Chainlink: El Puente Entre los Contratos Inteligentes y el Mundo Real

En el corazón de la revolución blockchain existe una paradoja fundamental: los contratos inteligentes operan en ecosistemas digitales cerrados, aislados de la información del mundo exterior. Chainlink emerge como la solución esencial, una red descentralizada de oráculos que actúa como el puente confiable entre los blockchains y los datos del mundo real. Este artículo explora cómo Chainlink resuelve el "problema del oráculo" y se posiciona como infraestructura crítica para el futuro de las finanzas y más allá.

El Problema del Oráculo: La Limitación de los Contratos Inteligentes

Los contratos inteligentes son programas autoejecutables que funcionan sobre una blockchain. Su poder radica en la automatización y la ausencia de intermediarios. Sin embargo, poseen una limitación crítica: no pueden acceder por sí mismos a datos externos a su cadena de bloques nativa.

Esto significa que un contrato inteligente diseñado para pagar un seguro agrícola basado en datos de lluvia, o para ejecutar una orden financiera según el precio de un activo, no puede funcionar sin un mecanismo externo de entrada de datos. Aquí es donde entra el concepto del oráculo.

Un oráculo blockchain no predice el futuro, sino que es un servicio que provee datos externos verificados a los contratos inteligentes, permitiendo que interactúen con eventos fuera de la cadena.

El desafío, conocido como "el problema del oráculo", no es solo técnico sino de seguridad. Confiar en una sola fuente de datos externa (un oráculo centralizado) reintroduce un punto único de fallo y manipulación, contradiciendo la esencia descentralizada de la tecnología blockchain. Chainlink fue creado para resolver este dilema de forma segura y descentralizada.

La Solución Descentralizada de Chainlink

Frente a la vulnerabilidad de los oráculos centralizados, Chainlink propone una red descentralizada. En lugar de una única fuente, múltiples nodos independientes de Chainlink recopilan datos de diversos feeds externos. Estos datos son luego agregados y validados antes de ser entregados al contrato inteligente.

Este proceso asegura que la información sea precisa y resistente a la manipulación. Si un nodo intentara enviar datos falsos, el consenso de la red lo anularía. La arquitectura de Chainlink combina componentes on-chain y off-chain para lograr este objetivo de manera eficiente y segura.

¿Qué es Chainlink (LINK)? Historia y Fundamentos

Chainlink es un proyecto pionero que comenzó con un whitepaper publicado en 2017 por los cofundadores Sergey Nazarov y Steve Ellis, junto con el investigador de seguridad Ari Juels. Su red principal (mainnet) se lanzó en 2019, marcando el inicio operativo de su infraestructura de oráculos descentralizados.

El proyecto es desarrollado y soportado por Chainlink Labs, una compañía con sede en Estados Unidos. Su visión va más allá de ser un simple proveedor de datos; aspira a ser el middleware universal que habilite el "internet de los contratos", donde las aplicaciones descentralizadas interactúan sin fricciones con sistemas tradicionales.

El Rol del Token LINK en el Ecosistema

El token nativo de la red, LINK, es fundamental para su modelo económico y de seguridad. Cumple dos funciones principales:

- Medio de Pago: Los desarrolladores que solicitan datos y servicios de la red de oráculos pagan a los nodos operadores en tokens LINK.

- Garantía de Seguridad: Los operadores de nodos deben depositar (o hacer staking de) LINK como garantía de su buen comportamiento. Si proporcionan datos inexactos o maliciosos, pueden perder parte de este stake.

Este mecanismo de incentivos alinea los intereses de los nodos con la precisión y confiabilidad de los datos, creando un sistema robusto y autorregulado.

Cómo Funciona la Red de Oracle de Chainlink: Un Proceso en Tres Pasos

El proceso mediante el cual Chainlink alimenta a un contrato inteligente con datos del mundo real es un ejemplo de ingeniería criptoeconómica. Se puede simplificar en tres etapas clave que aseguran la integridad de la información.

1. Solicitud On-Chain y Selección del Oracle

Todo comienza cuando un contrato inteligente, alojado en una blockchain como Ethereum, necesita información externa. Este contrato emite una solicitud a través de un contrato de Chainlink en la misma cadena. La solicitud especifica qué datos necesita y los criterios para los nodos oráculo.

El sistema de reputación de Chainlink entra en juego aquí. Los contratos pueden seleccionar automáticamente los nodos con mejor historial de rendimiento y mayor cantidad de LINK en staking, asegurando un servicio de alta calidad. Esta selección descentralizada es el primer filtro de seguridad.

2. Recopilación y Agregación de Datos Off-Chain

Una vez seleccionados, los nodos de Chainlink independientes reciben la solicitud. Cada nodo consulta múltiples fuentes de datos externas predefinidas (APIs de proveedores como exchanges financieros, servicios meteorológicos, etc.) a través de sus adaptadores off-chain.

Cada nodo obtiene un valor y lo devuelve a la red. Luego, el contrato de agregación de Chainlink recopila todas las respuestas. Utilizando un mecanismo de agregación ponderada, consolida estos datos en un único valor de consenso, a menudo descartando los extremos para mitigar el impacto de cualquier dato atípico o malicioso.

3. Entrega On-Chain y Verificación Final

El valor de consenso agregado es entonces enviado de vuelta al contrato inteligente solicitante en la blockchain. Este contrato recibe una respuesta única, verificada y confiable que puede utilizar para ejecutar su lógica programada, como liberar fondos o actualizar un estado.

Los nodos que proporcionaron datos correctos y oportunos son recompensados con tokens LINK por su servicio. Aquellos cuyo desempeño fue deficiente o que intentaron manipular el resultado ven afectada su reputación y pueden sufrir penalizaciones económicas sobre su stake. Este ciclo completo asegura un flujo de datos confiable y a prueba de manipulaciones.

Principales Casos de Uso y Aplicaciones de Chainlink

La versatilidad de Chainlink se refleja en su amplia adopción en diversos sectores. Su capacidad para proporcionar datos confiables ha convertido a la red en una pieza fundamental para la economía descentralizada. Desde las finanzas hasta los seguros, los casos de uso demuestran el valor práctico de este puente entre mundos.

Finanzas Descentralizadas (DeFi)

En el ecosistema DeFi, los precios de los activos son críticos. Protocols líderes como Aave, Compound y Synthetix dependen de los oráculos de Chainlink para obtener feeds de precios seguros. Estos datos son esenciales para funciones como la liquidación de préstamos y la emisión de activos sintéticos.

Un precio incorrecto podría generar pérdidas masivas. Chainlink mitiga este riesgo mediante la agregación descentralizada de datos de múltiples exchanges. Esto garantiza que los precios reflejen con precisión las condiciones del mercado, protegiendo a los usuarios y la integridad de los protocolos.

Miles de millones de dólares en valor están asegurados por los oráculos de Chainlink en el ecosistema DeFi, demostrando su papel como infraestructura financiera crítica.

Seguros Paramétricos y Agricultura

Chainlink permite la creación de seguros paramétricos automatizados. Un ejemplo destacado son los seguros agrícolas que se activan con datos meteorológicos. Un contrato inteligente puede compensar automáticamente a un agricultor si los datos de oráculos confiables, como los de Weather.com, indican una sequía severa.

Estos sistemas eliminan la necesidad de reclamaciones manuales y ajustes de pérdidas. La transparencia y automatización reducen costos y aumentan la velocidad de los pagos. Este caso de uso muestra cómo blockchain puede tener un impacto tangible en industrias tradicionales.

Juegos y NFTs

En el ámbito de los juegos blockchain y los NFTs, Chainlink ofrece aleatoriedad verificable (Verifiable Random Function - VRF). Los desarrolladores utilizan VRF para generar resultados aleatorios justos, como la asignación de recompensas poco comunes o las características de un NFT.

Esto garantiza a los jugadores que los resultados no están manipulados. La capacidad de demostrar aleatoriedad justa es vital para la adopción masiva de juegos descentralizados, donde la confianza en el sistema es primordial.

Chainlink y las Finanzas Tradicionales (TradFi): Una Convergencia Inevitable

El potencial de Chainlink ha atraído la atención de gigantes de las finanzas tradicionales (TradFi). Colaboraciones estratégicas con instituciones como SWIFT, Mastercard y VISA señalan un camino hacia la interoperabilidad entre sistemas heredados y la Web3.

Estas alianzas buscan explorar la tokenización de activos del mundo real y la creación de puentes de pago eficientes. Chainlink actúa como la capa de conectividad que permite a estos sistemas procesar transacciones sobre blockchains de manera segura y confiable.

