Risks Involved in Investing in Cryptocurrency

Introduction

Cryptocurrency has emerged as one of the most talked-about investment opportunities in recent years. With the rise of Bitcoin, Ethereum, and thousands of alternative coins (altcoins), many investors are eager to dive into digital assets in hopes of high returns. However, while cryptocurrencies offer potential rewards, they also come with significant risks that every investor must understand before committing their funds.

Unlike traditional investments like stocks or bonds, cryptocurrencies operate in a largely unregulated, highly volatile, and technologically complex environment. This article explores the key risks involved in cryptocurrency investments, helping you make informed decisions before entering this unpredictable market.

1. Extreme Market Volatility

One of the most notable risks in cryptocurrency investing is extreme price volatility. Digital assets can experience dramatic price swings in very short periods. For example, Bitcoin has seen both meteoric rises and devastating crashes, sometimes losing or gaining more than 20% of its value in a single day.

Why Is Cryptocurrency so Volatile?

Several factors contribute to cryptocurrency volatility:

- Speculation: Many investors buy cryptocurrencies based on hype rather than fundamentals, leading to bubbles and sharp corrections.

- Market Liquidity: Compared to traditional markets, crypto markets have lower liquidity, meaning large trades can cause significant price movements.

- Regulatory News: Government crackdowns or endorsements can trigger massive price swings.

- Technological Developments: Updates, hacks, or security flaws in blockchain networks can impact prices drastically.

For investors, this volatility means potential for high gains but also severe losses. Unlike stable assets, cryptocurrencies require strong risk tolerance and an ability to withstand rapid value fluctuations.

2. Lack of Regulation and Investor Protections

Unlike traditional financial institutions, most cryptocurrency markets operate without stringent regulatory oversight. This exposes investors to several dangers:

Potential Fraud and Scams

The decentralized nature of cryptocurrencies makes them an attractive target for scammers. Common fraudulent schemes include:

- Pump-and-Dump Schemes: Groups artificially inflate a coin's price before selling off their holdings, leaving others with worthless assets.

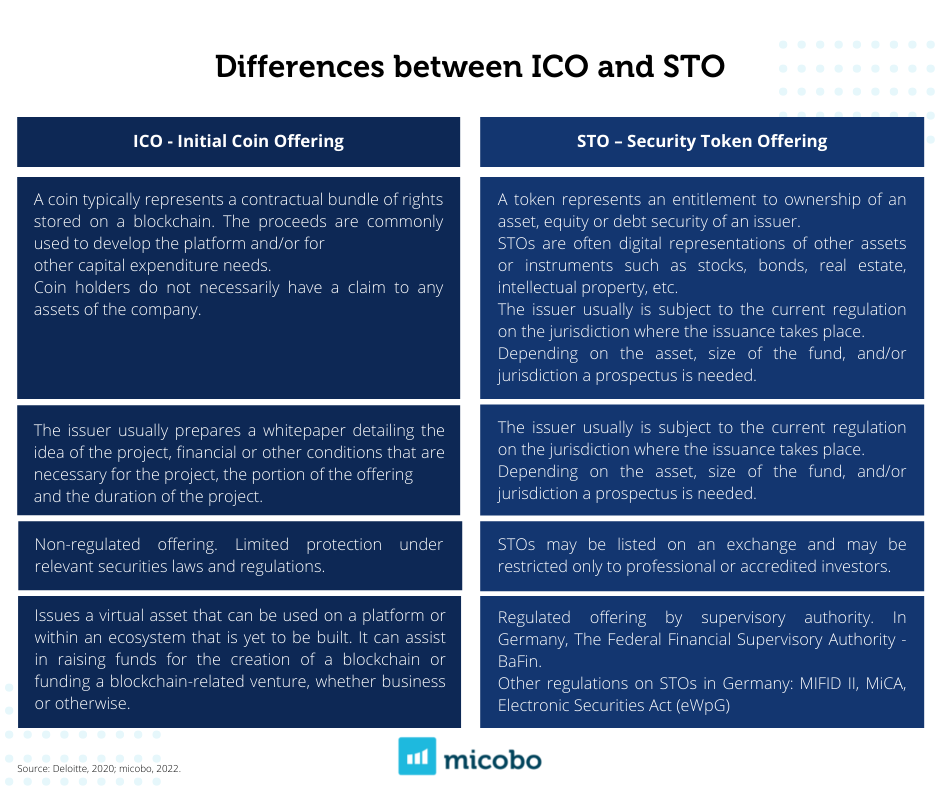

- Fake ICOs (Initial Coin Offerings): Fraudsters create fraudulent fundraising projects and disappear with investors' money.

