Lead Market Outlook: Trends, Demand, and Forecasts to 2032

The global lead market remains a cornerstone of modern industry, driven by its essential role in energy storage and industrial applications. With a history spanning over 5,000 years, this durable metal is primarily consumed in the production of lead-acid batteries. Current market analysis projects significant growth, with the sector expected to expand at a compound annual growth rate (CAGR) of 5.9%, reaching approximately USD 38.57 billion by 2032.

Understanding Lead: A Durable Industrial Metal

Lead is a dense, blue-gray metal known for its high malleability and excellent corrosion resistance. It possesses a relatively low melting point, which makes it easy to cast and shape for a wide array of applications. These fundamental properties have made it a valuable material for centuries, from ancient Roman plumbing to modern technological solutions.

Key Physical and Chemical Properties

The metal's ductility and density are among its most valuable traits. It can be easily rolled into sheets or extruded into various forms without breaking. Furthermore, lead's resistance to corrosion by water and many acids ensures the longevity of products in which it is used, particularly in harsh environments.

Another critical property is its ability to effectively shield radiation. This makes it indispensable in medical settings for X-ray rooms and in nuclear power facilities. The combination of these characteristics solidifies lead's role as a versatile and reliable industrial material.

Primary Applications and Uses of Lead

The demand for lead is overwhelmingly dominated by a single application: lead-acid batteries. This sector accounts for more than 80% of global consumption. These batteries are crucial for starting, lighting, and ignition (SLI) systems in vehicles, as well as for energy storage in renewable systems and backup power supplies.

Beyond batteries, lead finds important uses in several other sectors. Its density makes it perfect for soundproofing and vibration damping in buildings. It is also used in roofing materials, ammunition, and, historically, in plumbing and paints, though these uses have declined due to health regulations.

Lead-Acid Batteries: The Dominant Driver

The automotive industry is the largest consumer of lead-acid batteries, with nearly every conventional car and truck containing one. The rise of electric vehicles (EVs) and hybrid cars also creates demand for these batteries in auxiliary functions. Furthermore, the growing need for renewable energy storage is opening new markets for large-scale lead-acid battery installations.

These batteries are favored for their reliability, recyclability, and cost-effectiveness compared to newer technologies. The established infrastructure for collection and recycling creates a circular economy for lead, with a significant portion of supply coming from recycled scrap material.

Global Lead Market Overview and Forecast

The international lead market is poised for a period of measurable growth coupled with shifting supply-demand dynamics. According to the International Lead and Zinc Study Group (ILZSG), the market is expected to see a growing surplus in the coming years. This indicates that supply is projected to outpace demand, which can influence global pricing.

The ILZSG forecasts a global surplus of 63,000 tonnes in 2024, expanding significantly to 121,000 tonnes in 2025.

Despite this surplus, overall consumption is still increasing. Demand for refined lead is expected to grow by 0.2% in 2024 to 13.13 million tonnes, followed by a stronger 1.9% increase in 2025 to reach 13.39 million tonnes. This growth is primarily fueled by economic expansion and infrastructure development in key regions.

Supply and Production Trends

Global mine production is on a steady upward trajectory. Estimates indicate a 1.7% increase to 4.54 million tonnes in 2024, with a further 2.1% rise to 4.64 million tonnes anticipated for 2025. This production growth is led by increased output from major mining nations like China, Australia, and Mexico.

The refined lead supply presents a slightly more complex picture. It is expected to dip slightly by 0.2% in 2024 to 13.20 million tonnes before rebounding with a 2.4% growth in 2025 to 13.51 million tonnes. This reflects the interplay between primary mine production and secondary production from recycling.

- Mine Supply 2024: 4.54 million tonnes (+1.7%)

- Mine Supply 2025: 4.64 million tonnes (+2.1%)

- Refined Supply 2024: 13.20 million tonnes (-0.2%)

- Refined Supply 2025: 13.51 million tonnes (+2.4%)

Leading Producers and Global Reserves

The landscape of lead production is dominated by a few key countries that control both current output and future reserves. Understanding this geographical distribution is critical for assessing the market's stability and long-term prospects.

China is the undisputed leader in production, accounting for a massive 2.4 million metric tons of annual mine production. This positions China as both the top producer and the top consumer of lead globally, influencing prices and trade flows. Other major producers include Australia (500,000 tons), the United States (335,000 tons), and Peru (310,000 tons).