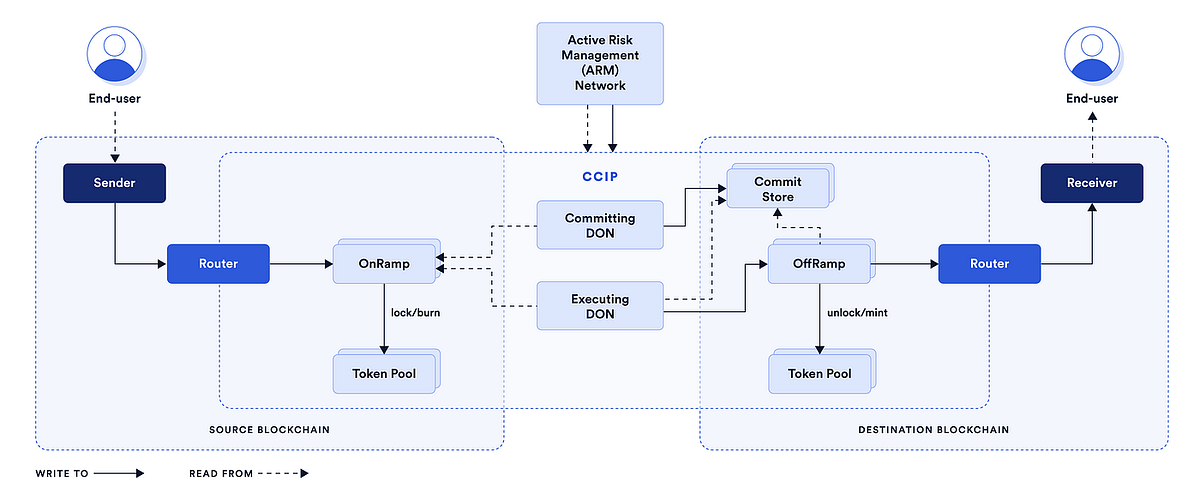

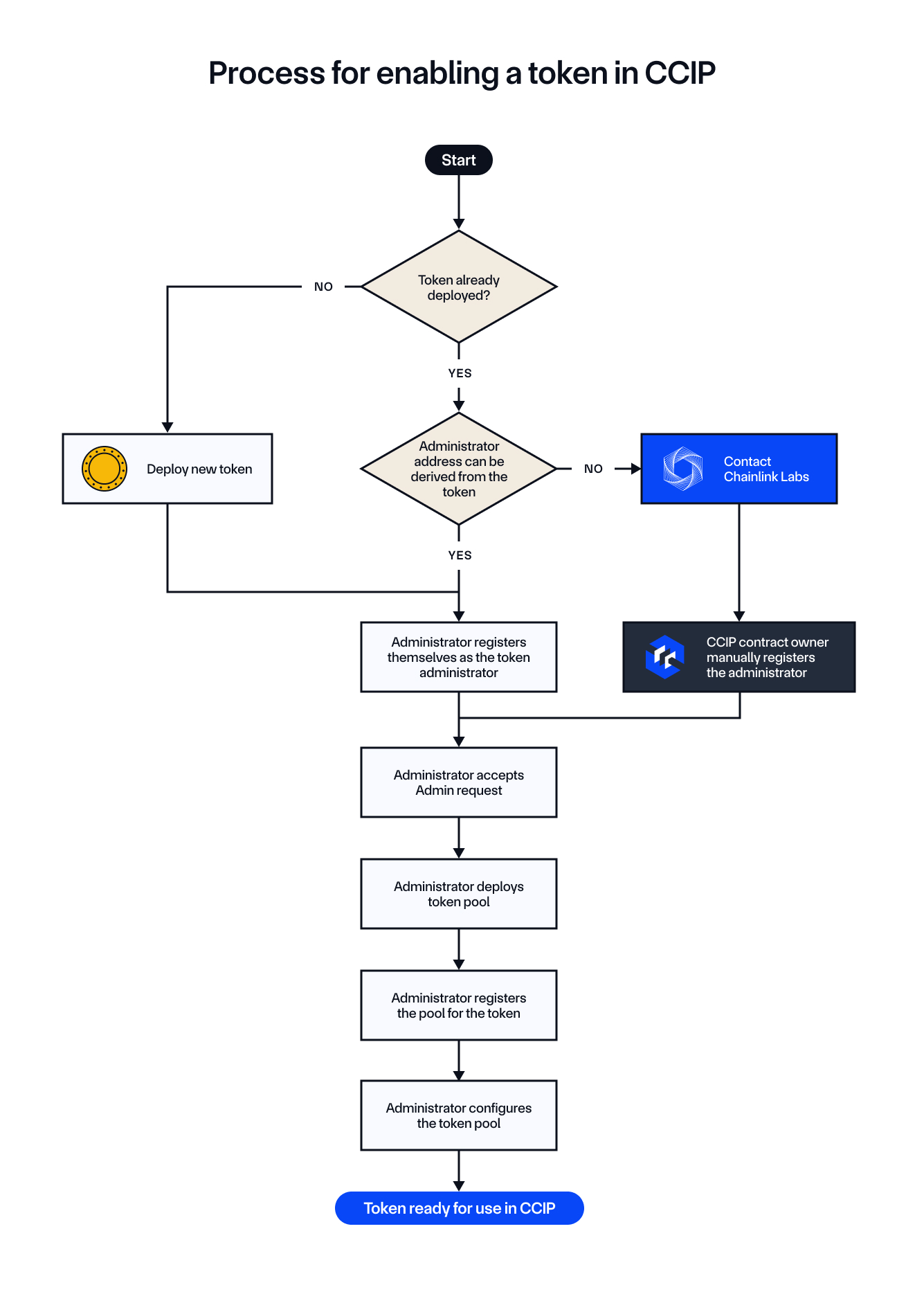

El Protocolo CCIP: Conectando Todos los Blockchains

Un desarrollo clave en esta convergencia es el Cross-Chain Interoperability Protocol (CCIP). Este protocolo permite la transferencia segura de datos y tokens entre diferentes cadenas de bloques. Es una pieza tecnológica fundamental para la visión de un internet de los contratos interconectados.

Por ejemplo, SWIFT planea utilizar CCIP para permitir que sus miles de bancos miembros puedan realizar liquidaciones cross-chain. Esto podría revolucionar las finanzas globales al unir la liquidez y la infraestructura de TradFi con la innovación de la Web3.

- Tokenización de Activos: Chainlink facilita la representación digital de activos como bienes raíces o materias primas en blockchain, usando datos del mundo real para valorarlos.

- Pagos Automatizados: Permite crear contratos inteligentes que realizan pagos automáticos basados en eventos verificados, como la entrega de una mercancía.

- Compromiso Institucional: La participación de bancos como ANZ y UBS en pruebas de CCIP valida la seriedad de esta tecnología para el futuro financiero.

Ventajas Clave de la Red Chainlink

La arquitectura de Chainlink ofrece una serie de ventajas distintivas que la posicionan como líder en el espacio de los oráculos. Estas características técnicas son la base de su confiabilidad y adopción constante.

Descentralización y Seguridad

La descentralización es el pilar de la seguridad de Chainlink. Al no depender de una sola entidad, la red se vuelve resistente a fallos y ataques. El mecanismo de staking de LINK incentiva económicamente a los operadores de nodos a actuar con honestidad.

Cualquier intento de manipulación resulta en una penalización financiera directa. Este modelo de seguridad criptoeconómica asegura que la red funcione para el beneficio colectivo, protegiendo la integridad de los datos que alimentan a miles de aplicaciones.

Flexibilidad e Interoperabilidad

Chainlink es agnóstico a la blockchain, lo que significa que puede servir datos a contratos inteligentes en múltiples redes como Ethereum, Polygon, Solana y otras. Esta flexibilidad es crucial en un ecosistema blockchain cada vez más fragmentado.

Los adaptadores off-chain permiten a la red conectarse con prácticamente cualquier API o fuente de datos existente. Esta interoperabilidad convierte a Chainlink en una capa de middleware universal, capaz de unir sistemas antiguos y modernos sin problemas.

Transparencia y Confianza

Todas las solicitudes y respuestas de datos en Chainlink son verificables en la blockchain. Los usuarios pueden auditar qué nodos participaron en una consulta y qué datos proporcionaron. Este nivel de transparencia es inaudito en los sistemas de datos tradicionales.

La confianza no se deposita en una empresa, sino en un código abierto y un mecanismo criptográfico probado. Esta es una ventaja fundamental para aplicaciones que gestionan activos de alto valor y requieren una auditoría completa.

La Arquitectura Técnica: On-Chain y Off-Chain

Comprender la arquitectura técnica de Chainlink es clave para apreciar su robustez. La red está inteligentemente dividida en dos componentes principales que trabajan en armonía para lograr su objetivo.

Componentes On-Chain

Los componentes on-chain son contratos inteligentes desplegados en blockchains como Ethereum. Estos contratos gestionan las solicitudes de datos entrantes de las dApps. Los principales contratos on-chain incluyen el contrato de reputación, el contrato de igualación de órdenes y el contrato de agregación.

Estos contratos automatizan la selección de nodos basada en su reputación y stake, y consolidan las respuestas off-chain. Actúan como el cerebro lógico de la red, asegurando que todo el proceso sea transparente e inmutable.

Componentes Off-Chain

Fuera de la cadena, una red de nodos de oráculo ejecuta el software de Chainlink. Estos nodos escuchan las solicitudes del componente on-chain. Cada nodo está conectado a fuentes de datos del mundo real a través de adaptadores especializados.

- Nodos Oracle: Computadoras operadas de forma independiente que recuperan y firman criptográficamente los datos externos.

- Adaptadores: Software que permite a los nodos conectarse de forma segura a APIs externas, bases de datos y otros sistemas legacy.

