Explore Any Narratives

Discover and contribute to detailed historical accounts and cultural stories. Share your knowledge and engage with enthusiasts worldwide.

The warehouse in Hamburg is silent except for the soft whir of autonomous drones. One, its sensors blinking, completes an inventory scan of a pallet of microchips. It doesn't return to a central server. Instead, it transmits a cryptographically sealed data packet—proof of condition, location, and time—directly to a logistics drone across the facility. A fraction of a second later, without human intervention or a centralized ledger, value is exchanged. The data has been purchased, the transaction verified, and the ledger updated. The drones, two nodes in a vast, silent economy, have just conducted business. This is the machine economy. This is the world IOTA is building.

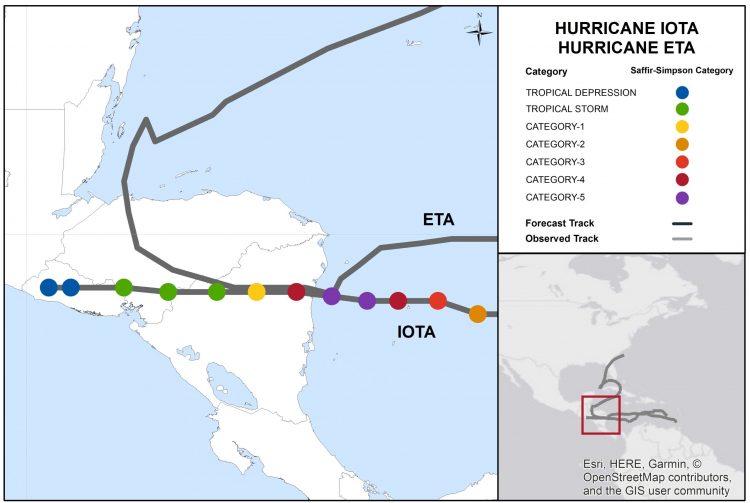

Forget everything you think you know about blockchain. The technology that powered Bitcoin and later Ethereum operates on a fundamental premise of sequential blocks, miners, and fees. IOTA, launched in 2015 by David Sønstebø, Sergey Ivancheglo, Dominik Schiener, and Dr. Serguei Popov, rejected that premise outright. Its founders saw a future not of people trading digital assets, but of machines trading data and value at a scale and speed impossible for legacy systems. Their invention was the Tangle, and it turned distributed ledger architecture on its head.

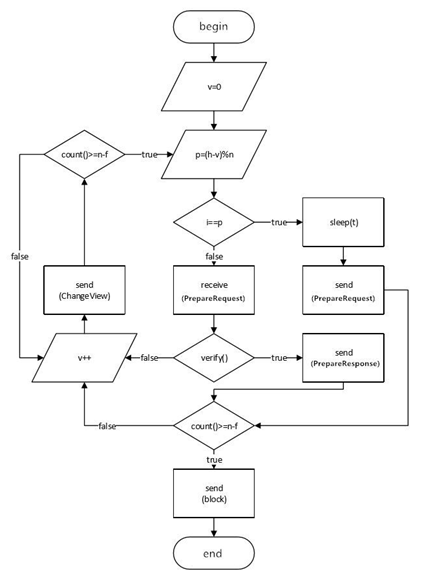

Imagine a sprawling, ever-growing web instead of a neat chain of blocks. That's the Tangle, a Directed Acyclic Graph (DAG). In a blockchain, new transactions wait to be bundled into a block by a miner, who is then rewarded. This creates bottlenecks, fees, and energy-intensive competition. The Tangle eliminates the block, the miner, and the fee. Here, to send a transaction, you must approve two previous ones. Validation is a mandatory act of participation, not a specialized service. The network's security and speed don't come from concentrated mining power but from the sheer volume of activity. More transactions mean more validators, which means faster confirmations and greater resilience.

According to a Deloitte Switzerland analysis, "The Tangle’s structure allows for parallel processing of transactions, which theoretically enables high scalability and feeless microtransactions—key requirements for machine-to-machine communication in IoT ecosystems."

The implications are profound. A sensor measuring soil moisture can sell its data for a fraction of a cent. An electric vehicle can pay an autonomous charging post per millisecond of energy draw. A shipping container can log its temperature and location at every port, creating an immutable, automated audit trail. These are not speculative use cases. They are the operational targets for a ledger designed from the atom up for the Internet of Things.

