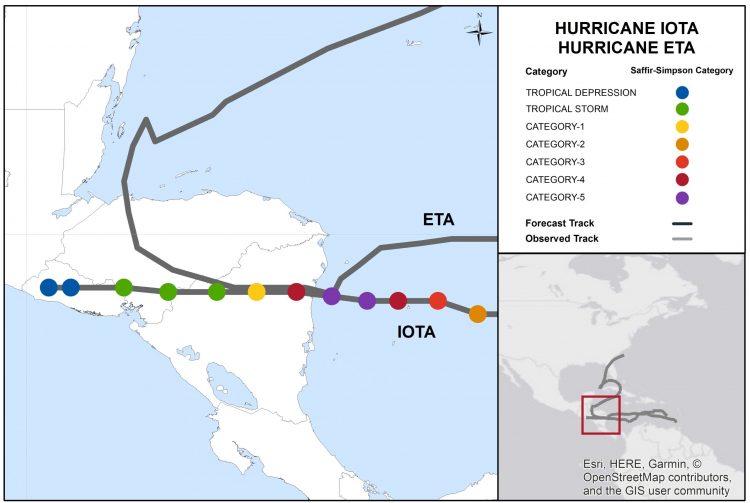

IOTA: The Protocol for Machines in an Age of Things

The warehouse in Hamburg is silent except for the soft whir of autonomous drones. One, its sensors blinking, completes an inventory scan of a pallet of microchips. It doesn't return to a central server. Instead, it transmits a cryptographically sealed data packet—proof of condition, location, and time—directly to a logistics drone across the facility. A fraction of a second later, without human intervention or a centralized ledger, value is exchanged. The data has been purchased, the transaction verified, and the ledger updated. The drones, two nodes in a vast, silent economy, have just conducted business. This is the machine economy. This is the world IOTA is building.

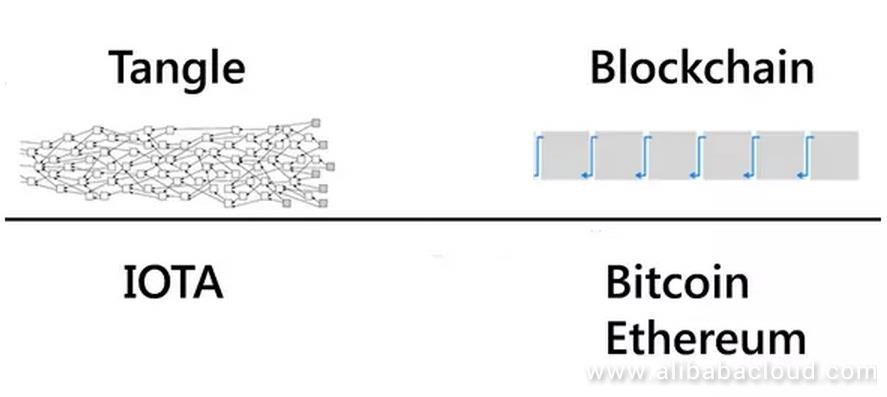

Forget everything you think you know about blockchain. The technology that powered Bitcoin and later Ethereum operates on a fundamental premise of sequential blocks, miners, and fees. IOTA, launched in 2015 by David Sønstebø, Sergey Ivancheglo, Dominik Schiener, and Dr. Serguei Popov, rejected that premise outright. Its founders saw a future not of people trading digital assets, but of machines trading data and value at a scale and speed impossible for legacy systems. Their invention was the Tangle, and it turned distributed ledger architecture on its head.

The Tangle: A Structural Revolution

Imagine a sprawling, ever-growing web instead of a neat chain of blocks. That's the Tangle, a Directed Acyclic Graph (DAG). In a blockchain, new transactions wait to be bundled into a block by a miner, who is then rewarded. This creates bottlenecks, fees, and energy-intensive competition. The Tangle eliminates the block, the miner, and the fee. Here, to send a transaction, you must approve two previous ones. Validation is a mandatory act of participation, not a specialized service. The network's security and speed don't come from concentrated mining power but from the sheer volume of activity. More transactions mean more validators, which means faster confirmations and greater resilience.

According to a Deloitte Switzerland analysis, "The Tangle’s structure allows for parallel processing of transactions, which theoretically enables high scalability and feeless microtransactions—key requirements for machine-to-machine communication in IoT ecosystems."

The implications are profound. A sensor measuring soil moisture can sell its data for a fraction of a cent. An electric vehicle can pay an autonomous charging post per millisecond of energy draw. A shipping container can log its temperature and location at every port, creating an immutable, automated audit trail. These are not speculative use cases. They are the operational targets for a ledger designed from the atom up for the Internet of Things.

The Core Proposition: Feeless, Scalable, Machine-Ready

IOTA's native cryptocurrency is MIOTA. Its total supply is fixed at a precise 4.75 billion tokens, with approximately 4.14 billion in circulation as of November 2025. But unlike Ethereum's ETH, which is consumed as "gas" to power transactions, MIOTA exists primarily as a value-transfer layer. The data layer itself is feeless. This distinction is critical. It means machines can transmit and verify data—the lifeblood of IoT—without any transactional cost barrier, enabling true micro- and nano-transactions.

For years, IOTA operated as a permissioned network with a central "Coordinator" node for security, a point of significant criticism. The project's roadmap has been a long, hard slog toward removing that crutch. The goal was always IOTA 2.0: a fully decentralized, coordinator-less network. That journey reached its most critical juncture in the second quarter of 2025 with the launch of the "Rebased Mainnet." This wasn't just an upgrade; it was a transformation. The Rebased Protocol rebuilt IOTA as a high-performance Layer 1 blockchain, integrating a robust consensus mechanism to finally achieve the decentralization its philosophy demanded.

