Hedera Hashgraph: Revolutionizing Blockchain Technology

The Emergence of Hedera Hashgraph

The blockchain space has seen its fair share of innovation and competition among various projects vying for market dominance. However, one technology stands out as a disruptor and potential game-changer: Hedera Hashgraph. Originally developed by Swirlds, Hedera Hashgraph is a public distributed ledger that offers unprecedented throughput and latency while maintaining security and decentralization. This decentralized network promises to solve some of the most pressing issues plaguing traditional blockchains, making it a compelling alternative for businesses and individuals seeking efficient and secure transactions.

Understanding Hashgraph

To understand the unique value proposition of Hedera Hashgraph, it's essential to grasp its underlying technology—the Hashgraph consensus algorithm. Unlike other blockchain technologies that rely on proof-of-work (PoW) or proof-of-stake (PoS) to achieve consensus, Hashgraph employs a novel approach that combines both gossip-based and synchronous Byzantine Fault Tolerance (BFT) mechanisms. This hybrid approach allows for significantly faster transaction speeds and more robust security compared to traditional blockchain networks.

A central concept in Hashgraph is the "hashgraph" structure itself. Think of a hashgraph as a tree-like structure where each node represents a transaction or a message that needs to be verified. Each node not only stores information about the transaction itself but also references two parent nodes, which act as a timestamp for the transaction. In this way, the hashgraph provides a clear chronological order, ensuring that all nodes have an accurate view of the transaction history.

Key Features of Hedera Hashgraph

Speedy Transactions: One of the standout features of Hedera Hashgraph is its ability to process thousands of transactions per second (TPS), with some reports citing rates exceeding over 5,000 TPS under optimal conditions. This rapid transaction speed makes it suitable for real-time applications like financial settlements, micropayments, and cross-border transactions, where quick confirmation times are critical.

Decentralization: Like many blockchain technologies, Hedera Hashgraph thrives on decentralization. By distributing the network across multiple nodes, no single point of failure exists, making it resistant to attacks and manipulation. Each participant in the network plays a vital role in validating transactions and reaching consensus, thereby ensuring that the system remains secure and unaffected by any single entity's actions.

Security and Privacy: Security in Hedera Hashgraph is achieved through a combination of cryptographic techniques, such as asymmetric encryption and digital signatures. This ensures that transactions are tamper-proof and that participants can trust the integrity of the network without needing a central authority. Additionally, Hedera Hashgraph offers robust privacy features, allowing users to maintain their anonymity while still ensuring the transparency of the transaction process.

Network Structure and Consensus Mechanism

The Hedera Hashgraph network is made up of a diverse range of nodes, including validators, witnesses, and clients. Validators are responsible for confirming transactions and validating blocks. Witnesses do not directly validate transactions but participate in the hashgraph structure to provide a more robust network. Clients interact with the network to send and receive transactions.

The consensus mechanism used by Hedera Hashgraph is designed to be highly efficient and secure. During a consensus round, validators quickly reach agreement on the order of transactions without requiring extensive computational power or energy consumption. This is achieved through a gossip-based protocol where validators receive and share messages about transactions they have heard about. Eventually, this leads to a global understanding of the correct sequence of events, which is then recorded in the hashgraph structure.

Tokenomics and Governance

Hedera Hashgraph operates without its own native token, unlike many other blockchain platforms. Instead, it utilizes a governance model that involves the Hedera Governing Council and the Hedera Token Service. The Hedera Governing Council, comprised of large corporations and organizations, helps ensure the stability and growth of the network. On the other hand, the Hedera Token Service allows developers to create and deploy custom stablecoins and digital assets on the Hedera platform.

This unique governance structure sets Hedera Hashgraph apart from other chains that rely on tokens for funding and incentive structures. By focusing on enterprise adoption and collaboration, Hedera aims to foster a more inclusive and collaborative ecosystem rather than being driven by the need for token value increases.

Applications and Use Cases

The versatile nature of Hedera Hashgraph makes it well-suited for a wide array of applications and industries. Financial services stand out as a key area where the technology could have a transformative impact. Financial institutions can achieve faster and cheaper cross-border payments, streamline settlement processes, and enhance compliance through immutable records.

Moreover, Hedera Hashgraph can enable innovative business models and services, such as decentralized finance (DeFi) applications, supply chain management, and identity verification systems. Its low-latency performance ensures that these applications can operate seamlessly, providing users with a frictionless experience.

Challenges and Future Prospects

No technology is without its challenges, and Hedera Hashgraph is no exception. One of the primary hurdles is achieving mainstream adoption. Compared to established technologies like Ethereum and Bitcoin, Hedera Hashgraph has limited brand recognition and user base. Addressing this requires extensive outreach and strategic partnerships with major industry players.

Another challenge lies in regulatory clarity. Although the technology offers enhanced privacy and security features, navigating regulatory landscapes around decentralized applications can be complex. Governments and regulatory bodies are still grappling with how to classify and regulate cryptocurrencies and blockchain technologies, which poses a risk to wider adoption.

Looking ahead, Hedera Hashgraph holds promising prospects for overcoming these challenges. As the world becomes increasingly interconnected and data-driven, a fast, secure, and scalable decentralized network like Hedera can play a crucial role in driving innovation. Collaborations with enterprises and continuous improvements to the technology will likely strengthen its position in the market.

Conclusion

Hedera Hashgraph represents a significant leap forward in blockchain technology. With its superior performance and robust security, it addresses many of the shortcomings of existing blockchain solutions. As more businesses recognize the potential benefits of Hedera Hashgraph in their operations, we can expect to see increased adoption and innovation within the ecosystem.

Technology Partnerships and Collaboration

Hedera Hashgraph has made significant strides in forming strategic partnerships to enhance its technological capabilities and expand its user base. These collaborations aim to leverage the unique strengths of Hedera Hashgraph, such as its high throughput and low latency, to address specific industry needs. For instance, in the financial services sector, Hedera has partnered with companies like BNY Mellon, a global leader in asset servicing, and State Street Corporation, a multinational financial services company. These partnerships have led to the development of innovative solutions tailored to the requirements of financial institutions, such as automated settlements and real-time payment processing.

In the realm of DeFi, major players like ChainSafe Systems and ChainSafe Labs have integrated Hedera Hashgraph into their platforms. These integrations have resulted in improved liquidity and scalability, making DeFi more accessible and efficient for users. Additionally, the partnership with ChainSafe has helped in creating secure and compliant DeFi applications, ensuring that users can trust the systems they interact with.

Moreover, Hedera Hashgraph has established a partnership with Polkadot, a multi-chain ecosystem, to explore cross-chain interoperability. This collaboration could potentially revolutionize the way different blockchain networks interact, paving the way for a more interconnected and decentralized digital economy.

Community and Ecosystem

The success of any blockchain network relies heavily on its community and ecosystem. Hedera Hashgraph has been building a strong community of developers, businesses, and enthusiasts from the onset. The Hedera Hashgraph website provides extensive resources and support, making it easier for new members to understand and engage with the platform. The Hedera Hashgraph API and SDKs have been designed to be user-friendly, facilitating the development of various applications and services.

The Hedera Hashgraph community includes a diverse range of participants, from small startups to large enterprises. Companies like ConsenSys, a leading blockchain solutions provider, have been actively working on Hedera-based projects, contributing to the ecosystem’s growth and innovation. These partnerships have not only facilitated the creation of new applications but also enhanced the overall user experience through continuous improvement and updates.

The Hedera Hashgraph GitHub repository is a testament to the community’s enthusiasm and contribution. Developers from around the world regularly contribute code, report bugs, and suggest new features, fostering an open and collaborative environment. This open-source model encourages innovation and ensures that the platform remains flexible and adaptable to the evolving needs of its users.