- Phishing Attacks: Hackers trick users into revealing private keys or login credentials.

No Government Backing or Insurance

Traditional bank accounts often benefit from government insurance (e.g., FDIC in the U.S.), protecting deposits up to a certain limit. Cryptocurrencies lack such safeguards—if an exchange collapses or funds are stolen, investors may have no recourse.

Legal and Tax Uncertainties

Cryptocurrency regulations vary widely across countries, and sudden legal changes can disrupt markets. Additionally, tax reporting for crypto gains can be complex, leading to potential compliance risks.

3. Security Risks and Hacking Threats

Cybersecurity is a major concern in the cryptocurrency space. Even though blockchain technology itself is secure, exchanges, wallets, and individual users are vulnerable to attacks.

Exchange Hacks

Cryptocurrency exchanges are prime targets for hackers. Several high-profile breaches, such as the Mt. Gox hack (2014) and the Coincheck theft (2018), led to losses worth hundreds of millions of dollars. Investors storing funds on exchanges risk losing everything if security measures fail.

Wallet Vulnerabilities

Crypto wallets, whether hardware or software-based, can be compromised if not properly secured. Private keys—necessary for accessing funds—can be stolen through malware, phishing, or physical theft.

Smart Contract Exploits

Cryptocurrencies like Ethereum rely on smart contracts, self-executing agreements written in code. Flaws in these contracts can lead to exploits, as seen in the infamous DAO hack, where $60 million in Ether was stolen.

4. Liquidity Risks

While major cryptocurrencies like Bitcoin and Ethereum enjoy high liquidity, smaller altcoins may suffer from thin trading volumes. This can make it difficult to buy or sell large amounts without impacting the price.

Illiquid Markets and Price Slippage

In low-liquidity markets, executing large trades can lead to significant price slippage—where the executed price differs from the expected price due to lack of buyers or sellers. This can result in unexpected losses.

Exchange Shutdowns and Withdrawal Freezes

Some exchanges, especially smaller or less reputable ones, may suddenly halt withdrawals or shut down entirely, trapping investors' funds.

5. Technological Risks

Blockchain technology is still evolving, and cryptocurrencies face several technological challenges that can affect their viability.

Network Congestion and High Fees

During peak usage, blockchain networks like Bitcoin or Ethereum can become congested, leading to slow transactions and high fees. This reduces usability and can negatively impact investor confidence.

Potential for Obsolescence

With thousands of cryptocurrencies in existence, many may fail due to competition, lack of development, or technological inferiority. Investors risk holding coins that eventually become obsolete.

---End of Part 1---

6. Regulatory and Legal Risks

Cryptocurrency operates in a legal gray area in many jurisdictions, making it susceptible to sudden regulatory crackdowns. Governments worldwide are still figuring out how to classify and regulate digital assets, which creates uncertainty for investors.

Government Bans and Restrictions

Some countries, including China and India, have imposed strict restrictions or outright bans on cryptocurrencies. These actions can drastically reduce market liquidity and sever access to exchanges, leaving investors with limited options to trade or sell their holdings.

KYC & AML Compliance Risks

Many exchanges now enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. If investors fail to comply with these requirements, their accounts may be frozen or seized. Additionally, regulatory scrutiny could force platforms to delist certain cryptocurrencies, causing price crashes.

Changing Tax Policies

Tax authorities worldwide are tightening cryptocurrency taxation rules. Investors may face unexpected capital gains taxes, reporting obligations, or audits. Misunderstanding tax requirements could result in legal penalties.

7. Market Manipulation

Due to lower liquidity and less oversight compared to traditional markets, cryptocurrency is highly prone to manipulation. Large holders, known as "whales," can influence prices by executing coordinated buy or sell orders.

Wash Trading and Spoofing

Some exchanges engage in wash trading—fake transactions designed to inflate trading volumes and attract investors. Similarly, spoofing (placing fake orders to manipulate prices) is prevalent in crypto markets, misleading traders into making poor decisions.

Whale Influence

A small number of entities hold significant portions of certain cryptocurrencies. If these whales decide to sell their holdings, prices can plummet, harming smaller investors.