Global Reserves and Future Supply Security

When looking at reserves—the identified deposits that are economically feasible to extract—the leaderboard shifts slightly. Australia holds the world's largest lead reserves, estimated at 35 million tons. This ensures its role as a critical supplier for decades to come.

China follows with substantial reserves of 17 million tons. Other countries with significant reserves include Russia (6.4 million tons) and Peru (6.3 million tons). The concentration of reserves in these regions highlights the geopolitical factors that can impact the lead supply chain.

- Australia: 35 million tons in reserves

- China: 17 million tons in reserves

- Russia: 6.4 million tons in reserves

- Peru: 6.3 million tons in reserves

Regional Market Analysis: Asia Pacific Dominance

The Asia Pacific region is the undisputed powerhouse of the global lead market, accounting for the largest share of both consumption and production. This dominance is fueled by rapid industrialization, urbanization, and a massive automotive sector. Countries like China and India are driving unprecedented demand for lead-acid batteries, which are essential for vehicles and growing energy storage needs.

China's role is particularly critical, representing over 50% of global lead use. The country's extensive manufacturing base for automobiles and electronics creates a consistent and massive demand for battery power. However, this growth is tempered by environmental regulations and government crackdowns on polluting smelters, which can periodically constrain supply and create market volatility.

Key Growth Drivers in Asia Pacific

Several interconnected factors are fueling the region's market expansion. The rapid adoption of electric vehicles (EVs) and two-wheelers, even with lithium-ion batteries for primary power, still requires lead-acid batteries for auxiliary functions. Furthermore, the push for renewable energy integration is creating a surge in demand for reliable backup power storage solutions across the continent.

- Urbanization and Infrastructure Development: Growing cities require more vehicles, telecommunications backup, and power grid storage.

- Growing Automotive Production: Asia Pacific is the world's largest vehicle manufacturing hub.

- Government Initiatives: Policies supporting renewable energy and domestic manufacturing boost lead consumption.

- Expanding Middle Class: Increased purchasing power leads to higher vehicle ownership and electronics usage.

Lead Market Dynamics: Supply, Demand, and Price Forecasts

The lead market is characterized by a delicate balance between supply and demand, which directly influences price trends. Current forecasts from the International Lead and Zinc Study Group (ILZSG) indicate a shift towards a growing market surplus. This anticipated surplus is a key factor that analysts believe will put downward pressure on lead prices through 2025.

Refined lead demand is projected to grow 1.9% to 13.39 million tonnes in 2025, but supply is expected to grow even faster at 2.4% to 13.51 million tonnes, creating a 121,000-tonne surplus.

Price sensitivity is also heavily influenced by Chinese economic policies and environmental inspections. Any disruption to China's smelting capacity can cause immediate price spikes, even amidst a broader surplus forecast. Investors and industry participants must therefore monitor both global stock levels and regional regulatory actions.

Analyzing the 2024-2025 Surplus

The projected surplus is not a sign of weak demand but rather of robust supply growth. Mine production is increasing steadily, and secondary production from recycling is becoming more efficient and widespread. This increase in available material is expected to outpace the steady, solid growth in consumption from the battery sector.

Key factors contributing to the surplus include:

- Increased Mine Output: New and expanded mining operations, particularly in Australia and Mexico.

- Efficiency in Recycling: Higher recovery rates from scrap lead-acid batteries.

- Moderating Demand Growth in China: A slowdown in the rate of GDP growth compared to previous decades.

The Critical Role of Lead Recycling

Recycling is a fundamental pillar of the lead industry's sustainability. Lead-acid batteries boast one of the highest recycling rates of any consumer product, often exceeding 99% in many developed economies. This closed-loop system provides a significant portion of the world's annual lead supply, reducing the need for primary mining.

The process of secondary production involves collecting used batteries, breaking them down, and smelting the lead components to produce refined lead. This method is more energy-efficient and environmentally friendly than primary production from ore. The Asia Pacific region, in particular, is seeing rapid growth in its secondary lead production capabilities.

Economic and Environmental Benefits of Recycling

The economic incentives for recycling are strong. Recycled lead is typically less expensive to produce than mined lead, providing cost savings for battery manufacturers. Furthermore, it helps stabilize the supply chain by providing a domestic source of material that is less susceptible to mining disruptions or export bans.

