MIT's Carbon Concrete Batteries Turn Buildings Into Powerhouses

The most boring slab in your city might be on the cusp of its greatest performance. Picture a standard concrete foundation, a wind turbine base, or a highway barrier. Now, imagine it quietly humming with electrical potential, charged by the sun, ready to power a home or charge a passing car. This is not speculative fiction. It is the result of a focused revolution in a Cambridge, Massachusetts lab, where the ancient art of masonry is colliding with the urgent demands of the energy transition.

A Foundation That Holds Electricity

The concept sounds like magic, but the ingredients are stubbornly ordinary: cement, water, and carbon black—a fine powder derived from incomplete combustion. Researchers at the Massachusetts Institute of Technology, led by professors Franz-Josef Ulm, Admir Masic, and Yang-Shao Horn, have pioneered a precise method of mixing these components to create what they call electron-conducting carbon concrete (ec³). The breakthrough, first detailed in a 2023 paper, is not just a new material. It is a new architectural philosophy. Their creation is a structural supercapacitor, a device that stores and releases energy rapidly, embedded within the very bones of our built environment.

The initial 2023 proof-of-concept was compelling. A block of this material, sized at 45 cubic meters (roughly the volume of a small shipping container), could store about 10 kilowatt-hours of energy—enough to cover the average daily electricity use of a U.S. household. The image was powerful: an entire home’s energy needs, locked inside its own basement walls. But the researchers weren't satisfied. They had a hunch the material could do more.

The 10x Leap: Seeing the Invisible Network

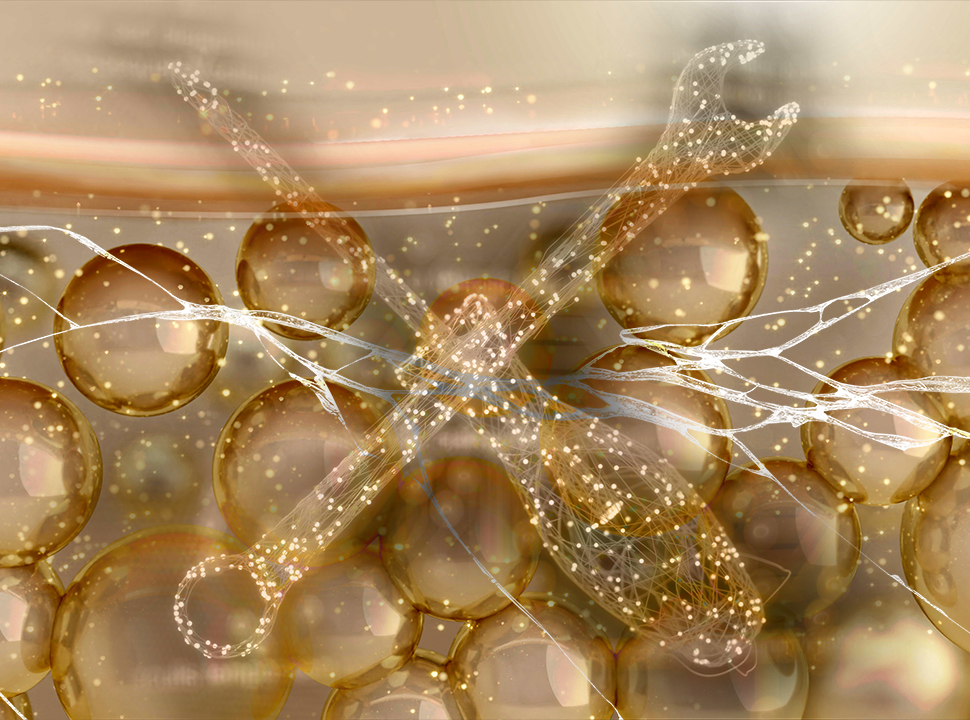

The pivotal advance came from looking closer. In 2024 and early 2025, the team employed a powerful imaging technique called FIB-SEM. This process allowed them to construct a meticulous 3D map of the carbon black’s distribution within the cured cement. They weren't just looking at a black mix; they were reverse-engineering the microscopic highway system inside the concrete.

“What we discovered was the critical percolation network,” explains Ulm. “It’s a continuous path for electrons to travel. By visualizing it in three dimensions, we moved from guesswork to precision engineering. We could see exactly how to optimize the mix for maximum conductivity without sacrificing an ounce of compressive strength.”

The imaging work was combined with two other critical innovations. First, they shifted from a water-based electrolyte to a highly conductive organic electrolyte, specifically quaternary ammonium salts in acetonitrile. Second, they changed the casting process, integrating the electrolyte directly during mixing instead of injecting it later. This eliminated a curing step and created thicker, more effective electrodes.

The result, published in Proceedings of the National Academy of Sciences (PNAS) in 2025, was a staggering order-of-magnitude improvement. The energy density of the material vaulted from roughly 0.2 kWh/m³ to over 2 kWh/m³. The implications are physical, and dramatic. That same household’s daily energy could now be stored in just 5 cubic meters of concrete—a volume easily contained within a standard foundation wall or a modest support pillar.

That number, the 10x leap, is what transforms the technology from a captivating lab demo into a genuine contender. It shifts the narrative from “possible” to “practical.”

The Artist's Palette: Cement, Carbon, and a Dash of Rome

To appreciate the elegance of ec³, one must first understand the problem it solves. The renewable energy transition has a glaring flaw: intermittency. The sun sets. The wind stops. Lithium-ion batteries, the current storage darling, are expensive, rely on finite, geopolitically tricky resources, and charge relatively slowly for grid-scale applications. They are also, aesthetically and physically, added on. They are boxes in garages or vast, isolated farms. The MIT team asked a different question. What if the storage was the structure itself?

The chemical process behind the concrete battery is deceptively simple. When mixed with water and cement, the carbon black—an incredibly cheap, conductive byproduct of oil refining—self-assembles into a sprawling, fractal-like network within the porous cement matrix. Pour the mix into two separate batches to form two electrodes. Separate them with a thin insulator, like a conventional plastic sheet. Soak the whole system in an electrolyte, and you have a supercapacitor. It stores energy through the electrostatic attraction of ions on the vast surface area of the carbon network, allowing for blisteringly fast charge and discharge cycles.

“We drew inspiration from history, specifically Roman concrete,” says Masic, whose research often bridges ancient materials science and modern innovation. “Their secret was robustness through internal complexity. We aimed for a similar multifunctionality. Why should a material only bear load? In an era of climate crisis, every element of our infrastructure must work harder.”