"The Rebased Mainnet launch in Q2 2025 marks the final architectural shift," noted a foundational council member in the project's official progress report. "We have transitioned from a unique DAG to a powerful, modular Layer 1 that retains our core advantages while achieving the security and decentralization required for global trust."

The performance claims are staggering. Theoretical throughput can reach 65,000 transactions per second (TPS). Real-world, sustainable throughput in current configurations is estimated at a still-massive ~4,000 TPS. Compare that to Ethereum's 15-30 TPS or even Solana's theoretical 65,000 amid frequent congestion. For a network built to handle the torrent of data from billions of devices, this scalability isn't a feature; it is the foundational premise.

From Protocol to Platform: The 2025 Inflection Point

The Rebased Mainnet did more than just decentralize. It opened the doors to a new era of programmability. IOTA now supports Ethereum Virtual Machine (EVM) compatibility and is integrating the MoveVM from the Aptos/Sui ecosystem. This means developers familiar with Solidity or Move can deploy smart contracts on IOTA, unlocking decentralized finance (DeFi), advanced automation, and complex logic for machine interactions. Tools like account abstraction and passkeys aim to make user and machine onboarding seamless.

Parallel to this technical metamorphosis, IOTA's real-world footprint expanded in 2025 through a strategic, policy-focused initiative: the Trade Trust and Identity Network (TWIN) Foundation. Established in partnership with major trade entities, TWIN aims to digitize global trade documentation—bills of lading, letters of credit, certificates of origin. In May 2025, the TWIN Foundation signed a Memorandum of Understanding with the Tony Blair Institute for Global Change, signaling a direct push to shape digital trade policy with national governments.

This move from tech labs to ministerial briefings is deliberate. IOTA is no longer just chasing pilots. It is seeking to establish the standard infrastructure for digitized trade and machine identity. Another project, the Trade Logistics Information Pipeline (TLIP), initially developed with the World Bank, is being operationalized in East African corridors, moving from prototype to production in streamlining cross-border trade data.

The narrative is coalescing. On one flank, IOTA 2.0 provides the raw, high-throughput, feeless infrastructure for machines to communicate and transact. On the other, initiatives like TWIN and TLIP are building the first major applications on top of it, targeting multi-trillion-dollar industries ripe for disruption. The theory of the Tangle is finally meeting the practice of global commerce. The question is no longer "Can it work?" but "Will the world adopt it?"

The Anatomy of Trust: From Tangle to Trade Lanes

IOTA’s decade-long journey from conceptual white paper to tangible trade infrastructure is a case study in stubborn, visionary execution. The project reached its ten-year milestone in 2025, and the narrative has definitively shifted from speculative crypto asset to operational backbone. The target is no less than the digitization of global trade, valued at over $33 trillion. This ambition crystallizes in the Trade Worldwide Information Network (TWIN), a flagship initiative that transforms IOTA’s theoretical advantages—feeless data, immutable audit trails—into concrete, cost-saving realities.

"The token isn't a speculative asset. It's the mechanism that makes the infrastructure work," asserts the IOTA Staking blog in a December 2025 analysis of TWIN's on-chain mechanics. "Staking for validator election ties network security directly to real-world utility and resilience."

TWIN’s architecture is deliberately bureaucratic, in the best sense. It replaces the morass of paper that chokes ports and customs houses: bills of lading, letters of credit, certificates of origin. Each document becomes a verifiable credential, anchored to a digital identity for every actor—exporter, importer, freight forwarder, bank, customs agency. A physical shipment is mirrored by a non-fungible token (NFT) on the IOTA Tangle, tracking its journey in real-time. Early deployment data is compelling. TWIN pilots report an 80% reduction in transaction costs, a 96% gain in cross-border efficiency, and a 35% increase in participation from small and medium-sized enterprises. Document delays shrink from weeks to minutes.

These aren’t just metrics for a press release; they are direct attacks on the friction that has defined global commerce for centuries. An AI-powered compliance layer scans documents before a ship ever reaches port, flagging discrepancies. Tokenized warehouse receipts unlock instant DeFi financing for goods in transit, freeing capital. The Hamburg warehouse scenario is no longer a futuristic vignette—it is a module in a vast, interconnected system going live. Pilots are scheduled to launch in over 10 countries across Africa, Europe, Southeast Asia, and North America within the next twelve months, with a target of 30+ by 2030.

The Staking Engine: Decentralization as a Product Feature

This push into regulated, governmental trade required solving IOTA’s original sin: perceived centralization. The “Coordinator” is gone. The new decentralization engine runs on staking. As of December 2025, over 2.3 billion IOTA tokens are staked, electing a network of 70+ active validators who secure the mainnet. The average staking reward sits between 11-12% APY. This mechanic is crucial. It ensures no single entity, not even the IOTA Foundation, controls the ledger validating a $33 trillion flow of goods. Trust is mathematically distributed.

"IOTA positions itself as a DAG-based solution specialized for IoT consensus," states a pivotal 2023 academic survey published by the Association for Computing Machinery on July 13, 2023. This paper has since become a key citation in later research on the AIoT convergence and digital identity, marking a growing vein of academic validation for the Tangle structure.

The technical roadmap in late 2025 focuses on two pivotal upgrades: Starfish, aimed at further horizontal scalability, and Hierarchies, which provide the trust infrastructure enterprises demand—all while maintaining backward compatibility. The price of MIOTA, however, tells a different story, hovering around $0.08689 in December 2025. This disconnect between operational momentum and token valuation is the central tension of IOTA’s current existence. Is the market simply slow to comprehend a fundamentally different value proposition, or is it rightly skeptical of the long adoption arc ahead?

