Polkadot: The Future of Interoperable Blockchain

Introduction to Polkadot

Polkadot is a groundbreaking multi-chain blockchain platform launched in 2020 by Gavin Wood, co-founder of Ethereum and creator of Solidity. Designed to address the issue of blockchain silos, Polkadot enables seamless interoperability between different blockchains through its unique architecture.

Understanding Polkadot's Architecture

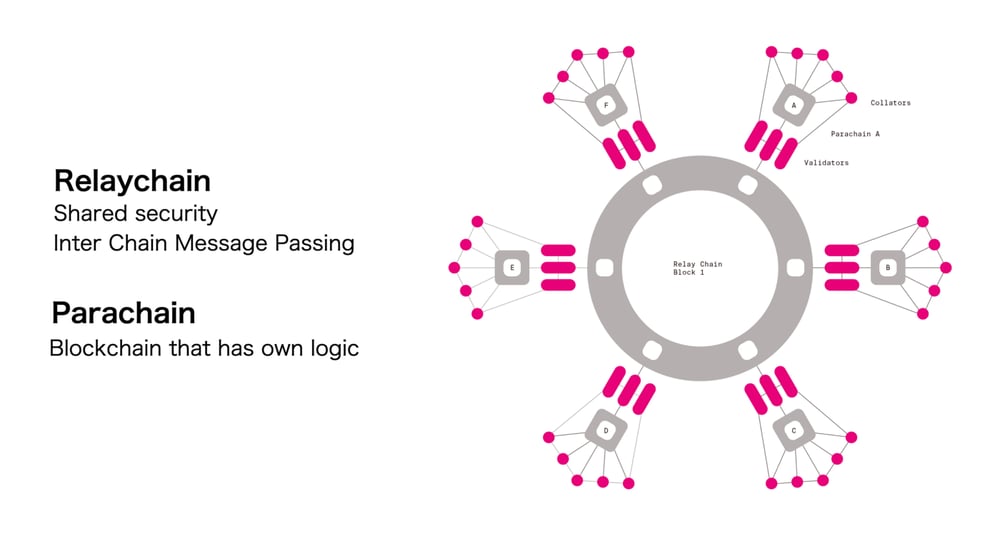

The Relay Chain

The relay chain is the heart of Polkadot's network. It coordinates security and consensus across the entire ecosystem, ensuring that all connected blockchains, known as parachains, can communicate and share information securely.

Parachains and Parathreads

Parachains are independent blockchains that run in parallel within the Polkadot network. They share the security of the relay chain and can be customized for specific use cases. Parathreads, on the other hand, offer a more flexible and cost-effective solution for blockchains that do not require continuous connectivity.

Cross-Consensus Messaging (XCM)

The Cross-Consensus Messaging (XCM) protocol is a key innovation of Polkadot. It allows different blockchains to communicate and transfer data and assets seamlessly, enabling true interoperability across the ecosystem.

The Role of the DOT Token

Governance

The native DOT token plays a crucial role in the Polkadot ecosystem. It supports on-chain governance, allowing token holders to vote on network upgrades and changes through a system called OpenGov.

Staking

DOT tokens are also used for staking, which secures the network through a proof-of-stake consensus mechanism. Stakers earn rewards for their participation but face penalties, known as slashing, for misbehavior.

Bonding

Another important function of DOT is bonding, which is used to secure parachain slots. Projects must bond DOT tokens to lease a parachain slot, ensuring their commitment to the network.

Polkadot's Growth and Adoption

Parachain Auctions

By 2023, Polkadot hosted 79 parachains across its mainnet and Kusama, a canary network for experimental deployments. Parachain auctions have been a significant driver of ecosystem growth, attracting a diverse range of projects.

