Understanding Crypto Tokens: A Comprehensive Guide

In recent years, digital currencies have taken the financial world by storm, with Bitcoin and Ethereum often dominating the conversation. However, the burgeoning field of blockchain technology is not just restricted to these well-known cryptocurrencies. The realm of crypto tokens is equally dynamic and holds immense potential for reshaping how we interact with financial assets.

In this guide, we will delve into the complex yet fascinating world of crypto tokens. We'll demystify what they are, how they function, their varying types, and the crucial role they play within the broader blockchain ecosystem.

What Are Crypto Tokens?

Crypto tokens are a type of cryptocurrency, typically representing an asset or a utility. They are often built on an existing blockchain and can represent ownership of a resource, participation in a network, or access to specific services. Unlike traditional cryptocurrencies, which primarily serve as a medium of exchange, tokens are more versatile and can be programmed with unique functionalities.

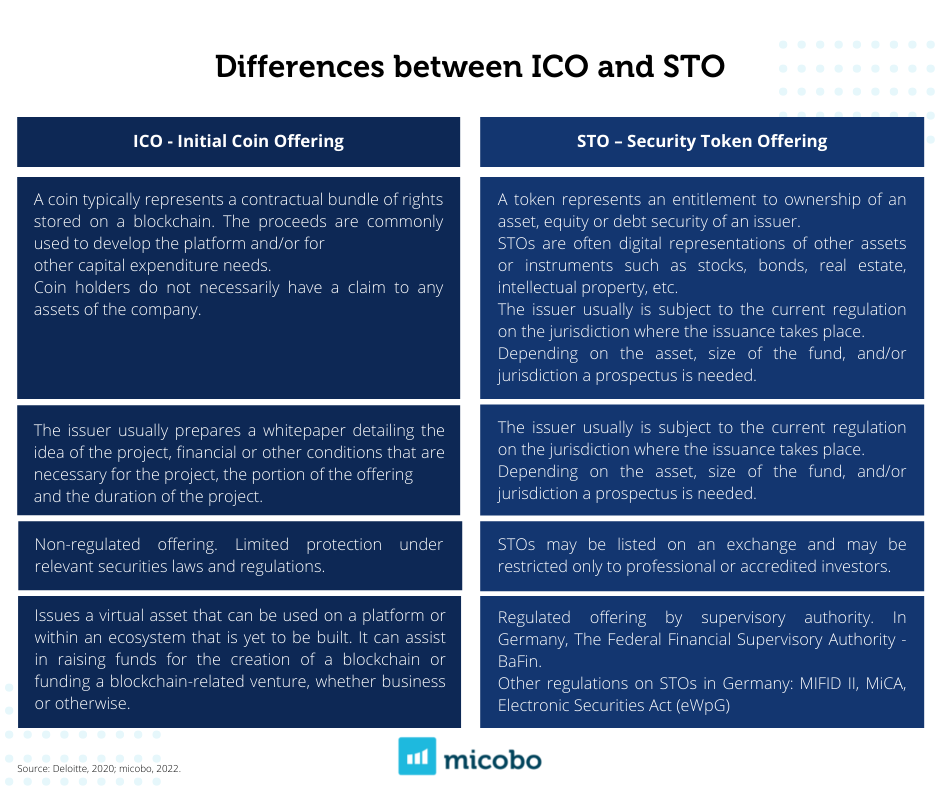

Tokens are predominantly created through the process of an Initial Coin Offering (ICO), a method reminiscent of a traditional Initial Public Offering (IPO) but specific to the crypto world. During an ICO, a company or project offers tokens for sale to raise capital. These tokens can later be traded on various cryptocurrency exchanges, making them accessible to a global audience.

How Crypto Tokens Work

To understand how crypto tokens operate, it’s essential to recognize their dependency on smart contracts and blockchain technology. Most tokens are issued on blockchains like Ethereum, which supports smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This code manages the transfer of tokens between parties, ensuring transparency and security without the need for a middleman.