From an environmental standpoint, recycling significantly reduces the need for mining, which minimizes landscape disruption and water pollution. It also ensures that toxic battery components are disposed of safely, preventing soil and groundwater contamination. Governments worldwide are implementing stricter regulations to promote and mandate lead recycling.

- Resource Conservation: Reduces the depletion of finite natural ore reserves.

- Energy Efficiency: Recycling lead uses 35-40% less energy than primary production.

- Waste Reduction: Prevents hazardous battery waste from entering landfills.

Lead Market Segments: Battery Type Insights

The lead market can be segmented by the types of batteries produced, each serving distinct applications. The Starting, Lighting, and Ignition (SLI) segment is the largest, designed primarily for automotive engines. These batteries provide the short, high-current burst needed to start a vehicle and power its electrical systems when the engine is off.

Motive power batteries are another crucial segment, used to power electric forklifts, industrial cleaning machines, and other utility vehicles. Unlike SLI batteries, they are designed for deep cycling, meaning they can be discharged and recharged repeatedly. The third major segment is stationary batteries, used for backup power and energy storage.

Growth in Stationary and Energy Storage Applications

The stationary battery segment is experiencing significant growth, driven by the global need for uninterruptible power supplies (UPS) and renewable energy support. Data centers, hospitals, and telecommunications networks rely on lead batteries for critical backup power during outages. This demand is becoming increasingly important for grid stability.

Furthermore, as countries integrate more solar and wind power into their grids, the need for large-scale energy storage systems grows. While lithium-ion is often discussed for this role, advanced lead-carbon batteries are a cost-effective and reliable technology for many stationary storage applications, supporting the overall stability of renewable energy sources.

- SLI Batteries: Dominant segment, tied directly to automotive production and replacement cycles.

- Motive Power Batteries: Essential for logistics, warehousing, and manufacturing industries.

- Stationary Batteries: High-growth segment for telecom, UPS, and renewable energy storage.

Environmental and Regulatory Landscape

The environmental impact of lead production and disposal remains a critical focus for regulators worldwide. While lead is essential for modern technology, it is also a toxic heavy metal that poses significant health risks if not managed properly. This has led to a complex web of international regulations governing its use, particularly in consumer products like paint and plumbing.

In many developed nations, strict controls have phased out lead from gasoline, paints, and water pipes. The U.S. Environmental Protection Agency (EPA), for example, has mandated the replacement of lead service lines to prevent water contamination. These regulations have successfully reduced environmental exposure but have also shifted the industry's focus almost entirely to the battery sector, where containment and recycling are more controlled.

Global Regulatory Trends and Their Impact

The regulatory environment is constantly evolving, with a growing emphasis on extended producer responsibility (EPR). EPR policies make manufacturers responsible for the entire lifecycle of their products, including collection and recycling. This has accelerated the development of sophisticated take-back programs for lead-acid batteries, ensuring they do not end up in landfills.

In China, intermittent smog crackdowns and environmental inspections can temporarily shut down smelting operations, causing supply disruptions. These actions, while aimed at curbing pollution, create volatility in the global lead market. Producers are increasingly investing in cleaner technologies to comply with stricter emissions standards and ensure operational continuity.

- Occupational Safety Standards: Strict limits on worker exposure in smelting and recycling facilities.

- Product Bans: Prohibitions on lead in toys, jewelry, and other consumer goods.

- Recycling Mandates: Laws requiring the recycling of lead-acid batteries.

- Emissions Controls: Tighter restrictions on sulfur dioxide and particulate matter from smelters.

Technological Innovations in the Lead Industry

Despite being an ancient metal, lead is at the center of ongoing technological innovation, particularly in battery science. Researchers are continuously improving the performance of lead-acid batteries to compete with newer technologies like lithium-ion. Innovations such as lead-carbon electrodes are enhancing cycle life and charge acceptance, making these batteries more suitable for renewable energy storage.

Advanced battery designs are extending the application of lead into new areas like micro-hybrid vehicles (start-stop systems) and grid-scale energy storage. These innovations are crucial for the industry's long-term viability, ensuring that lead remains a relevant and competitive material in the evolving energy landscape.

Enhanced Flooded and AGM Battery Technologies

Two significant advancements are dominating the market: Enhanced Flooded Batteries (EFB) and Absorbent Glass Mat (AGM) batteries. EFB batteries offer improved cycle life over standard batteries for vehicles with basic start-stop technology. AGM batteries, which use a fiberglass mat to contain the electrolyte, provide even better performance, supporting more advanced auto systems and deeper cycling applications.