IOTA's native cryptocurrency is MIOTA. Its total supply is fixed at a precise 4.75 billion tokens, with approximately 4.14 billion in circulation as of November 2025. But unlike Ethereum's ETH, which is consumed as "gas" to power transactions, MIOTA exists primarily as a value-transfer layer. The data layer itself is feeless. This distinction is critical. It means machines can transmit and verify data—the lifeblood of IoT—without any transactional cost barrier, enabling true micro- and nano-transactions.

For years, IOTA operated as a permissioned network with a central "Coordinator" node for security, a point of significant criticism. The project's roadmap has been a long, hard slog toward removing that crutch. The goal was always IOTA 2.0: a fully decentralized, coordinator-less network. That journey reached its most critical juncture in the second quarter of 2025 with the launch of the "Rebased Mainnet." This wasn't just an upgrade; it was a transformation. The Rebased Protocol rebuilt IOTA as a high-performance Layer 1 blockchain, integrating a robust consensus mechanism to finally achieve the decentralization its philosophy demanded.

"The Rebased Mainnet launch in Q2 2025 marks the final architectural shift," noted a foundational council member in the project's official progress report. "We have transitioned from a unique DAG to a powerful, modular Layer 1 that retains our core advantages while achieving the security and decentralization required for global trust."

The performance claims are staggering. Theoretical throughput can reach 65,000 transactions per second (TPS). Real-world, sustainable throughput in current configurations is estimated at a still-massive ~4,000 TPS. Compare that to Ethereum's 15-30 TPS or even Solana's theoretical 65,000 amid frequent congestion. For a network built to handle the torrent of data from billions of devices, this scalability isn't a feature; it is the foundational premise.

The Rebased Mainnet did more than just decentralize. It opened the doors to a new era of programmability. IOTA now supports Ethereum Virtual Machine (EVM) compatibility and is integrating the MoveVM from the Aptos/Sui ecosystem. This means developers familiar with Solidity or Move can deploy smart contracts on IOTA, unlocking decentralized finance (DeFi), advanced automation, and complex logic for machine interactions. Tools like account abstraction and passkeys aim to make user and machine onboarding seamless.

Parallel to this technical metamorphosis, IOTA's real-world footprint expanded in 2025 through a strategic, policy-focused initiative: the Trade Trust and Identity Network (TWIN) Foundation. Established in partnership with major trade entities, TWIN aims to digitize global trade documentation—bills of lading, letters of credit, certificates of origin. In May 2025, the TWIN Foundation signed a Memorandum of Understanding with the Tony Blair Institute for Global Change, signaling a direct push to shape digital trade policy with national governments.

This move from tech labs to ministerial briefings is deliberate. IOTA is no longer just chasing pilots. It is seeking to establish the standard infrastructure for digitized trade and machine identity. Another project, the Trade Logistics Information Pipeline (TLIP), initially developed with the World Bank, is being operationalized in East African corridors, moving from prototype to production in streamlining cross-border trade data.

The narrative is coalescing. On one flank, IOTA 2.0 provides the raw, high-throughput, feeless infrastructure for machines to communicate and transact. On the other, initiatives like TWIN and TLIP are building the first major applications on top of it, targeting multi-trillion-dollar industries ripe for disruption. The theory of the Tangle is finally meeting the practice of global commerce. The question is no longer "Can it work?" but "Will the world adopt it?"

IOTA’s decade-long journey from conceptual white paper to tangible trade infrastructure is a case study in stubborn, visionary execution. The project reached its ten-year milestone in 2025, and the narrative has definitively shifted from speculative crypto asset to operational backbone. The target is no less than the digitization of global trade, valued at over $33 trillion. This ambition crystallizes in the Trade Worldwide Information Network (TWIN), a flagship initiative that transforms IOTA’s theoretical advantages—feeless data, immutable audit trails—into concrete, cost-saving realities.

"The token isn't a speculative asset. It's the mechanism that makes the infrastructure work," asserts the IOTA Staking blog in a December 2025 analysis of TWIN's on-chain mechanics. "Staking for validator election ties network security directly to real-world utility and resilience."

TWIN’s architecture is deliberately bureaucratic, in the best sense. It replaces the morass of paper that chokes ports and customs houses: bills of lading, letters of credit, certificates of origin. Each document becomes a verifiable credential, anchored to a digital identity for every actor—exporter, importer, freight forwarder, bank, customs agency. A physical shipment is mirrored by a non-fungible token (NFT) on the IOTA Tangle, tracking its journey in real-time. Early deployment data is compelling. TWIN pilots report an 80% reduction in transaction costs, a 96% gain in cross-border efficiency, and a 35% increase in participation from small and medium-sized enterprises. Document delays shrink from weeks to minutes.