This philosophy of multifunctionality is the soul of the project. The material must be, first and foremost, good concrete. The team found the sweet spot at approximately 10% carbon black by volume. At this ratio, the compressive strength remains more than sufficient for many structural applications while unlocking significant energy storage. Want more storage for a non-load-bearing wall? Increase the carbon content. The strength dips slightly, but the trade-off becomes an architect’s choice, a new variable in the design palette.

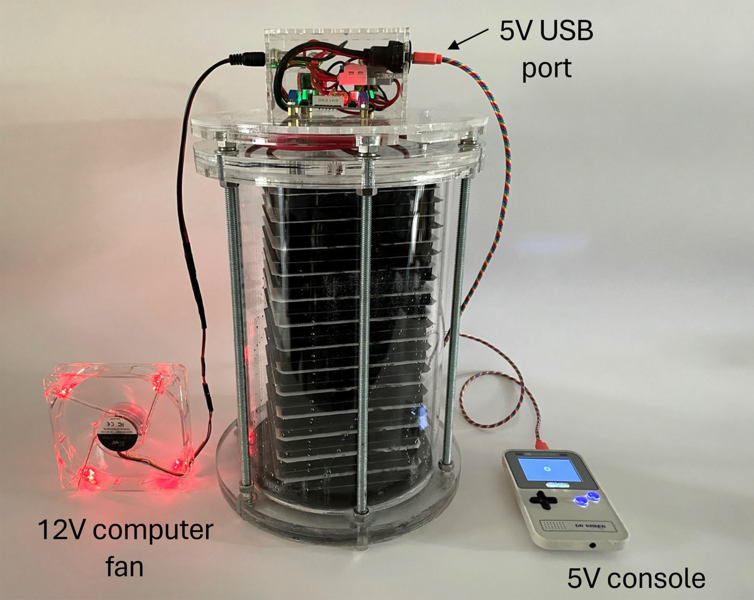

The early demonstrations were beautifully literal. In one, a small, load-bearing arch made of ec³ was constructed. Once charged, it powered a bright 9V LED, a tiny beacon proving the concept’s viability. In Sapporo, Japan, a more pragmatic test is underway: slabs of conductive concrete are being used for self-heating, melting snow and ice on walkways without an external power draw. These are not just science fair projects. They are deliberate steps toward proving the material’s durability and function in the real world—its artistic merit judged not by a gallery but by winter storms and structural load tests.

The auditorium for this technology is the planet itself, and the performance is just beginning.

The Chemistry of Ambition: From Pompeii's Ashes to Modern Grids

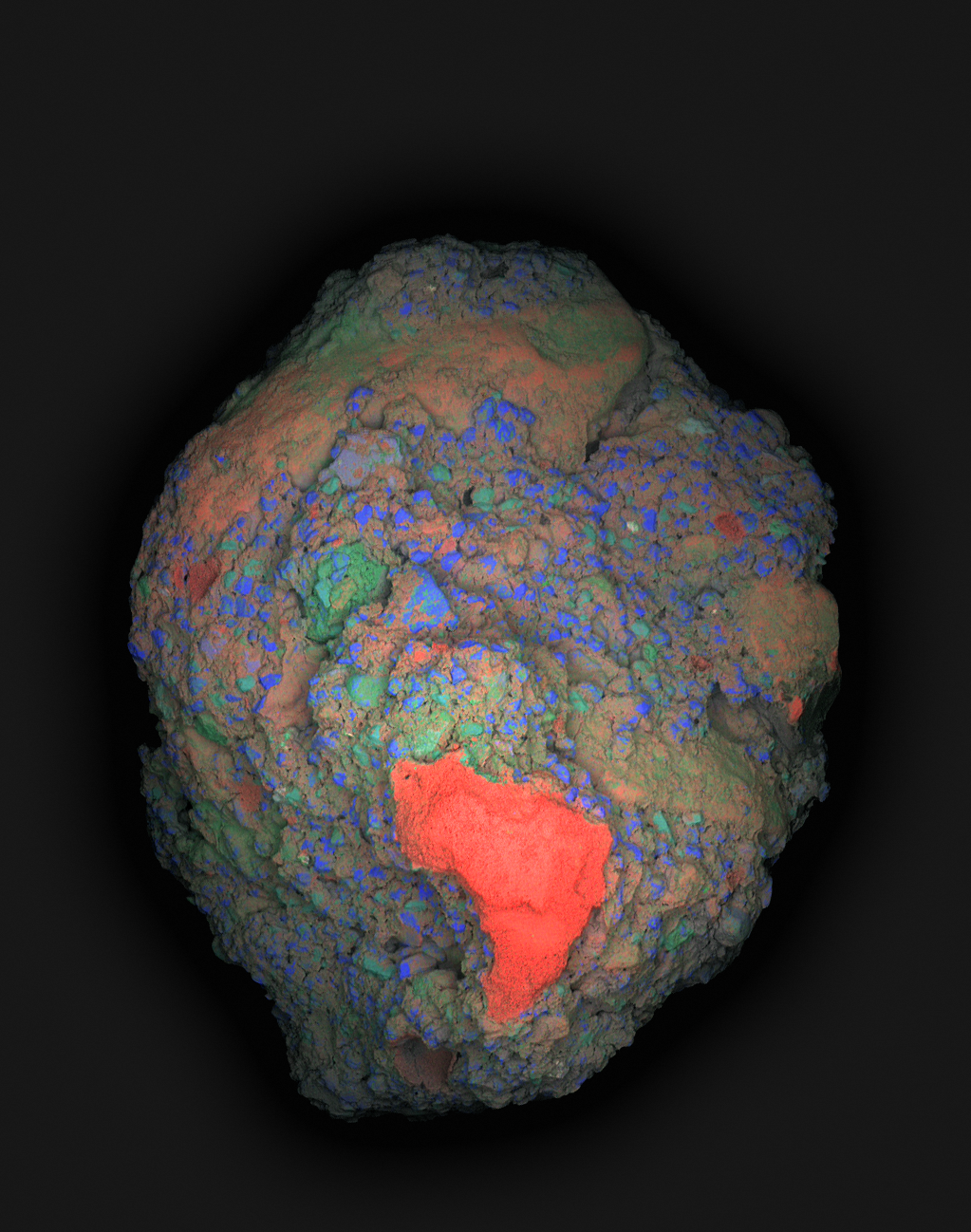

Admir Masic did not set out to build a battery. He went to Pompeii to solve a two-thousand-year-old mystery. The archaeological site, frozen in volcanic ash, offered more than just tragic tableaus. It held perfectly preserved raw materials for Roman concrete, including intact quicklime fragments within piles of dry-mixed volcanic ash. This discovery, published by Masic's team in 2023 and highlighted again by MIT News on December 9, 2025, upended long-held assumptions about ancient construction. The Romans weren't just mixing lime and water; they were "hot-mixing" dry quicklime with ash before adding water, a process that created self-healing lime clasts as the concrete cured.