The Penny Crypto Paradox: Niche or Nebulous?

IOTA consistently ranks among “penny cryptos” with high potential—it was listed 8th in a December 2025 roundup for its IoT zero-fee niche. This categorization is both a blessing and a curse. It attracts speculators looking for a lottery ticket, but it undermines the project’s deliberate positioning as infrastructure, not a casino chip. The comparison game is inevitable. Analyses often pit IOTA against Hedera Hashgraph, another DAG-based ledger favored by enterprises.

"IOTA prioritizes feeless machine-to-machine scalability," notes a technical comparison from CoinExams in December 2025, "while Hedera employs a council model and nominal fees. Their core design philosophies target different segments of the enterprise DLT market."

This is a polite way of saying they are solving different problems. Hedera seeks to be a general-purpose enterprise ledger with stable, predictable governance. IOTA is a specialist, a protocol built for a specific, high-volume, low-value transactional environment that doesn’t yet exist at scale. IOTA’s entire value proposition is predicated on the explosive growth of autonomous machine economies. If that growth is linear or slow, IOTA becomes a solution in search of a problem. If it’s exponential, IOTA is positioned at the nexus.

The critical gap in most analyses, including favorable ones, is the lack of head-to-head, real-world benchmarks. We see impressive early TWIN results, but where are the side-by-side throughput, finality, and cost comparisons against Hedera, or against layer-2 rollups on Ethereum, in a live industrial setting? The theoretical 65,000 TPS is a powerful marketing line, but the sustained real-world figure of ~4,000 TPS is what matters. Is that enough for the tsunami of IoT data? Probably, for now. But competitors aren’t standing still.

One contrarian observation cuts to the heart of the matter: IOTA’s most significant achievement in 2025 may not be technical, but political. The MoU with the Tony Blair Institute and the orchestration of TWIN represent a masterclass in policy entrepreneurship. They are building a coalition of governments and trade bodies before the technology is universally stress-tested. This “field of dreams” strategy—if you build the coalition, the usage will come—is high-risk, high-reward. It bypasses the typical crypto adoption funnel entirely, aiming straight for institutional standardization.

"The 2025 Rebased Mainnet transition was conditional on validator readiness, security audits, and exchange integrations," details a report from the UAE Blockchain Organization. "Meeting these conditions was non-negotiable for credibility with the institutional partners TWIN requires."

This institutional push redefines token utility. Staking isn’t just for yield; it’s for voting rights in a network that aspires to underpin sovereign trade digitization. The yield of 11-12% is the incentive to participate in securing what is effectively a public utility. This creates a fascinating dynamic: the token’s value is theoretically tied to the volume and importance of the data and value flowing over the network, not to speculative trading pairs on Binance. But can that theory hold when the vast majority of token holders are still crypto natives, not shipping conglomerates?

A rhetorical question lingers. If a machine-driven transaction occurs on the Tangle but doesn’t involve the speculatively traded MIOTA token, does it count for the market? IOTA’s design deliberately decouples the feeless data layer from the value layer. The immense value is in the integrity and flow of data—the oil of the 21st century. The token secures the network that enables that flow. This is a profoundly different model from Ethereum, where ETH is consumed as fuel. It is more analogous to holding shares in the company that owns the pipeline. The market, however, remains addicted to the simpler narrative of gas fees and burn mechanisms.

The project’s focus is unwavering. While other layer-1 chains frantically court DeFi degens and NFT artists, IOTA’s development updates read like engineering white papers for supply chain managers. Codebase advancements like Starfish and Hierarchies are about enterprise readiness and scalability under load, not launching the next meme coin. This discipline is admirable, but it forsakes the network effects that a vibrant, if frivolous, retail ecosystem can provide. IOTA is building a cathedral in an age obsessed with pop-up shops. The cathedral could outlast them all, or remain a stunning, under-occupied monument.

The Quiet Infrastructure of Everything

IOTA’s significance transcends cryptocurrency price charts. It represents a fundamental philosophical bet about the next phase of the internet: that the most valuable transactions will be invisible, executed between machines, and that the ledger recording them must be as lightweight and ubiquitous as the network itself. While other blockchains compete to become financial supercomputers or digital gold, IOTA aims to become the TCP/IP of value and trust for the Internet of Things—a foundational protocol, not a flashy application. Its legacy, should it succeed, won’t be measured in market cap alone, but in the silent efficiency of global systems. It seeks to remove friction not from trading apes on a screen, but from moving food, medicine, and manufactured goods across the planet.

"The 2023 ACM survey that categorized IOTA's Tangle as a specialized IoT consensus mechanism has been cited in over a dozen subsequent papers on AIoT integration and digital passports," notes a research analyst tracking DLT academic literature. "It's moved from being a curious alternative to a serious architectural proposal in peer-reviewed work."

This academic and institutional traction underscores a deeper impact. IOTA is part of a small group of projects attempting to bridge the chasm between cryptographic innovation and tangible, regulated industry. The TWIN initiative isn’t a dApp; it’s a potential new standard for international trade, developed in concert with policymakers. The choice to use a permissionless, feeless DAG for this is radical. It suggests a future where the trust infrastructure for critical systems is open, transparent, and not owned by any single corporation or government. The cultural impact is subtle but profound: it proposes that the most trustworthy ledger for our physical world might be a decentralized, machine-optimized network.

The Inevitable Friction of the Real World

For all its visionary engineering and political maneuvering, IOTA faces hurdles that are monumental precisely because its ambitions are. The most glaring is the adoption timeline. Pilots in 10+ countries are promising, but production-scale deployment across 30+ by 2030 is a herculean task of integration, legal compliance, and behavioral change. Global trade is a beast of legacy systems and entrenched interests. An 80% cost reduction is a compelling carrot, but the stick of implementation is heavy. The project’s history, marked by technical overhauls like the Rebased Mainnet, while necessary, fuels a narrative of perpetual "soon" that tries the patience of both investors and potential enterprise clients.