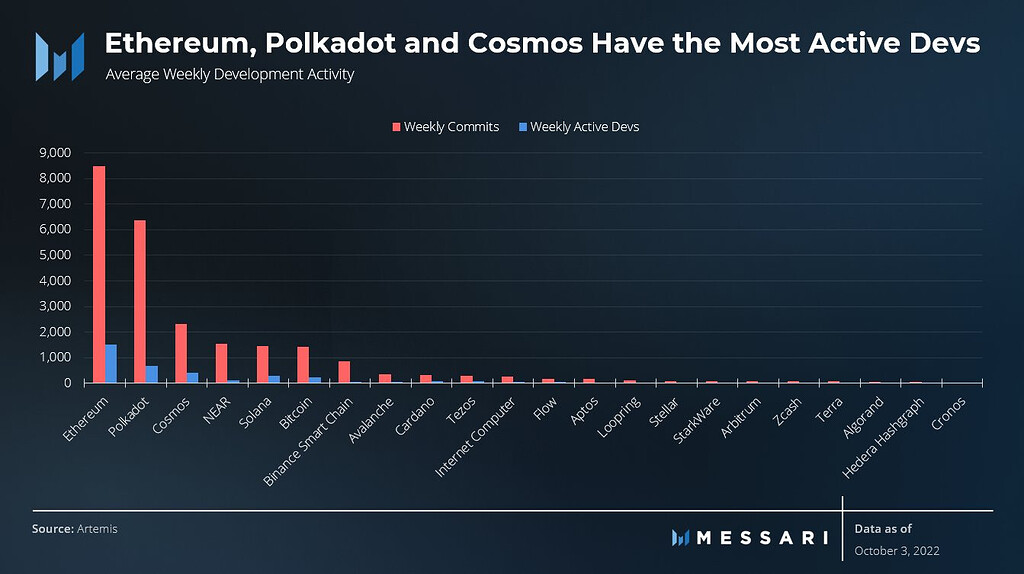

Developer Activity

Polkadot has seen a surge in developer activity, surpassing Ethereum in active developer contributions. This vibrant community is building innovative solutions across various sectors, including DeFi, NFTs, and gaming.

Polkadot 2.0: The Next Evolution

Asynchronous Backing

The Polkadot 2.0 upgrades introduce several groundbreaking features. Asynchronous backing reduces block time from 12 to 6 seconds, enabling parallel validation and significantly improving network efficiency.

Elastic Scaling

Elastic scaling is another key innovation, allowing dynamic core allocation to handle demand spikes. This feature targets a theoretical maximum of 623,000+ transactions per second (TPS) at full capacity, positioning Polkadot as a scalable solution for Web3 applications.

Agile Coretime

Agile coretime introduces a flexible compute purchasing model, similar to cloud resources. This allows projects to scale their operations dynamically, making Polkadot a versatile platform for a wide range of use cases.

Polkadot's Vision for Web3

Interoperability and Scalability

Polkadot aims to create a decentralized Web3 where blockchains can process transactions in parallel. This approach addresses the scalability issues faced by single-chain networks like Ethereum, offering a more efficient and cost-effective solution.

Decentralized Governance

With its fully on-chain governance model, Polkadot empowers DOT holders to control network upgrades. This decentralized approach ensures that the network evolves in a transparent and community-driven manner.

Conclusion

Polkadot is at the forefront of blockchain innovation, offering a scalable and interoperable platform for the next generation of decentralized applications. With its unique architecture, robust governance model, and continuous upgrades, Polkadot is well-positioned to shape the future of Web3.

Polkadot's Impact on Real-World Assets (RWAs)

Polkadot is making significant strides in the real-world assets (RWAs) sector. Projects like Centrifuge are leveraging Polkadot's infrastructure to tokenize traditional assets, such as Treasury Bills (T-Bills), bringing them on-chain. This innovation is unlocking new opportunities for liquidity and accessibility in the financial markets.

The Growing RWA Market

The RWA market is projected to reach a staggering $2 trillion by 2030, according to McKinsey. Polkadot's ability to facilitate secure and efficient tokenization positions it as a key player in this burgeoning sector. By bridging the gap between traditional finance and decentralized ecosystems, Polkadot is paving the way for a more inclusive financial system.

Key RWA Projects on Polkadot

- Centrifuge: Focuses on tokenizing real-world assets, enabling seamless integration with DeFi protocols.

- Energy Web: Aims to revolutionize energy trading through decentralized solutions.