"These results revealed that the Romans prepared their binding material by taking calcined limestone (quicklime), grinding them to a certain size, mixing it dry with volcanic ash, and then eventually adding water," Masic stated in the 2025 report on the Pompeii findings.

That ancient technique, a masterclass in durable, multifunctional design, became the philosophical bedrock for the carbon concrete battery. The ec³ project is an intellectual grandchild of Pompeii. It asks the same fundamental question the Roman engineers answered: how can a material serve more than one master? For the Romans, it was strength and self-repair. For Masic, Ulm, and Horn, it is strength and energy storage. The parallel is stark. Both innovations treat concrete not as a dead, inert filler but as a dynamic, responsive system. Where Roman lime clasts reacted with water to seal cracks, MIT's carbon network reacts with an electrolyte to store ions.

This historical grounding lends the project a cultural weight many flashy tech demos lack. It’s not a disruption born from nothing; it’s a recalibration of humanity’s oldest and most trusted building material. The team used stable isotope studies to trace carbonation in Roman samples, a forensic technique that now informs how they map the carbon black network in their own mixes. The lab tools are cutting-edge, but the inspiration is archaeological.

The Scale of the Promise: Cubic Meters and Kilowatt-Hours

The statistics are where ambition transforms into tangible potential. The original 2023 formulation required 45 cubic meters of concrete to store a household's daily 10 kWh. The 2025 upgrade, with its optimized network and organic electrolytes, slashes that volume to 5 cubic meters. Consider the average suburban basement. Those cinderblock walls have a volume. Now imagine them silently holding a day's worth of electricity, charged by rooftop solar panels. The architectural implications are profound. Every foundation, every retaining wall, every bridge abutment becomes a candidate for dual use.

Compare this to conventional battery storage. A contemporary Battery Energy Storage System (BESS) unit, like the Allye Max 300, offers 180 kW / 300 kWh of capacity. It is also a large, discrete, manufactured object that must be shipped, installed, and allocated space. The carbon concrete alternative proposes to erase that distinction between structure and storage. The storage *is* the structure. The building is the battery. This isn't an additive technology; it's a transformative one.

Masic's emotional connection to the Roman research fuels this transformative vision. The Pompeii work wasn't just academic.

"It’s thrilling to see this ancient civilization’s know-how, care, and sophistication being unlocked," Masic reflected. That thrill translates directly to the modern lab. It's a belief that past ingenuity can solve future crises.

But can excitement pave a road? The application moving fastest toward real-world testing is, literally, paving. In Sapporo, Japan, slabs of conductive concrete are being trialed for de-icing. This is a perfect, low-stakes entry point. The load-bearing requirements are minimal, the benefit—safe, ice-free walkways without resistive heating wires—is immediate and visible. It’s a pragmatic first act for a technology with starring-role aspirations.

The Inevitable Friction: Scalability and the Ghost of Cost

Every revolutionary material faces the gauntlet of scale. For ec³, the path from a lab-cast arch powering an LED to a skyscraper foundation powering offices is mined with practical, gritty questions the press releases often gloss over. The carbon black itself is cheap and abundant, a near-waste product. The cement is ubiquitous. The concept is brilliant. So where’s the catch?

We must look to a related but distinct MIT innovation for clues: a CO2 mineralization process developed by the same research ecosystem. A 2025 market analysis report from Patsnap on this technology flags a critical, almost mundane weakness: electrode costs. While the report notes the process can achieve 150-250 kg of CO2 uptake per ton of material and operates 10 times faster than passive methods, it also states plainly that "electrode costs are a noted weakness." The carbon concrete battery, while different, lives in the same economic universe. Its "electrodes" are the conductive concrete blocks themselves, and their production—precise mixing, integration of specialized organic electrolytes, quality control on a job site—will not be free.

"The uncertainty lies in commercial scalability," the Patsnap report concludes about the mineralization tech, a verdict that hangs like a specter over any adjacent materials science breakthrough.

Think about a construction site today. Crews pour concrete from a truck. It's messy, robust, and forgiving. Now introduce a mix that must contain a precise 10% dispersion of carbon black, be cast in two separate, perfectly insulated electrodes, and incorporate a specific, likely expensive, organic electrolyte. The margin for error shrinks. The need for skilled labor increases. The potential for a costly mistake—a poorly mixed batch that compromises the entire building's energy storage—becomes a real liability. This isn't a fatal flaw; it's the hard engineering and business puzzle that follows the "Eureka!" moment. Who manufactures the electrolyte? Who certifies the installers? Who warranties a battery that is also a load-bearing wall?

Furthermore, the trade-off between strength and storage is a designer's tightrope. The 10% carbon black mix is the structural sweet spot. But what if a developer wants to maximize storage in a non-load-bearing partition wall? They might crank the carbon content higher. That wall now holds more energy but is slightly weaker. This requires a new kind of architectural literacy, a fluency in both structural engineering and electrochemistry. Building codes, famously slow to adapt, would need a complete overhaul. The insurance industry would need to develop entirely new risk models. The technology doesn't just ask us to change a material; it asks us to change the entire culture of construction.

Compare it again to the Roman concrete inspiration. The Romans had centuries to refine their hot-mixing technique through trial and error across an empire. Modern construction operates on tighter budgets and faster timelines. The carbon concrete battery must prove it can survive not just the lab, but the hustle, shortcuts, and cost-cutting pressures of a global industry.

The Critical Reception: A Quiet Auditorium

Unlike a controversial film or a divisive album, ec³ exists in a pre-critical space. There is no Metacritic score, no raging fan debate on forums. The "audience reception" is currently measured in the cautious interest of construction firms and the focused scrutiny of fellow materials scientists. This silence is telling. It indicates a technology still in its prologue, awaiting the harsh, illuminating lights of commercial validation and peer implementation.