Security and Compliance

One of the critical factors in the success of any blockchain technology is its security and compliance. Hedera Hashgraph has taken several steps to ensure that it meets stringent security standards. The implementation of robust cryptographic techniques, such as secure hash functions and digital signatures, guarantees the security of transactions and data. These measures help prevent unauthorized access, tampering, and fraudulent activities, thereby maintaining the integrity of the network.

Moreover, Hedera Hashgraph has been actively working towards achieving regulatory compliance. The Hedera Governing Council, with its diverse membership, plays a crucial role in ensuring that the network operates within the legal framework. This includes working with regulatory bodies and industry stakeholders to address any concerns and provide transparent and secure solutions. This approach not only enhances the legitimacy of Hedera Hashgraph but also ensures that businesses can trust the platform for their critical operations.

The Hedera Hashgraph network has also implemented advanced security features such as zero-knowledge proofs and privacy-enhancing technologies. These features allow users to maintain their privacy while still ensuring the transparency of transactions. For example, zero-knowledge proofs can be used to verify the authenticity of transactions without revealing sensitive information, providing a balance between security and privacy.

Scalability and Interoperability

One of the most significant challenges for blockchain technologies is scalability. Hedera Hashgraph addresses this challenge through its innovative architecture. The technology’s ability to handle thousands of transactions per second makes it suitable for high-throughput applications, such as real-time payments and decentralized marketplaces. Hedera Hashgraph’s design allows for smooth scaling, ensuring that the network can accommodate a growing number of users and applications without compromising on performance.

Interoperability is another key aspect that sets Hedera Hashgraph apart. The network’s ability to interact with other blockchains and decentralized networks through bridges and protocols ensures that it can serve as a versatile platform for various use cases. By fostering cross-chain interoperability, Hedera Hashgraph can help in building a more interconnected and seamless digital ecosystem. This interoperability is particularly important for businesses operating in multiple markets, as it enables them to leverage the benefits of different blockchain networks while maintaining a unified approach.

Another aspect of scalability is the network’s ability to handle large volumes of data. Hedera Hashgraph’s efficient data management techniques ensure that transaction data is stored and managed in a way that minimizes overhead and maximizes efficiency. This is crucial for applications that require extensive data processing, such as decentralized finance and supply chain management.

Economic and Environmental Impact

Blockchain technology, particularly cryptocurrencies, has often been criticized for its high energy consumption and carbon footprint. However, Hedera Hashgraph addresses this issue through its innovative consensus mechanism. By eliminating the need for extensive computational power, Hedera Hashgraph significantly reduces energy consumption, making it a more environmentally friendly solution. This is particularly important as governments and organizations globally strive to combat climate change and promote sustainability.

The economic impact of Hedera Hashgraph is also noteworthy. By enabling faster and cheaper transactions, the technology has the potential to reduce costs for businesses and consumers. This is especially beneficial for businesses operating in industries with high transaction volumes, such as financial services and e-commerce. The technology can help businesses reduce their operational costs and improve their competitive edge.

Future Roadmap and Research & Development

To continue driving innovation and maintain its position as a leading blockchain network, Hedera Hashgraph has a well-defined roadmap and a strong commitment to ongoing research and development. The team regularly updates the network to address emerging challenges and incorporate new technologies. For instance, the development of Hedera Health, a dedicated service for medical blockchain applications, showcases Hedera Hashgraph’s commitment to addressing specific industry needs.

The Hedera Hashgraph Research & Development (R&D) team is continuously exploring new innovations and technologies. This includes the development of new consensus algorithms, privacy-enhancing protocols, and advanced security measures. The R&D team’s efforts are aimed at making Hedera Hashgraph even more powerful and versatile, enabling it to meet the evolving demands of its users.

Apart from technological advancements, the Hedera Hashgraph team is also focused on enhancing user experience and accessibility. The team is working on improving the usability of the platform, making it more intuitive and user-friendly. This includes the development of user-friendly tools and interfaces, as well as ongoing support and documentation.

Moreover, the Hedera Hashgraph team is dedicated to fostering a vibrant and collaborative community. The team regularly engages with users, developers, and industry stakeholders to gather feedback and insights. This collaborative approach ensures that the platform evolves in a way that best meets the needs of its diverse user base.

Conclusion

Hedera Hashgraph has established itself as a leading decentralized network with unique features that set it apart from other blockchain technologies. Its high throughput, robust security, and innovative consensus mechanism make it well-suited for a wide range of applications. The network’s strong community, strategic partnerships, and ongoing R&D efforts further reinforce its potential for future growth and success. As more businesses and organizations recognize the benefits of Hedera Hashgraph, we can expect to see continued innovation and adoption in the blockchain space.

Real-World Applications and Case Studies

Several real-world applications and case studies highlight the tangible benefits of using Hedera Hashgraph. For example, the United Nations Global Green Ribbon Award recognized the World Food Programme (WFP) for its adoption of Hedera Hashgraph to improve the transparency and efficiency of food assistance programs. This collaboration has helped in tracking food donations and ensuring that aid reaches the intended beneficiaries in a timely and secure manner. By leveraging Hedera Hashgraph's low-latency, high-throughput capabilities, the WFP can conduct real-time checks and balances, reducing the risk of fraud and mismanagement.

Another notable case study is the partnership between Hedera Hashgraph and VeChain, a leading blockchain platform focused on supply chain traceability. Together, they developed a system that tracks the journey of luxury goods from production to retail. This solution ensures that consumers can verify the authenticity and origin of products, thereby enhancing brand trust and protecting against counterfeiting. The integration of Hedera Hashgraph into VeChain's ecosystem provides a secure and efficient way to manage complex supply chains, addressing the challenges of authenticity and traceability.

Furthermore, the Canadian payment network Bambora leveraged Hedera Hashgraph to create a real-time payment platform. This platform is designed to support merchants in processing transactions instantly, offering a seamless user experience. The platform's ability to handle thousands of transactions per second makes it ideal for e-commerce and other high-volume payment ecosystems. By integrating Hedera Hashgraph, Bambora has been able to reduce transaction times and improve overall payment processing efficiency, ultimately enhancing customer satisfaction.

Challenges and Future Directions

Despite its many advantages, Hedera Hashgraph faces several challenges that need addressed for it to become even more scalable and user-friendly. One major challenge is the issue of network congestion during peak times. While the technology can handle high transaction volumes, ensuring smooth operation during periods of high demand remains a critical concern. Hedera Hashgraph is continually working on optimizing its consensus algorithms and network architecture to enhance performance, particularly during peak usage periods.

Another challenge is the need for more comprehensive regulatory guidance. While the technology has made significant strides in achieving compliance, the lack of clear regulatory frameworks can be a significant deterrent for businesses looking to adopt blockchain solutions. As a result, Hedera Hashgraph is actively engaged with regulatory bodies and industry stakeholders to advocate for a more supportive regulatory environment. This collaboration aims to promote the responsible and widespread adoption of blockchain technology.

To address these challenges and stay ahead of the curve, Hedera Hashgraph is focusing on several key areas for future development. One area of focus is improving cross-chain interoperability. By enabling seamless communication between different blockchain networks, Hedera Hashgraph can help in building a more integrated and interconnected digital economy. Additionally, the team is exploring the integration of artificial intelligence (AI) and machine learning (ML) to enhance the network's security and operational efficiency. These technologies can help in detecting and mitigating potential threats in real-time, ensuring the continued security and reliability of the network.

Furthermore, Hedera Hashgraph is investing in research and development to explore new use cases and applications. The network is particularly interested in exploring the potential of decentralized identity solutions, smart contracts, and decentralized finance (DeFi). Decentralized identity solutions can provide individuals with control over their personal data, ensuring privacy and security. Smart contracts can enable automated and trusted transactions in a wide range of sectors, while decentralized finance can offer new opportunities for decentralized lending, savings, and trading.