- peaq: Targets mobility and logistics, offering decentralized infrastructure for these industries.

Polkadot in Decentralized Physical Infrastructure (DePIN)

Polkadot is also making waves in the Decentralized Physical Infrastructure (DePIN) sector. DePIN projects leverage blockchain technology to create decentralized networks for physical infrastructure, such as energy grids, mobility solutions, and more. Polkadot's interoperable and scalable architecture makes it an ideal platform for these innovative projects.

Energy Web and Decentralized Energy Trading

Energy Web is a prominent DePIN project on Polkadot, focusing on decentralized energy trading. By utilizing Polkadot's infrastructure, Energy Web enables peer-to-peer energy transactions, promoting sustainability and efficiency in the energy sector.

peaq and Mobility Solutions

peaq is another notable DePIN project, targeting mobility and logistics. By leveraging Polkadot's interoperability, peaq aims to create a decentralized network for mobility solutions, enhancing transparency and efficiency in the logistics industry.

Polkadot's Role in Decentralized AI

Polkadot is also exploring the intersection of blockchain and artificial intelligence. Decentralized AI projects on Polkadot aim to create transparent and secure AI models, leveraging the network's robust infrastructure. This fusion of technologies has the potential to revolutionize various industries, from healthcare to finance.

Tokenized Assets and Web3 Gaming

Polkadot's versatility extends to tokenized assets and Web3 gaming. The network's ability to support customizable parachains makes it an attractive platform for gaming projects. By enabling true ownership of in-game assets and seamless cross-chain interactions, Polkadot is shaping the future of gaming.

Enterprise Blockchain-as-a-Service (BaaS)

Polkadot is also making inroads into the enterprise sector with its Blockchain-as-a-Service (BaaS) offerings. By providing SDKs and API integrations, Polkadot enables businesses to leverage blockchain technology without the need for extensive technical expertise. This approach is driving institutional adoption and fostering innovation across various industries.

Polkadot's Competitive Advantages

Interoperability

One of Polkadot's standout features is its interoperability. Unlike single-chain networks, Polkadot enables seamless communication between different blockchains. This capability is crucial for creating a truly decentralized and connected Web3 ecosystem.

Scalability

Polkadot's architecture is designed for scalability. With the ability to process over 1,000 transactions per second (TPS) and a theoretical maximum of 623,000+ TPS, Polkadot is well-equipped to handle the demands of a growing user base and complex applications.

Security

Security is a top priority for Polkadot. The network's relay chain ensures that all connected parachains share a common security model. This shared security approach reduces the risk of attacks and enhances the overall robustness of the ecosystem.

Polkadot's Ecosystem and Community

Developer Activity

Polkadot boasts a vibrant and active developer community. With over 79 parachains and numerous projects in development, the network is a hub of innovation. The active participation of developers ensures continuous growth and evolution of the Polkadot ecosystem.

Community Governance

Polkadot's on-chain governance model empowers the community to shape the future of the network. DOT holders can propose and vote on upgrades, ensuring that the network evolves in a decentralized and transparent manner. This community-driven approach fosters a sense of ownership and engagement among participants.

Polkadot's Future Outlook

Upcoming Upgrades

Polkadot's roadmap includes several exciting upgrades. The introduction of asynchronous backing and elastic scaling will further enhance the network's performance and scalability. Additionally, the integration of Ethereum-compatible Solidity smart contracts via the Polkadot Virtual Machine (PVM) will make it easier for developers to migrate their projects to Polkadot.

Market Predictions

Analysts are optimistic about Polkadot's future. With a current price of around $4.17 in mid-2025, predictions suggest a potential increase to $1.84 to $2.04 by the end of the year. These projections reflect the growing confidence in Polkadot's technology and its potential to revolutionize the blockchain landscape.

Institutional Adoption

Polkadot's modular architecture and enterprise-friendly solutions are driving institutional adoption. As more businesses recognize the benefits of blockchain technology, Polkadot is well-positioned to become a leading platform for enterprise applications. This trend is expected to accelerate as the network continues to evolve and expand its capabilities.