- Subgraphs: Especificaciones para indexar y consultar datos blockchain, facilitando la recuperación eficiente de información.

La comunicación entre estos componentes garantiza que los datos fluyan de manera segura desde el mundo exterior hasta el contrato inteligente que los necesita, cerrando el círculo de funcionalidad.

El Futuro de Chainlink: Internet de los Contratos y Más Allá

La visión a largo plazo para Chainlink es ambiciosa y se extiende más allá de los oráculos de precios. El equipo de Chainlink Labs proyecta la evolución de la red hacia un "Internet de los Contratos" totalmente realizado. En este futuro, los contratos inteligentes interactuarán de forma autónoma y segura con cualquier sistema del mundo real.

Este ecosistema permitiría flujos de trabajo complejos automatizados entre empresas, gobiernos e individuos. La capacidad de Chainlink para proporcionar datos confiables, computación descentralizada y conectividad cross-chain lo posiciona como el candidato ideal para construir esta infraestructura global.

Expansión en Nuevos Mercados Verticales

Chainlink está explorando activamente la aplicación de su tecnología en industrias más allá de las finanzas. Sectores como la cadena de suministro, la energía y la salud representan oportunidades masivas. La verificación automática de eventos en la logística o el acceso seguro a registros médicos son solo algunos ejemplos.

La capacidad de la red para manejar diferentes tipos de datos, desde lecturas de sensores IoT hasta registros oficiales, amplía enormemente su potencial de uso. La escalabilidad y seguridad de Chainlink serán factores críticos para su adopción en estos sectores altamente regulados.

Se estima que el mercado de oráculos blockchain crecerá exponencialmente, con Chainlink liderando la adopción institucional y sentando las bases para la próxima generación de aplicaciones empresariales.

Desafíos y Consideraciones para la Adopción Masiva

A pesar de su potencial, Chainlink enfrenta varios desafíos en su camino hacia la adopción global. La comprensión de estos factores es crucial para evaluar realista el futuro del proyecto. La tecnología debe superar obstáculos técnicos, regulatorios y de mercado.

Desafíos Técnicos y de Escalabilidad

La demanda de datos en tiempo real y de baja latencia presenta un desafío de escalabilidad constante. A medida que más dApps se integran con Chainlink, la red debe manejar un volumen creciente de solicitudes sin comprometer la velocidad o la seguridad. Las soluciones de capa 2 y las mejoras en la eficiencia de los contratos son áreas de desarrollo activo.

Garantizar la máxima tolerancia a fallos bizantinos en un entorno de nodos en constante expansión también es técnicamente complejo. La red debe mantener su resistencia incluso ante ataques coordinados o fallos generalizados en las fuentes de datos externas.

Consideraciones Regulatorias

La naturaleza global y descentralizada de Chainlink plantea preguntas regulatorias complejas. ¿Cómo se regulan los oráculos que proporcionan datos financieros críticos? La claridad regulatoria será un factor clave para la adopción institucional a gran escala.

Proyectos como la colaboración con SWIFT demuestran un esfuerzo proactivo por trabajar dentro de los marcos financieros existentes. La capacidad de Chainlink para operar de manera compatible con las regulaciones sin comprometer su descentralización fundamental será un equilibrio delicado pero necesario.

- Competencia Emergente: Otros proyectos de oráculos están surgiendo, aunque Chainlink mantiene una ventaja significativa en adopción y asociaciones.

- Complejidad para Desarrolladores: Integrar Chainlink requiere experiencia técnica, lo que puede ser una barrera de entrada para algunos proyectos.

- Dependencia de Fuentes Externas: La calidad de los datos finales depende de la precisión de las APIs externas, un riesgo que debe gestionarse cuidadosamente.

Chainlink en el Ecosistema Cripto: Análisis del Token LINK

El token LINK es más que un simple medio de pago dentro del ecosistema Chainlink. Su valor económico está intrínsecamente ligado al crecimiento y uso de la red. Analizar su utilidad y dinámica de mercado proporciona una visión completa del proyecto.

Utilidad y Modelo Tokenómico

La utilidad principal de LINK gira en torno a la seguridad y gobernanza de la red. Como se mencionó, el staking de LINK protege el sistema contra comportamientos maliciosos. Los desarrolladores también lo utilizan para pagar los servicios de oráculo, creando una demanda constante.

Futuras iteraciones del protocolo podrían incluir mecanismos de gobernanza comunitaria donde los poseedores de LINK participen en la toma de decisiones. Esta evolución convertiría a LINK en un token de utilidad y gobernanza, aumentando aún más su valor para los titulares a largo plazo.

Perspectivas de Mercado y Adopción

El valor de LINK está directamente correlacionado con la adopción de la red Chainlink. A medida que más aplicaciones empresariales y DeFi utilizan sus oráculos, la demanda del token para pagos y staking aumenta. Las asociaciones de alto perfil con instituciones TradFi son indicadores fuertes de una adopción creciente.

Los analistas observan métricas como el número de "parejas de precios" seguidas, el valor total asegurado por los oráculos y el volumen de staking para evaluar la salud del ecosistema. Estas métricas proporcionan una base más fundamentada para el análisis que la mera especulación de precios.

Comparación con Otros Proyectos de Oracle

Si bien Chainlink es el proyecto de oráculo más prominente, no es el único en el espacio. Comprender sus ventajas comparativas ayuda a contextualizar su posición de liderazgo en el mercado.

Chainlink se distingue por su enfoque en la descentralización máxima y su red de nodos independientes. A diferencia de algunos competidores que pueden depender de un modelo más federado o semi-centralizado, Chainlink prioriza la resistencia a la censura y la falta de un punto único de fallo.

Su ventaja más significativa es probablemente el efecto de red. Al tener la mayor cantidad de integraciones activas, asociaciones institucionales y valor asegurado, Chainlink se beneficia de una gran ventaja de liquidez y confianza. Para un desarrollador, elegir el oráculo más utilizado minimiza el riesgo técnico y de adopción.

Conclusión: El Puente Hacia un Futuro Descentralizado

Chainlink ha demostrado de manera convincente su papel como infraestructura crítica para Web3. Al resolver el problema del oráculo de forma segura y descentralizada, ha desbloqueado todo el potencial de los contratos inteligentes. Su tecnología permite que aplicaciones blockchain interactúen con el mundo real de manera confiable, un avance fundamental para la adopción masiva.

Los puntos clave que destacan la importancia de Chainlink incluyen:

- Solución al Problema del Oracle: Proporciona datos externos verificados a los contratos inteligentes de forma descentralizada.

- Seguridad Criptoeconómica: El mecanismo de staking de LINK incentiva la honestidad de los nodos operadores.

- Adopción Empresarial: Colaboraciones con gigantes como SWIFT y Mastercard validan su utilidad en las finanzas tradicionales.

- Interoperabilidad: Protocolos como CCIP permiten la comunicación fluida entre diferentes blockchains y sistemas legacy.

- Versatilidad: Sus casos de uso se extienden desde DeFi y seguros hasta cadena de suministro y gaming.

Mirando hacia el futuro, el camino de Chainlink parece destinado a una mayor integración con la economía global. Su visión del "Internet de los Contratos" promete un mundo donde los acuerdos digitales se ejecuten de forma automática, transparente y confiable. Aunque persisten desafíos técnicos y regulatorios, la trayectoria de Chainlink lo posiciona no solo como un puente entre blockchains y el mundo real, sino como un pilar fundamental sobre el cual se podría construir la próxima era de Internet.

La evolución de Chainlink será un indicador clave del progreso general de la industria blockchain hacia aplicaciones prácticas y de alto impacto. Su éxito en conectar dos mundos previamente separados lo convierte en uno de los proyectos más estratégicamente importantes en el espacio cripto actual, con el potencial de transformar industrias enteras mediante la automatización basada en la confianza.

Chainlink: A Revolução dos Oráculos na Era das Blockchains

O Chainlink estabeleceu-se como a plataforma de oráculos padrão da indústria, performando um papel revolucionário no ecossistema blockchain. Esta tecnologia inovadora conecta smart contracts isolados a dados do mundo real, habilitando aplicações descentralizadas avançadas em setores como DeFi e finanças tokenizadas. A sua infraestrutura é fundamental para a interoperabilidade e a adoção mainstream da tecnologia de ledger distribuído.

O Problema dos Smart Contracts Isolados

As blockchains tradicionais foram projetadas para serem ambientes fechados e seguros. No entanto, esta característica também é a sua maior limitação, pois os smart contracts executam-se de forma isolada, sem acesso direto a informações externas. Esta incapacidade de interagir com dados off-chain restringe drasticamente o seu potencial, mantendo-os confinados a operações básicas dentro da própria rede.

Sem uma conexão confiável com o mundo exterior, contratos inteligentes não podem responder a eventos em tempo real, como flutuações de preços de ativos, resultados de eleições ou condições climáticas. É aqui que os oráculos blockchain entram em cena, atuando como pontes críticas que suprem esta lacuna de informação. O Chainlink surgiu para resolver este desafio fundamental de forma descentralizada e segura.