The cultural impact, however, is already being felt in narrative. The project embodies a powerful and growing trend: the demand for multifunctionality in the climate era. As the Rocky Mountain Institute (RMI) outlined in its work on 100% carbon-free power for productions, the future grid requires elegant integrations, not just additive solutions. This concrete is a physical manifestation of that principle. It’s a narrative of convergence—of infrastructure and utility, of past wisdom and future need.

"This aligns with the trend toward multifunctional materials for the energy transition," notes a synthesis of the technical landscape, positioning ec³ as part of a broader movement, not a solitary miracle.

Yet, one must ask a blunt, journalistic question: Is this the best path? Or is it a captivating detour? The world is also pursuing radically different grid-scale storage: flow batteries, compressed air, gravitational storage in decommissioned mines. These are dedicated storage facilities. They don't ask a hospital foundation to double as a backup power supply. They are single-purpose, which can be a virtue in reliability and maintenance. The carbon concrete vision is beautifully distributed, but distribution brings complexity. If a section of your foundation-battery fails, how do you repair it? You can't unplug a single cell in a monolithic pour.

The project’s greatest artistic merit is its audacious metaphor. It proposes that the solution to our futuristic energy problem has been hiding in plain sight, in the very skeleton of our civilization. Its greatest vulnerability is the immense, unglamorous work of turning that metaphor into a plumbing and electrical standard. The team has proven the chemistry and the physics. The next act must prove the economics and the logistics. That story, yet to be written, will determine if this remains a brilliant lab specimen or becomes the bedrock of a new energy age.

The Architecture of a New Energy Imagination

The true significance of MIT's carbon concrete transcends kilowatt-hours per cubic meter. It engineers a paradigm shift in how we perceive the built environment. For centuries, architecture has been defined by form and function—what a structure looks like and what it physically houses. This material injects a third, dynamic dimension: energy metabolism. A building is no longer a passive consumer at the end of a power line. It becomes an active participant in the grid, a reservoir that fills with solar energy by day and releases it at night. This redefines the artistic statement of a wall or a foundation. Its value is no longer just in what it holds up, but in what it holds.

This is a direct challenge to the aesthetic of the energy transition. We’ve grown accustomed to the visual language of sustainability as addition: solar panels bolted onto roofs, battery banks fenced off in yards, wind turbines towering on the horizon. Ec³ proposes a language of integration and disappearance. The renewable infrastructure becomes invisible, woven into the fabric of the city itself. It offers a future where a historic district can achieve energy independence not by marring its rooflines with panels, but by retrofitting its massive stone foundations with conductive concrete cores. The cultural impact is a quieter, more subtle form of green design, one that prizes elegance and multifunctionality over technological exhibitionism.

"This aligns with the trend toward multifunctional materials for the energy transition," states analysis from the Rocky Mountain Institute, framing ec³ not as a lone invention but as a vanguard of a necessary design philosophy where every element must serve multiple masters in a resource-constrained world.

The legacy, should it succeed, will be a new literacy for architects and civil engineers. They will need to think like circuit designers, understanding current paths and storage density as foundational parameters alongside load limits and thermal mass. The blueprint of the future might include schematics for the building’s internal electrical network right next to its plumbing diagrams. This isn't just a new product; it's the seed for a new discipline, a fusion of civil and electrical engineering that could define 21st-century construction.

The Formwork of Reality: Cracks in the Vision

For all its brilliant promise, the carbon concrete battery faces a wall of practical constraints that no amount of scientific enthusiasm can simply wish away. The most glaring issue is the electrolyte. The high-performance organic electrolyte that enabled the 10x power boost—quaternary ammonium salts in acetonitrile—is not something you want leaking into the groundwater. Acetonitrile is volatile and toxic. The notion of embedding vast quantities of it within the foundations of homes, schools, and hospitals introduces a profound environmental and safety dilemma. The search for a stable, safe, high-conductivity electrolyte that can survive for decades encased in concrete, through freeze-thaw cycles and potential water ingress, is a monumental chemical engineering challenge in itself.

Durability questions loom just as large. A lithium-ion battery has a known lifespan, after which it is decommissioned and recycled. What is the lifespan of a foundation that is also a battery? Does its charge capacity slowly fade over 50 years? If so, the building’s energy profile degrades alongside its physical structure. And what happens at end-of-life? Demolishing a standard concrete building is complex. Demolishing one laced with conductive carbon and potentially hazardous electrolytes becomes a specialized hazardous materials operation. The cheerful concept of a "building that is a battery" ignores the sobering reality of a "building that is a toxic waste site."

Finally, the technology must confront the immense inertia of the construction industry. Building codes move at a glacial pace for good reason: they prioritize proven safety. Introducing a radically new structural material that also carries electrical potential will require years, likely decades, of certification testing, insurance industry acceptance, and trade union retraining. The first commercial applications will not be in homes, but in controlled, low-risk, non-residential settings—perhaps the de-icing slabs in Sapporo, or the bases of offshore wind turbines where containment is easier. The road to your basement is a long one.

The project's weakest point is not its science, but its systems integration. It brilliantly solves a storage problem in the lab while potentially creating a host of new environmental, safety, and regulatory problems in the field. This isn't a criticism of the research; it's the essential, gritty work that comes next. The most innovative battery chemistry is worthless if it can't be safely manufactured, installed, and decommissioned at scale.

Pouring the Next Decade

The immediate future for ec³ is not commercialization, but intense, focused validation. The research team, and any industrial partners they attract, will be chasing specific milestones. They must develop and test a benign, water-based or solid-state electrolyte that matches the performance of their current toxic cocktail. Long-term weathering studies, subjecting full-scale blocks to decades of simulated environmental stress in accelerated chambers, must begin immediately. Crucially, they need to partner with a forward-thinking materials corporation or a national lab to establish pilot manufacturing protocols beyond the lab bench.

Look for the next major update not in a scientific journal, but in a press release from a partnership. A tie-up with a major cement producer like Holcim or a construction giant like Skanska, announced in late 2026 or 2027, would signal a serious move toward scale. The first real-world structural application will likely be a government-funded demonstrator project—something like a bus shelter with a charging station powered by its own walls, or a section of sound-barrier highway that powers its own lighting. These will be the critical "concerts" where the technology proves it can perform outside the studio.

