What is Cryptocurrency?

In recent years, the term "cryptocurrency" has become a common buzzword, capturing the attention of investors, tech enthusiasts, and even the general public. But what exactly is cryptocurrency, and why has it garnered so much interest? At its core, cryptocurrency is a type of digital or virtual currency that relies on cryptographic techniques to secure transactions. Unlike traditional currencies issued by governments and central banks, cryptocurrencies are decentralized and typically operate on technologies like blockchain. This article delves into the fundamentals of cryptocurrency, exploring its origins, mechanics, and the possibilities it unfolds for the future of finance.

The Origins of Cryptocurrency

The concept of a digital currency that is independent of central authority isn't entirely novel. It was, however, the advent of Bitcoin in 2009 by an anonymous figure known as Satoshi Nakamoto that turned the concept into reality. Bitcoin was introduced as an open-source software, aiming to create a peer-to-peer electronic cash system that allowed for secure and direct transactions without intermediaries, like banks or financial institutions. The release of Bitcoin introduced the world to blockchain technology, a distributed ledger that records all transactions across a network of computers, making it both transparent and immutable.

The Mechanics of Cryptocurrency

Cryptocurrencies function on a medium known as blockchain, which is an ingenious implementation of distributed ledger technology (DLT). The blockchain acts as a digital record book, where transactions are recorded in chronological order and are publicly accessible. This ledger is decentralized, meaning it is managed by a network of computers (often referred to as nodes) spread across the globe. No single entity has control over it, which helps in preventing fraud and unauthorized manipulation.

Transactions made through cryptocurrencies are verified and securely encrypted through cryptographic algorithms. This ensures a high level of security and privacy for users, making it difficult for any malicious entity to alter transaction details or create counterfeit coins. Additionally, many cryptocurrencies use a system called "proof of work" to validate transactions, where participants (miners) must solve complex mathematical problems to add transactions to the blockchain, thereby earning new coins in return.

The Diverse World of Cryptocurrencies

While Bitcoin was the first cryptocurrency, the ecosystem has since expanded to thousands of distinct cryptocurrencies, each with its own unique features and purposes. Some of the most well-known include Ethereum, Ripple, Litecoin, and Cardano. Ethereum, for example, is recognized not just as a digital currency but also for its smart contract platform, which allows developers to create decentralized applications (DApps) on its blockchain.

Other cryptocurrencies have different focuses. For instance, Ripple aims to facilitate fast and low-cost international money transfers, whereas Litecoin presents itself as a faster and more efficient alternative to Bitcoin for everyday transactions. This diversity allows cryptocurrencies to cater to a wide range of needs and industries, from financial services to supply chain management and beyond.

Investing and Trading in Cryptocurrencies

Cryptocurrencies have become a popular investment vehicle, attracting both retail and institutional investors. The allure lies in their potential for high returns, stemming from significant volatility and speculative interest. Cryptocurrency exchanges, much like stock exchanges, are platforms where individuals can buy, sell, and trade different cryptocurrencies. These exchanges offer a variety of trading pairs, allowing users to exchange one cryptocurrency for another or for fiat currencies like the US dollar or euro.

Despite the potential for profit, trading and investing in cryptocurrencies come with substantial risk. The market is highly volatile, with prices capable of swinging dramatically within a short time. Investors require a deep understanding of market trends, risk management strategies, and technical analysis to navigate this volatile landscape successfully.

In conclusion, the world of cryptocurrency is expansive and complex, characterized by innovative technology and rapid evolution. While the potential rewards are significant, so too are the risks, making it essential for enthusiasts and investors alike to educate themselves about this dynamic field. As cryptocurrencies continue to mature and integrate into the global financial system, their role and impact are sure to grow, shaping the future of how we perceive and handle money.

The Advantages of Cryptocurrency

As the cryptocurrency market continues to expand, it’s essential to examine the benefits that have propelled the adoption of this transformative technology. Among the most significant advantages is decentralization. Cryptocurrencies operate independently of central authorities or governments, reducing the risk of governmental manipulation or policy-influenced devaluation. This decentralized nature promotes financial sovereignty, allowing individuals greater control over their own assets.