Hedera Hashgraph is also emphasizing the importance of community engagement and education. The team believes that fostering a strong and supportive community is essential for the long-term success of the network. To achieve this, Hedera Hashgraph is organizing webinars, workshops, and conferences to provide users with valuable insights and best practices. Additionally, the team is collaborating with educational institutions to develop courses and training programs that can help in building a skilled workforce equipped with the knowledge and skills needed to work with blockchain technology.

Conclusion

Hedera Hashgraph is at the forefront of blockchain innovation, offering a unique set of features that address many of the challenges faced by traditional blockchain networks. From its ability to handle thousands of transactions per second to its robust security and cross-chain interoperability, Hedera Hashgraph is poised to play a significant role in shaping the future of decentralized finance and beyond. As businesses continue to explore and adopt blockchain technology, the real-world applications and case studies demonstrate the transformative potential of Hedera Hashgraph. With ongoing improvements and a strong focus on community engagement, Hedera Hashgraph is well-positioned to become a leading force in the blockchain ecosystem.

Understanding Balancer: A Revolutionary Automated Market Maker in DeFi

Introduction to Decentralized Finance (DeFi)

Decentralized finance, commonly referred to as DeFi, is transforming the financial landscape by eliminating intermediaries and decentralizing control over economic transactions. It utilizes blockchain technology to offer open, permissionless, and interconnectable financial services. From lending and borrowing to trading and earning interest, DeFi applications are changing how individuals interact with financial instruments. At the core of this innovation is a subset known as Automated Market Makers (AMMs), which have revolutionized how tokens are traded on decentralized exchanges. Among these AMMs, Balancer stands out as a leading protocol due to its unique approach and functionalities.

What is Balancer?

Balancer is an automated portfolio manager and trading platform that distinguishes itself by allowing users to create liquidity pools with multiple tokens in varying weights. This flexibility marks a significant departure from traditional single-asset pools found in earlier DeFi protocols. Founded by Fernando Martinelli and Mike McDonald, Balancer started as a spin-off of the Brazilian software company, BlockScience, and quickly gained attention for its innovative take on liquidity provision.

Fundamentally, Balancer operates by using mathematical formulas to facilitate trading without relying on order books, which are characteristic of traditional exchanges. This mechanism not only ensures constant liquidity but also offers new opportunities for passive income through liquidity provision. Liquidity providers contribute to pools and earn trading fees, all while retaining exposure to multiple assets in a single pool.

How Does Balancer Work?

At its core, Balancer's design is a multi-token generalized AMM that mirrors an index fund, offering users automated portfolio management. Balancer pools are smart contracts that define the proportions of each token, which can be adjusted depending on the user's strategy. For instance, a user can create a pool with 50% ETH, 30% DAI, and 20% LINK if desired.

The Balancer ecosystem operates through several key components:

1. **Liquidity Pools* These are the foundation of Balancer. Pools consist of up to eight different cryptocurrencies, and their values are kept in balance as traders buy or sell tokens through them. As trades occur, the prices of the tokens in the pool adjust according to predefined mathematical formulas to maintain the weighted average.

2. **Smart Pools* These are dynamic pools that allow for adjustable parameters such as fees, token weights, and whitelisting. This flexibility makes them attractive for projects in need of unique liquidity solutions.

3. **Balancer Token (BAL)* This native token is crucial for governance decisions within the Balancer ecosystem. BAL holders propose and vote on changes such as protocol upgrades and fee structures, thus decentralizing the control and future direction of the platform.

4. **Stable Pools* An upgrade to the traditional pool system, stable pools are designed to minimize slippage when trading between stablecoins or pegged tokens. This innovation caters especially to traders looking for low-volatility trading pairs.

Advantages of Using Balancer

Balancer offers several advantages that help it stand out in the highly competitive DeFi space:

- **Flexibility in Pool Design* Unlike traditional AMM platforms that limit pools to two tokens, Balancer allows up to eight tokens per pool, giving liquidity providers the ability to diversify and tailor their investments to match specific risk appetites and market views.

- **Optimized for Capital Efficiency* Balancer’s pools operate with flexible weightings and fee structures enabling higher capital efficiency compared to fixed-weight systems. Providers can capture trading fees and yield farming rewards while maintaining exposure to a diversified portfolio.

- **Decentralized Governance* Through the BAL token, users participate in governance decisions, making Balancer a truly community-driven project. This fosters transparency and aligns the interests of the ecosystem with its users.

- **Reduced Gas Fees* The platform continually improves to reduce transaction costs. Integrations such as Layer 2 solutions contribute to making trading affordable for all participants in the ecosystem.

Real-World Applications and Case Studies

Balancer has been utilized by numerous projects and individuals to achieve a variety of financial objectives. For example, startups can create liquidity pools tailored to their specific requirements, such as fundraising or token distribution events. Meanwhile, individual traders and investors use Balancer to hedge against volatility and earn passive income through fees generated from pool activities.

A noteworthy example is how asset managers utilize Balancer pools to mimic portfolio rebalancing. Instead of conducting periodic trades to maintain target asset allocations, Balancer's automatic balancing mechanism ensures portfolios adjust dynamically according to market conditions.

Conclusion

Balancer represents a significant advancement in the DeFi landscape, offering unparalleled customization in liquidity provision and portfolio management. Its multi-token pools, dynamic fee structures, and governance model provide users with a powerful toolkit for navigating decentralized finance. As DeFi continues to grow and integrate into mainstream finance, Balancer's role as a versatile and user-centric AMM is poised to expand, making it a valuable player in the journey toward a fully decentralized financial future.

The Mechanics of Balancer Pools

Understanding how Balancer pools function is essential for appreciating the innovative power this protocol brings to decentralized finance. Unlike traditional financial instruments, Balancer’s pools require no centralized authority to maintain balance or liquidity; instead, mathematical algorithms take charge, allowing users to benefit from an automated experience.

Every transaction within a Balancer pool involves the adjustment of token weights to ensure that the predefined proportions are maintained. This automatic rebalancing occurs without user intervention. For instance, if there’s an excessive purchase of one token within a pool, its price will increase due to demand, making it more expensive relative to other tokens in the pool, thus encouraging sellers to bring the pool back into balance. This is reminiscent of the buy-low, sell-high strategy but executed autonomously.

Smart Pools and Their Unique Capabilities

One of Balancer’s standout features is its Smart Pools, which empower users to create customized liquidity pools with adjustable parameters. These dynamic pools let users or developers impose bespoke rules, automate portfolio adjustments, and even charge varying fees based on market conditions or other variables.

Smart Pools can function similarly to automated asset managers, adjusting the pool composition based on predefined criteria like market movements or external data oracles. This flexibility extends the Balancer platform into areas like algorithmic trading strategies and controlled exposure to specific market sectors, offering significant appeal to institutional and retail investors alike.

In addition, projects in the DeFi ecosystem can leverage Smart Pools to conduct Initial DEX Offerings (IDOs) or liquidity mining programs tailored to their needs. By adjusting entry and exit fees or implementing whitelists, these projects ensure they maximize engagement and investor loyalty while maintaining optimal liquidity levels.

Balancer in the Broader DeFi Ecosystem

Balancer’s flexible and user-centric model has positioned it as a critical infrastructure player in the burgeoning DeFi landscape. As decentralized finance grows, with users increasingly seeking alternative financial services outside traditional banking systems, the cooperative and interoperable nature of protocols like Balancer becomes vital.

The integration of Balancer into other DeFi projects showcases the protocol's versatility. It has found synergies with lending platforms such as Aave and Compound, where users can simultaneously earn interest on assets deposited in these platforms while providing liquidity on Balancer. Furthermore, synthetics platforms and derivatives projects leverage Balancer’s rebalancing capabilities to create innovative financial products that appeal to sophisticated investors.