Critically, the "feeless" value proposition, while elegant, creates a unique economic ambiguity. Validators are elected by stakers earning 11-12% APY, but this reward is an inflationary mechanism, new tokens minted to secure the network. The long-term sustainability of this model under massive transactional load is unproven. If token value doesn’t appreciably correlate with network usage growth—a distinct possibility if the value is in the data, not the token—the security incentive could weaken. Furthermore, the niche focus is a double-edged sword. It provides clarity but also limits the viral, organic developer growth that has propelled chains like Ethereum and Solana. IOTA’ ecosystem is being built top-down through partnerships, a slower, more deliberate process vulnerable to the inertia of large institutions.

Technical risks remain. While the Tangle’s DAG structure elegantly solves for scalability and feeless transfers, its security under extreme adversarial conditions is less battle-tested than Bitcoin’s proof-of-work or Ethereum’s move to proof-of-stake. The decentralized validator set, though growing, is still modest at 70+ nodes. A successful, high-profile attack on TWIN or a major partner could shatter years of careful trust-building in an instant. The project’s success is contingent not just on its own code, but on the parallel maturation of IoT security standards and hardware—a chain is only as strong as its weakest device.

The market’s persistent valuation of MIOTA as a "penny crypto," despite the scale of its ambitions, highlights a final, harsh truth. The financial markets and the physical infrastructure markets operate on different clocks and different logics. IOTA is playing a long game on a chessboard where most spectators are watching a slot machine.

The forward look for IOTA is etched in a calendar of tangible, unglamorous milestones. The staged rollout of TWIN pilots throughout 2026 will provide the first real-world stress test of the network under diverse regulatory regimes. The technical upgrades of **Starfish** and **Hierarchies** are scheduled for mainnet implementation by Q3 2026, aiming to prove that the protocol can scale vertically and institutionally without breaking backward compatibility. The validator count needs to see a steady climb toward the hundreds to credibly claim decentralization at a global scale. Each quarter from now on must deliver not just code commits, but signed contracts and live, revenue-generating trade flows on the network.

Predictions are folly, but trajectories are visible. IOTA will not "moon" on retail hype. Its value will accrue like interest, slowly and then suddenly, as each major port, each customs union, each automotive supply chain plugs into its Tangle. The silence of the Hamburg warehouse, where machines trade data without friction, is the sound it aims to replicate across the world. The question is whether the world is ready to listen.

In conclusion, IOTA presents a revolutionary protocol enabling secure, feeless machine-to-machine communication and value transfer without centralized ledgers. As the Internet of Things expands, it challenges us to rethink how data and value will flow in an automated world. The question is not if machines will transact autonomously, but which foundation they will build upon.

Polkadot: The Future of Interoperable Blockchain

Introduction to Polkadot

Polkadot is a groundbreaking multi-chain blockchain platform launched in 2020 by Gavin Wood, co-founder of Ethereum and creator of Solidity. Designed to address the issue of blockchain silos, Polkadot enables seamless interoperability between different blockchains through its unique architecture.

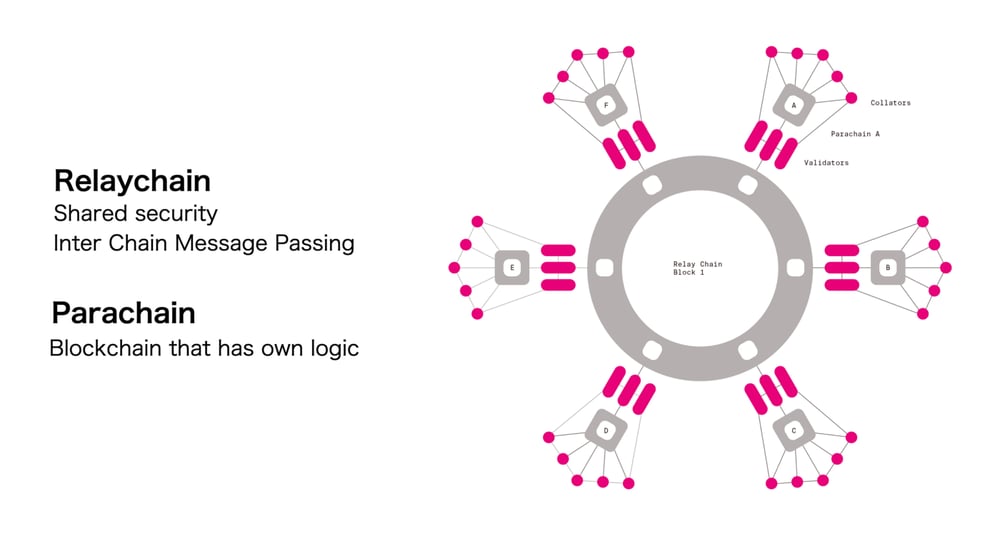

Understanding Polkadot's Architecture

The Relay Chain

The relay chain is the heart of Polkadot's network. It coordinates security and consensus across the entire ecosystem, ensuring that all connected blockchains, known as parachains, can communicate and share information securely.

Parachains and Parathreads

Parachains are independent blockchains that run in parallel within the Polkadot network. They share the security of the relay chain and can be customized for specific use cases. Parathreads, on the other hand, offer a more flexible and cost-effective solution for blockchains that do not require continuous connectivity.

Cross-Consensus Messaging (XCM)

The Cross-Consensus Messaging (XCM) protocol is a key innovation of Polkadot. It allows different blockchains to communicate and transfer data and assets seamlessly, enabling true interoperability across the ecosystem.

