The Silent Revolution: How Cryptocurrencies Are Reshaping Global Finance

As the world grapples with the impact of traditional financial institutions and governments on the economy, a silent revolution is unfolding in the realm of finance. Cryptocurrencies, once considered a fringe interest for tech enthusiasts and libertarians, have now surged to the forefront of economic discussions as a legitimate means of exchange and investment. This modern class of digital assets is redefining the way we think about money, challenging the very fabric of the global financial system.

Bitcoin, the progenitor of all cryptocurrencies, was born from the ashes of the 2008 financial crisis—a crisis that shook the faith of many in the centralized banking system. Its mysterious creator, known only as Satoshi Nakamoto, envisioned a world where currency could be exchanged without the need for traditional financial intermediaries, such as banks or governments. The idea was simple yet powerful: a decentralized, peer-to-peer electronic cash system that could operate transparently and securely thanks to blockchain technology.

In the years following, thousands of cryptocurrencies have emerged, each with unique features and purposes. From Ethereum, which expanded the blockchain's capabilities beyond mere currency, to Ripple's XRP, which aims to revolutionize cross-border payments, these digital assets are not just stores of value but vessels of innovation that reach into multiple sectors of the economy.

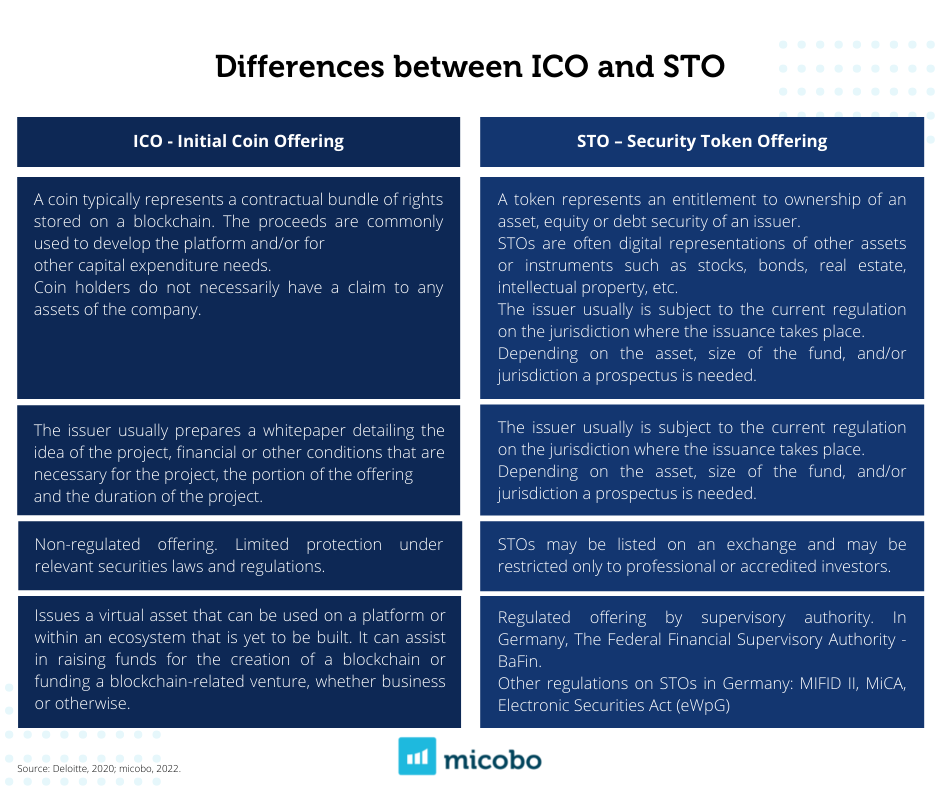

However, with this innovation comes volatility and uncertainty. The cryptocurrency market is known for its wild price swings, making it a field that intrigues investors and frightens regulators. The questions of how to regulate these digital currencies and how governments should approach their rise are still without clear answers. Concerns about security, illicit activities, and market manipulation abound, adding layers of complexity to the already intricate ecosystem.

Despite the skepticism, the appeal of cryptocurrencies lies not just in their potential for high returns, but also in the philosophy they carry—a philosophy of financial sovereignty and inclusivity. With over 1.7 billion adults around the world without access to a bank account, cryptocurrencies offer a gateway to financial services for the unbanked and underbanked populations. This potential for financial inclusion could not only uplift individuals but invigorate entire economies previously cut off from the global financial system.

Even as the public grapples with understanding and acceptance, the backend infrastructure of the cryptocurrency world is evolving at a rapid pace. The advent of decentralized finance (DeFi) platforms has given rise to a parallel financial system where lending, borrowing, and earning interest can be done without the mediation of traditional financial institutions. These DeFi protocols offer an alternative vision for finance—one that is open, programmable, and interoperable.