When you purchase or receive a token, your transaction is recorded on the blockchain, an immutable and distributed ledger. The ownership of tokens and their associated rights or functions are thus guaranteed through blockchain technology, which ensures that records are tamper-proof and reliable.

Types of Crypto Tokens

Crypto tokens fall into several categories based on their intended use and functionality. Here are a few predominant types:

1. Utility Tokens

Utility tokens provide holders with future access to a product or service. These tokens are not meant for investment purposes but rather as a mechanism to facilitate services within a platform. A prominent example of a utility token is Binance Coin (BNB), which users leverage for fee reductions and other benefits within the Binance cryptocurrency exchange platform.

2. Security Tokens

Security tokens represent ownership in a real-world asset, such as shares in a company, real estate, or other valuable resources. They are subject to federal securities regulations and are designed to offer investors a degree of legal protection and oversight akin to traditional securities. Security tokens are a bridge between traditional finance and the dynamic world of blockchain.

3. Tokenized Assets

Tokenized assets are converted from their real-world form to a digital token on the blockchain. For example, physical assets like gold, real estate, or artwork can be tokenized, allowing fractional ownership and improved liquidity.

4. Non-Fungible Tokens (NFTs)

Non-fungible tokens are unique and indivisible tokens that represent ownership of a specific item or piece of content, such as digital art, music, or collectibles. Unlike regular cryptocurrencies or other fungible tokens, NFTs cannot be exchanged on a one-to-one basis and track ownership and provenance of a single item on the blockchain.