Balancer's compatibility and potential for cross-protocol engagements extend to yield farming strategies, which have become a mainstay for DeFi participants seeking higher returns on their holdings. Through strategic collaborations, Balancer enhances liquidity opportunities, allowing users to maximize yield by simultaneously earning trading fees and protocol-specific rewards.

The Governance Model and Community Participation

At the heart of Balancer's decentralized ethos is its governance framework, designed to ensure that decision-making power resides with the community rather than a centralized entity. BAL token holders are encouraged to participate in shaping the future of the platform by proposing changes, voting on protocol upgrades, and defining fee structures.

This democratic approach ensures that all stakeholders have a vested interest in the protocol's success, fostering innovation and responsiveness to the market's evolving needs. Balancer’s governance model also invites transparency and accountability, as discussions and decisions are recorded on the blockchain, allowing any participant to audit and verify actions taken within the ecosystem.

Through decentralized governance, users contribute to enhancing Balancer’s resilience and adaptability, ensuring the protocol remains at the cutting edge of technological and market developments. As DeFi continues to scale, this community-led approach is anticipated to play an increasingly pivotal role.

Security and Risk Considerations

As with any DeFi protocol, security is paramount in ensuring user confidence and long-term viability. Balancer has undertaken extensive audits of its smart contracts to safeguard funds and prevent exploits, yet the open and evolving nature of DeFi means participants must remain vigilant.

Risks associated with smart contracts, market fluctuations, and external attacks are inherent. Therefore, Balancer encourages users to engage in best practices such as diversifying portfolios, using updated software wallets, and staying informed about protocol developments. The community also plays a crucial role in identifying vulnerabilities and suggesting improvements, further solidifying Balancer as a secure AMM choice.

It’s important for users to be aware of impermanent loss, a risk that arises when providing liquidity to AMMs. This occurs when price variations between pooled tokens result in a loss compared to simply holding the tokens separately. However, Balancer's multi-token pools and dynamic weighting can mitigate some of these concerns, providing an added layer of security and potential profit for liquidity providers.

Future Prospects for Balancer

As Balancer continues to innovate and expand its offerings, its future within the DeFi ecosystem looks promising. The ongoing development of Layer 2 solutions and collaborations with major blockchain projects aims to further reduce transaction costs and enhance scalability. These efforts are crucial for fostering increased adoption and more seamless user experiences.

Balancer is also exploring partnerships and integrations with traditional finance institutions looking to enter the DeFi space, illustrating the protocol's potential as a bridge between decentralized and conventional financial systems. By providing a flexible and robust platform, Balancer is well-positioned to accommodate this convergence and continue supporting diverse financial needs globally.

In conclusion, Balancer’s pioneering approach to automated market making and liquidity provision represents a substantial leap forward in DeFi. Its innovative structures and community-driven governance have not only set new standards for what AMMs can achieve but also promise to underpin the growth of a more equitable and accessible financial landscape. As we move forward, Balancer's adaptability and forward-thinking solutions will undoubtedly play a crucial role in defining the future of finance.

Exploring Balancer’s Impact on Portfolio Management

One of Balancer’s defining features is its ability to transform how users approach portfolio management within the blockchain ecosystem. Traditionally, portfolio rebalancing in finance involves manually adjusting asset allocations to align with specific investment goals. However, Balancer automates this process, offering a seamless and efficient alternative that allows users to maintain desired exposures without frequent manual intervention.

By employing mathematical algorithms, Balancer pools automatically rebalance upon each trade, ensuring that the predefined asset allocations remain intact. This autonomy allows investors to focus on strategic decision-making rather than the mechanics of rebalancing. Balancer’s unique capability has sparked interest among crypto investors and asset managers who appreciate the efficiency and cost-effectiveness it introduces to portfolio management.

Moreover, Balancer’s automated rebalancing is particularly advantageous in volatile markets where rapid changes in asset prices can quickly shift portfolio allocations. By ensuring that pools remain in the intended proportion, investors minimize transaction fees and capitalize on market dynamics with minimal disruption.

Balancer and the Evolution of Yield Farming

Yield farming, an attractive concept for many in the DeFi space, has seen significant evolution with platforms like Balancer. Yield farmers seek to maximize returns by strategically allocating liquidity across various protocols to capture the highest yield from trading fees, rewards, and other incentives.

Balancer’s flexible pool designs have been instrumental in this evolution. By enabling multi-token pools and allowing adjustable weights, it facilitates complex yield farming strategies that go beyond simple liquidity provision. Users can optimize their position to benefit from multiple income streams while simultaneously participating in protocol governance and decision-making.

Balancer’s integration with Layer 2 solutions further enhances these opportunities by reducing gas costs, making it more economical for yield farmers to move positions swiftly in response to market conditions. This increased efficiency provides a fertile ground for innovation, as developers and users continuously explore new strategies to leverage Balancer’s protocol for optimal returns.

Education and Accessibility: Making Balancer User-Friendly

While Balancer’s advanced features offer immense potential, they also come with a steep learning curve for newcomers to DeFi. Recognizing this, the Balancer community has made concerted efforts to improve accessibility and educational resources, ensuring that more users can confidently engage with the platform’s offerings.

Through comprehensive guides, tutorials, and community forums, users can gain insights into setting up pools, understanding yield farming strategies, and navigating the intricacies of Balancer’s ecosystem. By demystifying the platform’s functionality, these resources empower both novice and experienced users to maximize Balancer’s potential.

Additionally, Balancer’s user interface continues to evolve, focusing on enhancing user experience through intuitive design and functionality. As the DeFi ecosystem becomes more inclusive, these efforts are critical in attracting a diverse range of participants and supporting widespread engagement with decentralized finance principles.

Challenges and Opportunities Ahead

Despite Balancer’s successes, the protocol faces several challenges that could impact its growth and adoption. As with any DeFi platform, security remains a top concern, and Balancer is continually tasked with safeguarding against novel exploits and vulnerabilities. The protocol’s sustainability hinges on maintaining rigorous security measures and fostering an active community of developers and users to address potential risks.

Another challenge is the competitive landscape of DeFi, where new entrants and established protocols vie for market share. To remain at the forefront, Balancer must continue to innovate, both in terms of technology and user engagement. By exploring new partnerships, enhancing cross-chain compatibility, and developing unique financial products, Balancer can consolidate its position as a market leader.

On the opportunity side, the rapid growth of tokenized assets and increasing interest from institutional investors present significant potential for Balancer’s expansion. As traditional finance engages with blockchain technology, Balancer’s robust infrastructure could serve as a gateway for institutions looking to explore decentralized asset management.

Moreover, the evolution of regulatory landscapes presents both challenges and opportunities. While regulation could impose constraints, it also offers a pathway to legitimacy and broader adoption, especially as DeFi seeks to integrate with global financial systems. Balancer’s commitment to transparency and user-centric governance may provide it with a strategic advantage in navigating these changes.

Final Thoughts

Balancer’s unique approach to automated market making and decentralized finance distinguishes it as a formidable player in the DeFi ecosystem. Through pioneering technology, community-driven governance, and commitment to innovation, Balancer not only elevates how liquidity and token management are conducted but also paves the way for a future where finance is truly decentralized and accessible to all.

As the landscape of digital finance continues to evolve, Balancer’s adaptable framework positions it well to harness emerging trends and opportunities. By embracing the ethos of decentralization and championing user empowerment, Balancer remains poised to influence how individuals and institutions engage with financial markets, driving the continued growth and development of decentralized finance worldwide.

Unraveling the Potential of Chainlink: A Bridge to Blockchain Innovation

In the rapidly evolving landscape of blockchain technology, Chainlink stands out as a pivotal player, forging a path toward decentralized Oracle solutions. As enterprises and developers continue exploring the boundless possibilities of blockchain, there's a growing need for reliable, secure, and scalable ways to connect smart contracts with real-world data. Enter Chainlink, a groundbreaking project that has captured the attention of the entire crypto community and beyond.