These aren’t just metrics for a press release; they are direct attacks on the friction that has defined global commerce for centuries. An AI-powered compliance layer scans documents before a ship ever reaches port, flagging discrepancies. Tokenized warehouse receipts unlock instant DeFi financing for goods in transit, freeing capital. The Hamburg warehouse scenario is no longer a futuristic vignette—it is a module in a vast, interconnected system going live. Pilots are scheduled to launch in over 10 countries across Africa, Europe, Southeast Asia, and North America within the next twelve months, with a target of 30+ by 2030.

This push into regulated, governmental trade required solving IOTA’s original sin: perceived centralization. The “Coordinator” is gone. The new decentralization engine runs on staking. As of December 2025, over 2.3 billion IOTA tokens are staked, electing a network of 70+ active validators who secure the mainnet. The average staking reward sits between 11-12% APY. This mechanic is crucial. It ensures no single entity, not even the IOTA Foundation, controls the ledger validating a $33 trillion flow of goods. Trust is mathematically distributed.

"IOTA positions itself as a DAG-based solution specialized for IoT consensus," states a pivotal 2023 academic survey published by the Association for Computing Machinery on July 13, 2023. This paper has since become a key citation in later research on the AIoT convergence and digital identity, marking a growing vein of academic validation for the Tangle structure.

The technical roadmap in late 2025 focuses on two pivotal upgrades: Starfish, aimed at further horizontal scalability, and Hierarchies, which provide the trust infrastructure enterprises demand—all while maintaining backward compatibility. The price of MIOTA, however, tells a different story, hovering around $0.08689 in December 2025. This disconnect between operational momentum and token valuation is the central tension of IOTA’s current existence. Is the market simply slow to comprehend a fundamentally different value proposition, or is it rightly skeptical of the long adoption arc ahead?

IOTA consistently ranks among “penny cryptos” with high potential—it was listed 8th in a December 2025 roundup for its IoT zero-fee niche. This categorization is both a blessing and a curse. It attracts speculators looking for a lottery ticket, but it undermines the project’s deliberate positioning as infrastructure, not a casino chip. The comparison game is inevitable. Analyses often pit IOTA against Hedera Hashgraph, another DAG-based ledger favored by enterprises.

"IOTA prioritizes feeless machine-to-machine scalability," notes a technical comparison from CoinExams in December 2025, "while Hedera employs a council model and nominal fees. Their core design philosophies target different segments of the enterprise DLT market."

This is a polite way of saying they are solving different problems. Hedera seeks to be a general-purpose enterprise ledger with stable, predictable governance. IOTA is a specialist, a protocol built for a specific, high-volume, low-value transactional environment that doesn’t yet exist at scale. IOTA’s entire value proposition is predicated on the explosive growth of autonomous machine economies. If that growth is linear or slow, IOTA becomes a solution in search of a problem. If it’s exponential, IOTA is positioned at the nexus.

The critical gap in most analyses, including favorable ones, is the lack of head-to-head, real-world benchmarks. We see impressive early TWIN results, but where are the side-by-side throughput, finality, and cost comparisons against Hedera, or against layer-2 rollups on Ethereum, in a live industrial setting? The theoretical 65,000 TPS is a powerful marketing line, but the sustained real-world figure of ~4,000 TPS is what matters. Is that enough for the tsunami of IoT data? Probably, for now. But competitors aren’t standing still.

One contrarian observation cuts to the heart of the matter: IOTA’s most significant achievement in 2025 may not be technical, but political. The MoU with the Tony Blair Institute and the orchestration of TWIN represent a masterclass in policy entrepreneurship. They are building a coalition of governments and trade bodies before the technology is universally stress-tested. This “field of dreams” strategy—if you build the coalition, the usage will come—is high-risk, high-reward. It bypasses the typical crypto adoption funnel entirely, aiming straight for institutional standardization.

"The 2025 Rebased Mainnet transition was conditional on validator readiness, security audits, and exchange integrations," details a report from the UAE Blockchain Organization. "Meeting these conditions was non-negotiable for credibility with the institutional partners TWIN requires."

This institutional push redefines token utility. Staking isn’t just for yield; it’s for voting rights in a network that aspires to underpin sovereign trade digitization. The yield of 11-12% is the incentive to participate in securing what is effectively a public utility. This creates a fascinating dynamic: the token’s value is theoretically tied to the volume and importance of the data and value flowing over the network, not to speculative trading pairs on Binance. But can that theory hold when the vast majority of token holders are still crypto natives, not shipping conglomerates?