Another advantage is security. Cryptocurrencies utilize advanced cryptography to secure transactions and wallet addresses, significantly reducing the risk of fraud. The blockchain's transparency, where all transactions are recorded openly, also aids in enhancing security. This transparency can deter fraudulent activities within the network, as every transaction is traceable and can be audited by anyone.

Speed and cost-effectiveness further distinguish cryptocurrencies from traditional banking. International transfers that typically take days can be executed in minutes with digital currencies, and often at a fraction of the cost. This efficiency is particularly beneficial for cross-border transactions, offering a practical alternative to traditional bank transfers and remittance services.

Moreover, cryptocurrencies provide financial services to the unbanked population, introducing financial inclusivity to regions with limited access to conventional banking infrastructure. With just a smartphone and internet access, individuals can participate in the cryptocurrency ecosystem, sending and receiving payments globally without needing a bank account.

The Risks and Challenges of Cryptocurrency

Despite its many advantages, the path to widespread cryptocurrency adoption is not without obstacles. Foremost among these is market volatility. Cryptocurrency prices are notoriously volatile, often experiencing drastic price swings within short periods. While this volatility can lead to substantial profits, it equally poses significant risks for unwary investors.

Regulatory uncertainty also looms large. Governments worldwide are grappling with how to regulate cryptocurrencies, balancing innovation with consumer protection and financial stability. While some countries have embraced digital currencies, others remain skeptical, fearing their potential use in money laundering, tax evasion, and other illicit activities. This uncertain regulatory landscape can hinder the mainstream adoption and integration of cryptocurrencies into existing financial systems.

Security concerns, although significantly mitigated by blockchain technology, are not entirely absent. High-profile exchange hacks and prominent thefts of digital assets have raised concerns about security vulnerabilities within the cryptocurrency space. Properly safeguarding private keys and selecting reputable platforms remain vital to ensuring one's assets are protected.

Additionally, the environmental impact of cryptocurrency mining, especially Bitcoin's proof-of-work model, has become a significant concern. The intensive energy consumption required for mining operations has led to criticisms regarding its carbon footprint and sustainability, prompting a push towards greener solutions like proof-of-stake and hybrid models.

The Evolution of Cryptocurrency Regulation

In response to the concerns surrounding cryptocurrencies, regulatory frameworks are beginning to take shape. Many countries and international bodies are working to establish guidelines that manage the risks while encouraging innovation. The objective is to develop a regulatory environment that fosters trust and security, ensuring that cryptocurrencies can coexist with traditional financial systems.

For instance, some nations have implemented stringent KYC (know your customer) and AML (anti-money laundering) requirements for cryptocurrency exchanges, aimed at curbing illegal activities. The European Union's Fifth Anti-Money Laundering Directive (5AMLD), which includes regulations on cryptocurrencies, is an example of regulatory attempts to increase transparency and accountability.

Nevertheless, striking the right balance can be complex, as overly stringent regulations may stifle innovation and limit the benefits that cryptocurrencies can offer. It's crucial for policymakers to work in collaboration with industry experts and stakeholders to craft regulations that are both effective and conducive to growth.