The Genesis of Chainlink: Solving the Oracle Problem

The concept of smart contracts revolutionized the idea of trustless transactions by allowing code to automatically execute agreements without intermediaries. However, their Achilles' heel lies in their inability to directly access off-chain data needed for a multitude of real-world applications. This limitation, known as the "Oracle problem," is the gap that Chainlink seeks to bridge.

Chainlink, launched in 2017 by SmartContract, is a decentralized network of nodes providing reliable inputs and outputs for complex smart contracts on any blockchain. The project was founded by Sergey Nazarov and Steve Ellis, who envisioned Chainlink as a way to decentralize and democratize access to data markets. Chainlink's core innovation is its Oracle technology, which serves as a middleware layer connecting blockchain environments to external data sources.

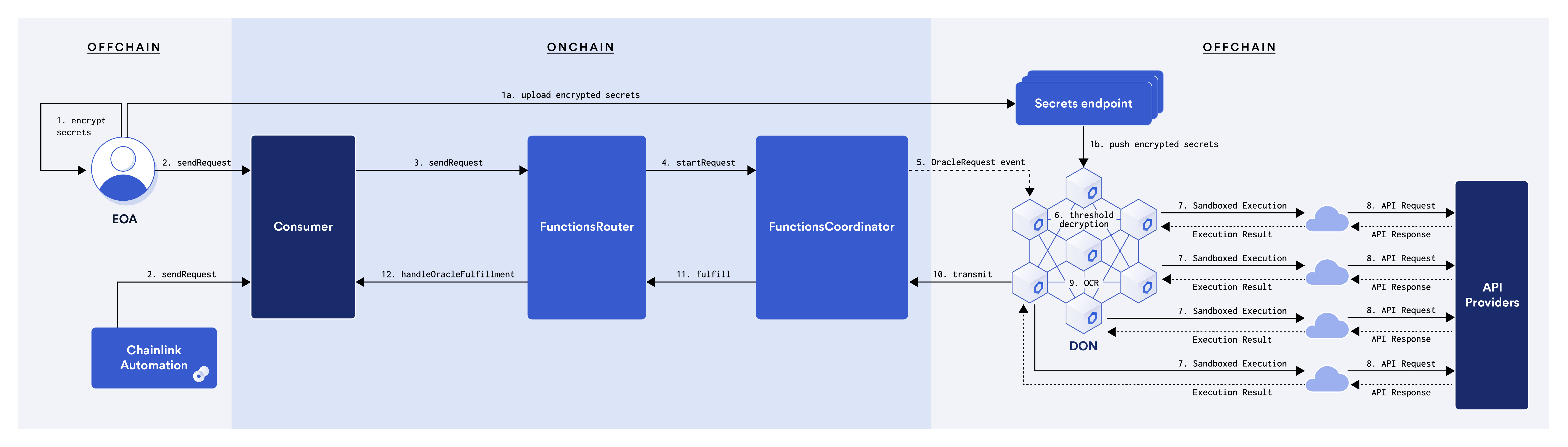

Understanding How Chainlink Works

At the heart of Chainlink's architecture are its decentralized Oracles, which are tasked with sourcing data from real-world sources and providing it to smart contracts. This decentralized network of Oracles ensures that no single point of failure can corrupt the data, which is crucial for maintaining the integrity and security of smart contracts.

Chainlink's operation can be illustrated through a series of steps called "Oracle processes":

1. **Oracle Selection* The process begins with a smart contract initiating a request for data. Chainlink logs this request and filters it through a series of Oracle nodes that compete to provide the necessary data. These nodes are selected based on their reputation, ensuring the quality and reliability of the data.

2. **Data Reporting* Once the Oracle nodes are selected, they retrieve the data from the specified sources. This can range from financial market data to IoT sensor readings.

3. **Aggregation* The data is then aggregated by Chainlink’s core software, where it is verified and processed to ensure accuracy and consistency. This aggregation process involves combining data from multiple Oracles to minimize the risk of manipulation and error.

4. **Delivery* Finally, the aggregated data is delivered to the requesting smart contract in a decentralized manner, ensuring that it is both secure and tamper-proof.

Chainlink's Use Cases and Industry Impact

Chainlink's ability to securely connect smart contracts with external data has a wide array of use cases that extend across various industries. Its utility has been demonstrated in sectors such as finance, insurance, gaming, and supply chain management.

One prominent use case is in the realm of decentralized finance (DeFi). Chainlink Oracles provide DeFi platforms with real-time price data, enabling functionalities like automated trading, lending, and borrowing without reliance on centralized data sources. This strengthens the security and decentralization of DeFi applications, which are often targeted by exploits.

In the insurance industry, Chainlink facilitates parametric insurance, which relies on predefined triggers rather than manual claims. For instance, smart contracts can automatically payout farmers if adverse weather conditions are recorded, as determined by data sourced through a Chainlink Oracle.

Chainlink is also playing a significant role in the gaming industry, where decentralized applications (dApps) require random number generation to ensure fairness. Through its Verifiable Random Function (VRF), Chainlink provides a provably fair and tamper-proof source of randomness critical for gaming dApps, lotteries, and NFT distributions.

Challenges and Future Prospects

While Chainlink’s technology offers substantial innovations, it is not without challenges. One of the primary concerns is the issue of scalability as the demand for data increases. The team is actively working on solutions such as Off-Chain Reporting (OCR), which aims to boost efficiency by decentralizing the data aggregation process.

Another challenge lies in maintaining the security of the network. Chainlink has been proactive in addressing potential vulnerabilities and has put substantial resources into researching newer security protocols and fostering community engagement for robust security audits.

Looking forward, Chainlink's role in enabling Smart Contracts in real-world scenarios continues to expand. With partnerships across leading blockchain platforms and enterprises, Chainlink is strategically poised to enhance the interoperability and adoption of decentralized technologies globally.

As the blockchain industry matures, Chainlink’s vision of a connected, secure, and trustless ecosystem will be instrumental in defining the next wave of technological evolution. In the upcoming parts of this article, we will delve deeper into Chainlink's ecosystem, explore its partnerships, and examine its impact on emerging blockchain use cases. Stay tuned for more insights on this influential project.

Diving Deeper into Chainlink's Ecosystem and Partnerships

Chainlink's success is not just rooted in its innovative technology but also in its strategic partnerships and vibrant ecosystem. By working alongside leading blockchain platforms, financial institutions, developers, and startups, Chainlink has established an extensive network that amplifies its capabilities and reach.

Key Partnerships Driving Innovation

Chainlink's collaboration strategy has been instrumental in proliferating its Oracle solutions across a broad spectrum of blockchain projects. Some notable partnerships include alliances with Ethereum, Polkadot, and the Binance Smart Chain, allowing these platforms to integrate secure, reliable data feeds into their ecosystems.

One particularly noteworthy collaboration is with Google Cloud. By working with Google, Chainlink has created a bridge that connects blockchain technology with traditional cloud services. This partnership enables organizations using Google Cloud's BigQuery to access blockchain data and adopt smart contract solutions to enhance existing business processes. Such integrations are crucial for bridging the gap between conventional tech infrastructures and decentralized applications, heralding a future where both worlds can coexist seamlessly.

In the decentralized finance sector, Chainlink has become a preferred Oracle provider for many DeFi platforms, including Aave, Synthetix, and Compound. These collaborations underscore Chainlink’s role in bolstering the reliability and security of DeFi products by providing accurate price feeds and tamper-proof data essential for executing smart contracts.

Developers and Community: The Backbone of Chainlink

A thriving community and developer base are essential for any blockchain project's success, and Chainlink is no exception. The network's open-source foundation encourages developers worldwide to contribute to its growth and innovation. Chainlink supports its developer community through detailed documentation, educational content, and hackathons that foster collaboration and creativity.