The journey for cryptocurrencies, however, is not without its roadblocks. Scalability issues, energy consumption, and regulatory scrutiny are persistent challenges that the industry must address. The recent dialogue surrounding Bitcoin's carbon footprint and the calls for environmentally-friendly crypto mining practices reflect a maturing space that's increasingly conscious of its impact on the broader world.

As the cryptocurrency industry navigates its tumultuous teenage years, the long-term vision is slowly coming into focus. While some see a future where fiat and digital currencies coexist, others predict a more radical shift—a world where cryptocurrencies replace traditional money as we know it. One thing is clear: the silent revolution of cryptocurrencies has begun, and its ripples are bound to be felt across the global economy for years to come.

In the next part of this article, we will dive deeper into the economic implications of cryptocurrencies and explore how institutions and governments are adapting to this revolution.

[Continue with the second part]The Economic Implications of the Cryptocurrency Revolution

As the cryptocurrency revolution gathers pace, its economic implications are far-reaching and complex. The decentralized nature of digital currencies promises a democratized financial system, but it raises significant questions regarding monetary policy, taxation, and financial stability.

Monetary policy, the traditional domain of central banks, is predicated upon control over money supply—something that central banks no longer hold in a world dominated by cryptocurrencies. Bitcoin, with its capped supply, and other similar cryptocurrencies introduce a deflationary element into the economy that central banks cannot easily counter with traditional instruments such as interest rates. This loss of monetary control is uncharted territory and could lead to a significant power shift from governments to the protocols governing cryptocurrencies.

Taxation is another area facing upheaval. Cryptocurrencies can cross borders seamlessly, and many transactions can be made anonymously, making regulatory oversight challenging. This has implications for tax authorities that are already struggling to keep up with the fast-moving digital economy. Governments around the world are racing to establish tax frameworks that can capture income from cryptocurrency transactions without stifling innovation.

Financial stability, meanwhile, is a point of contention. The volatility of the cryptocurrency market is emblematic of nascent, unregulated markets. But as this market grows, so does the potential for systemic impact. Large price swings can create ripple effects that spill over into the broader financial markets, the extent of which remains uncertain. Financial regulators are concerned that without proper oversight, the rise of cryptocurrencies could pose risks akin to those precursors that led to previous financial crises.

Institutional and governmental responses to these challenges have been varied. Some countries have embraced the crypto wave, looking to become hubs of innovation. For instance, Switzerland and Singapore are shaping up to be favorable environments for cryptocurrency businesses, recognizing the potential economic benefits. Other countries, wary of the implications for financial control, have taken a more conservative approach, with some even outright banning cryptocurrencies.