A rhetorical question lingers. If a machine-driven transaction occurs on the Tangle but doesn’t involve the speculatively traded MIOTA token, does it count for the market? IOTA’s design deliberately decouples the feeless data layer from the value layer. The immense value is in the integrity and flow of data—the oil of the 21st century. The token secures the network that enables that flow. This is a profoundly different model from Ethereum, where ETH is consumed as fuel. It is more analogous to holding shares in the company that owns the pipeline. The market, however, remains addicted to the simpler narrative of gas fees and burn mechanisms.

The project’s focus is unwavering. While other layer-1 chains frantically court DeFi degens and NFT artists, IOTA’s development updates read like engineering white papers for supply chain managers. Codebase advancements like Starfish and Hierarchies are about enterprise readiness and scalability under load, not launching the next meme coin. This discipline is admirable, but it forsakes the network effects that a vibrant, if frivolous, retail ecosystem can provide. IOTA is building a cathedral in an age obsessed with pop-up shops. The cathedral could outlast them all, or remain a stunning, under-occupied monument.

IOTA’s significance transcends cryptocurrency price charts. It represents a fundamental philosophical bet about the next phase of the internet: that the most valuable transactions will be invisible, executed between machines, and that the ledger recording them must be as lightweight and ubiquitous as the network itself. While other blockchains compete to become financial supercomputers or digital gold, IOTA aims to become the TCP/IP of value and trust for the Internet of Things—a foundational protocol, not a flashy application. Its legacy, should it succeed, won’t be measured in market cap alone, but in the silent efficiency of global systems. It seeks to remove friction not from trading apes on a screen, but from moving food, medicine, and manufactured goods across the planet.

"The 2023 ACM survey that categorized IOTA's Tangle as a specialized IoT consensus mechanism has been cited in over a dozen subsequent papers on AIoT integration and digital passports," notes a research analyst tracking DLT academic literature. "It's moved from being a curious alternative to a serious architectural proposal in peer-reviewed work."

This academic and institutional traction underscores a deeper impact. IOTA is part of a small group of projects attempting to bridge the chasm between cryptographic innovation and tangible, regulated industry. The TWIN initiative isn’t a dApp; it’s a potential new standard for international trade, developed in concert with policymakers. The choice to use a permissionless, feeless DAG for this is radical. It suggests a future where the trust infrastructure for critical systems is open, transparent, and not owned by any single corporation or government. The cultural impact is subtle but profound: it proposes that the most trustworthy ledger for our physical world might be a decentralized, machine-optimized network.

For all its visionary engineering and political maneuvering, IOTA faces hurdles that are monumental precisely because its ambitions are. The most glaring is the adoption timeline. Pilots in 10+ countries are promising, but production-scale deployment across 30+ by 2030 is a herculean task of integration, legal compliance, and behavioral change. Global trade is a beast of legacy systems and entrenched interests. An 80% cost reduction is a compelling carrot, but the stick of implementation is heavy. The project’s history, marked by technical overhauls like the Rebased Mainnet, while necessary, fuels a narrative of perpetual "soon" that tries the patience of both investors and potential enterprise clients.

Critically, the "feeless" value proposition, while elegant, creates a unique economic ambiguity. Validators are elected by stakers earning 11-12% APY, but this reward is an inflationary mechanism, new tokens minted to secure the network. The long-term sustainability of this model under massive transactional load is unproven. If token value doesn’t appreciably correlate with network usage growth—a distinct possibility if the value is in the data, not the token—the security incentive could weaken. Furthermore, the niche focus is a double-edged sword. It provides clarity but also limits the viral, organic developer growth that has propelled chains like Ethereum and Solana. IOTA’ ecosystem is being built top-down through partnerships, a slower, more deliberate process vulnerable to the inertia of large institutions.

Technical risks remain. While the Tangle’s DAG structure elegantly solves for scalability and feeless transfers, its security under extreme adversarial conditions is less battle-tested than Bitcoin’s proof-of-work or Ethereum’s move to proof-of-stake. The decentralized validator set, though growing, is still modest at 70+ nodes. A successful, high-profile attack on TWIN or a major partner could shatter years of careful trust-building in an instant. The project’s success is contingent not just on its own code, but on the parallel maturation of IoT security standards and hardware—a chain is only as strong as its weakest device.