O Papel Vital dos Oráculos de Blockchain

Um oráculo de blockchain é essencialmente um serviço que alimenta dados externos em contratos inteligentes. Eles funcionam como agentes de conexão que buscam, verificam e transmitem informações do mundo real para o ambiente on-chain. O Chainlink elevou este conceito através de uma rede descentralizada de oráculos (DONs), que elimina pontos únicos de falha.

Esta abordagem descentralizada é crucial para manter a segurança e a confiabilidade inerentes às blockchains. Ao invés de confiar numa única fonte, o Chainlink agrega dados de múltiplos nós independentes, garantindo que as informações fornecidas aos smart contracts são precisas e resistentes a manipulações. Esta inovação transforma contratos inteligentes em aplicações poderosas e com utilidade prática real.

Chainlink: O Padrão Industrial para Dados Confiáveis

O Chainlink não é apenas mais um projeto no espaço cripto; é a infraestrutura de oráculos mais adotada globalmente. A plataforma protege atualmente mais de $93 bilhões em valor across diversas aplicações blockchain, um testemunho da sua confiabilidade e segurança. A sua participação de mercado de 75% em meados de 2025 solidifica a sua posição de liderança.

A supremacia do Chainlink é resultado de anos de desenvolvimento e de uma arquitetura robusta projetada para ambientes institucionais. A sua rede é utilizada por gigantes financeiros como SWIFT e Mastercard, demonstrando a sua capacidade de atender aos rigorosos requisitos do setor financeiro tradicional. Esta adoção maciça faz do Chainlink um componente crítico da infraestrutura financeira global em evolução.

Chainlink já facilitou mais de $9 trilhões em valor de transações, conectando o mundo tradicional às blockchains.

A Arquitetura da Rede de Oráculos Descentralizados (DONs)

A espinha dorsal do Chainlink é a sua Rede de Oráculos Descentralizados (DONs). Esta arquitetura emprega uma agregação de dados multi-camadas que envolve fontes de dados diversificadas, operadores de nós independentes e a própria rede de oráculos. Os nós são geograficamente dispersos e executam software auditado, garantindo resiliência mesmo durante interrupções de serviços em nuvem.

- Fontes de Dados Múltiplas: Coleta de informação de diversos provedores premium para garantir precisão.

- Operadores de Nós Independentes: Entidades reputáveis que operam a infraestrutura de forma descentralizada.

- Modelo de Custo Compartilhado: Permite que múltiplas aplicações dividam o custo dos serviços de oráculo.

Este design sofisticado garante um uptime de 100% mesmo durante outages de infraestrutura crítica, uma estatística impressionante que supera concorrentes diretos. A velocidade de transação de 1-2 segundos torna-o ideal para aplicações financeiras de alta frequência que exigem atualizações de preços rápidas e confiáveis.

Domínio de Mercado e Comparativo Técnico

Em meados de 2025, o ecossistema de oráculos apresenta alguns players significativos, mas o Chainlink mantém uma liderança esmagadora. A sua capacidade de atender a casos de uso complexos, desde DeFi até integrações com bancos centrais, diferencia-o profundamente. A tabela abaixo ilustra uma comparação técnica com outros oráculos principais:

| Solução | Velocidade de Transação | Recursos de Confiabilidade |

|---|---|---|

| Chainlink | 1-2 segundos | 100% uptime em outages de nuvem |

| Band Protocol | 3 segundos (10k+ TPS) | >99% uptime |

| Pyth Network | Até 1ms | Especializado em DeFi |

Enquanto soluções como Pyth oferecem latência extremamente baixa, o Chainlink oferece um equilíbrio superior entre velocidade, descentralização e versatilidade. A sua capacidade de servir uma ampla gama de indústrias, indo muito além do nicho de DeFi, é um dos seus maiores trunfos. Esta abrangência é essencial para a massificação da tecnologia blockchain.

O Impacto na Economia Real e Adoção Institucional

O sucesso do Chainlink é medido não apenas pela sua dominância técnica, mas pelo seu impacto tangível na economia global. Parcerias estratégicas com instituições financeiras consolidadas estão trazendo bilhões de usuários para o ecossistema blockchain. A colaboração com a SWIFT, por exemplo, conecta mais de 11.500 bancos à tecnologia descentralizada.

Da mesma forma, a integração com a Mastercard potencialmente expõe 3.5 bilhões de portadores de cartão a ativos digitais através de infraestrutura segura. Estas parcerias demonstram uma ponte material entre o sistema financeiro tradicional (TradFi) e o mundo emergente das finanças descentralizadas (DeFi). O Chainlink está na vanguarda desta transformação histórica.

Inovações Tecnológicas Principais: De Chainlink 2.0 ao CRE

A evolução do Chainlink não parou na sua rede de oráculos inicial. O desenvolvimento do Chainlink 2.0 introduziu o conceito de Redes de Oráculos Descentralizadas (DONs) como uma camada de computação off-chain segura. Esta inovação permitiu que a plataforma oferecesse muito mais do que simples feeds de dados, expandindo para computação confidencial e serviços de automação complexa.

A mais recente fronteira nesta jornada é o Chainlink Runtime Environment (CRE). Este ambiente de computação descentralizado é modular e agnóstico a blockchains, projetado especificamente para acelerar a adoção das finanças tradicionais. O CRE oferece compatibilidade com sistemas legados, permitindo que instituições financeiras interajam com smart contracts sem necessidade de uma revisão completa da sua infraestrutura.

O Protocolo de Interoperabilidade Cross-Chain (CCIP)

Outra peça fundamental do ecossistema Chainlink é o Cross-Chain Interoperability Protocol (CCIP). Este protocolo permite transferências seguras não apenas de tokens, mas também de mensagens e dados arbitrários entre diferentes blockchains. Ele resolve um dos maiores desafios do espaço: a fragmentação entre redes isoladas.

- Pontes Seguras: Expansão para conexões como Solana-Base, facilitando a movimentação de liquidez.

- Projeto Drex (Brasil): Piloto envolvendo o banco central brasileiro e instituições de Hong Kong para transações cross-border.

- Comunicação Universal: Permite que smart contracts em qualquer chain ativem funções em outras redes de forma verificável.

O CCIP está posicionado para se tornar o padrão para comunicação segura entre blockchains, superando as vulnerabilidades conhecidas das pontes tradicionais. A sua arquitetura é fundamental para a visão de um ecossistema multi-chain integrado e eficiente, onde os ativos e dados fluem livremente entre ambientes distintos.

Casos de Uso Transformadores no Mundo Real

O poder do Chainlink é melhor compreendido através das aplicações revolucionárias que ele possibilita. Estas aplicações vão desde finanças descentralizadas até soluções para governos e empresas tradicionais, demonstrando a versatilidade da plataforma.

Revolucionando as Finanças Descentralizadas (DeFi)

No coração do ecossistema DeFi, os feeds de dados do Chainlink são a infraestrutura crítica para plataformas de empréstimo, stablecoins e derivativos. Projetos como Aave e GMX dependem dos oráculos para obter preços de ativos precisos e em tempo real, essenciais para determinação de colateral e liquidações justas.

A introdução dos Data Streams trouxe atualizações de preços com latência submilissegundo e custos de gas significativamente reduzidos. Isso permitiu a criação de derivativos perpétuos e mercados de previsão de alta frequência, como o Polymarket no Polygon. A segurança e a velocidade desses feeds são o que mantém a integridade financeira de bilhões de dólares em valor bloqueado (TVL).

O Chainlink protege mais de $93 bilhões em aplicações blockchain, uma marca 35 vezes superior aos seus concorrentes mais próximos.

Finanças Tokenizadas e Integração TradFi

A tokenização de ativos do mundo real (RWA) é uma das áreas de crescimento mais explosivo, e o Chainlink está no centro desta tendência. A plataforma fornece os oráculos necessários para conectar ativos tokenizados, como títulos, imóveis ou metais preciosos, a dados de avaliação off-chain, eventos de dividendos e relatórios regulatórios.

Parcerias estratégicas com gigantes como a Intercontinental Exchange (ICE) para dados de forex e metais, e com o Departamento de Comércio dos EUA para dados económicos on-chain, ilustram esta missão. Estas integrações permitem que ativos tradicionais sejam representados e negociados em blockchains com auditabilidade total e conformidade regulatória.

Adoção Institucional e o Ano Pivotal de 2025

O ano de 2025 está sendo amplamente visto como um marco histórico para a integração de blockchains nos mercados de capitais tradicionais e sistemas de bancos centrais. Neste contexto, o Chainlink posiciona-se não apenas como um fornecedor de dados, mas como uma camada completa de conectividade e coordenação.

O Chainlink Runtime Environment (CRE) é crucial neste cenário, pois oferece um caminho para que instituições financeiras legadas participem da economia on-chain sem abandonar os seus sistemas principais. O foco está em fornecer dados confiáveis, identidade verificável e orquestração de transações complexas que atendam aos padrões institucionais de segurança e compliance.

Pilares da Integração com Mercados de Capitais

A adoção institucional está assente em quatro pilares principais habilitados pelo Chainlink:

- Dados Confiáveis: Feeds de dados premium e auditados que satisfazem requisitos regulatórios.

- Identidade On-Chain: Soluções de prova de reserva e verificação de credenciais para contrapartes.