The Importance of Crypto Tokens in the Blockchain Ecosystem

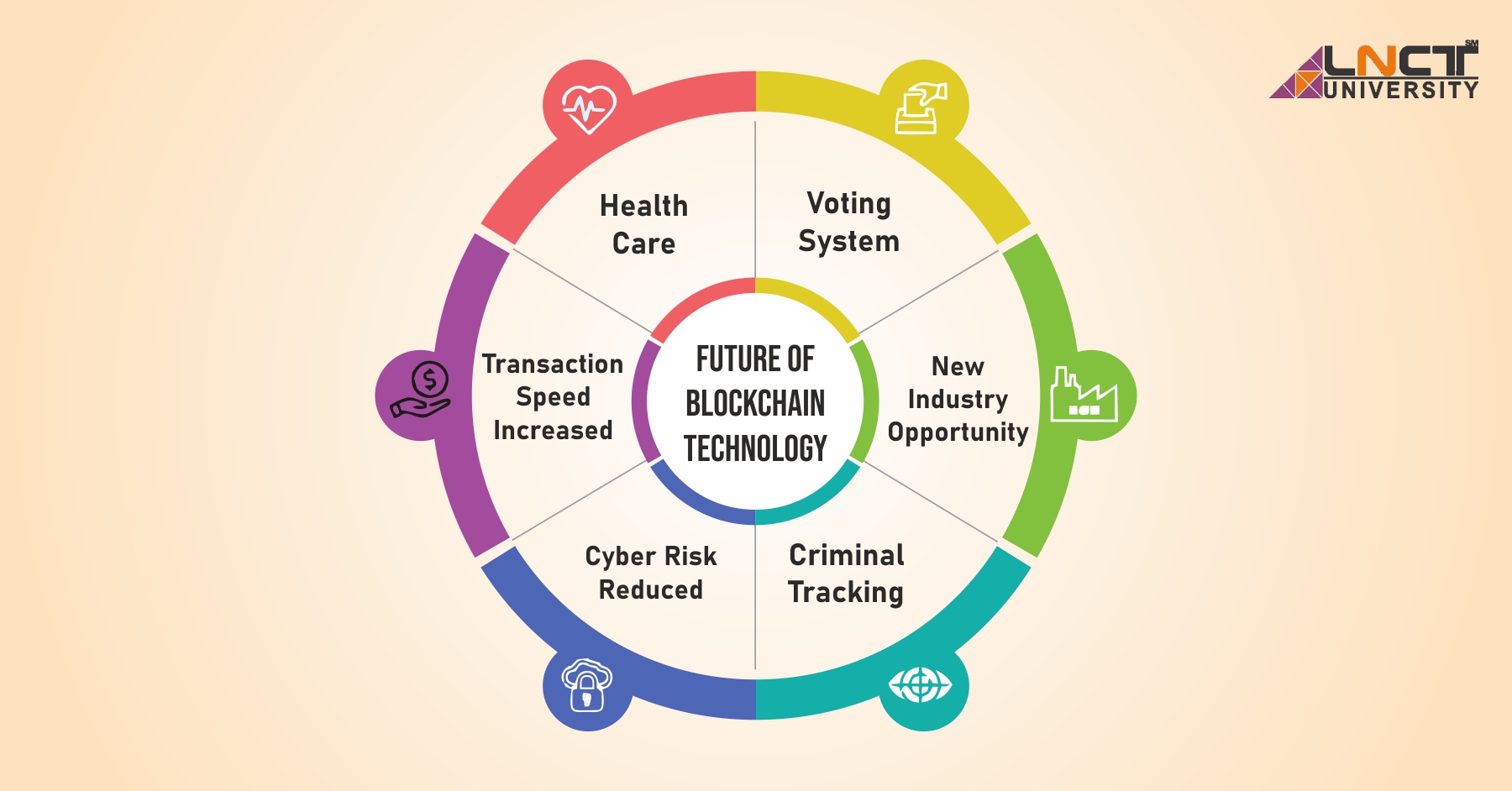

Crypto tokens play a pivotal role in the broader blockchain narrative by expanding its application beyond simple financial transactions. They are the building blocks for decentralized applications (DApps), allowing developers to create complex ecosystems with varied functionalities.

For businesses and entrepreneurs, tokens offer an innovative way to engage with investors and consumers. They facilitate fundraising through mechanisms like ICOs, enabling projects to gather capital while allowing early adopters a chance to partake in future successes.

Moreover, tokens empower decentralized finance (DeFi) applications, which are reshaping traditional financial services by offering new ways to lend, borrow, and grow investments without intermediaries. As tokens trade in decentralized exchanges, they contribute to liquidity and fluidity in the cryptocurrency markets.

As the digital world continues to evolve, understanding the intricacies of crypto tokens becomes essential for anyone interested in technology, finance, or innovation. Their applications are boundless, capable of disrupting industries and creating opportunities for new forms of economic interaction.

In the following sections, we will further explore the challenges facing crypto tokens and their potential future trajectory within a rapidly shifting landscape.

Challenges and Risks Associated with Crypto Tokens

While the prospects of crypto tokens are indeed captivating, they are not without inherent challenges and risks. Understanding these issues is crucial for anyone looking to invest in or develop projects centered around tokens.

1. Regulatory Uncertainty

One of the foremost concerns regarding crypto tokens is regulatory ambiguity. Different jurisdictions have varied stances on cryptocurrencies and tokens, leading to a patchwork of laws and regulations. This uncertainty can impact the development and distribution of tokens. In some regions, stringent regulations classify certain tokens as securities, subjecting them to the same rules as traditional financial instruments. This necessitates thorough legal compliance and can deter smaller projects due to cost constraints.

2. Security Concerns

The digital nature of crypto tokens makes them susceptible to various cyber threats. Smart contract vulnerabilities, improper coding, and sophisticated hacking techniques can lead to the loss of tokens. Frequent high-profile attacks on crypto exchanges and DeFi projects highlight the importance of robust security measures and audits. Consequently, token issuers need to prioritize these measures to safeguard investors and their projects.

3. Market Volatility

Crypto markets are notoriously volatile, and tokens are no exception. Prices can swing dramatically based on market sentiment, regulatory news, or technological advancements. Such volatility can pose a risk for investors, who must be prepared for the roller-coaster-like fluctuations. While this volatility can lead to significant gains, it can also result in steep losses, underscoring the importance of research and risk management.