The market’s persistent valuation of MIOTA as a "penny crypto," despite the scale of its ambitions, highlights a final, harsh truth. The financial markets and the physical infrastructure markets operate on different clocks and different logics. IOTA is playing a long game on a chessboard where most spectators are watching a slot machine.

The forward look for IOTA is etched in a calendar of tangible, unglamorous milestones. The staged rollout of TWIN pilots throughout 2026 will provide the first real-world stress test of the network under diverse regulatory regimes. The technical upgrades of **Starfish** and **Hierarchies** are scheduled for mainnet implementation by Q3 2026, aiming to prove that the protocol can scale vertically and institutionally without breaking backward compatibility. The validator count needs to see a steady climb toward the hundreds to credibly claim decentralization at a global scale. Each quarter from now on must deliver not just code commits, but signed contracts and live, revenue-generating trade flows on the network.

Predictions are folly, but trajectories are visible. IOTA will not "moon" on retail hype. Its value will accrue like interest, slowly and then suddenly, as each major port, each customs union, each automotive supply chain plugs into its Tangle. The silence of the Hamburg warehouse, where machines trade data without friction, is the sound it aims to replicate across the world. The question is whether the world is ready to listen.

In conclusion, IOTA presents a revolutionary protocol enabling secure, feeless machine-to-machine communication and value transfer without centralized ledgers. As the Internet of Things expands, it challenges us to rethink how data and value will flow in an automated world. The question is not if machines will transact autonomously, but which foundation they will build upon.

Your personal space to curate, organize, and share knowledge with the world.

Discover and contribute to detailed historical accounts and cultural stories. Share your knowledge and engage with enthusiasts worldwide.

Connect with others who share your interests. Create and participate in themed boards about any topic you have in mind.

Contribute your knowledge and insights. Create engaging content and participate in meaningful discussions across multiple languages.

Already have an account? Sign in here

Откройте для себя инновационную блокчейн-платформу Tezos с уникальной системой управления и поддержкой формальной верифи...

View Board

Изучите Cardano (ADA) – блокчейн третьего поколения с научным подходом, масштабируемостью и экологичностью. Узнайте о ст...

View Board

Exploring Uniswap's revolutionary impact on decentralized exchanges, this article delves into its history, unique automa...

View Board

## Мета-описание для статьи о глобальном регулировании криптовалют **Оптимизированный вариант (160 символов):** "Полн...

View Board

Познакомьтесь с миром Биткоина — узнайте, как децентрализованная цифровая валюта изменила подход к финансовым операциям....

View Board

MakerDAO – децентрализованная кредитная платформа на блокчейне Ethereum для получения займов в стейблкоине DAI под залог...

View Board

Polkadot (DOT) — инновационный мультицепочечный протокол для Web3, решающий проблемы взаимодействия и масштабируемости. ...

View Board

Исследуйте SushiSwap — децентрализованную биржу с возможностью заработка на ликвидности и стейкинге. Узнайте, как получи...

View Board

Узнайте как функционируют цифровые кошельки криптовалют основные типы и их особенности вместе с советами по безопасности...

View Board

Discover the dual nature of Near Earth Objects (NEOs): potential threats & scientific goldmines. Learn how we track, stu...

View Board

Discover the essential risks of cryptocurrency investing with our comprehensive guide. Learn how to navigate high market...

View Board

Aave (AAVE) – крупнейший протокол DeFi-кредитования с пулами ликвидности и flash loans. Узнайте, как зарабатывать на деп...

View Board

Откройте для себя революцию в безопасности данных с доказательствами с нулевым разглашением (ZKP). Узнайте, как эта техн...

View Board

IOTA revolutionizes blockchain with Tangle technology, offering zero transaction fees, scalability, and decentralization...

View Board

IOTA: Uma Plataforma Distribuída Sem Taxas Visando a Revolução das TECs Introdução IOTA é uma plataforma de tecnologia...

View Board

Découvrez IOTA, une cryptomonnaie révolutionnaire qui redéfinit les transactions dans l'Internet des objets grâce au Tan...

View BoardPKI — невидимый страж цифрового доверия, шифрующий и сертифицирующий данные для абсолютной безопасности онлайн. Узнайте,...

View Board

**Meta Description:** Узнайте все о шифре Виженера: история, принцип работы, примеры шифрования и методы криптоанализа...

View Board

"Узнайте, как одноразовый блокнот обеспечивает абсолютную секретность. Разберитесь в принципах шифрования, истории и при...

View Board

Полиалфавитные шифры: история, принципы работы и методы криптоанализа. Классификация шифров от Виженера до современных р...

View Board

Comments