- Conectividade Universal: O protocolo CCIP ligando sistemas TradFi a múltiplas blockchains.

- Coordenação de Transações: Automação de fluxos de trabalho financeiros complexos através de smart contracts.

Este conjunto completo de serviços torna o Chainlink um parceiro estratégico inevitável para bancos, gestores de ativos e bolsas que buscam explorar a tecnologia blockchain. A infraestrutura está a ser testada em projetos piloto de bancos centrais e em iniciativas de moeda digital, sinalizando a sua prontidão para aplicações de nível sistêmico.

A Expansão para Stablecoins Regulados e Liquidações Híbridas

O crescimento de stablecoins regulados e lastreados em ativos reais depende diretamente de oráculos robustos. Estes stablecoins exigem verificação contínua e em tempo real das reservas que os lastreiam, uma função perfeita para as DONs do Chainlink. A transparência e a auditabilidade proporcionadas são essenciais para a confiança do mercado e dos reguladores.

Além disso, conceitos avançados como liquidações atómicas e híbridas estão a tornar-se realidade. Estes mecanismos permitem a troca simultânea de ativos em diferentes blockchains ou entre ambientes on-chain e off-chain, reduzindo o risco de contraparte. O Chainlink atua como o orquestrador confiável destas transações complexas, garantindo que todas as condições são cumpridas antes da execução final.

Tendências Futuras e Ampliando os Limites da Tecnologia

A trajetória do Chainlink aponta para uma expansão contínua além dos feeds de preços. A plataforma está a evoluir para ser uma camada abrangente de serviços de automação e computação descentralizada. As tendências futuras destacam a convergência com tecnologias de privacidade e inteligência artificial, bem como a exploração de novos tipos de dados.

O crescimento em ambientes fortemente regulados está a impulsionar a adoção de provas de conhecimento zero (ZK-proofs). Estas tecnologias, quando integradas com oráculos, podem permitir que dados sensíveis sejam utilizados em smart contracts sem serem revelados publicamente. Esta é uma etapa crucial para casos de uso em saúde, identidade digital e finanças privadas.

Oráculos para Identidade, Reputação e IA

Um dos horizontes mais promissores é a área de oráculos de identidade e reputação. O Chainlink pode fornecer credenciais verificáveis on-chain, como históricos de crédito, diplomas ou certificações profissionais, sem comprometer a privacidade do utilizador. Isto é fundamental para sistemas de empréstimo subcolateralizado e governança descentralizada.

- Dados para IA: Fornecimento de conjuntos de dados verificados e auditáveis para treinar modelos de inteligência artificial descentralizados.

- Orquestração On-Chain: Coordenação de workflows complexos que envolvem múltiplos sistemas e blockchains, automatizando processos empresariais.

- Eventos Físicos: Conectar oráculos de hardware a contratos inteligentes para setores como logística (rastreamento), seguros (clima) e energia.

Esta diversificação posiciona o Chainlink como a camada de conectividade universal para a Web3, indo muito além do nicho inicial de preços de criptomoedas. A capacidade de trazer qualquer dado, evento ou computação off-chain de forma segura para o domínio on-chain é o seu verdadeiro valor a longo prazo.

Análise de Mercado e Perspectivas para o Token LINK

O token LINK é o ativo nativo que alimenta a economia da rede Chainlink. Ele é usado para pagar os operadores de nós pelos seus serviços de oráculo e como garantia para garantir a entrega de dados correta. A saúde e a valorização do LINK estão intrinsecamente ligadas ao crescimento da rede e à sua adoção.

Analistas projetam que, com a contínua integração institucional e a expansão para novos mercados, a demanda pelos serviços da rede deve aumentar significativamente. Esta maior procura pelos serviços de oráculo deverá exercer uma pressão positiva no valor do LINK, à medida que mais tokens são utilizados e colocados em staking para garantir a segurança da rede.

Previsões de mercado especulativas apontam para potenciais alcances de $15,88 para o LINK em 2026 e $19,30 em 2030, impulsionadas pela adoção massiva como infraestrutura financeira crítica.

O Papel do Staking e da Governança

O staking de LINK é um componente central do modelo de segurança econômica do Chainlink 2.0. Os operadores de nós e os participantes da rede colocam tokens LINK como garantia. Se um nó fornecer dados incorretos ou se comportar de forma maliciosa, uma parte dessa garantia pode ser cortada (slashed).

Este mecanismo alinha os incentivos econômicos, assegurando que os operadores têm interesse financeiro em manter a precisão e a segurança da rede. À medida que mais valor é protegido pela rede (atualmente >$93B), maior será a garantia necessária, potencialmente criando um ciclo virtuoso de procura por tokens LINK para staking, reduzindo a oferta circulante.

O Papel Crítico do Chainlink no Futuro Descentralizado

À medida que o mundo avança para um modelo de finanças tokenizadas e sistemas automatizados baseados em contratos, a necessidade por dados confiáveis do mundo real torna-se não apenas conveniente, mas existencial. O Chainlink posicionou-se para ser a camada neutra e agnóstica que torna esta transição possível, segura e eficiente.

Mais do que uma simples ferramenta para criptomoedas, o Chainlink está a tornar-se a infraestrutura de confiança para a coordenação global. Desde a execução automática de contratos de seguro com base em dados climáticos até a liquidação instantânea de títulos internacionais, as suas aplicações estão a redefinir a operação dos mercados.

Resumo do Impacto e Conquistas

Para consolidar o entendimento, é crucial revisitar os marcos e o impacto quantificável do Chainlink:

- Domínio de Mercado: Liderança com 75% de participação no setor de oráculos.

- Valor Protegido: Mais de $93 bilhões em aplicações blockchain.

- Resiliência Operacional: 100% de uptime, comprovada durante interrupções de grandes provedores de nuvem.

- Adoção Institucional: Parcerias com SWIFT (11.500+ bancos), Mastercard, ICE e agências governamentais.

- Visão Tecnológica: Evolução de uma rede de oráculos para uma plataforma completa de computação e automação descentralizada (CRE e CCIP).

Estes números não são apenas estatísticas; eles representam a confiança depositada pela indústria numa única solução para um dos problemas mais desafiadores da computação descentralizada. O Chainlink tornou-se um utilitário público essencial para a Web3.

Conclusão: A Ponte Indispensável para um Novo Paradigma

O Chainlink transcendeu a sua definição inicial como um simples fornecedor de dados para criptomoedas. Hoje, ele é a ponte crítica e descentralizada que conecta o imenso valor e as lógicas da economia tradicional ao potencial transformador das blockchains. Sem os seus oráculos, os smart contracts seriam ferramentas isoladas, incapazes de interagir com a complexidade do mundo real.

A sua jornada desde o conceito de oráculo até à visão atual do Chainlink 2.0, DONs, CCIP e CRE ilustra uma evolução constante focada em resolver as necessidades mais prementes da indústria. Ao garantir dados confiáveis, computação segura e interoperabilidade universal, o Chainlink está a construir os alicerces sobre os quais a próxima geração de aplicações financeiras e empresariais será construída.

Olhando para o futuro, o papel do Chainlink só tende a expandir-se. O crescimento das finanças tokenizadas, a digitalização de ativos tradicionais e a demanda crescente por automação transparente e imparcial garantem que a sua infraestrutura será cada vez mais indispensável. O Chainlink não está apenas a participar da revolução blockchain; está a fornecer a cola fundamental que permite que esta revolução se integre verdadeiramente na sociedade e na economia global, capacitando um futuro onde os contratos são verdadeiramente inteligentes, autónomos e conectados ao mundo que nos rodeia.

Crypto Exchanges Explained: Understanding the Complex World of Digital Currencies

The Rise of Cryptocurrencies: In recent years, cryptocurrencies have emerged as one of the fastest-growing and most exciting technologies of our time. From Bitcoin to Ethereum, these digital assets have captured the imagination of both tech enthusiasts and traditional investors alike. As more people dive into the world of blockchain technology and digital currencies, understanding how to navigate the crypto landscape becomes increasingly important. One crucial aspect of this journey is comprehending the role and function of crypto exchanges.

What Are Crypto Exchanges?: At their core, crypto exchanges serve as marketplaces where individuals can buy, sell, and trade different cryptocurrencies. Whether you're looking to convert fiat currencies like dollars or euros into cryptocurrencies or exchange one type of digital currency for another, crypto exchanges offer a user-friendly environment and efficient trading mechanisms tailored specifically to these needs.

However, beyond being simple trading platforms, crypto exchanges come equipped with various features aimed at enhancing security, liquidity, and user experience. These features range from advanced trading tools to robust security measures, making crypto exchanges essential tools for anyone involved in the crypto ecosystem.

The Variety of Crypto Exchanges

Different Types of Crypto Exchanges: There isn't just one type of crypto exchange; instead, they vary widely based on platform characteristics, regulatory environments, and target markets. Here’s a breakdown of some common types:

- Centralized Exchanges (CEX): The traditional model, CEXs such as Binance, Coinbase, and Kraken operate under a centralized model, meaning they hold users’ funds and execute trades on behalf of individual users. They provide easy-to-use interfaces and a wide range of trading pairs, making them popular among both beginners and experienced traders.