By 2030, the goal should be to have a fully codified product specification for non-residential, non-habitable structures. Success isn't a world of battery-homes by 2040; it's a world where every new data center foundation, warehouse slab, and offshore wind turbine monopile is routinely specified as an ec³ variant, adding gigawatt-hours of distributed storage to the grid as a standard feature of construction, not an exotic add-on.

We began with the image of a boring slab, the most ignored element of our cities. That slab, thanks to a fusion of Roman inspiration and MIT ingenuity, now hums with latent possibility. It asks us to look at the world around us not as a collection of inert objects, but as a dormant network of potential energy, waiting to be awakened. The ultimate success of this technology won't be measured in a patent filing or a power density chart. It will be measured in the moment an architect, staring at a blank site plan, first chooses a foundation not just for the load it bears, but for the power it provides. That is the quiet revolution waiting in the mix.

Lead Market Outlook: Trends, Demand, and Forecasts to 2032

The global lead market remains a cornerstone of modern industry, driven by its essential role in energy storage and industrial applications. With a history spanning over 5,000 years, this durable metal is primarily consumed in the production of lead-acid batteries. Current market analysis projects significant growth, with the sector expected to expand at a compound annual growth rate (CAGR) of 5.9%, reaching approximately USD 38.57 billion by 2032.

Understanding Lead: A Durable Industrial Metal

Lead is a dense, blue-gray metal known for its high malleability and excellent corrosion resistance. It possesses a relatively low melting point, which makes it easy to cast and shape for a wide array of applications. These fundamental properties have made it a valuable material for centuries, from ancient Roman plumbing to modern technological solutions.

Key Physical and Chemical Properties

The metal's ductility and density are among its most valuable traits. It can be easily rolled into sheets or extruded into various forms without breaking. Furthermore, lead's resistance to corrosion by water and many acids ensures the longevity of products in which it is used, particularly in harsh environments.

Another critical property is its ability to effectively shield radiation. This makes it indispensable in medical settings for X-ray rooms and in nuclear power facilities. The combination of these characteristics solidifies lead's role as a versatile and reliable industrial material.

Primary Applications and Uses of Lead

The demand for lead is overwhelmingly dominated by a single application: lead-acid batteries. This sector accounts for more than 80% of global consumption. These batteries are crucial for starting, lighting, and ignition (SLI) systems in vehicles, as well as for energy storage in renewable systems and backup power supplies.

Beyond batteries, lead finds important uses in several other sectors. Its density makes it perfect for soundproofing and vibration damping in buildings. It is also used in roofing materials, ammunition, and, historically, in plumbing and paints, though these uses have declined due to health regulations.

Lead-Acid Batteries: The Dominant Driver

The automotive industry is the largest consumer of lead-acid batteries, with nearly every conventional car and truck containing one. The rise of electric vehicles (EVs) and hybrid cars also creates demand for these batteries in auxiliary functions. Furthermore, the growing need for renewable energy storage is opening new markets for large-scale lead-acid battery installations.

These batteries are favored for their reliability, recyclability, and cost-effectiveness compared to newer technologies. The established infrastructure for collection and recycling creates a circular economy for lead, with a significant portion of supply coming from recycled scrap material.

Global Lead Market Overview and Forecast

The international lead market is poised for a period of measurable growth coupled with shifting supply-demand dynamics. According to the International Lead and Zinc Study Group (ILZSG), the market is expected to see a growing surplus in the coming years. This indicates that supply is projected to outpace demand, which can influence global pricing.

The ILZSG forecasts a global surplus of 63,000 tonnes in 2024, expanding significantly to 121,000 tonnes in 2025.

Despite this surplus, overall consumption is still increasing. Demand for refined lead is expected to grow by 0.2% in 2024 to 13.13 million tonnes, followed by a stronger 1.9% increase in 2025 to reach 13.39 million tonnes. This growth is primarily fueled by economic expansion and infrastructure development in key regions.

Supply and Production Trends

Global mine production is on a steady upward trajectory. Estimates indicate a 1.7% increase to 4.54 million tonnes in 2024, with a further 2.1% rise to 4.64 million tonnes anticipated for 2025. This production growth is led by increased output from major mining nations like China, Australia, and Mexico.

The refined lead supply presents a slightly more complex picture. It is expected to dip slightly by 0.2% in 2024 to 13.20 million tonnes before rebounding with a 2.4% growth in 2025 to 13.51 million tonnes. This reflects the interplay between primary mine production and secondary production from recycling.

- Mine Supply 2024: 4.54 million tonnes (+1.7%)

- Mine Supply 2025: 4.64 million tonnes (+2.1%)

- Refined Supply 2024: 13.20 million tonnes (-0.2%)

- Refined Supply 2025: 13.51 million tonnes (+2.4%)

Leading Producers and Global Reserves

The landscape of lead production is dominated by a few key countries that control both current output and future reserves. Understanding this geographical distribution is critical for assessing the market's stability and long-term prospects.

China is the undisputed leader in production, accounting for a massive 2.4 million metric tons of annual mine production. This positions China as both the top producer and the top consumer of lead globally, influencing prices and trade flows. Other major producers include Australia (500,000 tons), the United States (335,000 tons), and Peru (310,000 tons).

Global Reserves and Future Supply Security

When looking at reserves—the identified deposits that are economically feasible to extract—the leaderboard shifts slightly. Australia holds the world's largest lead reserves, estimated at 35 million tons. This ensures its role as a critical supplier for decades to come.

China follows with substantial reserves of 17 million tons. Other countries with significant reserves include Russia (6.4 million tons) and Peru (6.3 million tons). The concentration of reserves in these regions highlights the geopolitical factors that can impact the lead supply chain.

- Australia: 35 million tons in reserves

- China: 17 million tons in reserves

- Russia: 6.4 million tons in reserves

- Peru: 6.3 million tons in reserves

Regional Market Analysis: Asia Pacific Dominance

The Asia Pacific region is the undisputed powerhouse of the global lead market, accounting for the largest share of both consumption and production. This dominance is fueled by rapid industrialization, urbanization, and a massive automotive sector. Countries like China and India are driving unprecedented demand for lead-acid batteries, which are essential for vehicles and growing energy storage needs.

China's role is particularly critical, representing over 50% of global lead use. The country's extensive manufacturing base for automobiles and electronics creates a consistent and massive demand for battery power. However, this growth is tempered by environmental regulations and government crackdowns on polluting smelters, which can periodically constrain supply and create market volatility.