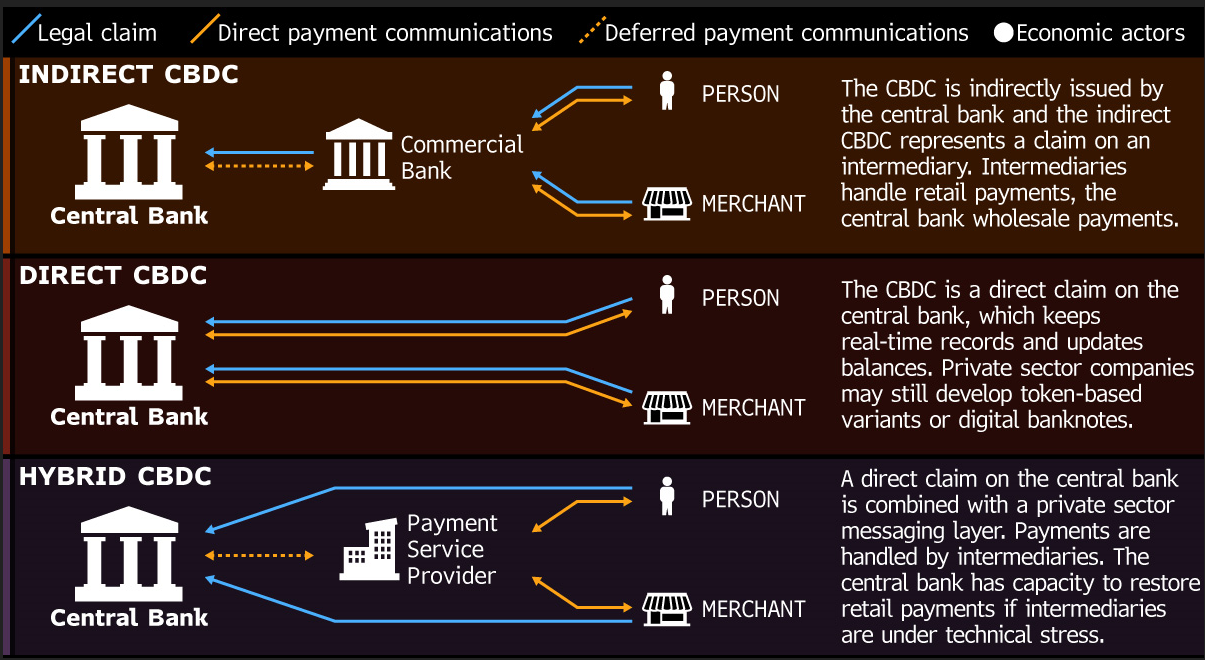

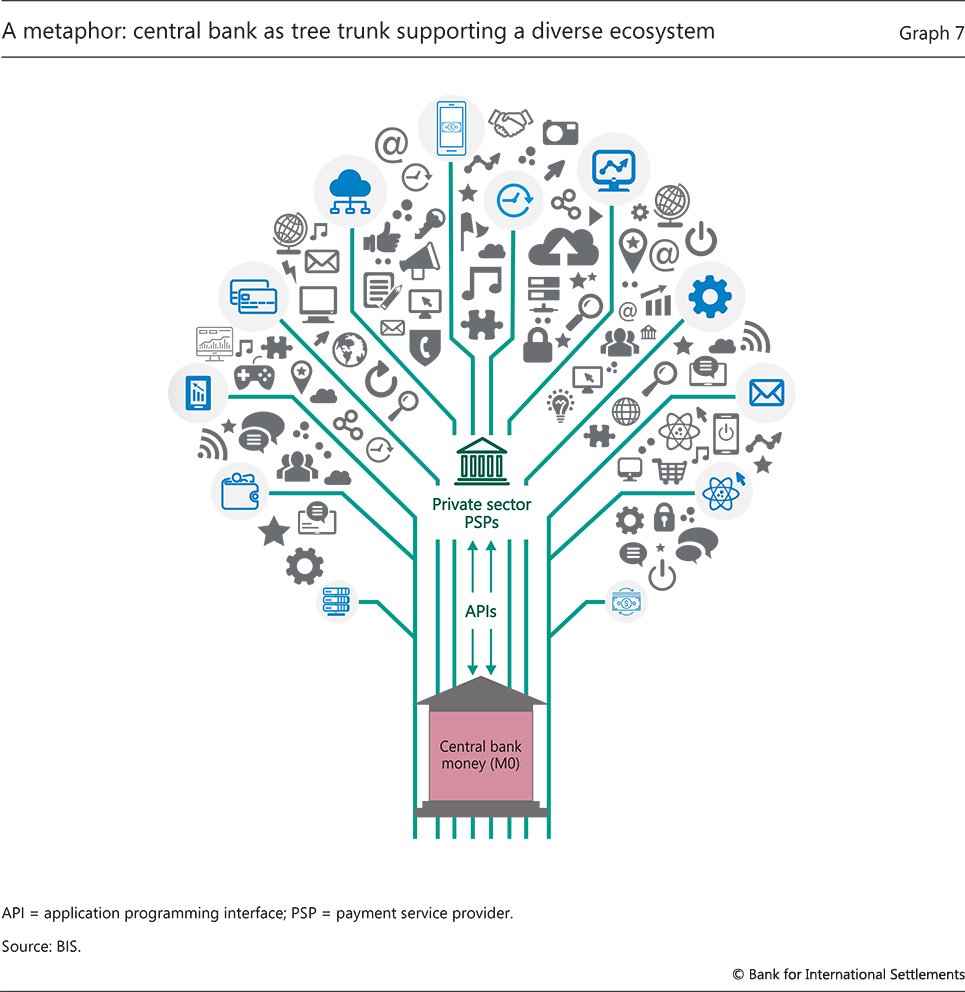

Amid these divergent views, the question arises: how can institutions and governments adapt? The answer may lie in a novel form of digital currency: central bank digital currencies (CBDCs). CBDCs are a digital form of fiat currency that could offer central banks the benefits of cryptocurrencies — immediate settlement, traceability, and 24/7 availability, while retaining control over the monetary system. Countries like China are already developing their own CBDCs, with others, including the European Central Bank and the Federal Reserve, exploring the idea.

Beyond the government's response, financial institutions are also adapting. Major banks, once wary of the crypto trend, are beginning to offer cryptocurrency-related services to their clients. Asset managers are incorporating digital assets into their portfolios as the demand for crypto exposure grows from institutional investors. The rise of Bitcoin ETFs and digital asset custodian services signal a growing entwinement between traditional finance and the world of cryptocurrencies.

In conclusion, the silent revolution of cryptocurrencies has set off a dialogue on the nature of money, the role of banks, and the authority of governments over financial systems. While cryptocurrencies promise a more inclusive and democratized financial landscape, they also pose significant challenges that need to be navigated wisely. The intersection of traditional financial structures with this new digital asset class is producing a hybrid economy where adaptation and regulation will play critical roles in shaping the future of global finance. As the revolution continues, one thing remains certain: the marriage of technology and economics will continue to provoke thought, spur innovation, and ultimately redefine what it means to have money in the 21st century.

Comments