Conclusion

Polkadot is a pioneering force in the blockchain industry, offering a scalable, interoperable, and secure platform for the next generation of decentralized applications. With its unique architecture, robust governance model, and continuous upgrades, Polkadot is shaping the future of Web3. As the network continues to grow and evolve, it is poised to become a cornerstone of the decentralized internet, driving innovation and fostering a more inclusive and connected digital ecosystem.

Polkadot's Technological Innovations

Cross-Consensus Messaging (XCM) Protocol

The Cross-Consensus Messaging (XCM) protocol is one of Polkadot's most significant technological advancements. This protocol enables seamless communication between different blockchains, allowing them to share data and assets securely. XCM is a cornerstone of Polkadot's interoperability, making it a leader in the multi-chain ecosystem.

Polkadot Virtual Machine (PVM)

The Polkadot Virtual Machine (PVM) is another groundbreaking innovation. It allows for the execution of Ethereum-compatible Solidity smart contracts on Polkadot's Asset Hub. This feature simplifies the migration of Ethereum-based projects to Polkadot, enhancing the network's appeal to developers and businesses alike.

Polkadot's Ecosystem Expansion

DeFi on Polkadot

Polkadot's ecosystem is rapidly expanding, particularly in the Decentralized Finance (DeFi) sector. Projects like Acala and Moonbeam are leveraging Polkadot's infrastructure to create innovative DeFi solutions. These projects offer a range of services, from stablecoins to decentralized exchanges, driving the growth of Polkadot's DeFi ecosystem.

NFTs and Digital Assets

Polkadot is also making significant strides in the Non-Fungible Token (NFT) space. The network's ability to support customizable parachains makes it an ideal platform for NFT projects. By enabling true ownership and interoperability of digital assets, Polkadot is shaping the future of the NFT market.

Polkadot's Impact on Enterprise Solutions

Blockchain-as-a-Service (BaaS)

Polkadot's Blockchain-as-a-Service (BaaS) offerings are driving enterprise adoption. By providing SDKs and API integrations, Polkadot enables businesses to leverage blockchain technology without extensive technical expertise. This approach is fostering innovation and accelerating the adoption of blockchain solutions across various industries.

Institutional Adoption

Polkadot's modular architecture and enterprise-friendly solutions are attracting institutional interest. This trend is expected to accelerate as the network continues to evolve and expand its capabilities.

Polkadot's Roadmap and Future Developments

Polkadot 2.0 Upgrades

The Polkadot 2.0 upgrades are set to revolutionize the network. Key features include asynchronous backing, which reduces block time to 6 seconds, and elastic scaling, which dynamically allocates cores to handle demand spikes. These upgrades will significantly enhance Polkadot's performance and scalability.

Ethereum Compatibility

The integration of Ethereum-compatible Solidity smart contracts via the Polkadot Virtual Machine (PVM) is a major milestone. This development will make it easier for Ethereum developers to migrate their projects to Polkadot, further expanding the network's ecosystem.

Polkadot's Market Performance and Predictions

Current Market Trends

Polkadot's native token, DOT, has shown resilience and growth potential. With a current price of around $4.17 in mid-2025, DOT is gaining traction among investors and traders. The token's utility in governance, staking, and bonding adds to its value proposition.

Price Predictions

Analysts are optimistic about DOT's future. Predictions suggest a potential increase to $1.84 to $2.04 by the end of 2025. These projections reflect the growing confidence in Polkadot's technology and its potential to revolutionize the blockchain landscape.

Polkadot's Community and Governance

On-Chain Governance

Polkadot's on-chain governance model is a key differentiator. It empowers DOT holders to propose and vote on network upgrades, ensuring that the network evolves in a decentralized and transparent manner. This community-driven approach fosters a sense of ownership and engagement among participants.

Developer Community

Polkadot boasts a vibrant and active developer community. With over 79 parachains and numerous projects in development, the network is a hub of innovation. The active participation of developers ensures continuous growth and evolution of the Polkadot ecosystem.