Key Growth Drivers in Asia Pacific

Several interconnected factors are fueling the region's market expansion. The rapid adoption of electric vehicles (EVs) and two-wheelers, even with lithium-ion batteries for primary power, still requires lead-acid batteries for auxiliary functions. Furthermore, the push for renewable energy integration is creating a surge in demand for reliable backup power storage solutions across the continent.

- Urbanization and Infrastructure Development: Growing cities require more vehicles, telecommunications backup, and power grid storage.

- Growing Automotive Production: Asia Pacific is the world's largest vehicle manufacturing hub.

- Government Initiatives: Policies supporting renewable energy and domestic manufacturing boost lead consumption.

- Expanding Middle Class: Increased purchasing power leads to higher vehicle ownership and electronics usage.

Lead Market Dynamics: Supply, Demand, and Price Forecasts

The lead market is characterized by a delicate balance between supply and demand, which directly influences price trends. Current forecasts from the International Lead and Zinc Study Group (ILZSG) indicate a shift towards a growing market surplus. This anticipated surplus is a key factor that analysts believe will put downward pressure on lead prices through 2025.

Refined lead demand is projected to grow 1.9% to 13.39 million tonnes in 2025, but supply is expected to grow even faster at 2.4% to 13.51 million tonnes, creating a 121,000-tonne surplus.

Price sensitivity is also heavily influenced by Chinese economic policies and environmental inspections. Any disruption to China's smelting capacity can cause immediate price spikes, even amidst a broader surplus forecast. Investors and industry participants must therefore monitor both global stock levels and regional regulatory actions.

Analyzing the 2024-2025 Surplus

The projected surplus is not a sign of weak demand but rather of robust supply growth. Mine production is increasing steadily, and secondary production from recycling is becoming more efficient and widespread. This increase in available material is expected to outpace the steady, solid growth in consumption from the battery sector.

Key factors contributing to the surplus include:

- Increased Mine Output: New and expanded mining operations, particularly in Australia and Mexico.

- Efficiency in Recycling: Higher recovery rates from scrap lead-acid batteries.

- Moderating Demand Growth in China: A slowdown in the rate of GDP growth compared to previous decades.

The Critical Role of Lead Recycling

Recycling is a fundamental pillar of the lead industry's sustainability. Lead-acid batteries boast one of the highest recycling rates of any consumer product, often exceeding 99% in many developed economies. This closed-loop system provides a significant portion of the world's annual lead supply, reducing the need for primary mining.

The process of secondary production involves collecting used batteries, breaking them down, and smelting the lead components to produce refined lead. This method is more energy-efficient and environmentally friendly than primary production from ore. The Asia Pacific region, in particular, is seeing rapid growth in its secondary lead production capabilities.

Economic and Environmental Benefits of Recycling

The economic incentives for recycling are strong. Recycled lead is typically less expensive to produce than mined lead, providing cost savings for battery manufacturers. Furthermore, it helps stabilize the supply chain by providing a domestic source of material that is less susceptible to mining disruptions or export bans.

From an environmental standpoint, recycling significantly reduces the need for mining, which minimizes landscape disruption and water pollution. It also ensures that toxic battery components are disposed of safely, preventing soil and groundwater contamination. Governments worldwide are implementing stricter regulations to promote and mandate lead recycling.

- Resource Conservation: Reduces the depletion of finite natural ore reserves.

- Energy Efficiency: Recycling lead uses 35-40% less energy than primary production.

- Waste Reduction: Prevents hazardous battery waste from entering landfills.

Lead Market Segments: Battery Type Insights

The lead market can be segmented by the types of batteries produced, each serving distinct applications. The Starting, Lighting, and Ignition (SLI) segment is the largest, designed primarily for automotive engines. These batteries provide the short, high-current burst needed to start a vehicle and power its electrical systems when the engine is off.

Motive power batteries are another crucial segment, used to power electric forklifts, industrial cleaning machines, and other utility vehicles. Unlike SLI batteries, they are designed for deep cycling, meaning they can be discharged and recharged repeatedly. The third major segment is stationary batteries, used for backup power and energy storage.

Growth in Stationary and Energy Storage Applications

The stationary battery segment is experiencing significant growth, driven by the global need for uninterruptible power supplies (UPS) and renewable energy support. Data centers, hospitals, and telecommunications networks rely on lead batteries for critical backup power during outages. This demand is becoming increasingly important for grid stability.

Furthermore, as countries integrate more solar and wind power into their grids, the need for large-scale energy storage systems grows. While lithium-ion is often discussed for this role, advanced lead-carbon batteries are a cost-effective and reliable technology for many stationary storage applications, supporting the overall stability of renewable energy sources.

- SLI Batteries: Dominant segment, tied directly to automotive production and replacement cycles.

- Motive Power Batteries: Essential for logistics, warehousing, and manufacturing industries.

- Stationary Batteries: High-growth segment for telecom, UPS, and renewable energy storage.

Environmental and Regulatory Landscape

The environmental impact of lead production and disposal remains a critical focus for regulators worldwide. While lead is essential for modern technology, it is also a toxic heavy metal that poses significant health risks if not managed properly. This has led to a complex web of international regulations governing its use, particularly in consumer products like paint and plumbing.

In many developed nations, strict controls have phased out lead from gasoline, paints, and water pipes. The U.S. Environmental Protection Agency (EPA), for example, has mandated the replacement of lead service lines to prevent water contamination. These regulations have successfully reduced environmental exposure but have also shifted the industry's focus almost entirely to the battery sector, where containment and recycling are more controlled.

Global Regulatory Trends and Their Impact

The regulatory environment is constantly evolving, with a growing emphasis on extended producer responsibility (EPR). EPR policies make manufacturers responsible for the entire lifecycle of their products, including collection and recycling. This has accelerated the development of sophisticated take-back programs for lead-acid batteries, ensuring they do not end up in landfills.

In China, intermittent smog crackdowns and environmental inspections can temporarily shut down smelting operations, causing supply disruptions. These actions, while aimed at curbing pollution, create volatility in the global lead market. Producers are increasingly investing in cleaner technologies to comply with stricter emissions standards and ensure operational continuity.

- Occupational Safety Standards: Strict limits on worker exposure in smelting and recycling facilities.

- Product Bans: Prohibitions on lead in toys, jewelry, and other consumer goods.

- Recycling Mandates: Laws requiring the recycling of lead-acid batteries.