The Future of Cryptocurrency

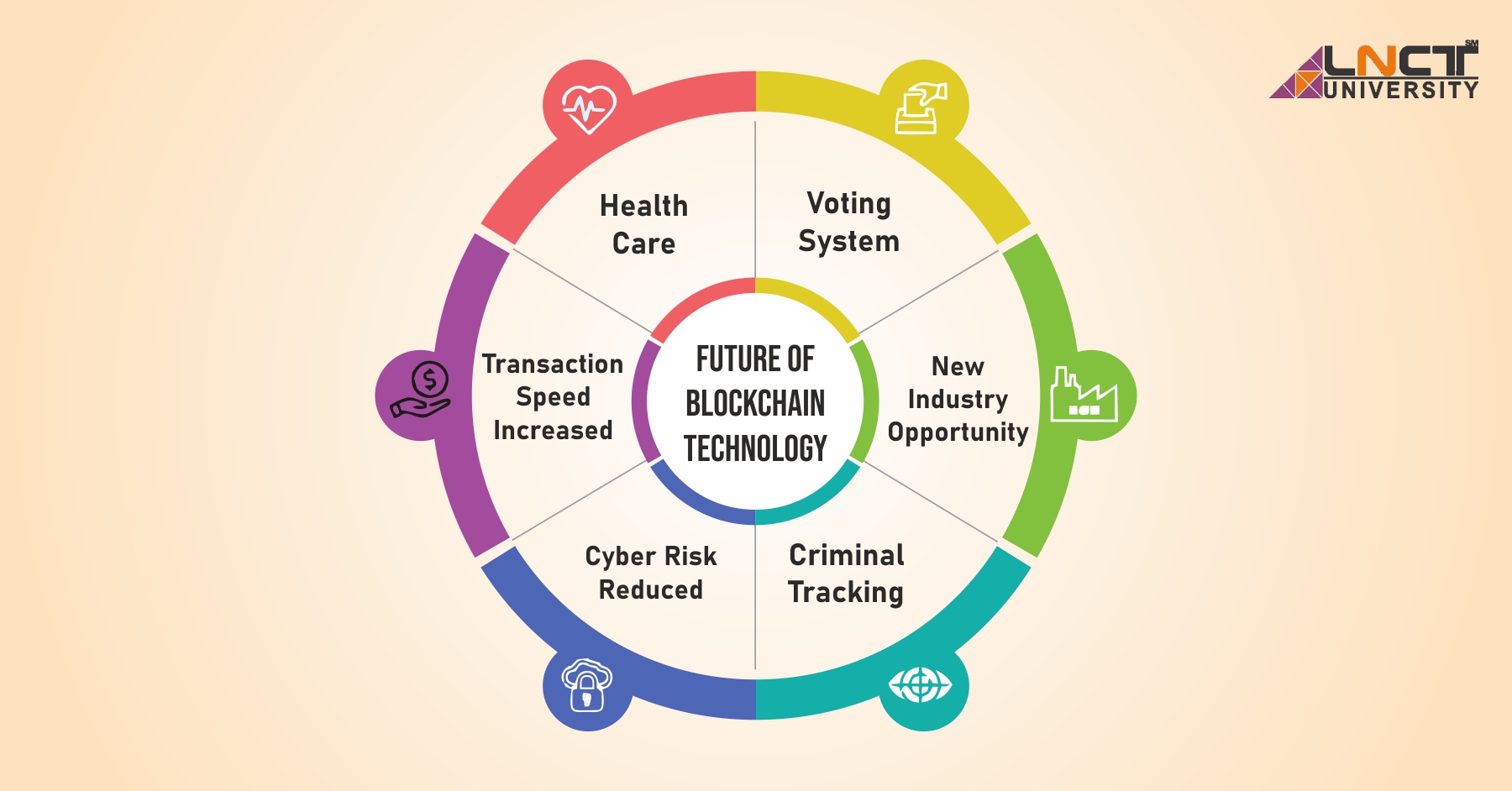

Looking ahead, the future of cryptocurrency holds promising possibilities, though it remains fraught with challenges that need to be navigated carefully. As blockchain technology becomes more sophisticated, cryptocurrencies are set to garner wider acceptance, potentially reshaping how financial transactions occur worldwide. Central Bank Digital Currencies (CBDCs) are one such initiative, where governments aim to issue digital versions of their sovereign currencies, combining the benefits of cryptocurrencies with the oversight of traditional monetary policy.

Moreover, innovation within the cryptocurrency ecosystem continues to thrive, with advancements in areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contract platforms, pushing the boundaries of what's possible in finance and beyond. DeFi, in particular, seeks to build an open financial system, offering traditional banking services such as borrowing and lending on decentralized platforms without intermediaries.

As these technologies develop, the conversation around cryptocurrencies is likely to shift from skepticism and curiosity to adoption and integration. Whether it’s through facilitating microtransactions, improving supply chain transparency, or developing digital identities, cryptocurrencies possess the potential to significantly reshape numerous industries.