The Role of the DOT Token

Governance

The native DOT token plays a crucial role in the Polkadot ecosystem. It supports on-chain governance, allowing token holders to vote on network upgrades and changes through a system called OpenGov.

Staking

DOT tokens are also used for staking, which secures the network through a proof-of-stake consensus mechanism. Stakers earn rewards for their participation but face penalties, known as slashing, for misbehavior.

Bonding

Another important function of DOT is bonding, which is used to secure parachain slots. Projects must bond DOT tokens to lease a parachain slot, ensuring their commitment to the network.

Polkadot's Growth and Adoption

Parachain Auctions

By 2023, Polkadot hosted 79 parachains across its mainnet and Kusama, a canary network for experimental deployments. Parachain auctions have been a significant driver of ecosystem growth, attracting a diverse range of projects.

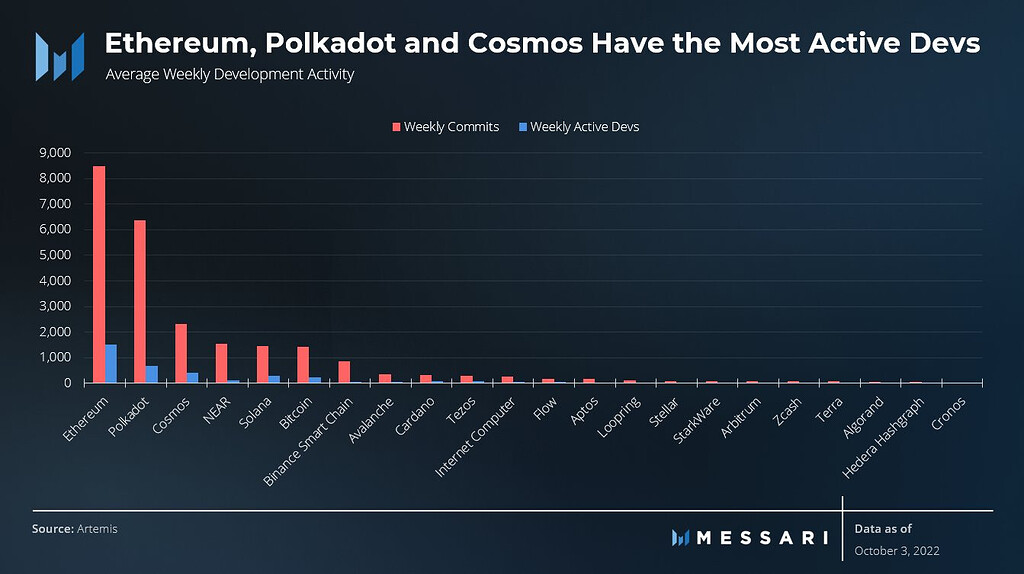

Developer Activity

Polkadot has seen a surge in developer activity, surpassing Ethereum in active developer contributions. This vibrant community is building innovative solutions across various sectors, including DeFi, NFTs, and gaming.

Polkadot 2.0: The Next Evolution

Asynchronous Backing

The Polkadot 2.0 upgrades introduce several groundbreaking features. Asynchronous backing reduces block time from 12 to 6 seconds, enabling parallel validation and significantly improving network efficiency.

Elastic Scaling

Elastic scaling is another key innovation, allowing dynamic core allocation to handle demand spikes. This feature targets a theoretical maximum of 623,000+ transactions per second (TPS) at full capacity, positioning Polkadot as a scalable solution for Web3 applications.

Agile Coretime

Agile coretime introduces a flexible compute purchasing model, similar to cloud resources. This allows projects to scale their operations dynamically, making Polkadot a versatile platform for a wide range of use cases.

Polkadot's Vision for Web3

Interoperability and Scalability

Polkadot aims to create a decentralized Web3 where blockchains can process transactions in parallel. This approach addresses the scalability issues faced by single-chain networks like Ethereum, offering a more efficient and cost-effective solution.

Decentralized Governance

With its fully on-chain governance model, Polkadot empowers DOT holders to control network upgrades. This decentralized approach ensures that the network evolves in a transparent and community-driven manner.

Conclusion

Polkadot is at the forefront of blockchain innovation, offering a scalable and interoperable platform for the next generation of decentralized applications. With its unique architecture, robust governance model, and continuous upgrades, Polkadot is well-positioned to shape the future of Web3.

Polkadot's Impact on Real-World Assets (RWAs)

Polkadot is making significant strides in the real-world assets (RWAs) sector. Projects like Centrifuge are leveraging Polkadot's infrastructure to tokenize traditional assets, such as Treasury Bills (T-Bills), bringing them on-chain. This innovation is unlocking new opportunities for liquidity and accessibility in the financial markets.

The Growing RWA Market

The RWA market is projected to reach a staggering $2 trillion by 2030, according to McKinsey. Polkadot's ability to facilitate secure and efficient tokenization positions it as a key player in this burgeoning sector. By bridging the gap between traditional finance and decentralized ecosystems, Polkadot is paving the way for a more inclusive financial system.

Key RWA Projects on Polkadot

- Centrifuge: Focuses on tokenizing real-world assets, enabling seamless integration with DeFi protocols.

- Energy Web: Aims to revolutionize energy trading through decentralized solutions.

- peaq: Targets mobility and logistics, offering decentralized infrastructure for these industries.

Polkadot in Decentralized Physical Infrastructure (DePIN)

Polkadot is also making waves in the Decentralized Physical Infrastructure (DePIN) sector. DePIN projects leverage blockchain technology to create decentralized networks for physical infrastructure, such as energy grids, mobility solutions, and more. Polkadot's interoperable and scalable architecture makes it an ideal platform for these innovative projects.