- Emissions Controls: Tighter restrictions on sulfur dioxide and particulate matter from smelters.

Technological Innovations in the Lead Industry

Despite being an ancient metal, lead is at the center of ongoing technological innovation, particularly in battery science. Researchers are continuously improving the performance of lead-acid batteries to compete with newer technologies like lithium-ion. Innovations such as lead-carbon electrodes are enhancing cycle life and charge acceptance, making these batteries more suitable for renewable energy storage.

Advanced battery designs are extending the application of lead into new areas like micro-hybrid vehicles (start-stop systems) and grid-scale energy storage. These innovations are crucial for the industry's long-term viability, ensuring that lead remains a relevant and competitive material in the evolving energy landscape.

Enhanced Flooded and AGM Battery Technologies

Two significant advancements are dominating the market: Enhanced Flooded Batteries (EFB) and Absorbent Glass Mat (AGM) batteries. EFB batteries offer improved cycle life over standard batteries for vehicles with basic start-stop technology. AGM batteries, which use a fiberglass mat to contain the electrolyte, provide even better performance, supporting more advanced auto systems and deeper cycling applications.

These technologies are responding to the automotive industry's demands for more robust electrical systems. As cars incorporate more electronics and fuel-saving start-stop technology, the requirements for the underlying battery become more stringent. The lead industry's ability to innovate has allowed it to maintain its dominant market position in the automotive sector.

Advanced lead-carbon batteries can achieve cycle lives exceeding 3,000 cycles, making them a cost-effective solution for renewable energy smoothing and frequency regulation.

Challenges and Opportunities for Market Growth

The lead market faces a dual landscape of significant challenges and promising opportunities. The primary challenge is its environmental reputation and the associated regulatory pressures. Competition from alternative battery chemistries, particularly lithium-ion, also poses a threat in specific high-performance applications like electric vehicles.

However, substantial opportunities exist in the renewable energy storage sector and the ongoing demand for reliable, cost-effective power solutions in developing economies. The established recycling infrastructure gives lead a distinct advantage in terms of sustainability and circular economy credentials, which are increasingly valued.

Navigating Competitive and Regulatory Pressures

The industry's future growth hinges on its ability to innovate and adapt. Continuous improvement in battery technology is essential to fend off competition. Simultaneously, proactive engagement with regulators to demonstrate safe and responsible production and recycling practices is crucial for maintaining social license to operate.

Market players are investing in cleaner production technologies and more efficient recycling processes to reduce their environmental footprint. By addressing these challenges head-on, the lead industry can secure its position as a vital component of the global transition to a more electrified and sustainable future.

- Opportunity: Growing demand for energy storage from solar and wind power projects.

- Challenge: Public perception and stringent environmental regulations.

- Opportunity: Massive automotive market requiring reliable SLI batteries.

- Challenge: Competition from lithium-ion batteries in certain applications.

Future Outlook and Strategic Recommendations

The long-term outlook for the lead market is one of steady growth, driven by its irreplaceable role in automotive and energy storage applications. The market size, valued at USD 24.38 billion in 2024, is projected to reach USD 38.57 billion by 2032, growing at a CAGR of 5.9%. This growth will be fueled by rising vehicle production and the global expansion of telecommunications and data centers requiring backup power.

The geographic focus will remain firmly on the Asia Pacific region, where economic development and urbanization are most rapid. Companies operating in this market should prioritize strategic investments in recycling infrastructure and advanced battery technologies to capitalize on these trends while mitigating environmental risks.

Strategic Imperatives for Industry Stakeholders

For miners, smelters, and battery manufacturers, several strategic actions are critical for future success. Diversifying into high-value segments like advanced energy storage can open new revenue streams. Building strong, transparent recycling chains will be essential for ensuring a sustainable and secure supply of raw materials.

Engaging in partnerships with automotive and renewable energy companies can help align product development with future market needs. Finally, maintaining a proactive stance on environmental, social, and governance (ESG) standards will be non-negotiable for attracting investment and maintaining market access.

- Invest in R&D: Focus on improving battery energy density and cycle life.

- Strengthen Recycling Networks: Secure supply and enhance sustainability credentials.

- Monitor Regulatory Changes: Adapt operations to comply with evolving global standards.

- Diversify Geographically: Explore growth opportunities in emerging markets beyond China.

Conclusion: The Enduring Role of Lead

In conclusion, the global lead market demonstrates remarkable resilience and adaptability. Despite well-documented environmental challenges and increasing competition, its fundamental role in providing reliable, recyclable, and cost-effective energy storage ensures its continued importance. The projected market growth to over USD 38 billion by 2032 underscores its enduring economic significance.

The industry's future will be shaped by its ability to balance economic growth with environmental responsibility. The high recycling rate of lead-acid batteries provides a strong foundation for a circular economy model. Technological advancements are continuously expanding the metal's applications, particularly in supporting the global transition to renewable energy.

The key takeaway is that lead is not a relic of the past but a material of the future. Its unique properties and well-established supply chain make it indispensable for automotive mobility, telecommunications, and power grid stability. As the world becomes more electrified, the demand for dependable battery technology will only increase, securing lead's place in the global industrial landscape for decades to come. Strategic innovation and responsible management will ensure this ancient metal continues to power modern life.

Harnessing the Sun: Next-Generation Solar Technology

As the world confronts the growing urgency of climate change, the quest for clean, renewable energy has taken center stage. Among the suite of sustainable power sources, solar energy remains a beacon of hope, promising a future less dependent on fossil fuels. But as we plunge deeper into the 21st century, what breakthroughs and innovations can we anticipate in solar technology that could revolutionize the way we harvest the energy of our closest star? This article delves into next-generation solar developments that aim to enhance efficiency, affordability, and versatility.

In the past decade, substantial strides have been made in improving traditional silicon-based solar panels – the type most commonly seen on residential rooftops and solar farms. These improvements range from tweaking the material properties to optimizing panel designs. Now, researchers and companies around the globe are looking beyond these incremental advances to more radical transformations in solar technology. These emerging innovations have the potential to dramatically increase solar energy's contribution to global power generation and reshape the energy landscape.

One of the most promising avenues in the evolution of solar technology is the development of perovskite solar cells. These cells are named after the mineral with a similar crystal structure and have startled the scientific community with their rapid improvement in efficiency. Some perovskite cells have achieved efficiency levels that rival – and sometimes exceed – those of traditional silicon cells. More importantly, perovskites can be produced at a fraction of the cost and with simpler manufacturing processes, such as printing techniques that allow for the development of flexible and lightweight solar panels. This could pave the way for solar panels to be integrated into a variety of new contexts, from the sides of buildings to the surfaces of cars, and even woven into fabric.