8. Limited Adoption and Utility Concerns

Despite growing interest, cryptocurrencies still face adoption barriers that could hinder long-term growth. Many projects promise real-world utility but fail to deliver, leading to disillusionment and price drops.

Merchant Acceptance

While some companies accept Bitcoin and other cryptocurrencies as payment, widespread adoption remains limited. If businesses do not embrace crypto payments, demand may stagnate, negatively affecting prices.

Dependence on Speculation

Most cryptocurrencies derive their value from speculation rather than actual utility. If investor sentiment shifts due to negative news, prices can collapse rapidly without underlying fundamentals to support them.

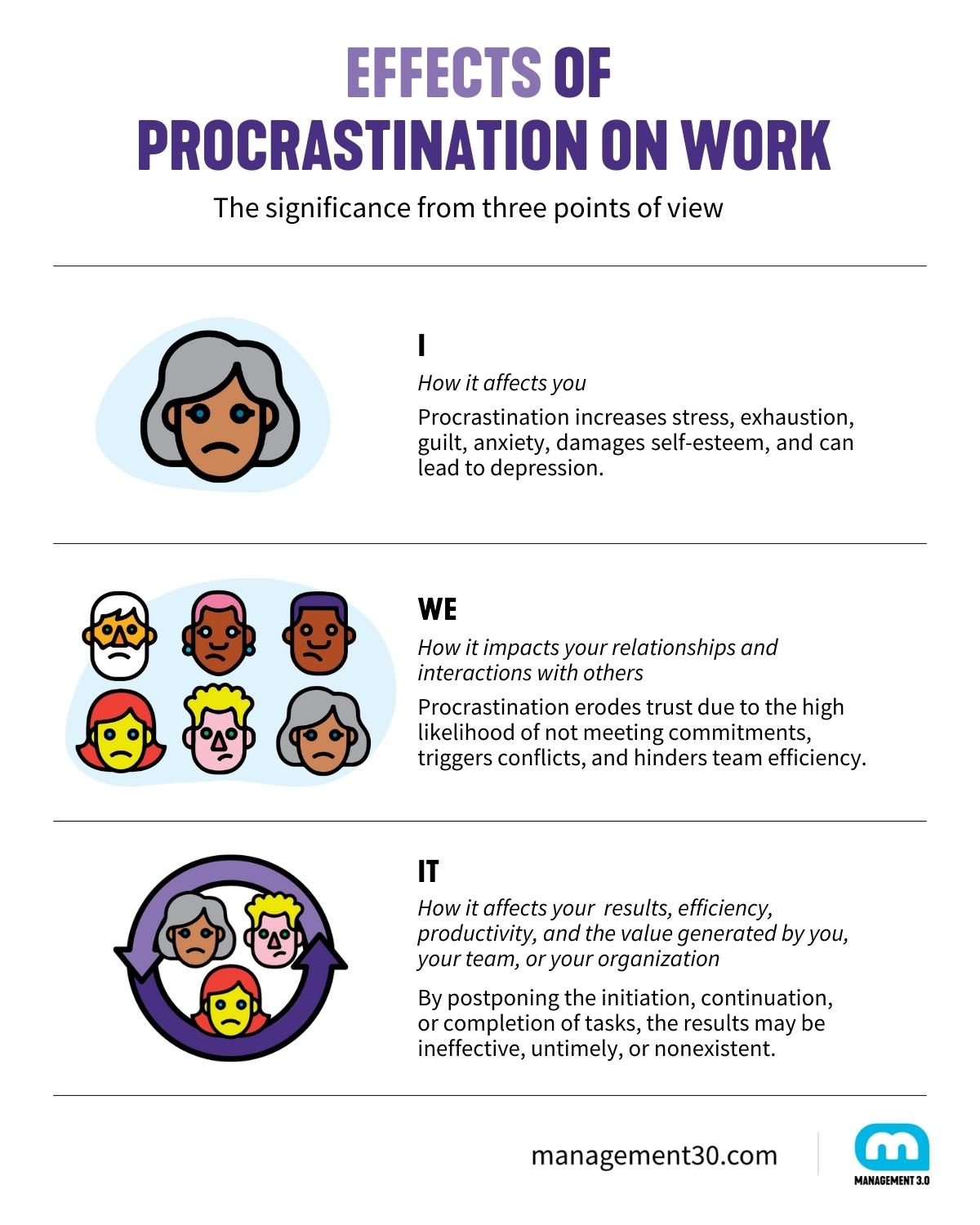

9. Emotional and Psychological Risks

Investing in cryptocurrency can be emotionally taxing due to extreme volatility and rapid market shifts. Many investors fall into psychological traps that lead to poor decision-making.