Conclusion: The Future of Polkadot

Polkadot is a pioneering force in the blockchain industry, offering a scalable, interoperable, and secure platform for the next generation of decentralized applications. With its unique architecture, robust governance model, and continuous upgrades, Polkadot is shaping the future of Web3.

Key Takeaways

- Interoperability: Polkadot's ability to enable seamless communication between different blockchains sets it apart from single-chain networks.

- Scalability: With the ability to process over 1,000 TPS and a theoretical maximum of 623,000+ TPS, Polkadot is well-equipped to handle the demands of a growing user base.

- Security: The network's shared security model ensures that all connected parachains are protected, enhancing the overall robustness of the ecosystem.

- Innovation: Polkadot's continuous upgrades and technological advancements, such as the XCM protocol and PVM, drive innovation and foster a vibrant developer community.

- Adoption: Polkadot's enterprise-friendly solutions and growing ecosystem are driving institutional adoption, positioning it as a leading platform for blockchain applications.

As Polkadot continues to evolve and expand its capabilities, it is poised to become a cornerstone of the decentralized internet. With its unique architecture, robust governance model, and continuous upgrades, Polkadot is shaping the future of Web3, driving innovation, and fostering a more inclusive and connected digital ecosystem. The journey of Polkadot is just beginning, and its potential to revolutionize the blockchain landscape is boundless.

Celo: The Blockchain Revolutionizing Payments and Finance

An Introduction to Celo

Celo is a new blockchain project that aims to bring financial services to the masses, particularly in developing countries. Founded in 2020, Celo is built on top of the Ethereum network but offers a faster, more scalable, and user-friendly environment for financial transactions. What sets Celo apart is its focus on making digital money available to every individual through its unique infrastructure and governance model.

The Problem Celo Solves

The world currently faces significant challenges when it comes to financial inclusivity. According to the World Bank, around 1.7 billion adults worldwide either do not have a bank account or do not use one. This lack of access to formal financial services hampers economic growth and exacerbates social inequalities. Traditional banking systems can be costly and inefficient, especially for those residing in remote or low-income areas. This is where Celo steps in to offer a solution.

Key Features of Celo

Decentralized Finance (DeFi)

Celo has built its foundations on DeFi principles, which means users can transact directly on the platform without relying on traditional intermediaries like banks. This eliminates costly transaction fees and speeds up the transfer of funds, regardless of the geographical distance between sender and recipient.

Digital Currencies

Celo introduces its own digital currencies designed to make transactions more accessible and convenient. The network supports a native cryptocurrency called CEL, as well as stablecoins that peg their value to real-world assets such as the US Dollar. Stablecoins are crucial because they provide pricing stability and reduce the risk associated with volatility in the crypto market.

Broad Network Compatibility

To ensure widespread adoption, Celo supports interchain compatibility through a protocol known as "Sequencer." This integration enables users to seamlessly switch between different blockchain networks, thereby expanding the potential user base.

Celo's Governance Model

A key strength of Celo lies in its governance model, which encourages community participation and ensures transparency. Users can participate in decision-making processes through a token-based voting system. Any member holding Celo tokens can cast votes on proposed upgrades, policy changes, and other critical decisions impacting the network.

Token Economics

The token economy on Celo is designed to incentivize healthy network activity. Users who stake CEL tokens receive a portion of transaction fees as rewards, promoting a virtuous cycle of adoption and security. Additionally, holders can delegate their tokens to validators to earn additional rewards.

The Role of Celo in Financial Inclusion

Celo’s mission is to make global financial services accessible to everyone, regardless of their socioeconomic status. By providing a secure and affordable platform for digital payments, the project aims to bridge the gap between the unbanked and the financially literate. Here are some specific ways through which Celo is making an impact:

Benefits for the Unbanked

- Reduced Costs: Traditional remittance services often charge high fees. Celo offers near-zero transaction costs, making it an attractive alternative.

- Fast Transactions: Unlike slower settlement times associated with conventional cross-border payments, Celo transactions are nearly instantaneous.

- Financial Literacy: Educational materials provided by Celo facilitate understanding of basic finance concepts, empowering users to make better financial decisions.