Another groundbreaking idea that's gaining traction is the creation of transparent solar cells. Imagine a world where every window, glass building facade, and possibly even smartphone screens could silently and invisibly harness solar energy. Researchers are exploring materials such as organic molecules and specially designed nanostructures to achieve this. While efficiency levels for transparent solar cells currently lag behind more opaque alternatives, their potential applications could exponentially expand the surfaces available for solar energy capture.

But it's not just about the panels themselves. Significant developments in energy storage and photovoltaic (PV) system integration are equally crucial to the solar revolution. The intermittent nature of solar power necessitates efficient storage solutions, which would ensure a steady supply of electricity, regardless of the time of day or weather conditions. Advances in battery technology, such as lithium-ion and emerging alternatives like sodium-ion or solid-state batteries, are making solar power more reliable and dispatchable. Additionally, smart grid technologies are improving the way solar systems interact with the wider energy network, optimizing distribution and enabling households to become active energy participants by selling excess power back to the grid.

Moreover, scientists are exploring advanced photovoltaic concepts that could lead to even greater efficiency gains. Multi-junction solar cells, which layer multiple types of photovoltaic materials, each extracting energy from a different portion of the solar spectrum, are moving from space applications to terrestrial ones. Although currently costly, these sophisticated cells have achieved efficiencies over 40% in lab settings, hinting at a future where solar power generation could be incredibly effective.

The environmental impact of solar panel production and end-of-life disposal is also a priority for a truly sustainable solar industry. Efforts are underway to minimize the use of hazardous materials, reduce energy consumption during manufacturing, and improve recyclability of panels. With the anticipated surge in solar panel waste in the coming decades, finding sustainable ways to reclaim and repurpose materials is becoming increasingly important.

As innovation surges forward, the economics of solar energy are also being transformed. The levelized cost of electricity (LCOE) from solar PV has plummeted, making it already cheaper than fossil fuels in many regions of the world, even without subsidies. This trend is expected to continue as new technologies come down in cost with greater scale and improved manufacturing processes. However, realizing these advancements' full potential will require supportive policies, continued investment in research and development, and robust infrastructure to handle widespread solar adoption.

The ascendance of solar power is not a distant dream—it is a rapidly unfolding reality that promises a cleaner, brighter future. As we witness the birth of these cutting-edge technologies, it becomes clear that the way we think about energy generation is on the cusp of a monumental shift, one where every ray of sunlight carries the potential to power our civilization sustainably and inexhaustively.The Future of Solar is Now: Integrating Innovation with Infrastructure

The dawn of next-generation solar technology is not just confined to the labs where cell efficiencies are pushed to their limits or where novel materials are engineered; it stretches to the very infrastructure that will be required to implement these innovations. The most sophisticated solar cell is of limited utility without the corresponding advancement in systems to deploy and manage it. The integration of new solar technologies into the existing energy landscape is a multifaceted challenge that includes grid modernization, regulatory adjustments, and new business models.

Grid modernization is a key aspect of the future solar landscape. Traditional power grids were designed for unidirectional flow from large, centralized power plants to consumers. However, with the widespread use of solar panels, the paradigm is shifting towards a more decentralized model where power flows in multiple directions and comes from diverse sources. To handle this, electrical grids will have to become 'smart', incorporating advanced sensors, responsive communication networks, and data analytics to balance supply and demand in real time. This will ensure stability and reliability, as more intermittent renewable sources like solar and wind are connected to the grid.

Furthermore, the incorporation of electric vehicles (EVs) presents both a challenge and an opportunity for solar energy integration. EVs can increase the demand for electricity but can also act as mobile energy storage units. Vehicle-to-grid (V2G) technology allows EVs to feed electricity back into the grid when demand is high, smoothing out variability in solar power generation. This symbiotic relationship between EVs and solar power could become a cornerstone of future smart grids.

Regulatory and policy frameworks are also pivotal in shaping the solar future. Policymakers are under pressure to create conducive environments for solar innovation to flourish. This includes subsidies and incentives for solar adoption, feed-in tariffs for surplus power generation, and investment in R&D. Governments play an instrumental role in setting renewable energy targets and facilitating the transition with a supportive legislative environment. There is also a growing need for international cooperation to harmonize standards and share best practices, making the global market more accessible and efficient.

In addition, as solar power becomes more prevalent, new business models are emerging. Power Purchase Agreements (PPAs), leasing arrangements, and solar-as-a-service are examples of models that have lower upfront costs and remove the burden of maintenance from consumers. Similarly, community solar projects allow multiple stakeholders to benefit from a single solar installation, broadening access to solar power beyond those with suitable rooftops to include renters and low-income households.

The social implications of solar technology are profound. Energy is not just a commodity; it is a pathway to development and quality of life improvements. The democratization of energy production through solar power has the potential to empower communities and contribute to the reduction of energy poverty. In remote areas, independent solar installations can provide a reliable power source where extending the traditional grid is economically infeasible. This localized approach to energy generation fosters resilience and self-sufficiency.

Education and workforce development are also essential to support the burgeoning solar industry. As solar technology evolves, so must the skills of workers who install, maintain, and manage solar systems. Emphasizing STEM (Science, Technology, Engineering, and Math) education and vocational training in the field of renewable energy can address the skills gap and ensure a steady supply of qualified professionals to drive the solar revolution.

Finally, innovation is not above potential pitfalls and challenges. Though we stand on the brink of remarkable technological advances in solar energy, their widespread adoption is contingent on overcoming economic, regulatory, and technical hurdles. Investment in infrastructure, workforce training, and an effective regulatory framework will be just as important as the scientific breakthroughs themselves.

In conclusion, the future of solar technology is a tapestry of interconnected advancements, societal changes, and policy evolution, all converging towards a more sustainable and equitable global energy landscape. With the right mix of innovation, investment, and intention, the promise of solar energy to power our world cleanly and efficiently is closer than ever before. We are entering an era where our rooftops, vehicles, and devices are not just instruments of consumption but active contributors to the energy matrix. As this vision comes to life, solar energy will no longer be an alternative form of power but a fundamental pillar of our everyday lives.

-k0its.jpg)