FOMO (Fear of Missing Out)

Investors often buy into cryptocurrencies during price surges out of fear of missing profits. This can lead to buying at inflated prices before inevitable corrections.

Panic Selling

Conversely, sharp price declines can trigger panic selling, causing investors to lock in losses instead of holding for potential recoveries.

Addiction to Trading

The 24/7 nature of cryptocurrency markets can encourage compulsive trading behaviors, resulting in excessive risk-taking and financial losses.

10. Dependence on Third-Party Services

While blockchain itself is decentralized, many investors rely on centralized services that introduce counterparty risks.

Custodial Exchange Risks

Using exchanges to store funds means trusting a third party with security. If the exchange is hacked, goes bankrupt, or freezes withdrawals (as seen with FTX), users can lose access to their assets permanently.

Staking and Lending Platform Vulnerabilities

Decentralized finance (DeFi) platforms offer staking and lending opportunities but also carry risks of smart contract exploits or platform collapses, as witnessed in the Celsius and Terra (LUNA) crashes.

11. Scams and Ponzi Schemes

The anonymous and pseudonymous nature of cryptocurrency makes it a breeding ground for fraudulent investment schemes.

High-Yield Investment Programs (HYIPs)

Many scams promise unrealistic weekly or monthly returns, only to vanish with investors’ deposits.

Rug Pulls

Developers of new tokens may abandon projects abruptly (rug pulls), selling off liquidity and leaving investors with worthless coins.

12. Concentration Risk in Crypto Portfolios

Many investors focus heavily on a single cryptocurrency, increasing their exposure to that asset’s specific risks.

Overexposure to Bitcoin or Altcoins

While Bitcoin is dominant, its performance isn’t guaranteed. Similarly, altcoins can experience extreme volatility or total failure.

Lack of Portfolio Diversification

Crypto investors often neglect traditional asset allocation, making their portfolios highly susceptible to market downturns.

13. Environmental and Sustainability Concerns

Bitcoin and other proof-of-work cryptocurrencies face criticism for high energy consumption, leading to potential regulatory backlash.

Green Policies Impacting Mining

Countries may impose stricter environmental regulations on mining operations, increasing costs and reducing profitability for miners.

Investor Sentiment Shift Toward Eco-Friendly Blockchains

As sustainability becomes a priority, investors may favor proof-of-stake coins (e.g., Ethereum post-Merge), causing declines in energy-intensive cryptocurrencies.

---End of Part 2---

14. Operational Risks in Blockchain Networks

While blockchain itself is designed to be secure, cryptocurrency networks are still susceptible to operational risks that can threaten both functionality and value.

51% Attacks on Proof-of-Work Networks

Smaller proof-of-work cryptocurrencies risk "51% attacks," where a single entity gains majority control of the network’s mining power. This allows bad actors to reverse transactions, double-spend coins, and destabilize the blockchain—potentially rendering the cryptocurrency worthless.

Node Centralization Issues

Ironically, many blockchains that promote decentralization have seen increasing node centralization. If a handful of entities control most validation nodes, the network becomes vulnerable to collusion or coercion, undermining trust in the system.

15. Smart Contract and Protocol Risks

Ethereum and other smart contract platforms introduce unique risks tied to code execution and governance models.

Unintended Code Execution

Smart contracts are immutable once deployed. If a bug exists—even a minor one—it can be exploited indefinitely unless the network agrees on a manual override (as seen in Ethereum’s DAO hack reversal).

Protocol Upgrade Risks

Hard forks (major upgrades) can fragment communities if consensus isn’t reached. Bitcoin’s 2017 split into BTC and Bitcoin Cash illustrates how contentious upgrades can create competing chains, diluting value and trust.

16. Privacy and Anonymity Myths

Many investors mistakenly believe cryptocurrency transactions are fully anonymous, exposing themselves to legal and tracking risks.

Pseudonymity ≠ Anonymity

Most blockchains are pseudonymous, meaning transactions link to public wallet addresses indefinitely. Sophisticated chain analysis tools, used by firms like Chainalysis, can often trace activity back to real-world identities.