The Chainlink Community Grant Program further incentivizes developers and research teams to contribute to the ecosystem by providing funding for high-impact projects. This initiative not only stimulates technological advancements but also ensures the continued decentralization and security of the network.

Chainlink also leverages its community through node operators, who are pivotal in ensuring the network's decentralization. These operators are incentivized through LINK tokens, the native currency of the Chainlink network, which serves as both a utility token and an economic incentive mechanism.

Exploring Chainlink's Technological Innovations

Chainlink is continuously expanding its technological capabilities to address complex issues associated with smart contracts and blockchain integration. While its core functionality revolves around providing secure data feeds, the project has introduced several groundbreaking technologies that enhance its operational scope.

Cross-Chain Interoperability Protocol (CCIP)

One of Chainlink’s ongoing projects is the development of the Cross-Chain Interoperability Protocol (CCIP), which aims to provide seamless interactions between different blockchain networks. CCIP is poised to revolutionize how chains interconnect, offering a standardized protocol for sharing data and asset transfers across disparate blockchain environments.

This innovation addresses one of the most significant challenges in the blockchain industry: interoperability. By enabling diverse blockchains to communicate safely and efficiently, CCIP could pave the way for a new standard in multi-chain environments, propelling forward the complete decentralization of data.

Verifiable Random Function (VRF)

Chainlink's Verifiable Random Function (VRF) is another crucial advancement that has already been implemented. VRF ensures the generation of provably fair and unbiased randomness, a critical component for applications such as gaming, lotteries, and non-fungible tokens (NFTs). By utilizing VRF, developers can assure users of transparency and fairness, enhancing user trust in decentralized applications.

VRF plays a vital role in fostering a fair digital ecosystem by providing verifiable proof that the randomness used is tamper-resistant and thus eliminates the risks of bias and manipulation. This has significant implications for blockchain applications where randomness is crucial for transparency and integrity.

The Road Ahead: Chainlink's Potential Future Impact

Chainlink’s journey exemplifies the transformative potential of blockchain technology. As the project moves forward, its commitment to solving the Oracle problem and enhancing smart contract capabilities remains steadfast, promising exciting developments on the horizon.

With the continued expansion of the blockchain sector, the demand for reliable, decentralized data will only increase. Chainlink is positioned to be at the forefront of this demand, leveraging its robust infrastructure, strategic partnerships, and collaborative ecosystem to expand its influence across various industries.

Moreover, Chainlink's advancements in cross-chain interoperability could redefine the blockchain landscape by enabling seamless interactions between platforms. This connectivity would boost the entire ecosystem's scalability, making blockchain technology more accessible and appealing to a broader range of users, enterprises, and developers.

As we look to the future, Chainlink's role in bridging the gap between blockchain networks and real-world data stands as a testament to the potential of innovative decentralization. In the final part of this article, we will explore further Chainlink's economic aspects, the impact of its tokenomics, and the broader implications for the blockchain industry. Stay tuned for more insights.

Understanding Chainlink's Tokenomics and Economic Model

Chainlink's utility and growing influence in the blockchain ecosystem are closely tied to its economic model, particularly the role of the LINK token. The LINK token serves as the fuel that powers the Chainlink network, incentivizing a decentralized web of Oracle nodes and ensuring the integrity and functionality of data provision.

The Utility of LINK Tokens

LINK tokens are primarily used to pay node operators for the retrieval of data from external sources, processing of data, and ensuring its delivery to smart contracts. This compensation mechanism creates an economic incentive for node operators to provide accurate and reliable data, as their earnings depend on their performance and reputation within the network.

In addition to compensating node operators, LINK tokens are also used as collateral to secure Oracle services. Node operators may be required to stake LINK in a collateralization scheme; this provides a financial stake in their performance, aligning their interests with the reliability and security of the data they manage. If an operator acts maliciously or fails to deliver accurate data, they risk having their staked LINK tokens reduced or slashed, providing a strong deterrent against dishonest behavior.

Token Distribution and Market Dynamics

The total supply of LINK is capped at 1 billion tokens, with a portion allocated for public sale, another reserved for node operator incentives, and the remainder held by the core team to fund ongoing development and ecosystem growth. This distribution model is designed to ensure long-term sustainability while motivating the continuous contribution of node operators.

The market dynamics of LINK are influenced by various factors, ranging from the demand for decentralized Oracles to broader market trends within the crypto sphere. As smart contracts gain traction across different industries, the demand for reliable data through Chainlink's Oracle services naturally increases, positively impacting the demand and valuation of LINK tokens.

Chainlink's Broader Implications for the Blockchain Industry

Chainlink's impact extends beyond its immediate use cases, fundamentally altering how blockchain technology interacts with the outside world. By providing a secure and decentralized way to incorporate real-world data, Chainlink is opening doors to innovative applications that were previously out of reach.

Enabling Trust and Security in Decentralized Systems

The decentralized nature of Chainlink's Oracle network fundamentally enhances the security and trustworthiness of smart contracts. By eliminating single points of failure and reducing reliance on centralized data sources, Chainlink addresses the vulnerabilities that have historically plagued blockchain applications.

This increased security is crucial for industries such as finance and insurance, where the reliability of data can directly impact the bottom line. Decentralized Oracles provide peace of mind for users, knowing that the data powering their smart contracts is secured through a robust and impartial network.

Paving the Way for Blockchain Adoption

By solving the Oracle problem, Chainlink is instrumental in broadening the scope and appeal of blockchain technology. Enterprises and developers can now explore complex use cases that require external data inputs, without compromising on security or decentralization. This breakthrough is likely to accelerate blockchain adoption across various sectors, encouraging more organizations to integrate blockchain solutions into their operations.

Additionally, Chainlink's commitment to interoperability through initiatives like CCIP could make blockchain technology more accessible to mainstream users and enterprises. By fostering a more connected ecosystem, Chainlink is helping to lower the barriers to entry, enabling even non-blockchain-native entities to benefit from decentralized technology.

Concluding Thoughts: Chainlink's Lasting Influence

As Chainlink continues to innovate and expand its reach, it is solidifying its position as a cornerstone in the blockchain revolution. Its ability to provide reliable, decentralized access to real-world data has profound implications not just for the future of smart contracts, but for the entire digital economy.

Through strategic partnerships, a vibrant community, and continued technological advancements, Chainlink is empowering a new era of blockchain applications that are more dynamic, secure, and versatile. As the project navigates its trajectory into uncharted territory, it is primed to influence not only the future of blockchain but also the broader technology landscape.

In the coming years, Chainlink's evolution will likely mirror the rapid advancements of the blockchain industry itself, with Oracle technology playing a decisive role in defining how decentralized networks interact and operate. For investors, developers, and enthusiasts alike, Chainlink represents both an opportunity and a visionary glimpse into the future possibilities of blockchain innovation. As we move ahead, the narrative of how Chainlink continues to shape this evolving landscape will be one of the most compelling stories in the world of technology.

Exploring Filecoin: Decentralized Data Storage for the Future

In the rapidly advancing world of technology, data storage solutions are evolving to meet the growing demands of businesses and individuals alike. One project that has attracted considerable attention in this space is Filecoin. Promising a decentralized network for data storage, Filecoin leverages blockchain technology to create a robust marketplace for storing and retrieving digital information. As we delve into the first segment of this comprehensive exploration, we will unwrap the key features, innovations, and implications Filecoin brings to the world of data management.

The Genesis of Filecoin

The concept of Filecoin was birthed by Protocol Labs, a company known for its cutting-edge contributions to the blockchain ecosystem. Founded by Juan Benet in 2014, Protocol Labs initially introduced the InterPlanetary File System (IPFS), a peer-to-peer data sharing network aiming to revolutionize the way the web operates. Building upon the success and functionality of IPFS, Filecoin was proposed as an adjunct solution to create a decentralized marketplace for data storage, introducing its own unique cryptocurrency as an incentivizing mechanism for participants.