Energy Web and Decentralized Energy Trading

Energy Web is a prominent DePIN project on Polkadot, focusing on decentralized energy trading. By utilizing Polkadot's infrastructure, Energy Web enables peer-to-peer energy transactions, promoting sustainability and efficiency in the energy sector.

peaq and Mobility Solutions

peaq is another notable DePIN project, targeting mobility and logistics. By leveraging Polkadot's interoperability, peaq aims to create a decentralized network for mobility solutions, enhancing transparency and efficiency in the logistics industry.

Polkadot's Role in Decentralized AI

Polkadot is also exploring the intersection of blockchain and artificial intelligence. Decentralized AI projects on Polkadot aim to create transparent and secure AI models, leveraging the network's robust infrastructure. This fusion of technologies has the potential to revolutionize various industries, from healthcare to finance.

Tokenized Assets and Web3 Gaming

Polkadot's versatility extends to tokenized assets and Web3 gaming. The network's ability to support customizable parachains makes it an attractive platform for gaming projects. By enabling true ownership of in-game assets and seamless cross-chain interactions, Polkadot is shaping the future of gaming.

Enterprise Blockchain-as-a-Service (BaaS)

Polkadot is also making inroads into the enterprise sector with its Blockchain-as-a-Service (BaaS) offerings. By providing SDKs and API integrations, Polkadot enables businesses to leverage blockchain technology without the need for extensive technical expertise. This approach is driving institutional adoption and fostering innovation across various industries.

Polkadot's Competitive Advantages

Interoperability

One of Polkadot's standout features is its interoperability. Unlike single-chain networks, Polkadot enables seamless communication between different blockchains. This capability is crucial for creating a truly decentralized and connected Web3 ecosystem.

Scalability

Polkadot's architecture is designed for scalability. With the ability to process over 1,000 transactions per second (TPS) and a theoretical maximum of 623,000+ TPS, Polkadot is well-equipped to handle the demands of a growing user base and complex applications.

Security

Security is a top priority for Polkadot. The network's relay chain ensures that all connected parachains share a common security model. This shared security approach reduces the risk of attacks and enhances the overall robustness of the ecosystem.

Polkadot's Ecosystem and Community

Developer Activity

Polkadot boasts a vibrant and active developer community. With over 79 parachains and numerous projects in development, the network is a hub of innovation. The active participation of developers ensures continuous growth and evolution of the Polkadot ecosystem.

Community Governance

Polkadot's on-chain governance model empowers the community to shape the future of the network. DOT holders can propose and vote on upgrades, ensuring that the network evolves in a decentralized and transparent manner. This community-driven approach fosters a sense of ownership and engagement among participants.

Polkadot's Future Outlook

Upcoming Upgrades

Polkadot's roadmap includes several exciting upgrades. The introduction of asynchronous backing and elastic scaling will further enhance the network's performance and scalability. Additionally, the integration of Ethereum-compatible Solidity smart contracts via the Polkadot Virtual Machine (PVM) will make it easier for developers to migrate their projects to Polkadot.

Market Predictions

Analysts are optimistic about Polkadot's future. With a current price of around $4.17 in mid-2025, predictions suggest a potential increase to $1.84 to $2.04 by the end of the year. These projections reflect the growing confidence in Polkadot's technology and its potential to revolutionize the blockchain landscape.

Institutional Adoption

Polkadot's modular architecture and enterprise-friendly solutions are driving institutional adoption. As more businesses recognize the benefits of blockchain technology, Polkadot is well-positioned to become a leading platform for enterprise applications. This trend is expected to accelerate as the network continues to evolve and expand its capabilities.

Conclusion

Polkadot is a pioneering force in the blockchain industry, offering a scalable, interoperable, and secure platform for the next generation of decentralized applications. With its unique architecture, robust governance model, and continuous upgrades, Polkadot is shaping the future of Web3. As the network continues to grow and evolve, it is poised to become a cornerstone of the decentralized internet, driving innovation and fostering a more inclusive and connected digital ecosystem.

Polkadot's Technological Innovations

Cross-Consensus Messaging (XCM) Protocol

The Cross-Consensus Messaging (XCM) protocol is one of Polkadot's most significant technological advancements. This protocol enables seamless communication between different blockchains, allowing them to share data and assets securely. XCM is a cornerstone of Polkadot's interoperability, making it a leader in the multi-chain ecosystem.

Polkadot Virtual Machine (PVM)

The Polkadot Virtual Machine (PVM) is another groundbreaking innovation. It allows for the execution of Ethereum-compatible Solidity smart contracts on Polkadot's Asset Hub. This feature simplifies the migration of Ethereum-based projects to Polkadot, enhancing the network's appeal to developers and businesses alike.

Polkadot's Ecosystem Expansion

DeFi on Polkadot

Polkadot's ecosystem is rapidly expanding, particularly in the Decentralized Finance (DeFi) sector. Projects like Acala and Moonbeam are leveraging Polkadot's infrastructure to create innovative DeFi solutions. These projects offer a range of services, from stablecoins to decentralized exchanges, driving the growth of Polkadot's DeFi ecosystem.

NFTs and Digital Assets

Polkadot is also making significant strides in the Non-Fungible Token (NFT) space. The network's ability to support customizable parachains makes it an ideal platform for NFT projects. By enabling true ownership and interoperability of digital assets, Polkadot is shaping the future of the NFT market.

Polkadot's Impact on Enterprise Solutions

Blockchain-as-a-Service (BaaS)

Polkadot's Blockchain-as-a-Service (BaaS) offerings are driving enterprise adoption. By providing SDKs and API integrations, Polkadot enables businesses to leverage blockchain technology without extensive technical expertise. This approach is fostering innovation and accelerating the adoption of blockchain solutions across various industries.