Regulatory Pressure on Privacy Coins

Privacy-focused coins like Monero (XMR) or Zcash (ZEC) face increasing scrutiny and delistings from exchanges due to regulatory concerns about money laundering, reducing liquidity and accessibility.

17. Inflation Risks in Stablecoins

Stablecoins—cryptocurrencies pegged to fiat currencies—are marketed as "safe havens," but carry hidden risks.

Collateralization Failures

Algorithmic stablecoins (e.g., Terra’s UST) rely on complex mechanisms to maintain pegs. If confidence falters, a death spiral can occur, as seen when UST collapsed alongside LUNA in May 2022.

Centralized Stablecoin Trust Issues

Fiat-backed stablecoins like Tether (USDT) require faith in the issuer’s reserves. If auditors or regulators uncover insufficient backing, a "bank run" scenario could trigger mass redemptions and destabilize markets.

18. Long-Term Viability and Technological Redundancy

The crypto space evolves rapidly, and today’s leading projects risk obsolescence due to innovation or shifting paradigms.

Quantum Computing Threats

Future quantum computers could theoretically break elliptic curve cryptography, jeopardizing Bitcoin and other networks’ security. While post-quantum cryptography is in development, proactive upgrades are uncertain.

Blockchain’s "Innovator’s Dilemma"

First-generation blockchains may struggle to adapt to superior Layer 2 solutions or entirely new architectures, leaving early investors stuck with depreciating legacy assets.

19. Cultural and Generational Risks

Cryptocurrency’s adoption hinges on sociocultural factors that remain unpredictable.

Generational Wealth Transfer Effects

If younger, crypto-friendly generations inherit significant wealth, adoption may surge. Conversely, distrust among older demographics or institutional investors could slow mainstream acceptance.

Ideological Conflicts Within Communities

Decentralized governance often leads to infighting (e.g., Bitcoin’s block size wars). Protracted disputes can stall development, fracture communities, and erode investor confidence.

20. Geopolitical and Macroeconomic Risks

Global events increasingly influence cryptocurrency markets in unpredictable ways.

Sanctions and Capital Controls

Authoritarian regimes may ban or co-opt cryptocurrencies to bypass sanctions (e.g., Russia) or enforce capital controls (e.g., Nigeria), creating regulatory arbitrage dangers for international investors.

Correlation With Traditional Markets

Once touted as "uncorrelated assets," major cryptocurrencies now often move in tandem with Nasdaq or risk-on assets. A global recession could trigger synchronized selloffs across crypto and traditional markets.

21. Psychological and Behavioral Pitfalls

Investor psychology plays an outsized role in crypto markets, often amplifying risks.

Overconfidence in Technical Analysis (TA)

Unlike traditional charts, crypto TA frequently fails due to extreme volatility and manipulation. Retail traders relying on indicators like RSI or Fibonacci retracements may suffer unexpected losses.

"HODL" Culture and Sunk Cost Fallacy

The meme-driven "HODL" mentality discourages rational profit-taking, leading investors to hold through bear markets despite fundamental deterioration.

22. Insurance and Recovery Challenges

Cryptocurrency’s irreversible transactions create unique recovery dilemmas.

Lost Private Keys

An estimated 20% of all mined Bitcoin is permanently inaccessible due to lost keys. Unlike bank accounts, no customer service exists to restore access.

Limited Insurance Coverage

While some exchanges offer partial insurance on custodial holdings, most DeFi protocols lack protections. The burden of security falls entirely on users.

Conclusion: Navigating Crypto Risks Strategically

Cryptocurrency investing isn’t inherently reckless—but it demands heightened due diligence. Unlike traditional finance, crypto markets lack safety nets, making risk management non-negotiable. Diversification, cold storage solutions, skepticism towards "guaranteed returns," and continuous education are essential. Regulatory clarity may eventually reduce some risks, but volatility and technological uncertainty will persist. Investors must honestly assess their risk tolerance before allocating capital to this dynamic but perilous asset class.

For those willing to embrace both the opportunities and hazards, cryptocurrencies remain a fascinating frontier—but one where vigilance is the price of participation.

---End of Part 3 / Final---

/2025/06/17/conflit-israel-iran-une-negociation-est-possible-et-d-ailleurs-une-negociation-etait-en-cours-entre-les-etats-unis-et-l-iran-pointe-dominique-de-villepin-6850a23288327691309226.jpg)

Comments