4. Lack of Awareness and Understanding

The crypto industry is still in its infancy for many, and understanding the nuances of crypto tokens can be challenging. This knowledge gap creates a breeding ground for misinformation and fraudulent schemes. For wider adoption and acceptance, it's vital that educational resources are developed to bridge this gap. Educating potential investors and users about token functionalities and risks is crucial for informed decision-making.

The Evolution of Crypto Tokens

Despite the challenges, the evolution of crypto tokens continues unabated, driven by technological advancements and increased interest in decentralized ecosystems. Several trends are shaping the future of crypto tokens:

1. Rise of Decentralized Finance (DeFi)

DeFi represents a revolutionary shift within the financial industry. Utilizing crypto tokens, DeFi platforms offer traditional financial services including lending, borrowing, and trading with enhanced efficiency and accessibility. DeFi tokens often power these platforms, providing liquidity, governance rights, and other functionalities. As DeFi grows, tokens play a vital role in facilitating an inclusive financial system that transcends borders.

2. Tokenomics and Governance

Tokenomics, the study of the economics of tokens, is a critical aspect of token design and functionality. Projects now focus on creating well-balanced ecosystems where token supply, demand, and utility are aligned. Additionally, decentralized governance models are increasingly adopted, allowing token holders to participate in decision-making processes. This democratic approach brings a significant level of transparency and community engagement to projects.

3. Increased Tokenization of Assets

Asset tokenization is gaining traction as more industries recognize the benefits of blockchain technology. From real estate to commodities, tokenization simplifies ownership, reduces transaction costs, and enhances liquidity. As this trend expands, the traditional barriers surrounding illiquid assets will continue to erode, offering investors unique opportunities for diversification.

4. Integration with Internet of Things (IoT) and Other Technologies

The integration of crypto tokens with IoT and other emerging technologies presents exciting possibilities. Tokens can facilitate machine-to-machine transactions, creating a seamless interaction between smart devices and blockchain networks. This fusion promises to automate processes and improve efficiency across various sectors, from supply chain management to energy distribution.

The Future of Crypto Tokens

The landscape of crypto tokens is poised for continued innovation and adaptation, as new use cases emerge and existing structures mature. Key factors that will shape their future include:

1. Enhanced Regulation

Greater regulatory clarity and uniformity are anticipated to encourage wider adoption and investment in token projects. Constructive regulations can foster innovation, protect investors, and lend legitimacy to the crypto space. This will lead to increased confidence and participation from traditional financial institutions.

2. Interoperability Solutions

Interoperability remains a significant hurdle in the blockchain sector. As solutions develop to link different blockchain networks, crypto tokens will gain broader utility and acceptance. Efforts to standardize token protocols are underway, promising a future where tokens can seamlessly move between disparate systems.

3. Evolution of Smart Contracts

Advancements in smart contract technology will redefine token functionalities, enhancing their efficiency and security. Smarter, more intuitive contracts can foster complex interactions, allowing for unique applications that are beyond the current scope. These developments will open new avenues for the use of tokens in different sectors.

As the intrigue surrounding crypto tokens grows, so does the necessity for awareness and education. The continued evolution of this digital asset class will undeniably impact traditional business models and consumer interactions. Staying informed and embracing these emerging trends will be essential for capitalizing on the opportunities presented by crypto tokens.

Case Studies: Successful Crypto Token Applications

To illustrate the transformative potential of crypto tokens, examining real-world case studies can offer valuable insights. These examples showcase the diversity and impact of token applications across different sectors.

1. Chainlink (LINK)

Chainlink is a prominent player in the realm of decentralized oracles, connecting smart contracts with real-world data. The Chainlink Network relies on LINK tokens to incentivize nodes to provide reliable data inputs and outputs, ensuring the integrity of smart contracts. By bridging the gap between blockchain networks and real-world data, Chainlink has enabled a host of DeFi applications and highlighted the critical role of tokens in securing and facilitating these ecosystems.

2. Uniswap (UNI)

Uniswap is a decentralized exchange (DEX) that leverages the Ethereum blockchain to facilitate the swapping of various tokens without relying on a centralized authority. The introduction of the UNI token added a governance layer, granting holders voting rights to influence the platform's development and fee structures. This democratization of decision-making has reinforced community involvement, showcasing how governance tokens can empower users and drive platform improvements.