Filecoin gained substantial attention and backing during its inception. It hosted one of the most successful Initial Coin Offerings (ICOs) in history, raising over $257 million in 2017. This remarkable financial backing underscored the significant interest and trust investors and the tech community placed in Filecoin's potential to transform data storage.

How Filecoin Works

Filecoin operates as a decentralized storage network that allows users to store, retrieve, and manage data efficiently. It utilizes blockchain technology, coupled with economic incentives, to encourage users to contribute to the network's storage capacity. Here’s a closer look at how Filecoin's model functions:

1. **Storage and Retrieval Miners* Two types of miners form the backbone of the Filecoin network: storage miners and retrieval miners. Storage miners contribute unused hard drive space, storing data from users in exchange for FIL, Filecoin's native cryptocurrency. Retrieval miners, on the other hand, specialize in retrieving data from the network and delivering it to users who request it, also earning FIL as a reward.

2. **Proof of Storage* Filecoin’s consensus mechanism revolves around two processes: Proof of Replication and Proof of Spacetime. Proof of Replication ensures that a miner has genuinely created multiple copies of the data they claim to store, while Proof of Spacetime verifies that the data is continually stored and accessible over time. These processes ensure the reliability and security of the network.

3. **Decentralized Marketplace* The network functions as an open marketplace where storage prices are determined by supply and demand dynamics. This allows users to find storage deals that fit their needs and budget, while miners can compete for business by offering competitive pricing and reliability.

4. **Smart Contracts and Flexibility* Filecoin's infrastructure is built to leverage smart contracts for secure, automated transactions. Users can set contracts that define conditions related to data storage duration, access permissions, and more, providing unprecedented flexibility.

Advantages of Filecoin

Filecoin’s approach to decentralized storage introduces several advantages, contributing to its appeal over traditional centralized systems:

1. **Cost Efficiency* By creating a competitive environment for storage pricing, Filecoin can potentially offer more cost-effective solutions than centralized providers, who often operate with fixed pricing structures.

2. **Decentralization and Redundancy* Unlike centralized data storage systems that pose high risk of single points of failure, Filecoin ensures data redundancy across a distributed network. This decentralization enhances data security and reduces vulnerability to outages and cyberattacks.

3. **Incentivized Participation* The incorporation of FIL rewards encourages more users to participate, bolstering storage availability and retrieval speed as the network grows.

4. **Accessibility and Control* Users maintain control over their data, determining who can access it and how it is used, aligning with increasing global concerns about data privacy and ownership.

Challenges and Criticisms

Despite its promising framework, Filecoin also faces a set of challenges and criticisms that it must address to achieve widespread adoption:

1. **Scalability and Latency* As with many blockchain-based solutions, scalability concerns persist. Ensuring rapid access to stored data across potentially vast geographic distances introduces latency challenges that the network must overcome.

2. **Onboarding and Technical Complexity* For a new user or organization accustomed to traditional data storage solutions, the transition to a blockchain-based system like Filecoin may seem daunting due to its technical complexity and new paradigms in data management.

3. **Market Volatility* The value of FIL can be highly volatile, influenced by external market dynamics that may impact the cost-benefit equation for participants, especially storage miners.

As we continue to explore Filecoin in subsequent parts, we'll delve deeper into its operational dynamics, real-world applications, and potential trajectory within the broader tech ecosystem. Stay tuned for a comprehensive view of how Filecoin could redefine data storage in the digital age.

Real-World Applications of Filecoin

One of the most compelling aspects of Filecoin is its broad spectrum of potential applications across various industries. As digital information continues to proliferate, reliable and efficient data storage becomes increasingly critical. Filecoin’s decentralized model offers innovative solutions that cater to different sectors.

Healthcare

In the realm of healthcare, the demands for secure and compliant data storage are paramount. Medical records, patient histories, and research data require robust protection against unauthorized access and breaches. Filecoin's decentralized nature provides enhanced data security by distributing files across multiple locations, reducing the risk of cyberattacks on a single centralized server. Moreover, privacy settings and access controls offered through smart contracts empower healthcare providers to manage data access in compliance with regulatory standards like HIPAA.

Media and Entertainment

The media and entertainment industry can leverage Filecoin to enhance content distribution and storage. With ever-growing volumes of digital media files — from movies and music to images and interactive content — the need for cost-effective and scalable storage is clear. Filecoin facilitates seamless storage and retrieval processes for content producers and distributors. By decentralizing storage solutions, it mitigates network congestion and ensures faster, more reliable content delivery.

Scientific Research

Scientific research involves the generation and analysis of vast amounts of data, from genomic sequences to astronomical observations. Filecoin's infrastructure supports the secure storage of significant datasets, enabling researchers to share data without risking its integrity. Decentralized storage not only provides cost-effective options but also fosters collaboration among researchers across different institutions and geographies, thus accelerating scientific discovery.

Decentralized Finance (DeFi)

The rapid growth of decentralized finance (DeFi) platforms has created a need for secure and efficient data management solutions. Filecoin can play a key role in facilitating data storage for decentralized applications (dApps) by providing immutable, tamper-proof storage that aligns with blockchain's principles of transparency and security. By integrating Filecoin's storage capabilities, DeFi projects can enhance their resilience and scalability.

Filecoin's Ecosystem and Partnerships

The success and expansion of any blockchain-based project are often underscored by the strength of its ecosystem and partnerships. Filecoin has proactively cultivated collaborations with diverse stakeholders to enhance its infrastructure and viability.

Integration with IPFS

Given Filecoin's roots with IPFS, the seamless integration between these two technologies strengthens their collective value proposition. IPFS serves as a decentralized web protocol that simplifies peer-to-peer file sharing, whereas Filecoin introduces economic incentives for data storage. This integration allows users to efficiently manage data storage and retrieval while reaping cost benefits and enhanced security.

Strategic Partnerships

Filecoin has forged strategic partnerships with industry leaders to expand its network utility and applicability. Collaborations with cloud service providers, infrastructure companies, and blockchain projects enable Filecoin to grow its user base and address diverse storage needs. Moreover, partnerships with university research groups and nonprofit organizations are vital in exploring innovative applications and fostering education around decentralized technologies.

Open-Source Development Community

Filecoin thrives on its open-source development community, which plays a crucial role in refining the platform's technology and enhancing its features. By attracting a global network of developers, Filecoin ensures a steady pipeline of improvements and innovations. This collaborative approach helps address technical challenges and aligns the network with the dynamic needs of its users.

Economic Model and Incentives

An integral aspect of Filecoin's design is its economic model, which incentivizes active participation across the network. Understanding this model is essential for stakeholders, including storage miners, retrieval miners, and users.

Token Economics

The Filecoin network operates on the FIL cryptocurrency, which is central to its economic framework. Storage miners earn FIL tokens by providing storage space and maintaining customer data, while retrieval miners receive payments for fetching and delivering data. The tokenomics are designed to ensure an equilibrium between storage supply and demand while rewarding network participants for their contributions.

Market Dynamics and Pricing

Filecoin's market-driven approach allows storage prices to vary based on supply and demand dynamics. This flexibility benefits users, who can negotiate competitive rates, and miners, who can optimize their offerings. Such a model enhances network adaptability and attracts diverse participants catering to different storage requirements.

Filecoin's Long-term Potential

The transition to a decentralized storage network marks a significant shift in the landscape of data management. Filecoin's potential lies in its ability to scale amidst increasing data demands while addressing key challenges. As blockchain technology matures, Filecoin is poised to redefine how data is stored, accessed, and managed across various digital ecosystems.