These technologies are responding to the automotive industry's demands for more robust electrical systems. As cars incorporate more electronics and fuel-saving start-stop technology, the requirements for the underlying battery become more stringent. The lead industry's ability to innovate has allowed it to maintain its dominant market position in the automotive sector.

Advanced lead-carbon batteries can achieve cycle lives exceeding 3,000 cycles, making them a cost-effective solution for renewable energy smoothing and frequency regulation.

Challenges and Opportunities for Market Growth

The lead market faces a dual landscape of significant challenges and promising opportunities. The primary challenge is its environmental reputation and the associated regulatory pressures. Competition from alternative battery chemistries, particularly lithium-ion, also poses a threat in specific high-performance applications like electric vehicles.

However, substantial opportunities exist in the renewable energy storage sector and the ongoing demand for reliable, cost-effective power solutions in developing economies. The established recycling infrastructure gives lead a distinct advantage in terms of sustainability and circular economy credentials, which are increasingly valued.

Navigating Competitive and Regulatory Pressures

The industry's future growth hinges on its ability to innovate and adapt. Continuous improvement in battery technology is essential to fend off competition. Simultaneously, proactive engagement with regulators to demonstrate safe and responsible production and recycling practices is crucial for maintaining social license to operate.

Market players are investing in cleaner production technologies and more efficient recycling processes to reduce their environmental footprint. By addressing these challenges head-on, the lead industry can secure its position as a vital component of the global transition to a more electrified and sustainable future.

- Opportunity: Growing demand for energy storage from solar and wind power projects.

- Challenge: Public perception and stringent environmental regulations.

- Opportunity: Massive automotive market requiring reliable SLI batteries.

- Challenge: Competition from lithium-ion batteries in certain applications.

Future Outlook and Strategic Recommendations

The long-term outlook for the lead market is one of steady growth, driven by its irreplaceable role in automotive and energy storage applications. The market size, valued at USD 24.38 billion in 2024, is projected to reach USD 38.57 billion by 2032, growing at a CAGR of 5.9%. This growth will be fueled by rising vehicle production and the global expansion of telecommunications and data centers requiring backup power.

The geographic focus will remain firmly on the Asia Pacific region, where economic development and urbanization are most rapid. Companies operating in this market should prioritize strategic investments in recycling infrastructure and advanced battery technologies to capitalize on these trends while mitigating environmental risks.

Strategic Imperatives for Industry Stakeholders

For miners, smelters, and battery manufacturers, several strategic actions are critical for future success. Diversifying into high-value segments like advanced energy storage can open new revenue streams. Building strong, transparent recycling chains will be essential for ensuring a sustainable and secure supply of raw materials.

Engaging in partnerships with automotive and renewable energy companies can help align product development with future market needs. Finally, maintaining a proactive stance on environmental, social, and governance (ESG) standards will be non-negotiable for attracting investment and maintaining market access.

- Invest in R&D: Focus on improving battery energy density and cycle life.

- Strengthen Recycling Networks: Secure supply and enhance sustainability credentials.

- Monitor Regulatory Changes: Adapt operations to comply with evolving global standards.

- Diversify Geographically: Explore growth opportunities in emerging markets beyond China.

Conclusion: The Enduring Role of Lead

In conclusion, the global lead market demonstrates remarkable resilience and adaptability. Despite well-documented environmental challenges and increasing competition, its fundamental role in providing reliable, recyclable, and cost-effective energy storage ensures its continued importance. The projected market growth to over USD 38 billion by 2032 underscores its enduring economic significance.

The industry's future will be shaped by its ability to balance economic growth with environmental responsibility. The high recycling rate of lead-acid batteries provides a strong foundation for a circular economy model. Technological advancements are continuously expanding the metal's applications, particularly in supporting the global transition to renewable energy.

The key takeaway is that lead is not a relic of the past but a material of the future. Its unique properties and well-established supply chain make it indispensable for automotive mobility, telecommunications, and power grid stability. As the world becomes more electrified, the demand for dependable battery technology will only increase, securing lead's place in the global industrial landscape for decades to come. Strategic innovation and responsible management will ensure this ancient metal continues to power modern life.