- Decentralized Exchanges (DEX): Unlike CEXs, DEXs do not maintain custody of traders' funds. Instead, transactions are executed directly between traders using smart contracts on decentralized networks. Examples include Uniswap and PancakeSwap. DEXs are particularly valued for their higher levels of security and privacy but may lack the same level of functionality and liquidity compared to CEXs.

- Custodial and Non-custodial Wallets: Some exchanges offer both custodial wallets (where the exchange holds private keys) and non-custodial wallets (where users control their own private keys). The choice depends on personal preference for convenience versus security.

Key Features of Crypto Exchanges

User Interface and Trading Tools: Modern crypto exchanges are designed with user experience in mind. This includes intuitive interfaces and user-friendly tools such as order books, market data widgets, and portfolio tracking dashboards. Advanced features might include automated trading bots, algorithmic trading capabilities, and margin trading. Each feature caters to different trader personas, whether it's day traders seeking quick access to the market or long-term investors looking for stable investments.

Liquidity and Trading Pairs: Liquidity is critical in determining a crypto exchange’s performance. High liquidity ensures that trades occur quickly without affecting market prices. Crypto exchanges list a variety of trading pairs, allowing users to swap between any two cryptocurrencies they choose. The presence of popular trading pairs like BTC/USDT (Bitcoin/Tether) and ETH/BTC (Ethereum/Bitcoin) typically indicates robust and reliable liquidity.

Security Measures and Compliance

Strong Security Protocols: Security is paramount in the crypto space due to the risk of theft and hacking. Top-tier crypto exchanges implement advanced security protocols such as multi-factor authentication (MFA), cold wallet storage for large holdings, and encryption to secure user data. Additionally, reputable exchanges undergo regular audits by independent firms to ensure compliance with best practices and regulatory standards.

Regulatory Compliance: As the crypto industry matures, so too does its legal framework. Reputable exchanges must adhere to local and international regulations. This includes Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to prevent fraudulent activities. By complying with these regulations, exchanges build trust within the financial community while ensuring compliance with legal standards.

User Verification and Identity Protection

User Verification Processes: To ensure the safety and integrity of the platform, users often need to complete a verification process before accessing sensitive features. Verification tiers typically include basic information for account creation and higher levels requiring additional personal documentation like identification cards. This hierarchical verification system helps reduce fraud and protects both the users and the exchange itself.

Privacy Concerns: While verification is necessary for compliance reasons, it also raises privacy concerns. Exchanges balance the need for transparency with user privacy by implementing strict policies regarding data usage and sharing. For instance, reputable exchanges often encrypt user data and strictly limit who has access to personally identifiable information.

The Impact of Global Regulations

The Role of Regulatory Bodies: As cryptocurrency gains mainstream acceptance, so does governmental scrutiny. Regulatory bodies around the world are taking steps to oversee the industry, ensuring that cryptocurrencies are used responsibly and ethically. Countries like Japan and the United States have established specific frameworks for regulating exchanges and digital assets. These regulations aim to protect consumers, prevent money laundering, and foster a fair trading environment.

The Effects on Industry Dynamics: Regulatory frameworks significantly affect the dynamics of the crypto market. Exchanges operating within jurisdictions with stringent regulations may face higher barriers to entry and operational costs. On the other hand, compliance with local laws can enhance trust among users and attract institutional investors. Conversely, laxer regulations can lead to a proliferation of speculative investments and potential vulnerabilities in the market.

Emerging Trends and Future Projections: As governments around the world continue to grapple with how best to regulate cryptocurrencies, several trends are likely to emerge. These include the development of regulatory sandboxes for experimenting with new technologies, increased focus on interoperability standards to facilitate cross-border transactions, and greater emphasis on technological safeguards like blockchain-based audits and immutable records. These developments promise to shape the future of crypto exchanges, making them more secure, transparent, and accessible.

Conclusion

In conclusion, crypto exchanges are more than just online marketplaces for buying and selling cryptocurrencies. They represent the backbone of the digital currency ecosystem, providing essential services that enable seamless transactions and facilitate investment opportunities. Whether you are a seasoned trader or a curious newcomer to the crypto world, understanding how these platforms work is fundamental to navigating the complexities of the digital asset landscape with confidence.

Marketplace Functionality and Trading Mechanisms

Order Book Trading: One of the primary features of crypto exchanges is their order book trading mechanism. Order books display open buy and sell orders at various price levels, allowing traders to see the entire market sentiment and make informed decisions. Traders can place limit orders to buy or sell at specified prices or market orders to execute immediately at the current market price. This transparency enhances the efficiency and fairness of trades.

Marginal Trading and Leverage: Leverage is a powerful tool offered by many crypto exchanges, enabling traders to amplify their profits or losses. By borrowing funds from the exchange, traders can increase their position size, potentially leading to substantial returns but also increasing the risk. However, leveraged trading requires careful management to avoid significant financial losses.

Trading Fees and Rewards: Fees play a crucial role in generating revenue for exchanges while influencing traders’ choices. Most reputable exchanges charge fees for each transaction, such as taker fees for executing market orders and maker fees for contributing to liquidity. Additionally, some exchanges offer rewards for liquidity providers or staking programs, incentivizing users to contribute to the exchange’s stability and performance.

User Support and Resources

Customer Support and Resources: User support is vital to maintaining customer satisfaction and addressing concerns promptly. Top-tier crypto exchanges provide various forms of customer support, including email, live chat, and phone support. Moreover, comprehensive educational resources, such as blog posts, tutorials, and webinars, help users understand complex topics and make informed decisions.

Ecosystem Integration: Many crypto exchanges integrate with other services in the broader ecosystem, such as wallets, DeFi platforms, and NFT marketplaces. These integrations offer users a seamless experience across multiple applications, enhancing usability and convenience. For example, some exchanges allow direct wallet integration, enabling users to instantly transfer funds and interact with various decentralized finance (DeFi) applications without leaving the exchange platform.

Security Challenges and Mitigation Strategies

Common Security Risks: Despite the robust measures in place, crypto exchanges face unique security challenges. Phishing attacks, hacking attempts, and insider threats pose significant risks. Hackers often exploit vulnerabilities in smart contracts, private key management systems, or user interfaces to steal funds or manipulate the market. Additionally, phishing scams trick users into revealing sensitive information, thereby compromising their accounts.

Mitigation Strategies: To address these risks, exchanges implement a combination of preventive, detective, and corrective measures. Preventive methods include regular software updates and security audits to identify and fix vulnerabilities. Detective methods involve monitoring for unusual activity and setting up alerts to quickly respond to suspicious behavior. Corrective actions include isolating affected accounts, freezing funds, and reimbursing victims in case of successful cyberattacks.

User Education: User education is a critical component of any security strategy. Encouraging users to practice good cybersecurity habits, such as enabling 2FA, regularly updating passwords, and exercising caution when clicking on links or downloading files, significantly reduces the risk of falling victim to cyber threats. Exchanges often conduct awareness campaigns to educate their user base about recognizing phishing attempts and securing their accounts.

Future Developments and Technological Innovations

Next-Gen Cryptocurrency Trading Platforms: Emerging technologies like zero-knowledge proofs, atomic swaps, and interoperable blockchain networks promise to transform the way crypto exchanges operate. Zero-knowledge proofs offer greater privacy and confidentiality, while atomic swaps allow users to swap cryptocurrencies without relying on a central intermediary. Interoperable blockchain networks can facilitate cross-chain transactions, enhancing liquidity and accessibility.

Quantum Computing Threats: With advancements in quantum computing, there is growing concern about the potential vulnerabilities it could introduce to cryptographic security protocols. Quantum computers may break existing encryption methods, necessitating the development of post-quantum cryptography techniques. Crypto exchanges should stay vigilant about these evolving threats and invest in research to ensure long-term security.

Regulatory Adaptation: As technological innovations advance, regulatory frameworks will likely adapt to keep pace. Authorities may release updated guidelines addressing new challenges and opportunities presented by emerging technologies. Crypto exchanges can stay ahead by monitoring regulatory developments closely and proactively engaging with policymakers to shape favorable regulatory environments.

Conclusion

In summary, crypto exchanges stand at the forefront of the rapidly evolving digital currency landscape. From traditional centralized models to innovative decentralized platforms, they cater to diverse user needs and preferences. With advanced features, stringent security measures, and ongoing technological advancements, crypto exchanges continue to evolve, offering a more secure, efficient, and accessible trading environment. As the industry matures, it is crucial for both exchanges and users to remain informed about emerging trends and challenges to navigate the dynamic crypto ecosystem successfully.

Consumer Protection and Market Integrity

Consumer Protections: Consumer protection is a critical aspect of any marketplace, especially since cryptocurrencies lack physical backing and can be extremely volatile. Reputable exchanges prioritize consumer protection through various measures, including insurance, escrow services, and dispute resolution mechanisms. Insurance policies like Coinbase’s $285 million USD Secure Trading Facility ensure that users’ funds are covered in case of incidents like hackings or significant breaches. Escrow services keep funds safe until confirmed transactions are completed, and dispute resolution mechanisms provide a structured way to address issues arising from trades.