In our upcoming segment, we will further explore the technological innovations underpinning Filecoin and examine its impact on contemporary data storage and beyond. Stay tuned as we unravel the complexities and future trajectories of this groundbreaking project.

Technological Innovations Behind Filecoin

At its core, Filecoin harnesses a blend of cutting-edge technologies that differentiate it from traditional data storage solutions. This segment delves into the innovations that power Filecoin and underline its promise as a transformative force in decentralized storage.

Blockchain and Cryptographic Foundations

Filecoin's reliance on blockchain technology offers multiple benefits, including transparency, data integrity, and security. Its decentralized ledger records all transactions and storage contracts, ensuring accountability and enabling trust among network participants. Additionally, cryptographic techniques are employed to safeguard data privacy and protection, ensuring that sensitive information remains encrypted and accessible only by authorized parties.

Efficient Data Retrieval Mechanisms

A critical challenge in decentralized networks is achieving efficient data retrieval. Filecoin addresses this through a dual-layer approach. First, its retrieval market encourages miners to deliver data quickly and reliably to users, incentivizing low-latency access. Second, Filecoin's design integrates seamlessly with IPFS, leveraging its capabilities for rapid peer-to-peer data location and distribution. This hybrid mechanism optimizes both storage and access processes.

Dynamic Proof Systems

Filecoin implements dynamic proof systems, chiefly Proof of Replication (PoRep) and Proof of Spacetime (PoSt). These cryptographic proofs ensure that storage providers are genuinely storing the data as promised and doing so over committed time frames. PoRep allows verifiable duplication of the data across different physical storage devices, while PoSt confirms continued storage over elapsed time, mitigating risks of data loss and fraudulent activities by miners.

Impact on the Digital Storage Landscape

Filecoin's innovative approach to data storage goes beyond technological prowess; its implications for the broader data storage industry are substantial.

Democratizing Data Storage

Filecoin democratizes access to data storage by creating a marketplace where anyone with excess storage capacity can participate. This openness reduces dependency on large, centralized cloud providers, empowering individuals and SMEs to compete alongside major corporations. Such democratization paves the way for more competitive pricing and customization, benefiting end-users with diverse data challenges.

Addressing Data Sovereignty Concerns

In an era where data sovereignty and privacy regulations are becoming increasingly stringent, Filecoin offers a viable solution. By allowing data to be stored across different jurisdictions according to user needs and regulatory requirements, Filecoin provides greater control over data governance. This flexibility aids organizations in complying with local data protection laws, boosting user trust and confidence.

Environmental and Sustainability Considerations

The environmental impact of large-scale data storage cannot be overstated, with data centers accounting for significant energy consumption globally. Filecoin’s decentralized approach presents opportunities for sustainability; distributed storage can better utilize existing infrastructure, potentially leading to lower energy use. Moreover, its economic model incentivizes more efficient storage methods, which could drive innovation in energy conservation and reduction of carbon footprints.

The Road Ahead for Filecoin

As Filecoin continues to evolve, several factors will play pivotal roles in its journey toward mainstream adoption and success.

Enhancing Network Scalability

For Filecoin to meet global data storage demands, scalability remains key. Efforts are ongoing to enhance network efficiency, optimize data transfer rates, and support an orchestrated increase in storage providers. Future protocol upgrades and community-driven improvements will be crucial in achieving scalable growth.

Expanding Ecosystem Integration

The expansion of Filecoin's ecosystem is vital for its sustained relevance. Strategic partnerships, especially with prominent IT infrastructure providers and innovative startups, can drive adoption by integrating Filecoin into diverse applications. Increased interoperability with other blockchain networks and technologies, including smart contracts and DeFi platforms, can further bolster its utility and adoption.

Regulatory and Market Adoption

Navigating the complex landscape of global regulations is a significant challenge. Filecoin must maintain vigilance over evolving legal frameworks, ensuring compliance and fostering collaboration with regulatory bodies. On the market front, increasing awareness and understanding among potential users and developers can lead to broader acceptance and conversion of pilot projects into long-term engagements.

In conclusion, Filecoin is a trailblazer in the domain of decentralized storage, championing a shift from traditional data management to an innovative, equitable, and efficient approach. Its ability to harness blockchain technology, coupled with pragmatic economic incentives, positions it uniquely to address modern storage challenges. While hurdles remain, Filecoin's continuous improvement and community-driven ethos offer substantial promise as a robust and adaptable solution for the data-driven future. As digital landscapes transform, Filecoin is in a prime position to drive new standards in storage solutions and empower users worldwide.

Understanding Blockchain Technology

The digital age has ushered in extraordinary innovations, reshaping countless facets of our world. Among these transformative technologies, blockchain stands out as one of the most revolutionary. While often associated with cryptocurrencies like Bitcoin, blockchain's potential spans far beyond digital currencies. Its implications are vast, affecting sectors ranging from finance to healthcare, logistics to entertainment. To fully grasp the potential impact of blockchain technology, it is essential to understand its core components, workings, and applications.

What is Blockchain Technology?

At its heart, blockchain is a distributed ledger technology that enables secure and transparent transactions. It is a decentralized database controlled by a network of computers, rather than a single entity. Each transaction is recorded as a "block," which is then linked to the previous one, creating a "chain." This chain of blocks is secured through cryptographic measures, ensuring data integrity and security.

The concept of blockchain was first introduced in 2008 by an anonymous entity known as Satoshi Nakamoto in the whitepaper, "Bitcoin: A Peer-to-Peer Electronic Cash System." Initially, blockchain served as the underlying technology for Bitcoin, but its uses have expanded significantly in the years since, promising transformative change across various industries.

How Does Blockchain Work?

To appreciate the inner workings of blockchain technology, consider a ledger or record book that stores entries. In this analogy, each block is like a page in this book, filled with transaction data. Unlike traditional ledgers, blockchain is maintained by a global network of computers, known as nodes. These nodes work together to verify and validate every transaction, ensuring that all entries are legitimate and accurate.

The Core Components of Blockchain

1. **Decentralization* Traditional databases are centralized, controlled by a single entity. In contrast, blockchain is decentralized, relying on a network of nodes to validate transactions. This reduces reliance on a central authority, potentially lowering costs and increasing data security.

2. **Immutability* Once data is entered into the blockchain, it becomes nearly impossible to alter or delete. This feature ensures the integrity and trustworthiness of the information recorded.

3. **Transparency* Each node in the blockchain network has access to the entire database and its complete history. This transparency helps prevent fraud and ensures accountability.

4. **Security* Blockchain incorporates advanced cryptographic techniques to secure data. Each block is encrypted and linked to the previous one, creating a tamper-proof chain.

The Process of Blockchain Transactions

The process of conducting a transaction on a blockchain primarily involves three stages:

1. **Initiation* A transaction is initiated by a participant, who broadcasts it to the network. This transaction can involve sending or receiving assets, such as cryptocurrencies, or executing contracts.

2. **Verification* Network nodes validate the transaction. They check that the initiating party has the necessary assets or permissions and has adhered to the network's rules. Nodes use consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS), to authenticate the transaction.

3. **Recording* Once validated, the transaction is combined with others to form a new block. This block is then added to the existing chain, ensuring the ledger's immutability and transparency.

Applications of Blockchain Technology

The versatility and security of blockchain have led to its exploration and adoption across numerous fields:

Finance

While best known for underpinning cryptocurrencies, blockchain is also redefining traditional finance. It enables faster and cheaper cross-border transactions, enhances the security of financial data, and has given rise to decentralized finance (DeFi) platforms, which allow users to borrow, lend, and trade without intermediaries.

Supply Chain Management

Blockchain provides unprecedented transparency within supply chains. By tracking assets in real-time, businesses can improve efficiency, reduce fraud, and ensure product authenticity. It allows consumers to verify the provenance of products, enhancing trust and satisfaction.

Healthcare