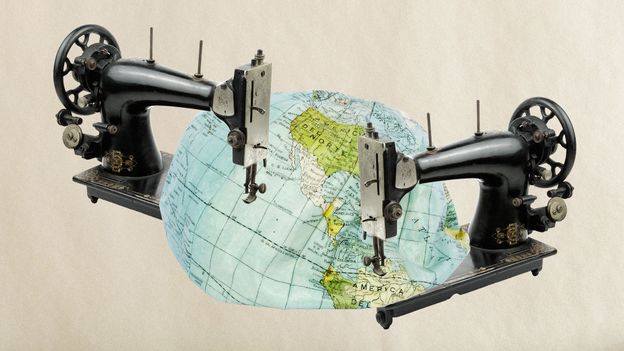

CIRCULAR FASHION: THE FUTURE OF SUSTAINABLE STYLE

In an age defined by fast fashion, the term "circular fashion" is gaining traction, signaling a seismic shift in the industry ethos. As global awareness of the environmental repercussions of current fashion practices intensifies, consumers and brands are being driven towards a sustainable approach that extends the life cycle of clothing, reduces waste, and creates a more ethical production loop.

The core concept of circular fashion rests on the principles of designing out waste, keeping materials in use, and regenerating natural systems. It's a transformative idea that could redefine our relationship with clothes. But what does it mean in practical terms, and how are fashion brands, large and small, integrating these principles into their operations?

Firstly, circular fashion encourages the design of garments that are more durable and can be easily repaired, repurposed, or recycled at the end of their lifespans. This is in stark contrast to the disposable mindset that dominates the current fast fashion market, where items are quickly discarded and replaced. As such, the focus shifts to quality over quantity, investing in pieces that can stand the test of time both in style and durability.

One of the early adopters of this model is Patagonia, which has built a robust program around repair, take-back, and reuse of their clothing. They encourage customers to buy less and to choose well. This is not just a call for quality, but also for customers to enter a new pact with their garments, to care for them, repair them, and eventually return them so they can be spun into new threads, quite literally.

Another facet of circular fashion is the sourcing of materials. The search for renewable materials, that either biodegrade or can be completely recycled, is paramount. Innovations such as Piñatex, made from pineapple leaf fibers, or Mylo, a leather-like material derived from fungi, are paving the way for a future where fashion does not depend on finite resources or materials that leave a permanent environmental scar.

Brands are also exploring the rental market as a venue for circularity. Rent the Runway, a service that allows customers to rent designer dresses for a fraction of the retail price, extends the lifecycle of garments and satisfies the modern consumer's desire for newness, all while curtailing the sheer volume of clothing produced.

Despite the promise of circularity, however, significant challenges remain. The existing global textile recycling infrastructure is limited, struggling to separate blended fibers and dyes or to handle the sheer volume of waste. While the technology to recycle textiles does exist, it’s not yet at a scale or efficiency to handle the global output of discarded garments.

Furthermore, consumer behavior poses a substantial barrier. The allure of cheap, trendy clothes is difficult to resist, and the convenience of disposing of the unwanted items compounds the problem. It requires a cultural shift, one where the value of clothes is reconsidered, and their lifecycle is extended through sharing, swapping, and thrifting.

Education is also crucial. Designers and manufacturers need to be schooled in circular principles from the ground up. Schools like the London College of Fashion are now offering courses on sustainable fashion, teaching the next generation of designers the importance of designing with the end in mind.

Finally, transparency along the supply chain is essential. With blockchain and other tracking technologies, brands are starting to provide customers with a roadmap of their products' journey. This is not solely for consumer engagement but also for accountability. By making the supply chain visible, brands can ensure ethical sourcing and production methods, and consumers can make informed choices.

As we move forward, circular fashion is not just a trend, it’s a necessity. The industry cannot continue on a path of unchecked production and disposal. The circular model provides a blueprint for sustainable style that balances our desire for creativity and expression with the needs of the planet. But turning this vision into widespread reality will require collective effort: from brands, designers, manufacturers, and most importantly, consumers.

In transforming our approach to fashion, we'll not only be redefining style but also our responsibility to the future of our environment. The question that lingers is, will the industry and consumers alike rise to meet the challenge, or will the circular fashion movement remain a niche in a world of linear consumption? Time will tell, but the seeds of change are undoubtedly sown.