Institutional Adoption

Polkadot's modular architecture and enterprise-friendly solutions are attracting institutional interest. This trend is expected to accelerate as the network continues to evolve and expand its capabilities.

Polkadot's Roadmap and Future Developments

Polkadot 2.0 Upgrades

The Polkadot 2.0 upgrades are set to revolutionize the network. Key features include asynchronous backing, which reduces block time to 6 seconds, and elastic scaling, which dynamically allocates cores to handle demand spikes. These upgrades will significantly enhance Polkadot's performance and scalability.

Ethereum Compatibility

The integration of Ethereum-compatible Solidity smart contracts via the Polkadot Virtual Machine (PVM) is a major milestone. This development will make it easier for Ethereum developers to migrate their projects to Polkadot, further expanding the network's ecosystem.

Polkadot's Market Performance and Predictions

Current Market Trends

Polkadot's native token, DOT, has shown resilience and growth potential. With a current price of around $4.17 in mid-2025, DOT is gaining traction among investors and traders. The token's utility in governance, staking, and bonding adds to its value proposition.

Price Predictions

Analysts are optimistic about DOT's future. Predictions suggest a potential increase to $1.84 to $2.04 by the end of 2025. These projections reflect the growing confidence in Polkadot's technology and its potential to revolutionize the blockchain landscape.

Polkadot's Community and Governance

On-Chain Governance

Polkadot's on-chain governance model is a key differentiator. It empowers DOT holders to propose and vote on network upgrades, ensuring that the network evolves in a decentralized and transparent manner. This community-driven approach fosters a sense of ownership and engagement among participants.

Developer Community

Polkadot boasts a vibrant and active developer community. With over 79 parachains and numerous projects in development, the network is a hub of innovation. The active participation of developers ensures continuous growth and evolution of the Polkadot ecosystem.

Conclusion: The Future of Polkadot

Polkadot is a pioneering force in the blockchain industry, offering a scalable, interoperable, and secure platform for the next generation of decentralized applications. With its unique architecture, robust governance model, and continuous upgrades, Polkadot is shaping the future of Web3.

Key Takeaways

- Interoperability: Polkadot's ability to enable seamless communication between different blockchains sets it apart from single-chain networks.

- Scalability: With the ability to process over 1,000 TPS and a theoretical maximum of 623,000+ TPS, Polkadot is well-equipped to handle the demands of a growing user base.

- Security: The network's shared security model ensures that all connected parachains are protected, enhancing the overall robustness of the ecosystem.

- Innovation: Polkadot's continuous upgrades and technological advancements, such as the XCM protocol and PVM, drive innovation and foster a vibrant developer community.

- Adoption: Polkadot's enterprise-friendly solutions and growing ecosystem are driving institutional adoption, positioning it as a leading platform for blockchain applications.

As Polkadot continues to evolve and expand its capabilities, it is poised to become a cornerstone of the decentralized internet. With its unique architecture, robust governance model, and continuous upgrades, Polkadot is shaping the future of Web3, driving innovation, and fostering a more inclusive and connected digital ecosystem. The journey of Polkadot is just beginning, and its potential to revolutionize the blockchain landscape is boundless.

Hedera Hashgraph: Revolutionizing Blockchain Technology

The Emergence of Hedera Hashgraph

The blockchain space has seen its fair share of innovation and competition among various projects vying for market dominance. However, one technology stands out as a disruptor and potential game-changer: Hedera Hashgraph. Originally developed by Swirlds, Hedera Hashgraph is a public distributed ledger that offers unprecedented throughput and latency while maintaining security and decentralization. This decentralized network promises to solve some of the most pressing issues plaguing traditional blockchains, making it a compelling alternative for businesses and individuals seeking efficient and secure transactions.

Understanding Hashgraph

To understand the unique value proposition of Hedera Hashgraph, it's essential to grasp its underlying technology—the Hashgraph consensus algorithm. Unlike other blockchain technologies that rely on proof-of-work (PoW) or proof-of-stake (PoS) to achieve consensus, Hashgraph employs a novel approach that combines both gossip-based and synchronous Byzantine Fault Tolerance (BFT) mechanisms. This hybrid approach allows for significantly faster transaction speeds and more robust security compared to traditional blockchain networks.

A central concept in Hashgraph is the "hashgraph" structure itself. Think of a hashgraph as a tree-like structure where each node represents a transaction or a message that needs to be verified. Each node not only stores information about the transaction itself but also references two parent nodes, which act as a timestamp for the transaction. In this way, the hashgraph provides a clear chronological order, ensuring that all nodes have an accurate view of the transaction history.

Key Features of Hedera Hashgraph

Speedy Transactions: One of the standout features of Hedera Hashgraph is its ability to process thousands of transactions per second (TPS), with some reports citing rates exceeding over 5,000 TPS under optimal conditions. This rapid transaction speed makes it suitable for real-time applications like financial settlements, micropayments, and cross-border transactions, where quick confirmation times are critical.

Decentralization: Like many blockchain technologies, Hedera Hashgraph thrives on decentralization. By distributing the network across multiple nodes, no single point of failure exists, making it resistant to attacks and manipulation. Each participant in the network plays a vital role in validating transactions and reaching consensus, thereby ensuring that the system remains secure and unaffected by any single entity's actions.

Security and Privacy: Security in Hedera Hashgraph is achieved through a combination of cryptographic techniques, such as asymmetric encryption and digital signatures. This ensures that transactions are tamper-proof and that participants can trust the integrity of the network without needing a central authority. Additionally, Hedera Hashgraph offers robust privacy features, allowing users to maintain their anonymity while still ensuring the transparency of the transaction process.