Market Manipulation and Fair Trading Practices: Market manipulation can severely undermine trust within the crypto space. Exchanges implement measures like order-matching algorithms and regulatory oversight to prevent such practices. Algorithmic trading ensures that every trade is handled fairly across the board, preventing individual users from gaining unfair advantages. Regulatory bodies and exchanges work together to monitor and penalize any suspected manipulative activities, ensuring a level playing field for all participants.

User Privacy and Data Security

User Privacy: Protecting user privacy is paramount, especially given the sensitive nature of financial information. Exchanges employ various strategies to safeguard user data. Encryption techniques like AES or RSA encrypt data at rest and in transit, ensuring that even if intercepted, data remains unreadable. Access controls and role-based permissions limit the exposure of sensitive information to only those who need it. Transparency in data handling policies further strengthens user trust by clearly outlining how personal information is collected, stored, and used.

Data Breach Response: Despite robust security measures, data breaches can still occur. Reputable exchanges have incident response plans in place to mitigate damage and restore normal operations swiftly. Regular security audits and penetration testing help identify and rectify vulnerabilities proactively. Communication with users during crises is crucial, and timely updates and remediation efforts rebuild confidence in the platform.

The Evolution of Regulation and Its Impact

Global Regulatory Landscape: The global regulatory landscape is continuously evolving, with countries implementing varied levels of oversight. Some jurisdictions, like South Korea and Japan, have stringent crypto regulations, while others, such as Gibraltar and Malta, offer a more permissive environment. Regional variations can create complexities for exchanges, requiring them to adapt to numerous sets of rules. As regulatory frameworks align more closely globally, exchanges may face harmonized standards, simplifying compliance efforts.

Impact on the Industry: Robust regulation can have mixed effects on the industry. On one hand, stringent regulations can deter speculative investments and promote responsible practices, reducing market volatility. On the other hand, overly restrictive regulations might stifle innovation and growth. Balancing these factors is essential for sustainable development within the crypto ecosystem.

Future Trends and Policy Developments: Looking ahead, several trends and policy developments are likely to shape the future of crypto regulation. Governments may establish dedicated agencies to oversee cryptocurrency activities, improving coordination and effectiveness. Additionally, international cooperation and standard-setting bodies like G20 and FATF (Financial Action Task Force) may play a larger role in harmonizing crypto regulations across borders. These developments aim to create a clearer, more stable regulatory environment for crypto exchanges and users.

Final Thoughts

In conclusion, crypto exchanges have become indispensable players in the evolving digital asset landscape. They offer a range of sophisticated tools and services that cater to the diverse needs of users, from beginners to experienced traders. As the industry continues to grow and evolve, it is essential for exchanges to maintain high standards of security, integrity, and compliance. Embracing transparency, implementing robust security measures, and embracing emerging technologies will be key to ensuring the sustained success and credibility of crypto exchanges in the years to come.

The journey of crypto exchanges is far from over. With continued innovation, stringent regulation, and a focus on user experience, these platforms will undoubtedly continue to redefine the horizon of digital finance, opening new avenues for investment and financial inclusion.

Cardano 2025 Roadmap: Scalability, Governance, and DeFi Growth

The Cardano blockchain enters 2025 at a pivotal moment in its evolution. Designed as a proof-of-stake blockchain platform, Cardano is renowned for its research-driven approach and commitment to sustainability, interoperability, and scalability. With major upgrades on the horizon, the platform is poised to significantly expand its capabilities in decentralized finance (DeFi), governance, and real-world applications, solidifying its position as a leading smart contract platform.

Introduction to the Cardano Blockchain

Cardano stands apart in the crowded blockchain space due to its foundational principles. It was built using high-assurance formal development methods, a rigorous peer-reviewed process that ensures security and reliability. The platform's architecture is uniquely layered, separating the settlement of transactions from the computation of smart contracts. This design provides a flexible foundation for sustainable blockchain applications.

The native cryptocurrency of the Cardano network is ADA. ADA is used for staking, paying transaction fees, and participating in network governance. Since the successful Alonzo hard fork in 2021, which introduced smart contract functionality, Cardano has become a direct competitor to platforms like Ethereum, offering developers a scientifically robust environment for building decentralized applications (DApps).

The Ouroboros Consensus Mechanism

At the heart of Cardano's operation is Ouroboros, the first provably secure proof-of-stake protocol. Unlike the energy-intensive mining used by Bitcoin, Ouroboros relies on a process called "minting." In this system, ADA holders delegate their stakes to stake pools, which are responsible for validating transactions and creating new blocks.

Slot leaders are selected algorithmically to perform these tasks, making the network highly energy-efficient. This decentralized consensus mechanism is fundamental to Cardano's ability to scale sustainably while maintaining robust security, a key advantage highlighted in its 2025 roadmap.

Cardano's 2025 Strategic Roadmap Overview

The 2025 roadmap for Cardano outlines an ambitious vision focused on three core pillars: scalability, governance, and interoperability. The development team at Input Output Global (IOG) is driving upgrades that will enhance network capacity, deepen community-led governance, and enable seamless communication with other blockchains.

A primary goal is to support billions of users by 2030. The 2025 plan serves as a critical stepping stone, introducing efficiency upgrades and enhanced developer tooling to make the platform more scalable and user-friendly. The roadmap is structured around the ongoing "eras" of Cardano's development, with a significant emphasis on the Voltaire era for governance.

Key Focus Areas for 2025

- Scalability Solutions: Implementing upgrades to increase transactions per second (TPS) and overall network capacity.

- Advanced Governance: Expanding on-chain voting and treasury management through the Voltaire era.

- Inter-Chain Communication: Building bridges and protocols for secure cross-chain interactions.

- DeFi and Stablecoin Expansion: Fostering growth in decentralized finance with key integrations like USDC and USDT.

Scalability and Performance Upgrades

Scalability remains a paramount challenge for all major blockchains, and Cardano's 2025 plan addresses this head-on. The roadmap includes several technical enhancements designed to significantly improve the network's throughput and efficiency. These upgrades are essential for supporting the projected growth in DeFi applications and user base.

A major initiative involves improvements to the Plutus smart contract platform. By optimizing how smart contracts are executed on-chain, Cardano aims to reduce transaction costs and latency, providing a smoother experience for both developers and end-users. These performance upgrades are critical for competing effectively in the high-stakes world of blockchain-based finance.

Cardano has already processed more than 105 million transactions, demonstrating substantial network activity and a strong foundation for future growth.

Hydra: Layer-2 Scaling Solutions

One of the most anticipated scalability features is Hydra, a layer-2 scaling solution. Hydra operates by creating off-chain "heads" that process transactions privately and quickly, only settling the final state on the main Cardano chain. This approach can dramatically increase the total number of transactions the network can handle.

Each Hydra head can process transactions independently, meaning the overall capacity of the network can scale nearly linearly with the number of active heads. The rollout of Hydra is a cornerstone of Cardano's strategy to achieve global-scale adoption without compromising on decentralization or security.

Advancements in Governance: The Voltaire Era

The Voltaire era represents the final major phase in Cardano's development, centering on the establishment of a self-sustaining, decentralized governance model. In 2025, this vision is becoming a reality with the expansion of on-chain voting and treasury systems. The goal is to empower the community to steer the future of the protocol.

Through a system of Cardano Improvement Proposals (CIPs), ADA holders can propose changes to the network, debate them, and vote on their implementation. This democratic process ensures that the platform evolves in a direction that reflects the collective interests of its stakeholders, moving away from a development team-led model to a truly community-operated network.

Project Catalyst and Community Funding

A key component of Voltaire is Project Catalyst, a series of experiments that form the largest decentralized innovation fund in the world. Community members submit proposals for projects, protocols, or developments, and the ADA community votes to allocate funding from the treasury.

This continuous funding cycle accelerates innovation within the Cardano ecosystem by financially supporting promising ideas directly from the community. It is a powerful mechanism for fostering organic growth and development, ensuring that resources are allocated to the most valued initiatives.

Interoperability and Cross-Chain Ambitions

A core tenet of Cardano's vision is blockchain interoperability. The 2025 roadmap details ambitious plans to build secure, trustless bridges to other major blockchain networks. This initiative moves beyond simple token bridges to enable seamless communication and shared functionality between entirely different protocols, a critical step for the future of decentralized finance (DeFi).

A major technical development is the planned deployment of an Inter-Blockchain Communication (IBC) protocol. Similar to the system used by Cosmos, this protocol would allow Cardano to securely exchange data and assets with other IBC-compatible chains. To facilitate this, Cardano is introducing a new consensus system called Minotaur, which blends Ouroboros' proof-of-stake with other consensus models to support these complex interchain interactions.

The Future of Hybrid DApps

The ultimate goal of this interoperability work is to enable Hybrid DApps. These are decentralized applications that are not confined to a single blockchain. A Hybrid DApp could leverage Cardano's security for settlement, another chain's high speed for gaming logic, and a third chain's storage capabilities, all without developers having to rebuild their application from scratch on each platform.

This approach reduces fragmentation and unlocks immense creative potential. It positions Cardano not as a standalone silo, but as a key participant in a connected, multi-chain ecosystem. This strategic focus directly addresses one of the three fundamental challenges Cardano was designed to solve: achieving true blockchain interoperability.