Stay tuned for the next segment of this article where we'll explore case studies of brands that are successfully implementing circular fashion principles, delve into the technological advancements propelling the industry forward, and analyze consumer attitudes and their evolving role in the circular fashion ecosystem.### Pioneers at the Helm of Circular Fashion

As the conversation surrounding circular fashion evolves, it's important to spotlight the change-makers who are redefining the industry. These pioneers are demonstrating that circular principles are not only viable but can also drive innovation and resonate with the conscious consumer.

Stella McCartney

, a long-time advocate of sustainable fashion, has been one of the frontrunners in integrating circular design into her collections. Her brand’s ethos is built on the belief that fashion should be both luxurious and responsible. McCartney’s collections frequently feature organic cotton, recyclable materials, and vegetarian leather, challenging the norms of luxury fashion. Her commitment extends to the production process, using renewable energy for its stores and offices as part of a broader commitment to environmental stewardship.Yet, the journey towards circularity is not limited to high-end fashion labels. Swedish retail giant

H&M

has been involved in efforts to close the material loop. Their garment collecting initiative allows shoppers to drop off unwanted clothes (from any brand) at H&M stores worldwide, rewarding them with a discount on their next purchase. These clothes are then sorted for reuse or recycling in various projects. H&M also launched its Conscious Collection, which uses sustainable materials like Tencel and recycled polyester, illustrating that circular fashion can have mass-market appeal.Adidas

, in collaboration with Parley for the Oceans, has initiated a line of shoes made from recycled ocean plastic. This initiative doesn't just put plastic waste to good use it also raises awareness about marine pollution. With millions of pairs sold, Adidas demonstrates that circular products can achieve commercial success while advancing sustainability.On the technology front, innovations are accelerating. Companies such as

Worn Again Technologies

are working on textile-to-textile recycling processes capable of separating, decontaminating, and extracting polyester and cotton from old or end-of-use textiles and clothing. This technology holds the promise of a true closed-loop solution for textile fibers.Digital platforms, too, are fostering circularity within the fashion ecosystem.

The RealReal

andVestiaire Collective

are luxury consignment websites that offer a marketplace for pre-owned designer fashion. Their success is indicative of a growing trend towards the circular model, where ownership is less important than access and use.The conversation around circular fashion is also broadening to include the concept of a product-as-a-service (PaaS). Dutch company

MUD Jeans

operates with a leasing model for its sustainable denim jeans. Customers pay a monthly fee to wear the jeans and, after a year, can either keep, swap, or return them. This model promotes long-term use and ensures that the materials are ultimately returned to the manufacturer, where they can be recycled into new products.Empowerment and Education

: As crucial as it is for brands to steer towards circularity, educating and empowering consumers to engage with sustainable practices is equally vital. Several NGOs and initiatives, like Fashion Revolution and the Clean Clothes Campaign, work to raise awareness and push for transparency and sustainability within the fashion industry. They empower consumers to ask brands, "Who made my clothes?", and to advocate for better conditions throughout the supply chain.Consumer Shift

: Attitudes toward fashion consumption are also witnessing a shift. The success of initiatives like the '30 wears campaign', which urges consumers to consider whether they will wear an item a minimum of 30 times before purchasing, reflects a growing consumer commitment to sustainable fashion. Additionally, the normalization of thrifting and vintage shopping as fashionable alternatives is a testament to the shifting attitudes towards consumption and reuse.It is clear that for circular fashion to become the standard, it must be a collective endeavor between brands, consumers, innovators, and policymakers. Legislation and regulations play a significant role in either restricting or promoting circular practices. Recently, countries such as France have passed laws to curb the destruction of unsold and returned garments, compelling companies to find sustainable ways to dispose of their unsold inventory.

In conclusion, the fashion industry stands at a pivotal point in its evolution. The circular fashion model presents a roadmap towards a sustainable future that harmonizes economic activity with ecological integrity. Innovative designers, pioneering brands, and new technologies are already forging ahead on this path, providing inspirational templates for change. Consumer education and shifts in behavior are catching up, gradually making circular fashion a widespread reality.

As these breakthroughs gain momentum, the question is not whether circular fashion will become the norm, but how quickly and effectively the industry as a whole will adapt to this paradigm. The next several years will be crucial in cementing the principles of circularity in fashion and ensuring that the ripples of today grow into the waves of tomorrow, changing the landscape of fashion forever.