Use Cases in Developing Countries

Developing economies often struggle with limited access to credit and financial products. Celo is addressing this issue by offering microloans and savings plans within its ecosystem. These services are designed to be easily accessible and affordable, catering to the unique needs of small-scale entrepreneurs and regular users.

Empowering Women and Marginalized Communities

Cryptoassets and decentralized finance can empower marginalized communities, including women, by providing them with tools to manage their finances independently. Through Celo’s robust governance and user-friendly interface, these communities gain greater control over their resources and are better positioned to participate in the global economy.

The Technology Behind Celo

Underpinning Celo’s ambitious goals is cutting-edge technology that enhances security, scalability, and interoperability. Here’s an overview of how these technologies contribute to Celo’s success:

Proof-of-Stake Consensus

Celo operates using the proof-of-stake (PoS) consensus mechanism, which is inherently more energy-efficient compared to proof-of-work (PoW). Validators who stake tokens are chosen based on their staked amounts and randomness factors, ensuring a fair and secure environment.

Rapid Transaction Speeds

To handle high volumes of transactions efficiently, Celo utilizes a sharding approach. By dividing the network into smaller sub-networks called shards, Celo significantly reduces confirmation times while maintaining data integrity across the network.

Interoperability with Other Blockchains

The Sequencer protocol allows Celo to interact with other major blockchain platforms, facilitating the exchange of value across different ecosystems. This interoperability is crucial for expanding Celo’s reach and integrating with established financial infrastructure.

Historical Milestones

Since its inception, Celo has achieved several milestones that underscore its commitment to innovation and growth:

Initial Launch

In early 2020, Celo launched its mainnet, marking the beginning of its journey toward revolutionizing financial inclusion. The launch included comprehensive testing phases to ensure the stability and security of the network.

Partnerships and Integrations

Throughout 2021, Celo formed partnerships with notable organizations such as Circle, the company behind the stablecoin USDC. These collaborations helped enhance Celo’s utility and credibility.

User Adoption

By mid-2022, Celo reported over one million registered users and hundreds of thousands of unique monthly active users. The rapid adoption highlights the growing interest in Celo’s innovative solutions.

Challenges Ahead

No project is without its challenges, and Celo is no exception. Addressing these hurdles is essential for its long-term sustainability:

Growing Competition

The blockchain space is highly competitive, with numerous projects vying for attention and usage. Celo must innovate continuously to stay ahead of emerging rivals and maintain user trust and satisfaction.

Regulatory Uncertainty

Lack of uniform regulations across jurisdictions creates challenges for cryptocurrencies and DeFi projects. Celo must navigate this complex landscape while advocating for regulatory clarity and support.

Scalability and Performance

As Celo scales, performance optimization remains crucial. Improvements in throughput and latency will be vital to meet growing demand and ensure a smooth user experience.

In summary, Celo represents a forward-thinking approach to financial inclusion and digital transformation. With a strong foundation in DeFi principles and a robust governance model, the project is well-positioned to reshape the landscape of global finance. As it continues to grow and overcome challenges, Celo has the potential to significantly improve the lives of millions around the world.

Future Prospects and Potential Impact

Looking ahead, Celo aims to continue expanding its ecosystem and increasing its impact on global financial inclusion. Here are some potential areas where Celo could thrive:

Integration with Traditional Banking Systems

One of the most exciting opportunities for Celo is integrating with traditional banking systems. By partnering with traditional financial institutions, Celo could help bridge the digital divide, enabling users to access both traditional and DeFi services. Such integrations could include collaborative ventures to set up hybrid banking services, combining the security and reach of traditional finance with the convenience and accessibility of DeFi.

Expanding to New Markets

Celo’s success largely depends on its ability to attract a diverse user base globally. Expanding to new markets requires addressing unique regional challenges and adapting accordingly. For instance, in Africa, Celo could focus on integrating with local payment systems and collaborating with telecommunications companies to promote mass adoption. Similarly, in Southeast Asia, partnerships with governments and NGOs could help establish Celo as a trusted financial solution for millions of citizens.