Network Structure and Consensus Mechanism

The Hedera Hashgraph network is made up of a diverse range of nodes, including validators, witnesses, and clients. Validators are responsible for confirming transactions and validating blocks. Witnesses do not directly validate transactions but participate in the hashgraph structure to provide a more robust network. Clients interact with the network to send and receive transactions.

The consensus mechanism used by Hedera Hashgraph is designed to be highly efficient and secure. During a consensus round, validators quickly reach agreement on the order of transactions without requiring extensive computational power or energy consumption. This is achieved through a gossip-based protocol where validators receive and share messages about transactions they have heard about. Eventually, this leads to a global understanding of the correct sequence of events, which is then recorded in the hashgraph structure.

Tokenomics and Governance

Hedera Hashgraph operates without its own native token, unlike many other blockchain platforms. Instead, it utilizes a governance model that involves the Hedera Governing Council and the Hedera Token Service. The Hedera Governing Council, comprised of large corporations and organizations, helps ensure the stability and growth of the network. On the other hand, the Hedera Token Service allows developers to create and deploy custom stablecoins and digital assets on the Hedera platform.

This unique governance structure sets Hedera Hashgraph apart from other chains that rely on tokens for funding and incentive structures. By focusing on enterprise adoption and collaboration, Hedera aims to foster a more inclusive and collaborative ecosystem rather than being driven by the need for token value increases.

Applications and Use Cases

The versatile nature of Hedera Hashgraph makes it well-suited for a wide array of applications and industries. Financial services stand out as a key area where the technology could have a transformative impact. Financial institutions can achieve faster and cheaper cross-border payments, streamline settlement processes, and enhance compliance through immutable records.

Moreover, Hedera Hashgraph can enable innovative business models and services, such as decentralized finance (DeFi) applications, supply chain management, and identity verification systems. Its low-latency performance ensures that these applications can operate seamlessly, providing users with a frictionless experience.

Challenges and Future Prospects

No technology is without its challenges, and Hedera Hashgraph is no exception. One of the primary hurdles is achieving mainstream adoption. Compared to established technologies like Ethereum and Bitcoin, Hedera Hashgraph has limited brand recognition and user base. Addressing this requires extensive outreach and strategic partnerships with major industry players.

Another challenge lies in regulatory clarity. Although the technology offers enhanced privacy and security features, navigating regulatory landscapes around decentralized applications can be complex. Governments and regulatory bodies are still grappling with how to classify and regulate cryptocurrencies and blockchain technologies, which poses a risk to wider adoption.

Looking ahead, Hedera Hashgraph holds promising prospects for overcoming these challenges. As the world becomes increasingly interconnected and data-driven, a fast, secure, and scalable decentralized network like Hedera can play a crucial role in driving innovation. Collaborations with enterprises and continuous improvements to the technology will likely strengthen its position in the market.

Conclusion

Hedera Hashgraph represents a significant leap forward in blockchain technology. With its superior performance and robust security, it addresses many of the shortcomings of existing blockchain solutions. As more businesses recognize the potential benefits of Hedera Hashgraph in their operations, we can expect to see increased adoption and innovation within the ecosystem.

Technology Partnerships and Collaboration

Hedera Hashgraph has made significant strides in forming strategic partnerships to enhance its technological capabilities and expand its user base. These collaborations aim to leverage the unique strengths of Hedera Hashgraph, such as its high throughput and low latency, to address specific industry needs. For instance, in the financial services sector, Hedera has partnered with companies like BNY Mellon, a global leader in asset servicing, and State Street Corporation, a multinational financial services company. These partnerships have led to the development of innovative solutions tailored to the requirements of financial institutions, such as automated settlements and real-time payment processing.

In the realm of DeFi, major players like ChainSafe Systems and ChainSafe Labs have integrated Hedera Hashgraph into their platforms. These integrations have resulted in improved liquidity and scalability, making DeFi more accessible and efficient for users. Additionally, the partnership with ChainSafe has helped in creating secure and compliant DeFi applications, ensuring that users can trust the systems they interact with.

Moreover, Hedera Hashgraph has established a partnership with Polkadot, a multi-chain ecosystem, to explore cross-chain interoperability. This collaboration could potentially revolutionize the way different blockchain networks interact, paving the way for a more interconnected and decentralized digital economy.

Community and Ecosystem

The success of any blockchain network relies heavily on its community and ecosystem. Hedera Hashgraph has been building a strong community of developers, businesses, and enthusiasts from the onset. The Hedera Hashgraph website provides extensive resources and support, making it easier for new members to understand and engage with the platform. The Hedera Hashgraph API and SDKs have been designed to be user-friendly, facilitating the development of various applications and services.

The Hedera Hashgraph community includes a diverse range of participants, from small startups to large enterprises. Companies like ConsenSys, a leading blockchain solutions provider, have been actively working on Hedera-based projects, contributing to the ecosystem’s growth and innovation. These partnerships have not only facilitated the creation of new applications but also enhanced the overall user experience through continuous improvement and updates.

The Hedera Hashgraph GitHub repository is a testament to the community’s enthusiasm and contribution. Developers from around the world regularly contribute code, report bugs, and suggest new features, fostering an open and collaborative environment. This open-source model encourages innovation and ensures that the platform remains flexible and adaptable to the evolving needs of its users.

Security and Compliance

One of the critical factors in the success of any blockchain technology is its security and compliance. Hedera Hashgraph has taken several steps to ensure that it meets stringent security standards. The implementation of robust cryptographic techniques, such as secure hash functions and digital signatures, guarantees the security of transactions and data. These measures help prevent unauthorized access, tampering, and fraudulent activities, thereby maintaining the integrity of the network.