The ongoing evolution of cryptocurrencies represents a dynamic and paradigm-shifting phenomenon in both technology and finance. While the journey is still unfolding, understanding the inherent benefits and challenges paves the way for informed participation in this exciting digital age.

Integrating Cryptocurrency into Everyday Life

The integration of cryptocurrency into everyday life is poised to revolutionize how individuals and businesses transact, save, and invest. As digital currencies become more mainstream, their applications in real-world scenarios are expanding rapidly. From retail and e-commerce to travel and hospitality, cryptocurrencies are gradually being accepted as a legitimate form of payment, offering an alternative to traditional credit card and cash transactions.

Several companies and platforms are spearheading the adoption of cryptocurrencies by enabling consumers to make purchases using digital assets. Major brands and retailers are now accepting Bitcoin and other cryptocurrencies for their products and services, either directly or through third-party payment processors. This trend not only caters to tech-savvy consumers but also opens up new market opportunities for businesses willing to embrace this evolving payment method.

Additionally, cryptocurrency ATMs and payment cards linked to digital wallets are simplifying how users interact with their crypto assets, making everyday transactions more seamless. These innovations facilitate the conversion of digital currencies into fiat at the point of sale, allowing for instant and hassle-free payments.

The Role of Education and Awareness

As cryptocurrencies penetrate further into public consciousness, the importance of education and awareness cannot be overstated. For individuals to make informed decisions about investing, using, or simply understanding cryptocurrencies, a solid foundation of knowledge is necessary. This includes grasping core concepts like blockchain technology, the mechanics of how transactions occur, and the potential risks involved in the crypto market.

Educational initiatives are being undertaken by various organizations, ranging from online courses and webinars to partnerships with academic institutions. These efforts aim to demystify cryptocurrencies and provide practical insights, enabling users to navigate the complexities of digital finance confidently. Moreover, fostering a culture of continuous learning will be crucial as the technology evolves and new cryptocurrency applications emerge.

Financial institutions and businesses also play a pivotal role in educating their customers and clients about the benefits and risks of digital currencies. Transparency and open communication regarding security measures and regulatory compliance help build trust, encouraging more widespread acceptance and integration of cryptocurrencies.

Challenges Ahead and Solutions

While the trajectory of cryptocurrencies appears promising, significant hurdles remain on the path to widespread adoption. Key challenges include scalability issues, where existing blockchain networks struggle to handle a large number of transactions efficiently. Efforts are underway to address these concerns, with innovations like the Lightning Network and sharding seeking to enhance transaction speeds and reduce costs.

Another pressing challenge is ensuring user security and mitigating the risk of fraud. The sector has seen a spate of hacks and scams, which can undermine confidence in the technology. As such, developing robust security protocols and fostering best practices for users—such as using multi-factor authentication and secure wallet solutions—are imperative for creating a safer environment.

Finally, public perception and cultural acceptance of cryptocurrencies remain barriers that require ongoing efforts. Dispelling myths and misinformation by highlighting positive use cases and responsible practices is vital to changing perceptions and fostering a culture of acceptance. Collaborative dialogue among stakeholders, including governments, industry leaders, and the public, is essential in shaping a cohesive and forward-thinking approach to digital currencies.

Conclusion

As we stand at the cusp of a digital revolution, cryptocurrencies offer myriad possibilities that could transform financial systems, empower individuals, and foster global economic inclusivity. From their roots in decentralized digital cash to their emergence as a versatile technology with far-reaching implications, cryptocurrencies continue to challenge traditional paradigms and inspire innovation.

While the journey is fraught with uncertainties and complex challenges, the potential benefits of embracing cryptocurrencies are profound. With continued development, supportive regulation, and a burgeoning acceptance, digital currencies could very well redefine the future of financial transactions and engagement.

Through understanding, adaptation, and strategic innovation, both individuals and institutions can harness the power of cryptocurrencies to unlock new opportunities and drive positive change in a rapidly evolving world. As we venture deeper into this digital frontier, the conversations we have today will shape the lasting impact cryptocurrencies have on society tomorrow.

.png?width=1504&name=MicrosoftTeams-image%20(2).png)

Comments