Innovative Product Launches

To keep users engaged and drive further adoption, Celo is likely to introduce new products and services. For example, the introduction of CeloGold, a gold-backed stablecoin, could appeal to users concerned about economic instability. Celo could also explore the development of non-fungible tokens (NFTs) for artists and creators in developing countries, providing them with a platform to sell their work.

Economic Implications and Societal Benefits

The economic benefits of adopting Celo extend beyond individuals and communities; they also have broader implications for national and regional economies:

Boost to Small Businesses

Small businesses in underdeveloped regions often face numerous challenges, such as limited access to funding and slow payment processes. By providing them with low-cost, fast, and secure payment methods, Celo can significantly enhance their cash flow and operational efficiency. This can lead to increased productivity and job creation, contributing to overall economic growth.

Promotion of Financial Literacy

Financial literacy is a critical asset for individuals and societies. Celo’s educational programs can empower people with the knowledge necessary to understand and utilize new financial tools effectively. This can lead to better decision-making, reduced poverty levels, and more equitable distribution of wealth. Moreover, financial literacy initiatives can help prevent fraud and misuse of digital assets.

Strengthening Economic Resilience

During economic disruptions or crises, individuals and businesses need reliable and resilient financial systems. Celo’s stable coin ecosystem, combined with its decentralized nature, offers a safer alternative to traditional financial systems that can be volatile during turbulent times. This resilience can help protect people’s savings and livelihoods during crisis periods.

Collaboration and Community Engagement

To achieve its ambitious goals, Celo must foster strong collaborations with various stakeholders, including:

Partnerships with Local Governments

Local governments can play a crucial role in promoting Celo. By working closely with policymakers, Celo can advocate for favorable regulatory environments and develop tailored solutions that address the unique needs of each country or region. Partnerships may involve joint initiatives to educate the public, distribute Celo tokens, and integrate blockchain technology into existing governmental services.

Collaborations with NGOs and Nonprofits

NGOs and nonprofits can be invaluable allies in Celo’s mission to promote financial inclusion. These organizations possess extensive networks and grassroots experience, which can help Celo reach underserved populations more effectively. Collaborative projects could include distributing Celo tokens to refugees and disaster victims, providing them with essential financial tools and resources.

Community Building through Celo Labs

Celo Labs, a subsidiary focused on community building and education, plays a pivotal role in fostering a supportive ecosystem. Through webinars, workshops, and hackathons, Celo Labs encourages community engagement and innovation. These events can bring together developers, entrepreneurs, and users to share ideas and collaborate on new projects, driving the growth and evolution of the Celo network.

Technological Innovations

As Celo continues to evolve, it is imperative to focus on technological advancements that enhance the user experience and improve network capabilities:

Enhanced Security Measures

Ensuring the security of user data and transactions is non-negotiable. Celo must continually improve its security protocols, such as multi-factor authentication, encryption standards, and smart contract auditing. Additionally, the integration of zero-knowledge proofs can increase privacy and confidentiality, giving users peace of mind.

Interoperability Expansion

While Celo already supports interoperability with other blockchains, there remain opportunities for expansion. Collaborating with other emerging blockchain projects, such as Polkadot and Cosmos, can create a larger interconnected network, enabling seamless cross-chain communication and reducing siloed operations.

Advancements in User Experience

To attract and retain users, Celo needs to prioritize improving the user experience. This includes simplifying onboarding processes, enhancing wallet functionality, and making transactions more intuitive. User feedback is crucial in refining these aspects, so Celo should actively engage with users to gather insights and suggestions for improvement.

In conclusion, Celo’s journey towards global financial inclusion is far from over. Continued innovation, strategic partnerships, and community engagement will be key to its success. As the project navigates the challenges and opportunities ahead, Celo has the potential to transform the financial landscape globally, bringing much-needed prosperity and empowerment to millions.

Stay tuned for updates on Celo’s exciting journey and join us in shaping a more inclusive and connected future through blockchain technology.