Cardano DeFi Ecosystem and Major Integrations

The Cardano DeFi ecosystem is experiencing substantial growth, marking a significant milestone in 2025. The total value locked (TVL) across various DeFi protocols on Cardano has surpassed $700 million for the first time. This surge reflects growing developer confidence and user adoption, establishing Cardano as a serious player in the decentralized finance sector.

Key to this expansion are groundbreaking integrations recently announced from strategic hubs like Hong Kong. These partnerships are bringing essential financial primitives to the Cardano blockchain, lowering the barrier to entry for both institutional and retail users and fostering a more robust financial ecosystem.

Pyth Oracle Integration

A landmark development is the integration of the Pyth Network oracle. Oracles are critical infrastructure that connect blockchains to real-world data. The Pyth partnership introduces sophisticated, high-fidelity price feeds for cryptocurrencies, stocks, forex, and commodities directly onto the Cardano network.

This enables developers to build advanced DeFi applications such as perpetual futures contracts, options trading platforms, and prediction markets that rely on accurate, real-time external data. The Pyth integration significantly expands the design space for builders on Cardano, moving DeFi beyond simple swapping and lending into more complex financial instruments.

Tier-1 Stablecoin Support (USDC and USDT)

Perhaps the most significant boost to Cardano's DeFi credibility is the official integration of Tier-1 stablecoins, specifically USD Coin (USDC) and Tether (USDT). The arrival of these major, widely recognized stablecoins provides a crucial on-ramp for fiat liquidity and a stable unit of account for users.

The integration of stablecoins like USDC and USDT is a game-changer, facilitating seamless fiat-to-crypto conversions, enhancing regulatory compliance, and simplifying cross-border transactions on the Cardano network.

This integration reduces volatility risk for traders and liquidity providers. It also makes Cardano-based DeFi protocols more accessible and appealing to a mainstream financial audience who are familiar with these digital dollar equivalents, directly fueling further TVL growth.

Key Components of a Thriving Cardano DeFi Scene

- Decentralized Exchanges (DEXs): Platforms like SundaeSwap, Minswap, and Wingriders facilitate token swapping and provide liquidity pools.

- Lending and Borrowing Protocols: Emerging platforms allow users to lend their ADA or other native assets to earn yield or use them as collateral for loans.

- Liquid Staking Solutions: Protocols that enable users to stake their ADA for network security while receiving a liquid staking token (LST) that can be used in other DeFi applications, maximizing capital efficiency.

- Advanced Financial Instruments: With oracles now available, the stage is set for derivatives, structured products, and more sophisticated trading tools.

Real-World Utility: Identity and Traceability Solutions

Beyond finance, Cardano is making significant strides in applying blockchain technology to real-world problems. In the second quarter of 2025, the Cardano Foundation launched two major open-source platforms focused on digital identity and supply chain traceability. These initiatives demonstrate Cardano's practical utility in enterprise and governmental contexts.

Veridian: Privacy-Preserving Digital Identity

The Foundation launched Veridian, a next-generation platform for decentralized digital identity. It focuses on privacy-preserving, interoperable credential verification. The platform empowers individuals with self-sovereign identity through the use of decentralized identifiers (DIDs) and verifiable credentials.

Imagine a digital wallet that holds your university degree, your professional licenses, and your medical vaccination records. With Veridian, you can share proofs of these credentials without revealing the underlying document or all your personal data. Target sectors include:

- Healthcare: Secure and portable patient records.

- Finance: Streamlined KYC (Know Your Customer) and compliance processes.

- Academia Tamper-proof diplomas and certificates.

- Government Services: Efficient and secure access to public benefits.

Originate: Supply Chain Provenance and Certification

Alongside Veridian, the Cardano Foundation launched Originate, an open-source traceability infrastructure. This platform helps businesses verify product authenticity and meet stringent industry certifications by providing an immutable record of a product's journey from origin to consumer.

Its flagship use case is a partnership to digitally certify the provenance of Georgian wine. By tracking each bottle from vineyard to store shelf on the Cardano blockchain, producers can prove authenticity, combat counterfeiting, and share detailed stories about their terroir and sustainable practices. This application showcases blockchain's power to bring transparency to agriculture and luxury goods.

The development of Veridian and Originate underscores a crucial point: Cardano's value proposition extends far beyond cryptocurrency speculation. It is building the foundational tools for a more verifiable, transparent, and user-centric digital future across multiple industries.

Cardano's Competitive Positioning in the Blockchain Landscape

Cardano occupies a unique niche in the highly competitive blockchain ecosystem. Unlike many projects that prioritize speed-to-market, Cardano's foundation is built upon peer-reviewed academic research and formal verification methods. This scientifically rigorous approach to development distinguishes it from competitors and provides a robust foundation for enterprise-level applications and mission-critical DeFi protocols.

Since the landmark Alonzo hard fork in September 2021, which introduced smart contract functionality, Cardano has directly entered the arena dominated by Ethereum. However, its value proposition extends beyond merely being an "Ethereum alternative." Cardano's layered architecture, energy-efficient Ouroboros consensus, and meticulous approach to upgrades position it as a platform focused on long-term sustainability and scalability, targeting global-scale adoption.

Competitive Advantages

- Scientific Rigor: Every major protocol update undergoes extensive academic peer review, minimizing risks and vulnerabilities.

- Sustainable Architecture The proof-of-stake Ouroboros protocol consumes a fraction of the energy used by proof-of-work networks like Bitcoin.

- Scalability Roadmap: With solutions like Hydra and ongoing protocol optimizations, Cardano is systematically addressing the blockchain trilemma of achieving scalability, security, and decentralization simultaneously.

- Enterprise-Friendly Governance: The evolving Voltaire governance model provides a clear, decentralized path for decision-making, which is attractive for institutions seeking regulatory clarity and stability.

Sustainability and Environmental Impact

In an era of increasing scrutiny on the environmental impact of blockchain technology, Cardano's commitment to sustainability is a significant competitive advantage. The entire network is built around the energy-efficient Ouroboros proof-of-stake protocol. This design choice fundamentally separates Cardano from first-generation blockchains that rely on energy-intensive mining.

The environmental benefit is substantial. Compared to proof-of-work networks, Cardano's energy consumption is negligible. This low carbon footprint is increasingly important for attracting environmentally conscious developers, investors, and enterprise partners. It aligns Cardano with global sustainability goals and makes it a viable candidate for applications in green finance, carbon credit tracking, and other eco-centric industries.

Real-World Applications for Sustainability

The platform's utility in promoting sustainability extends beyond its own energy use. Projects like the Originate traceability platform are being used to verify sustainable agricultural practices, such as the Georgian wine provenance project. This demonstrates blockchain's potential to bring transparency to supply chains, allowing consumers to make informed, ethical purchasing decisions and holding companies accountable for their environmental claims.

Investment Perspective and ADA Tokenomics

From an investment standpoint, Cardano presents a compelling case built on its strong fundamentals and continued development. The native cryptocurrency, ADA, serves three primary functions within the ecosystem: a medium of exchange for transactions, a tool for staking and securing the network, and a voting right for on-chain governance. This multi-faceted utility creates intrinsic demand for the token.

The total supply of ADA is capped at 45 billion tokens, a fixed supply that introduces a deflationary aspect to its economics. Like Bitcoin, this hard cap means that no new ADA will be created beyond this limit, potentially leading to price appreciation as adoption increases and overall supply remains fixed.

Staking and Passive Income

A cornerstone of ADA's value proposition is staking. ADA holders can participate in the network's security by delegating their tokens to a stake pool. In return, they earn staking rewards, typically in the range of 4-5% annually. This mechanism incentivizes long-term holding and active participation in the network, rather than short-term speculation.

The ability for ADA holders to earn staking rewards provides a powerful incentive for network participation and long-term investment, contributing to the overall health and security of the Cardano ecosystem.

Staking is designed to be user-friendly and non-custodial, meaning users retain ownership of their ADA while delegating it. This lowers the barrier to entry for participation and strengthens the network's decentralization by distributing stake across many independent pools.

Future Outlook and Long-Term Vision

Looking beyond the 2025 roadmap, Cardano's long-term vision is nothing short of ambitious. The ultimate goal is to become the financial operating system for the world, providing a platform for secure, transparent, and accessible financial services for the billions of people who are currently unbanked or underbanked.

The focus on interoperability, identity, and governance laid out in the near-term roadmap lays the foundation for this grand vision. By creating bridges between disparate blockchain systems, empowering individuals with control over their digital identities, and establishing a sustainable model for decentralized governance, Cardano is building the infrastructure for a more inclusive and equitable global financial system.

The Path to Global Adoption

- Partnerships with Governments and Institutions: Cardano has actively pursued partnerships in developing nations, exploring use cases for everything from digital identity for citizens to land registry on the blockchain.

- Focus on Education: A key part of the strategy involves educating a new generation of developers through initiatives like the Cardano Developer Portal and partnerships with academic institutions.

- User Experience Improvements: Making blockchain technology accessible to non-technical users is paramount. Ongoing development focuses on simplifying wallet interfaces, streamlining transactions, and abstracting away the underlying complexity.

Conclusion: Cardano's Strategic Trajectory