3. Basic Attention Token (BAT)

BAT has fundamentally changed the digital advertising industry by integrating blockchain with internet browsing. Through the Brave browser, users are rewarded with BAT tokens for viewing privacy-respecting ads. Advertisers benefit from more engaged and authentic interactions while users can monetize their attention. This ecosystem is a testament to how utility tokens can revamp traditional models, fostering a fairer value exchange between consumers and businesses.

Community Impact and Social Responsibility

Beyond their economic and technological implications, crypto tokens have the potential to foster substantial community impact and promote social responsibility. As the cryptocurrency landscape evolves, integrating ethical considerations into token projects can yield significant social benefits.

1. Financial Inclusion

Crypto tokens can lower barriers to financial services, providing access to underbanked populations globally. By offering more inclusive financial products and services, tokens empower individuals in regions where traditional banking services are limited or non-existent. Projects focusing on micro-lending, remittances, and savings mechanisms demonstrate the potential of tokens to address socio-economic challenges and promote financial equity.

2. Environmental Considerations

As awareness of the environmental impact of blockchain technology grows, there is a push towards developing eco-friendly solutions. Some token projects are actively looking to mitigate their carbon footprints by optimizing consensus mechanisms, investing in renewable energy sources, and promoting sustainability initiatives. The development of green blockchain technology and eco-conscious tokens reflects a broader commitment to minimizing environmental impacts.

3. Charitable Contributions and Social Causes

Tokens are being increasingly leveraged to support charitable causes, enabling direct contributions to nonprofits and social enterprises through blockchain-based platforms. These initiatives eliminate intermediaries, ensuring that more funds reach their intended target. Tokenized fundraising campaigns present a transparent and effective way to support humanitarian efforts and community development projects worldwide.

Guidelines for Engaging with Crypto Tokens

To successfully navigate the complex landscape of crypto tokens, it is essential to approach them with informed caution and strategic foresight. Here are some guidelines for individuals and businesses considering engaging with tokens:

1. Conduct Thorough Research

Understand the project's vision, team, and use case before investing in or developing a token. Due diligence involves evaluating the project's whitepaper, market potential, and its alignment with your own financial goals or business objectives. Knowing the competitive landscape and assessing the project's unique value proposition is crucial.

2. Diversify and Manage Risk

Avoid concentrated positions in a single token or project by diversifying your holdings across multiple assets. A diversified portfolio can mitigate risk and optimize potential returns. Additionally, adopting sound risk management strategies, such as setting stop-loss orders and understanding market trends, is vital for maintaining portfolio health.

3. Stay Updated on Regulation and Compliance

As regulatory environments evolve, keeping abreast of changes is vital to ensure compliance and legality in your token activities. Understanding local and international regulations can safeguard against unforeseen legal issues and enhance long-term stability.

4. Engage with the Community

Joining communities related to specific tokens or broader cryptocurrency discourse can provide valuable insights and foster collaboration. These engagements can further understanding, keep you informed about project developments, and support collective growth and innovation.

Conclusion: The Ongoing Journey of Crypto Tokens

Crypto tokens represent one of the most versatile and dynamic innovations emerging from the blockchain revolution. As their utility expands across various sectors, from finance and advertising to art and social enterprise, the importance of understanding and engaging with tokens cannot be overstated.

Despite the hurdles of regulatory ambiguity, security threats, and market volatility, the trajectory of crypto tokens is promising. With ongoing advancements in technology and a growing focus on ethical considerations, the future of crypto tokens looks bright, holding the potential to reshape industries and empower individuals worldwide.

As this journey continues, those who navigate the space with knowledge and strategic foresight will find themselves at the forefront of a new digital economy, where crypto tokens are integral to everyday interactions and opportunities.

:max_bytes(150000):strip_icc()/crypto-token.asp-v5-6774f213bd3b4deaac537f196990edff.png)

Comments