The Roadmap for Growth and Success

To achieve these milestones, Celo has outlined a comprehensive roadmap that guides its strategic direction and tactical execution. Here are the key components of this roadmap:

Phase 1: Consolidation and Expansion

The first phase focuses on consolidating the current user base and expanding the ecosystem. This involves:

- Scaling Infrastructure: Enhancing the network's capacity to handle higher volumes of transactions and ensuring seamless performance.

- Marketing and Outreach: Launching targeted marketing campaigns to educate potential users and attract a broader audience.

- Partnerships: Strengthening and forming new partnerships with financial institutions, governments, and NGOs to broaden the reach of Celo.

Phase 2: Innovation and Product Development

The second phase is centered on innovation and product development:

- New Product Launches: Introducing innovative financial products such as CeloGold (gold-backed stablecoins), CeloCredit (microloans and credit systems), and CeloPay (advanced payment solutions).

- Technology Advancements: Investing in research and development to improve security, scalability, and user experience.

- Educational Programs: Expanding educational initiatives to promote financial literacy and digital awareness among users.

Phase 3: Global Expansion and Impact

The final phase aims to expand globally and measure the impact of Celo’s initiatives:

- International Rollouts: Launching operations in new markets with tailored solutions to suit local needs and customs.

- Sustainability Initiatives: Implementing sustainable practices within the network to reduce environmental impact.

- Impact Assessment: Conducting rigorous studies to evaluate the socio-economic impact of Celo’s initiatives, ensuring they deliver meaningful benefits to communities.

Engagement with Stakeholders

To build a strong and vibrant community, Celo engages with various stakeholders:

Active Participation in Decentralized Governance

Celo emphasizes the importance of decentralized governance. Through its token-based voting system, users and stakeholders have the power to propose and vote on network changes, ensuring a democratic decision-making process.

Community Events and Workshops

Celo hosts regular webinars, workshops, and hackathons to foster collaboration among developers, entrepreneurs, and users. These events not only drive innovation but also build a sense of community and shared purpose.

Partnership with Influential Organizations

Celo collaborates with influential organizations to amplify its impact. For example, partnerships with major banks and fintech companies can help integrate Celo into existing financial systems, making it more accessible to a wider audience.

Overcoming Challenges and Maintaining Momentum

As Celo progresses, it faces a range of challenges. To maintain momentum and overcome these obstacles, the project must:

Address Regulatory Issues

Regulatory uncertainties pose a significant challenge. Effective advocacy and collaboration with regulatory bodies can help navigate these issues. Transparency and clear documentation of Celo’s protocols and compliance with international standards will be crucial.

Ensure Technical Stability and Reliability

Technical stability is essential to build user trust. Regular updates, bug fixes, and continuous monitoring of the network are necessary to maintain reliability and security. Transparent communication about system upgrades and downtime will also help manage user expectations.

Build User Trust and Loyalty

User trust and loyalty are critical for sustained growth. Celo can achieve this by providing a seamless and secure experience, offering robust customer support, and continuously improving user engagement and satisfaction.

The Future Outlook

The future outlook for Celo is bright, with significant potential for impact. Several factors support this optimism:

Increasing Popularity

As more individuals and businesses recognize the benefits of decentralized finance and financial inclusion, Celo’s popularity is likely to grow exponentially. The project’s ability to deliver fast, secure, and cost-effective financial services will only strengthen its position in the market.

Positive User Feedback

The positive user feedback from early adopters indicates that Celo’s vision resonates with many people. Continued innovation and expansion can further bolster user satisfaction and attract new users.

Evolving Market Landscape

The evolving market landscape presents both challenges and opportunities. Emerging trends such as central bank digital currencies (CBDCs), DeFi, and Web3 technologies are all aligned with Celo’s mission. By innovating and staying ahead of these trends, Celo can maintain relevance and stay competitive.

Conclusion

As Celo continues its journey towards global financial inclusion, it remains committed to delivering accessible and innovative financial solutions. With its robust roadmap, strong community engagement, and strategic partnerships, Celo is poised to make a significant impact on the financial landscape. Whether you’re an investor, developer, or simply an interested observer, Celo’s progress and potential offer exciting opportunities for collaboration and innovation.

Join the Celo community today and be part of this transformative movement towards a more inclusive and connected future.